Slack

#1

Slack

https://www.wsj.com/articles/slack-f...ng-11549301336

Slack Files to Go Public With Direct Listing

Feb. 4, 2019

Slack Technologies Inc. has filed paperwork for its direct listing on the stock market, setting it up to be the second major company to use the nontraditional method for an initial public offering.

The workplace-messaging company’s IPO could come as soon as this spring, people familiar with the matter have said. By the time it debuts, Slack could be valued well above $7 billion, the level at which it recently raised money. Slack’s filing with the Securities and Exchange Commission was confidential and didn’t reveal any pricing information.

Slack, which is based in San Francisco, runs an app used for group communication, especially in offices, and recently said it has more than 10 million daily active users in 150 countries. Workers use Slack to chat digitally with colleagues, sharing documents, web links, details of projects and more.

Like many technology companies, Slack will go public with a dual-class share structure that will give its co-founder and CEO, Stewart Butterfield, and others voting control in excess of their ownership stake, according to people familiar with the offering.

Slack is working with Goldman Sachs Group Inc., Morgan Stanley and Allen & Co. on its deal. The trio were the advisers on Spotify’s direct listing.

In addition to Slack, other companies that could begin trading publicly this year include Uber Technologies Inc. and Lyft Inc.—both of which have made confidential filings—and potentially Airbnb Inc. and Palantir Technologies Inc.

Slack has raised more than $1 billion since the app launched in 2013 at increasingly higher valuations and still has significant cash on its balance sheet, people familiar with the company said. In August, Slack raised $427 million in a funding round led by Dragoneer Investment Group and General Atlantic valuing the company at $7.1 billion. That came after it raised money from SoftBank Group Corp. in 2017.

The company emerged from a failed videogame effort initiated by Mr. Butterfield. The game didn’t catch on, but one of its features was developed into a messaging platform that became Slack.

Slack’s success caught the attention of several tech companies, including Microsoft Corp. , which launched a rival service called Teams nearly two years ago. The service resembles Slack, but it also leverages some of Microsoft’s widely used products, notably its Office software and Skype videoconferencing service.

Facebook , too, is trying to get a piece of the market with its Workplace service, which just added Nestlé SA as a customer. Alphabet Inc.’s Google also offers email and messaging services, and cloud-computing giant Amazon.com Inc. has a handful of collaboration services, including a videoconferencing service called Chime.

Feb. 4, 2019

Slack Technologies Inc. has filed paperwork for its direct listing on the stock market, setting it up to be the second major company to use the nontraditional method for an initial public offering.

The workplace-messaging company’s IPO could come as soon as this spring, people familiar with the matter have said. By the time it debuts, Slack could be valued well above $7 billion, the level at which it recently raised money. Slack’s filing with the Securities and Exchange Commission was confidential and didn’t reveal any pricing information.

Slack, which is based in San Francisco, runs an app used for group communication, especially in offices, and recently said it has more than 10 million daily active users in 150 countries. Workers use Slack to chat digitally with colleagues, sharing documents, web links, details of projects and more.

Like many technology companies, Slack will go public with a dual-class share structure that will give its co-founder and CEO, Stewart Butterfield, and others voting control in excess of their ownership stake, according to people familiar with the offering.

Slack is working with Goldman Sachs Group Inc., Morgan Stanley and Allen & Co. on its deal. The trio were the advisers on Spotify’s direct listing.

In addition to Slack, other companies that could begin trading publicly this year include Uber Technologies Inc. and Lyft Inc.—both of which have made confidential filings—and potentially Airbnb Inc. and Palantir Technologies Inc.

Slack has raised more than $1 billion since the app launched in 2013 at increasingly higher valuations and still has significant cash on its balance sheet, people familiar with the company said. In August, Slack raised $427 million in a funding round led by Dragoneer Investment Group and General Atlantic valuing the company at $7.1 billion. That came after it raised money from SoftBank Group Corp. in 2017.

The company emerged from a failed videogame effort initiated by Mr. Butterfield. The game didn’t catch on, but one of its features was developed into a messaging platform that became Slack.

Slack’s success caught the attention of several tech companies, including Microsoft Corp. , which launched a rival service called Teams nearly two years ago. The service resembles Slack, but it also leverages some of Microsoft’s widely used products, notably its Office software and Skype videoconferencing service.

Facebook , too, is trying to get a piece of the market with its Workplace service, which just added Nestlé SA as a customer. Alphabet Inc.’s Google also offers email and messaging services, and cloud-computing giant Amazon.com Inc. has a handful of collaboration services, including a videoconferencing service called Chime.

#2

Senior Moderator

#3

Released S-1 today : https://www.sec.gov/Archives/edgar/d...6/slacks-1.htm

Direct listing under ticker symbol = SK

https://www.barrons.com/articles/sla...ow-51556297281

https://www.marketwatch.com/story/sl...ing-2019-04-26

Direct listing under ticker symbol = SK

https://www.barrons.com/articles/sla...ow-51556297281

The Slack IPO Is Coming. Here’s What You Need to Know.

April 26, 2019

Slack filed for a direct public listing Friday, which would make the maker of workplace productivity software publicly traded without raising money for it to use.

It’s unclear what Slack’s market value might be as a public company. Last year, it announced a round of financing valuing it at $7.1 billion. Its filing, meanwhile, said that its class B shares traded hands in private transactions at prices between $8.37 and $23.41 in the fiscal year ended Jan. 31.

The company had about $181 million in cash and equivalents on hand at the end of January, up from $120 million a year before. Here are some more key facts.

• Slack reported revenue of around $400 million in the fiscal year ended Jan. 31, up more than 80% from $220 million the prior year. Gross profits, which came in at $349 million, rose at roughly the same rate.

• But operating losses increased from $144 million in 2018 to $154 million last year, as operating expenses exceeded $500 million. “We expect to continue to incur net losses for the foreseeable future,” the company said in its filing.

• The company reported more than 10 million daily active users last year, with more than 600,000 organizations having at least three users of its software. It had 88,000 paying customers, and 575 of those each represent more than $100,000 in annual recurring revenue.

The 575 customers accounted for about 40% of revenue last year. Adding more, larger, organizations is a key component of Slack’s sales strategy.

Adding more, larger, organizations is a key component of Slack’s sales strategy.

April 26, 2019

Slack filed for a direct public listing Friday, which would make the maker of workplace productivity software publicly traded without raising money for it to use.

It’s unclear what Slack’s market value might be as a public company. Last year, it announced a round of financing valuing it at $7.1 billion. Its filing, meanwhile, said that its class B shares traded hands in private transactions at prices between $8.37 and $23.41 in the fiscal year ended Jan. 31.

The company had about $181 million in cash and equivalents on hand at the end of January, up from $120 million a year before. Here are some more key facts.

• Slack reported revenue of around $400 million in the fiscal year ended Jan. 31, up more than 80% from $220 million the prior year. Gross profits, which came in at $349 million, rose at roughly the same rate.

• But operating losses increased from $144 million in 2018 to $154 million last year, as operating expenses exceeded $500 million. “We expect to continue to incur net losses for the foreseeable future,” the company said in its filing.

• The company reported more than 10 million daily active users last year, with more than 600,000 organizations having at least three users of its software. It had 88,000 paying customers, and 575 of those each represent more than $100,000 in annual recurring revenue.

The 575 customers accounted for about 40% of revenue last year.

Adding more, larger, organizations is a key component of Slack’s sales strategy.

Adding more, larger, organizations is a key component of Slack’s sales strategy.

Slack non-IPO: 5 things to know about the direct listing

Apr 26, 2019

Slack Technologies Inc. is looking for a better direct-listing fate than Spotify Technology SA.

The music-streaming service reminded tech unicorns late last year that companies don’t have to issue new shares or raise money through a traditional offering if they wish to go public, and now Slack is following in its footsteps. The business-chat company filed direct-listing paperwork on Friday.

Direct listings differ from traditional initial public offerings, in that the company doesn’t issue new shares or seek to raise money through the process of going public. Rather, the listing makes it possible for existing shareholders to sell their shares to the public.

Slack’s filing reveals a business with slowing revenue growth but narrowing losses, as well as a heavy dependence on just a several hundred key customers, or less than 1% of its paid customer base, for a major chunk of its sales. Here are five things to know about the company, which intends to list on the New York Stock Exchange under the ticker “SK.”

(1) Revenue deceleration

Slack topped $400 million in annual revenue for its fiscal year ended in January, though growth slowed from the prior period. The company’s revenue rose 82% from $220.5 million in 2018, down from a growth rate of just over 100% a year earlier.

Founded in 2009, Slack admitted in its prospectus that it has “limited experience with respect to determining the optimal prices for Slack.” The company expects that it might need to change its pricing model periodically going forward.

The messaging company made progress in narrowing its losses, posting a net loss of $140.7 million last year, compared with $181 million a year earlier. Slack continues to see sizable investments in its future, as it grows its sales force and customer experience teams and ramps up marketing spending.

(2) Heavily reliant on big customers

Slack had 88,000 paid customers as of the end of January, but only a small fraction of those accounted for a huge chunk of the company’s revenue.

The filing disclosed that Slack has 575 customers—about 0.7% of total paid customers—that each generate more than $100,000 in annual recurring revenue, up from 298 a year earlier. This cohort contributed to about 40% of Slack’s revenue last year, the company said. Slack finds the metric indicative of its ability to attract large businesses to its platform, and the company bills its customers based on the number of users that it has on its platform.

On the opposite end, Slack has a huge base of organizations using the service for free, numbering more than 500,000 at the end of January. “This model facilitates rapid and efficient user adoption, particularly by empowering users to access Slack without the friction of payment or a formal sales interaction,” the prospectus said. “We believe free usage helps prospective paid customers realize the value of Slack and users spread the word organically throughout their networks and organizations.”

(3) Working hard or hardly working

Slack depends on becoming a bigger part of workplace culture so that more users within a given company start to make use of the platform—and pay for it.

The company said that it had 10 million daily active users across its free and paid tiers in the three months ended in January, though it didn’t provide a breakdown between the two. Slack disclosed that “many” of its paid customers have thousands of active users, while the company’s largest paid customers have “tens of thousands” of daily users.

During the final week of January, Slack saw its free and paid user base spend more than 50 million hours combined on the service, sending more than a billion messages. On a normal workday in that period, the company said, users on paid subscriptions were connected to Slack for an average of nine hours and spent more than 90 minutes actively engaging on the service.

(4) Competing with giants

Slack acknowledged that it’s going up against at least one big player as it moves to simplify communications at work. The company mentions Microsoft Corp. as its “primary competitor” currently but admitted that current partners, including Atlassian Corp., Alphabet Inc.’s Google GOOGL, and newly public Zoom Video Communications Inc. could come out with new products to rival Slack’s platform.

“Some of our larger competitors have substantially broader product offerings and leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that discourages users from purchasing Slack, including through selling at zero or negative margins, product bundling, or closed technology platforms,” Slack said in its filing.

(5) Another dual-class structure

Slack, like many other hot young tech companies, will have a dual-class stock structure that concentrates voting power among executives and others who owned shares ahead of Slack’s expected listing. The company will list Class A shares on the NYSE, but its Class B shares will each have 10 times the voting power of each Class A share. Slack has yet to disclose the approximate voting power that Class B shareholders will have at the time of the listing.

Apr 26, 2019

Slack Technologies Inc. is looking for a better direct-listing fate than Spotify Technology SA.

The music-streaming service reminded tech unicorns late last year that companies don’t have to issue new shares or raise money through a traditional offering if they wish to go public, and now Slack is following in its footsteps. The business-chat company filed direct-listing paperwork on Friday.

Direct listings differ from traditional initial public offerings, in that the company doesn’t issue new shares or seek to raise money through the process of going public. Rather, the listing makes it possible for existing shareholders to sell their shares to the public.

Slack’s filing reveals a business with slowing revenue growth but narrowing losses, as well as a heavy dependence on just a several hundred key customers, or less than 1% of its paid customer base, for a major chunk of its sales. Here are five things to know about the company, which intends to list on the New York Stock Exchange under the ticker “SK.”

(1) Revenue deceleration

Slack topped $400 million in annual revenue for its fiscal year ended in January, though growth slowed from the prior period. The company’s revenue rose 82% from $220.5 million in 2018, down from a growth rate of just over 100% a year earlier.

Founded in 2009, Slack admitted in its prospectus that it has “limited experience with respect to determining the optimal prices for Slack.” The company expects that it might need to change its pricing model periodically going forward.

The messaging company made progress in narrowing its losses, posting a net loss of $140.7 million last year, compared with $181 million a year earlier. Slack continues to see sizable investments in its future, as it grows its sales force and customer experience teams and ramps up marketing spending.

(2) Heavily reliant on big customers

Slack had 88,000 paid customers as of the end of January, but only a small fraction of those accounted for a huge chunk of the company’s revenue.

The filing disclosed that Slack has 575 customers—about 0.7% of total paid customers—that each generate more than $100,000 in annual recurring revenue, up from 298 a year earlier. This cohort contributed to about 40% of Slack’s revenue last year, the company said. Slack finds the metric indicative of its ability to attract large businesses to its platform, and the company bills its customers based on the number of users that it has on its platform.

On the opposite end, Slack has a huge base of organizations using the service for free, numbering more than 500,000 at the end of January. “This model facilitates rapid and efficient user adoption, particularly by empowering users to access Slack without the friction of payment or a formal sales interaction,” the prospectus said. “We believe free usage helps prospective paid customers realize the value of Slack and users spread the word organically throughout their networks and organizations.”

(3) Working hard or hardly working

Slack depends on becoming a bigger part of workplace culture so that more users within a given company start to make use of the platform—and pay for it.

The company said that it had 10 million daily active users across its free and paid tiers in the three months ended in January, though it didn’t provide a breakdown between the two. Slack disclosed that “many” of its paid customers have thousands of active users, while the company’s largest paid customers have “tens of thousands” of daily users.

During the final week of January, Slack saw its free and paid user base spend more than 50 million hours combined on the service, sending more than a billion messages. On a normal workday in that period, the company said, users on paid subscriptions were connected to Slack for an average of nine hours and spent more than 90 minutes actively engaging on the service.

(4) Competing with giants

Slack acknowledged that it’s going up against at least one big player as it moves to simplify communications at work. The company mentions Microsoft Corp. as its “primary competitor” currently but admitted that current partners, including Atlassian Corp., Alphabet Inc.’s Google GOOGL, and newly public Zoom Video Communications Inc. could come out with new products to rival Slack’s platform.

“Some of our larger competitors have substantially broader product offerings and leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that discourages users from purchasing Slack, including through selling at zero or negative margins, product bundling, or closed technology platforms,” Slack said in its filing.

(5) Another dual-class structure

Slack, like many other hot young tech companies, will have a dual-class stock structure that concentrates voting power among executives and others who owned shares ahead of Slack’s expected listing. The company will list Class A shares on the NYSE, but its Class B shares will each have 10 times the voting power of each Class A share. Slack has yet to disclose the approximate voting power that Class B shareholders will have at the time of the listing.

#4

Team Owner

It seems like every 5 years or so there is a better IM software available. AIM, ICQ, Skype, Slack, Teams, etc. I have not used Microsoft Teams but my understanding is it's a serious competitor.

I'm on the fence with this one.

I'm on the fence with this one.

#5

Sanest Florida Man

It's a competitor because it's now included with O365

#6

Changed ticker from SK to WORK

Expected to start trading on Thurs. June 20

Expected to start trading on Thurs. June 20

#7

https://www.wsj.com/articles/slack-i...re-11560978612

Slack IPO Reference Price Set at $26 a Share

June 19, 2019

Slack IPO reference price set at $26 a share

This is a developing story and will be updated shortly.

June 19, 2019

Slack IPO reference price set at $26 a share

This is a developing story and will be updated shortly.

Trending Topics

#8

Senior Moderator

]NYSE: WORK

41.73 USD +15.73 (60.50%)

41.73 USD +15.73 (60.50%)

#10

Team Owner

#11

$26.41 : -$4.66 (-15.00%)

After hours: 5:33PM EDT

Q2 2020 results

Loss of $0.14 vs loss of $0.19 EST

Revenue of $145 million vs $141.3 million EST

Q3 2020 guidance

Loss of $0.09 to $0.08 vs loss of $0.07 EST

Revenue between $154 million and $156 million vs $154.2 million EST

FY 2020 guidance

Loss of $0.42 to $0.40 vs loss of $0.42 EST

Revenue between $603 million to $610 million vs $600.6 million EST

https://investor.slackhq.com/news/ne...ancial-Results

Second Quarter Fiscal 2020 Financial Highlights:

- Total revenue was $145.0 million, an increase of 58% year-over-year. Revenue was negatively impacted by $8.2 million of credits related to service level disruption in the quarter.

- GAAP gross profit was $113.9 million, or 78.5% gross margin, compared to $80.7 million, or 87.7% gross margin, in the second quarter of fiscal year 2019. Non-GAAP gross profit was $126.3 million, or 87.1% gross margin, compared to $80.7 million, or 87.7% gross margin, in the second quarter of fiscal year 2019.

- GAAP operating loss was $363.7 million, or 251% of total revenue

, compared to a $33.7 million loss in the second quarter of fiscal year 2019, or 37% of total revenue.

, compared to a $33.7 million loss in the second quarter of fiscal year 2019, or 37% of total revenue.- GAAP net loss per basic and diluted share was $0.98. Non-GAAP net loss per share was $0.14.

For the third quarter of fiscal year 2020, Slack currently expects:

- Total revenue of $154 million to $156 million, representing year-over-year growth of 46% to 48%.

- Non-GAAP operating loss of $49 million to $47 million.

- Non-GAAP net loss per share of $0.09 to $0.08, assuming weighted average shares outstanding of 544 million.

For the full fiscal year 2020, Slack currently expects:

Total revenue of $603 million to $610 million, representing year-over-year growth of 51% to 52%.

Non-GAAP operating loss of $180 million to $176 million, including approximately $30 million of one-time direct listing related expenses.

Non-GAAP net loss per share of $0.42 to $0.40, assuming weighted average shares outstanding of 399 million.

https://www.marketwatch.com/story/sl...nce-2019-09-04

Slack shares plunge 15% on weak earnings guidance

Sept 4, 2019

The workplace-communications company reported second-quarter results that exceeded Wall Street estimates but forecast a slightly larger-than-expected loss for its current quarter, renewing concerns about its road to profitability and revenue growth. Slack said it expects to lose 8 cents to 9 cents a share; analysts polled by FactSet have estimated 7 cents.

The weak guidance overshadowed what was generally a good quarter. Slack reported a non-GAAP loss of 14 cents a share, and said revenue improved 58% to $145 million. Analysts surveyed by FactSet had expected a loss of 19 cents a share on revenue of $141.3 million. For the year, FactSet is predicting a loss of 42 cents a share on revenue of $600.6 million.

It may be the fastest-growing software-as-a-service (SaaS) company ever, but Slack’s results following a disappointing direct public offering underscore deep-seated concerns among investors about its growth trajectory. After opening at $38.50 on June 20 and climbing to $42, shares have sunk to $31.01 after Wednesday’s market close, though they shot up 8% during regular trading. (The S&P 500 index SPX, +1.08% has gained 17% this year.)

Growth remains a principle worry. Slack’s revenue rose 110% in fiscal years 2017-2018, but slowed to 82% in 2018-2019 and the company is now forecasting 47% to 50% in the current fiscal year, with revenue between $590 million and $600 million. Slack reported $400 million in fiscal 2019 revenue. On Wednesday, Slack said it expects Q3 revenue to grow 46% to 48%, to $154 million to $156 million.

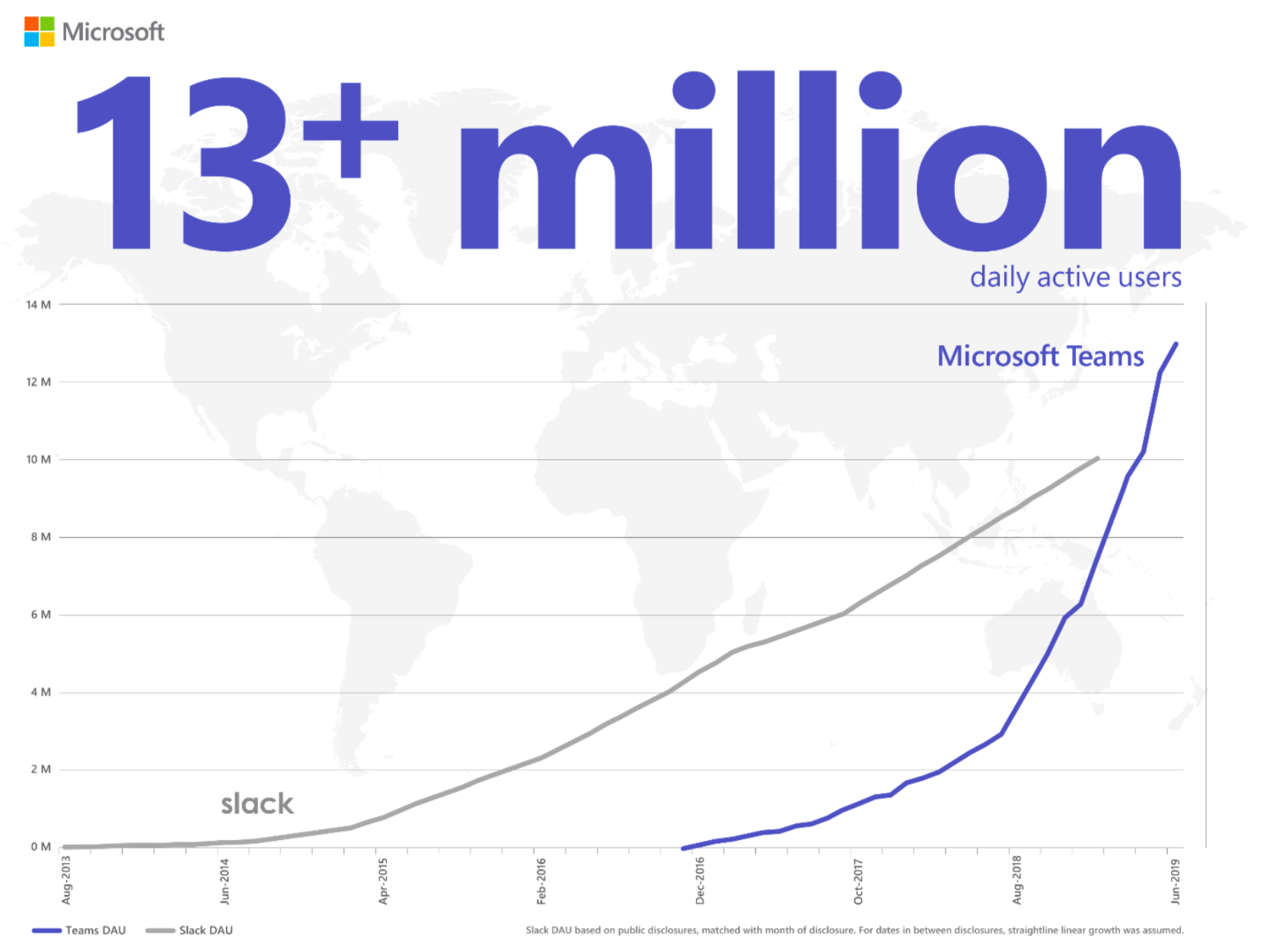

A major obstacle to Slack’s growth is Microsoft Corp. , which includes the Teams work chat app in Office 365 business subscriptions. In July, Microsoft released statistics suggesting Teams is more widely used than Slack, largely because of adoption among companies that use Microsoft productivity software.

Sept 4, 2019

The workplace-communications company reported second-quarter results that exceeded Wall Street estimates but forecast a slightly larger-than-expected loss for its current quarter, renewing concerns about its road to profitability and revenue growth. Slack said it expects to lose 8 cents to 9 cents a share; analysts polled by FactSet have estimated 7 cents.

The weak guidance overshadowed what was generally a good quarter. Slack reported a non-GAAP loss of 14 cents a share, and said revenue improved 58% to $145 million. Analysts surveyed by FactSet had expected a loss of 19 cents a share on revenue of $141.3 million. For the year, FactSet is predicting a loss of 42 cents a share on revenue of $600.6 million.

It may be the fastest-growing software-as-a-service (SaaS) company ever, but Slack’s results following a disappointing direct public offering underscore deep-seated concerns among investors about its growth trajectory. After opening at $38.50 on June 20 and climbing to $42, shares have sunk to $31.01 after Wednesday’s market close, though they shot up 8% during regular trading. (The S&P 500 index SPX, +1.08% has gained 17% this year.)

Growth remains a principle worry. Slack’s revenue rose 110% in fiscal years 2017-2018, but slowed to 82% in 2018-2019 and the company is now forecasting 47% to 50% in the current fiscal year, with revenue between $590 million and $600 million. Slack reported $400 million in fiscal 2019 revenue. On Wednesday, Slack said it expects Q3 revenue to grow 46% to 48%, to $154 million to $156 million.

A major obstacle to Slack’s growth is Microsoft Corp. , which includes the Teams work chat app in Office 365 business subscriptions. In July, Microsoft released statistics suggesting Teams is more widely used than Slack, largely because of adoption among companies that use Microsoft productivity software.

#13

Sanest Florida Man

I could be way off here but is this the trend now that companies go public once they're in trouble and need more money? They'll be private as long business is good but once it starts to turn then we better go public in order to save us? Uber, Slack, Twitter, Lyft

#15

Team Owner

It's .com 1999 all over again. The insiders want to GTFO, they go public, sell it to bag holders.

Last edited by doopstr; 09-10-2019 at 06:39 PM.

The following users liked this post:

#1 STUNNA (09-13-2019)

#16

Added 7 million daily users in 4 months?

https://www.barrons.com/articles/sla...rs-51574184700

Slack Stock Slides as Rival Microsoft Teams Hits 20 Million Active Users

Nov. 19, 2019

Slack stock (ticker: WORK) was trading sharply lower Tuesday after Microsoft (MSFT) disclosed in a blog post that it now has 20 million daily active users for Teams, Slack’s chief rival in the market for collaborative communications tools.

Teams is part of the Microsoft 365 suite of office productivity tools. Microsoft made the disclosure in a blog post called “5 attributes of successful teams,” by Jared Spataro, corporate VP for Microsoft 365. In the post, he said that “last month Teams customers participated in more than 27 million voice or video meetings and performed over 220 million open, edit, or download actions on files stored in Teams.” In July, Microsoft had announced that it had 13 million users.

Last month, Slack said it had 12 million active users.

Wedbush analyst Dan Ives, who has an Underperform rating and $14 target price on Slack stock, wrote in a research note this morning that the news about Teams is an “ominous sign” for Slack.

“We continue to believe that while Slack has the first mover advantage in this new market opportunity, Microsoft represents the biggest risk for investors given its massive enterprise installed base and the fact that it offers Teams with no extra charge to its Office 365 business customers,” he writes. “Although Slack has a strong growth opportunity ahead, in our opinion penetrating this next phase of enterprises will be incrementally more difficult as the Microsoft/Teams value proposition presents a major competitive hurdle going forward in sales cycles.”

Nov. 19, 2019

Slack stock (ticker: WORK) was trading sharply lower Tuesday after Microsoft (MSFT) disclosed in a blog post that it now has 20 million daily active users for Teams, Slack’s chief rival in the market for collaborative communications tools.

Teams is part of the Microsoft 365 suite of office productivity tools. Microsoft made the disclosure in a blog post called “5 attributes of successful teams,” by Jared Spataro, corporate VP for Microsoft 365. In the post, he said that “last month Teams customers participated in more than 27 million voice or video meetings and performed over 220 million open, edit, or download actions on files stored in Teams.” In July, Microsoft had announced that it had 13 million users.

Last month, Slack said it had 12 million active users.

Wedbush analyst Dan Ives, who has an Underperform rating and $14 target price on Slack stock, wrote in a research note this morning that the news about Teams is an “ominous sign” for Slack.

“We continue to believe that while Slack has the first mover advantage in this new market opportunity, Microsoft represents the biggest risk for investors given its massive enterprise installed base and the fact that it offers Teams with no extra charge to its Office 365 business customers,” he writes. “Although Slack has a strong growth opportunity ahead, in our opinion penetrating this next phase of enterprises will be incrementally more difficult as the Microsoft/Teams value proposition presents a major competitive hurdle going forward in sales cycles.”

#17

Reports Q3 2020 results on Wed.

Q3 2020 analyst estimates

Loss of $0.08 per share

Revenue of $156 million

Options suggesting a 14% to 15% move

Got Dec. 20 $22.5/$20 put spreads for a gamble

Q3 2020 analyst estimates

Loss of $0.08 per share

Revenue of $156 million

Options suggesting a 14% to 15% move

Got Dec. 20 $22.5/$20 put spreads for a gamble

#18

$21.66 : -$0.91 (-4.03%)

$20.26 : -$1.40 (-6.46%)

After hours: 4:38PM EST

https://investor.slackhq.com/news/ne...s/default.aspx

Q3 2020 results

Non-GAAP loss of $0.02 per share vs loss of $0.08 per share expected -- beat

Revenue of $168.73 million vs $156 million expected -- beat

Q4 2020 guidance

Non-GAAP loss per share between $0.06 and $0.07 vs estimate for loss of $0.06 -- teeny tiny miss

Revenue between $172 million and $174 million vs estimate for $173.02 million -- teeny tiny miss

#19

Team Owner

Someone will eventually buy them out. My bet is on Salesforce.

Thread

Thread Starter

Forum

Replies

Last Post