We Company (WeWork)

#1

We Company (WeWork)

https://www.cnbc.com/2019/04/29/the-...y-for-ipo.html

The We Company, better known as WeWork, files confidentially for IPO

Apr 29, 2019

The company did not reveal financial information in the filing. However, in a presentation shared with CNBC in March, The We Company said it had a net loss of $1.9 billion on $1.8 billion in revenue in 2018, and a net loss of $933 million on $886 million in revenue in 2017.

WeWork’s business model continues to rely on heavy funding from private investors, namely SoftBank, which has poured over $10 billion into the company, including $2 billion this year. WeWork has to plunge cash into real estate in some of the most expensive markets and makes money back over time as companies and individuals pay their rent, or membership.

The firm rebranded from the name “WeWork” earlier this year in order to encompass the expanding scope of its plans. WeWork now encompasses the co-working space business with which the firm got its start. The We Company’s other business units include WeLive, which provides flexible residential offerings and WeGrow, its education unit.

In the memo to employees Neumann told staff, “We have regularly focused on how to take our business to the next level in every aspect. As part of keeping all options open, we confidentially filed a draft S-1 registration statement with the Securities and Exchange Commission in December. After a lot of thought, last week we decided to file the first amendment to our submission, which is a step towards allowing us to decide to become a public company.”

Apr 29, 2019

The company did not reveal financial information in the filing. However, in a presentation shared with CNBC in March, The We Company said it had a net loss of $1.9 billion on $1.8 billion in revenue in 2018, and a net loss of $933 million on $886 million in revenue in 2017.

WeWork’s business model continues to rely on heavy funding from private investors, namely SoftBank, which has poured over $10 billion into the company, including $2 billion this year. WeWork has to plunge cash into real estate in some of the most expensive markets and makes money back over time as companies and individuals pay their rent, or membership.

The firm rebranded from the name “WeWork” earlier this year in order to encompass the expanding scope of its plans. WeWork now encompasses the co-working space business with which the firm got its start. The We Company’s other business units include WeLive, which provides flexible residential offerings and WeGrow, its education unit.

In the memo to employees Neumann told staff, “We have regularly focused on how to take our business to the next level in every aspect. As part of keeping all options open, we confidentially filed a draft S-1 registration statement with the Securities and Exchange Commission in December. After a lot of thought, last week we decided to file the first amendment to our submission, which is a step towards allowing us to decide to become a public company.”

#2

https://www.wsj.com/articles/as-wewo...er-11557954423

As WeWork’s Losses Mount, It Aims to Distance Itself From Uber

May 15, 2019

As WeWork Cos. heads toward an initial public offering, its ebullient chief executive believes it shouldn’t be lumped in the same category as massively money-losing companies like Uber Technologies Inc. and Lyft Inc.

“Our business model is quite different,” WeWork CEO Adam Neumann said from the startup’s New York headquarters.

WeWork on Wednesday reported a $264 million loss in the first quarter on strong revenue growth after recording a $1.9 billion loss last year.

What gets lost in all the red ink, Mr. Neumann and Chief Financial Officer Artie Minson said, is that WeWork’s losses are largely due to investments in businesses that make money.

Silicon Valley is wincing now that public-market investors have determined Uber and its ride-hailing rival Lyft are worth less than private investors thought, amid concerns over their large losses and unclear path to profitability. Despite rapid growth, Uber and Lyft last year reported a combined $4.6 billion loss for the 12 months ending in March, and both stocks are trading well below their IPO prices.

While investors’ enthusiasm for high-growth, money-losing startups may be waning, it hasn’t deterred technology companies waiting in line to make their debuts, according to bankers and investors. Like WeWork, many of these firms are seeking ways to differentiate themselves from Uber and Lyft, including by characterizing their losses as temporary and a path to growth.

WeWork, which at $47 billion is the country’s most valuable startup now that Uber is public, has long been dogged by skepticism about its lofty valuation.

The company on Wednesday reported its first-quarter results to media and bond investors, saying that revenue grew by 112% to $728 million. Its net loss slightly narrowed from last year, but that was partly because of a $367 million one-time gain the company realized.

While Uber and Lyft are spending heavily on costs that are fundamental to the business, like finding enough drivers, Mr. Minson said WeWork is focusing on building out its offices and filling them up with rent-paying businesses. Once that happens, WeWork says the centers are typically making healthy profit margins.

“There is a real difference between losing money and investing money,” Mr. Minson said.

He said large companies are shifting to shorter leases and outsourcing real-estate management, so WeWork is spending heavily now to capitalize on the trend.

Aside from the robust spending, WeWork has other qualities that analysts and real-estate investors find concerning. The company has only existed during a bull market, and its core business model involves signing long-term leases and then subleasing them shorter term—a risk in a recession when office rents tend to fall sharply. WeWork says that so far, it has performed well in regions with recessionary economies.

WeWork is also run by a CEO who has voting control over the company and has made decisions that have concerned some of its investors. On Wednesday, WeWork said Mr. Neumann plans to sell the properties he owns and leases to WeWork to its real-estate investment arm at cost, a move to eliminate a potential conflict of interest.

WeWork isn’t required to disclose its financial results publicly, but since it took on bond debt last year, it has provided to media outlets its financial presentation given to bond investors. The company stopped disclosing occupancy this quarter, which was down to 80% in the fourth quarter of 2018.

WeWork went through about $650 million of cash in the first quarter, leaving it with $5.9 billion in cash and commitments. Analysts at Sanford C. Bernstein Co. estimate it will burn through around $9 billion of cash between 2019 and 2020. Its expenses have been doubling at a similar rate as revenue. The company needs to spend big on sales and marketing to find the next person or company to rent, and when WeWork adds new members, it also needs to build new desks. Its membership rose 111% to 466,000 from a year ago.

May 15, 2019

As WeWork Cos. heads toward an initial public offering, its ebullient chief executive believes it shouldn’t be lumped in the same category as massively money-losing companies like Uber Technologies Inc. and Lyft Inc.

“Our business model is quite different,” WeWork CEO Adam Neumann said from the startup’s New York headquarters.

WeWork on Wednesday reported a $264 million loss in the first quarter on strong revenue growth after recording a $1.9 billion loss last year.

What gets lost in all the red ink, Mr. Neumann and Chief Financial Officer Artie Minson said, is that WeWork’s losses are largely due to investments in businesses that make money.

Silicon Valley is wincing now that public-market investors have determined Uber and its ride-hailing rival Lyft are worth less than private investors thought, amid concerns over their large losses and unclear path to profitability. Despite rapid growth, Uber and Lyft last year reported a combined $4.6 billion loss for the 12 months ending in March, and both stocks are trading well below their IPO prices.

While investors’ enthusiasm for high-growth, money-losing startups may be waning, it hasn’t deterred technology companies waiting in line to make their debuts, according to bankers and investors. Like WeWork, many of these firms are seeking ways to differentiate themselves from Uber and Lyft, including by characterizing their losses as temporary and a path to growth.

WeWork, which at $47 billion is the country’s most valuable startup now that Uber is public, has long been dogged by skepticism about its lofty valuation.

The company on Wednesday reported its first-quarter results to media and bond investors, saying that revenue grew by 112% to $728 million. Its net loss slightly narrowed from last year, but that was partly because of a $367 million one-time gain the company realized.

While Uber and Lyft are spending heavily on costs that are fundamental to the business, like finding enough drivers, Mr. Minson said WeWork is focusing on building out its offices and filling them up with rent-paying businesses. Once that happens, WeWork says the centers are typically making healthy profit margins.

“There is a real difference between losing money and investing money,” Mr. Minson said.

He said large companies are shifting to shorter leases and outsourcing real-estate management, so WeWork is spending heavily now to capitalize on the trend.

Aside from the robust spending, WeWork has other qualities that analysts and real-estate investors find concerning. The company has only existed during a bull market, and its core business model involves signing long-term leases and then subleasing them shorter term—a risk in a recession when office rents tend to fall sharply. WeWork says that so far, it has performed well in regions with recessionary economies.

WeWork is also run by a CEO who has voting control over the company and has made decisions that have concerned some of its investors. On Wednesday, WeWork said Mr. Neumann plans to sell the properties he owns and leases to WeWork to its real-estate investment arm at cost, a move to eliminate a potential conflict of interest.

WeWork isn’t required to disclose its financial results publicly, but since it took on bond debt last year, it has provided to media outlets its financial presentation given to bond investors. The company stopped disclosing occupancy this quarter, which was down to 80% in the fourth quarter of 2018.

WeWork went through about $650 million of cash in the first quarter, leaving it with $5.9 billion in cash and commitments. Analysts at Sanford C. Bernstein Co. estimate it will burn through around $9 billion of cash between 2019 and 2020. Its expenses have been doubling at a similar rate as revenue. The company needs to spend big on sales and marketing to find the next person or company to rent, and when WeWork adds new members, it also needs to build new desks. Its membership rose 111% to 466,000 from a year ago.

#3

S-1 filing : https://www.sec.gov/Archives/edgar/d...d781982ds1.htm

If you thought Uber would be a bad investment....

https://www.wsj.com/articles/wework-...lf-11567689174

3 days later, another valuation cut.

https://www.wsj.com/articles/wework-...ut-11567976754

https://observer.com/2019/09/softban...nderwater-ipo/

https://observer.com/2019/09/softban...nderwater-ipo/

If you thought Uber would be a bad investment....

https://www.wsj.com/articles/wework-...lf-11567689174

WeWork Weighs Slashing Valuation by More Than Half Amid IPO Skepticism

Sept. 5, 2019

WeWork’s parent company is exploring a dramatic reduction in its valuation as it aims to go public while facing widespread skepticism over its business model and corporate governance, according to people familiar with the company’s listing plans and its recent talks with major investors.

We Co. is considering putting a price tag on its initial public offering that would value the company somewhere in the $20 billion range, potentially at the low end. That is less than half of the $47 billion mark where it last raised private capital this year, making it one of the largest valuation comedowns in IPO history.

Adam Neumann, We’s co-founder and chief executive, flew to Tokyo last week to meet one of the company’s biggest investors, SoftBank Group Chief Executive Masayoshi Son, and members of his team. There, they discussed the possibility of an additional infusion of capital.

Among the ideas considered was SoftBank serving as an anchor investor in the IPO by buying a significant portion of the roughly $3 billion to $4 billion the company is expected to raise. The executives also discussed whether SoftBank might invest a chunk of money that would allow We to delay its IPO until 2020.

It isn’t known whether SoftBank will ultimately put more money into We. Some of the conglomerate’s key investors have previously balked at doing so.

Over the past year, SoftBank committed to invest $4 billion in the company at a valuation of around $47 billion. It also spent $1 billion to buy existing shares from We employees and investors at a valuation of around $23 billion.

Since We unveiled the papers for its IPO last month, potential investors have raised concerns with the company and its underwriters about We’s steep losses, as well as hundreds of millions of dollars of real-estate deals and past personal loans involving the firm and Mr. Neumann. They have also balked at valuations anywhere near the $47 billion mark.

That harsh reception has been a surprising wake-up call for We executives. Because of that, We and its underwriters have considered raising money at a much lower price tag than initially expected.

We had been planning to debut in September, The Wall Street Journal previously reported, which was earlier than many investors anticipated. But the situation remains fluid, and We could still start its roadshow to pitch potential investors on the IPO as soon as Monday. The company hasn’t yet chosen an exchange on which to list its shares.

Some existing investors, aware of potential public buyers’ wariness toward We, have advocated shelving the IPO until next year.

“I’ve heard no bullish views at all,” said Rett Wallace, chief executive of Triton Research, which analyzes pre-IPO companies for investors. “There were Uber bulls, there were Lyft bulls, there were Snap bulls.” He added that “WeWork is exhausting people’s cynicism.”

It is difficult to find other venture-backed technology companies during the past decade whose valuations have fallen so steeply at their IPOs, according to a Renaissance Capital analysis.

[ . . . ]

We has a significant amount of red ink on its own income statement. As it continues to increase spending on areas like sales and marketing, its losses — totaling $1.67 billion for the 12 months ended in June — have been trending in the opposite direction of what companies typically like to show as they head toward public ownership.

We primarily rents long-term space, renovates it, then divides the offices and subleases them short-term to other companies. It has for years baffled landlords and startup investors with its valuation, which has been more akin to that of a software company with limited costs than an office-space provider. IWG PLC—a similar company that has less growth but is profitable—rents a comparable number of desks but has a market capitalization of around $4.6 billion, one-tenth the level at which We was most recently valued. Even before the IPO prospectus was filed, some former executives and current We employees told the Journal they were bracing for a big drop in value.

If We does begin its roadshow Monday, it would be on track to go public as soon as late September. The company has been talking with underwriters about a September listing or waiting until October so its executives and bankers could spend several additional weeks meeting with investors to keep explaining more aspects of the business. The company could also wait until next year to debut if it raises more capital this year.

Should We move forward with an IPO, it would also trigger a huge debt raise for the company. A number of banks including JPMorgan Chase & Co. and Goldman Sachs Group Inc. have committed to providing We with up to $6 billion in debt when it goes public, contingent on We raising $3 billion in an IPO.

[ . . . ]

Sept. 5, 2019

WeWork’s parent company is exploring a dramatic reduction in its valuation as it aims to go public while facing widespread skepticism over its business model and corporate governance, according to people familiar with the company’s listing plans and its recent talks with major investors.

We Co. is considering putting a price tag on its initial public offering that would value the company somewhere in the $20 billion range, potentially at the low end. That is less than half of the $47 billion mark where it last raised private capital this year, making it one of the largest valuation comedowns in IPO history.

Adam Neumann, We’s co-founder and chief executive, flew to Tokyo last week to meet one of the company’s biggest investors, SoftBank Group Chief Executive Masayoshi Son, and members of his team. There, they discussed the possibility of an additional infusion of capital.

Among the ideas considered was SoftBank serving as an anchor investor in the IPO by buying a significant portion of the roughly $3 billion to $4 billion the company is expected to raise. The executives also discussed whether SoftBank might invest a chunk of money that would allow We to delay its IPO until 2020.

It isn’t known whether SoftBank will ultimately put more money into We. Some of the conglomerate’s key investors have previously balked at doing so.

Over the past year, SoftBank committed to invest $4 billion in the company at a valuation of around $47 billion. It also spent $1 billion to buy existing shares from We employees and investors at a valuation of around $23 billion.

Since We unveiled the papers for its IPO last month, potential investors have raised concerns with the company and its underwriters about We’s steep losses, as well as hundreds of millions of dollars of real-estate deals and past personal loans involving the firm and Mr. Neumann. They have also balked at valuations anywhere near the $47 billion mark.

That harsh reception has been a surprising wake-up call for We executives. Because of that, We and its underwriters have considered raising money at a much lower price tag than initially expected.

We had been planning to debut in September, The Wall Street Journal previously reported, which was earlier than many investors anticipated. But the situation remains fluid, and We could still start its roadshow to pitch potential investors on the IPO as soon as Monday. The company hasn’t yet chosen an exchange on which to list its shares.

Some existing investors, aware of potential public buyers’ wariness toward We, have advocated shelving the IPO until next year.

“I’ve heard no bullish views at all,” said Rett Wallace, chief executive of Triton Research, which analyzes pre-IPO companies for investors. “There were Uber bulls, there were Lyft bulls, there were Snap bulls.” He added that “WeWork is exhausting people’s cynicism.”

It is difficult to find other venture-backed technology companies during the past decade whose valuations have fallen so steeply at their IPOs, according to a Renaissance Capital analysis.

[ . . . ]

We has a significant amount of red ink on its own income statement. As it continues to increase spending on areas like sales and marketing, its losses — totaling $1.67 billion for the 12 months ended in June — have been trending in the opposite direction of what companies typically like to show as they head toward public ownership.

We primarily rents long-term space, renovates it, then divides the offices and subleases them short-term to other companies. It has for years baffled landlords and startup investors with its valuation, which has been more akin to that of a software company with limited costs than an office-space provider. IWG PLC—a similar company that has less growth but is profitable—rents a comparable number of desks but has a market capitalization of around $4.6 billion, one-tenth the level at which We was most recently valued. Even before the IPO prospectus was filed, some former executives and current We employees told the Journal they were bracing for a big drop in value.

If We does begin its roadshow Monday, it would be on track to go public as soon as late September. The company has been talking with underwriters about a September listing or waiting until October so its executives and bankers could spend several additional weeks meeting with investors to keep explaining more aspects of the business. The company could also wait until next year to debut if it raises more capital this year.

Should We move forward with an IPO, it would also trigger a huge debt raise for the company. A number of banks including JPMorgan Chase & Co. and Goldman Sachs Group Inc. have committed to providing We with up to $6 billion in debt when it goes public, contingent on We raising $3 billion in an IPO.

[ . . . ]

3 days later, another valuation cut.

https://www.wsj.com/articles/wework-...ut-11567976754

WeWork Parent Weighs Further Valuation Cut

Office-sharing company eyes valuation below $20 billion amid investor skepticism

Sept. 8, 2019

WeWork’s parent is eyeing a valuation for its initial public offering that could fall below $20 billion as some existing investors push the workspace company to shelve the planned offering, people familiar with the matter said.

Despite plans to begin a roadshow to market the shares to new investors as early as Monday, We Co. and its underwriters are planning to hold meetings this week among themselves and with investors to figure out what changes may be needed to help garner enough demand for an IPO, the people said.

A valuation below the $20 billion level that people familiar with the matter last week said the company was considering would be an even steeper drop from the $47 billion mark where We last raised private capital this year. The startup faces skepticism among potential public investors over its governance, business model and ability to turn a profit while continuing to grow. The latest potential cut comes at a time when IPO demand for companies with a path to profitability is surging and would be particularly painful for investors who have given or committed over $10 billion to the company since it was founded in 2010.

Potential investors have been unnerved by co-founder and Chief Executive Adam Neumann ’s sales of hundreds of millions of dollars of his stock and loans of more than $740 million tied to his shares in the company, according to Wall Street Journal reports and regulatory filings. Mr. Neumann also controls a majority of the voting rights of the company and recently doubled the potency of his supervoting shares.

Some investors have indicated interest in the IPO and it is possible the company will pull it off at a valuation of $20 billion or higher.

Should We yank or postpone the IPO, it stands to miss out on nearly $10 billion needed to fund its ambitious but money-losing global-growth plans. The company was planning to raise $3 billion to $4 billion in the IPO and up to $6 billion in debt that is contingent on the IPO raising at least $3 billion.

If the IPO doesn’t happen, the company will either need to find more cash or scale back its plans for further growth, according to people close to the company. One problem is that We has long been betting its main appeal to investors is its rapid growth, but that growth is fueled by ever-growing helpings of cash.

[ . . . ]

Office-sharing company eyes valuation below $20 billion amid investor skepticism

Sept. 8, 2019

WeWork’s parent is eyeing a valuation for its initial public offering that could fall below $20 billion as some existing investors push the workspace company to shelve the planned offering, people familiar with the matter said.

Despite plans to begin a roadshow to market the shares to new investors as early as Monday, We Co. and its underwriters are planning to hold meetings this week among themselves and with investors to figure out what changes may be needed to help garner enough demand for an IPO, the people said.

A valuation below the $20 billion level that people familiar with the matter last week said the company was considering would be an even steeper drop from the $47 billion mark where We last raised private capital this year. The startup faces skepticism among potential public investors over its governance, business model and ability to turn a profit while continuing to grow. The latest potential cut comes at a time when IPO demand for companies with a path to profitability is surging and would be particularly painful for investors who have given or committed over $10 billion to the company since it was founded in 2010.

Potential investors have been unnerved by co-founder and Chief Executive Adam Neumann ’s sales of hundreds of millions of dollars of his stock and loans of more than $740 million tied to his shares in the company, according to Wall Street Journal reports and regulatory filings. Mr. Neumann also controls a majority of the voting rights of the company and recently doubled the potency of his supervoting shares.

Some investors have indicated interest in the IPO and it is possible the company will pull it off at a valuation of $20 billion or higher.

Should We yank or postpone the IPO, it stands to miss out on nearly $10 billion needed to fund its ambitious but money-losing global-growth plans. The company was planning to raise $3 billion to $4 billion in the IPO and up to $6 billion in debt that is contingent on the IPO raising at least $3 billion.

If the IPO doesn’t happen, the company will either need to find more cash or scale back its plans for further growth, according to people close to the company. One problem is that We has long been betting its main appeal to investors is its rapid growth, but that growth is fueled by ever-growing helpings of cash.

[ . . . ]

https://observer.com/2019/09/softban...nderwater-ipo/

https://observer.com/2019/09/softban...nderwater-ipo/

SoftBank’s WeWork Bet Is Already $4 Billion Underwater Before IPO

09/06/19

As the summer heat subsides, the hot IPO market of 2019 also seems to be heading into a chilly season.

Just look at the numbers. As of this week, most of this year’s flashy market debuts—Uber, Lyft and Slack, just to name a few—have all hit their record low share price levels due to a mixed impact from a never-ending trade war, recession fears and these companies’ own subpar performances.

All the embattled companies mentioned above have a common investor behind the scenes—Japan’s telecom giant SoftBank Group. SoftBank’s venture capital arm, the $100 billion Vision Fund, owns sizable stakes in Uber, Lyft and Slack and has seen hundreds of millions of dollars dissipate after the market rout lately.

Adding to the piling bad news, this week another SoftBank heavy bet, WeWork, said it might have to slash its IPO valuation by more than half from the previously estimated $47 billion to somewhere between $20 billion and $30 billion.

The New York-based office space-sharing startup reached its sky-high valuation earlier this year after SoftBank infused $2 billion into the unprofitable company. But its staggering losses ($1.6 billion last year) look increasingly bothersome to many Wall Street analysts as the company nears its IPO date.

Since 2017, SoftBank has invested a total of around $10.4 billion in WeWork through multiple funding rounds. The Japanese conglomerate currently owns 29% of WeWork, the startup disclosed on Wednesday. That’s a larger stake than that of WeWork’s own CEO and co-founder, Adam Neumann, who owns 22%.

WeWork said Neumann will eventually own 29% of the company, too, after his stock options fully vest.

For SoftBank, the WeWork account is already over $4 billion in red ink at the company’s new lower-end IPO valuation. There’s no guarantee that the share price will take off once the trading begins, either. After all, for now WeWork shows no more promise of profitability than its peer SoftBank-backed unicorns, whose share prices have all tanked over 20% since going public.

09/06/19

As the summer heat subsides, the hot IPO market of 2019 also seems to be heading into a chilly season.

Just look at the numbers. As of this week, most of this year’s flashy market debuts—Uber, Lyft and Slack, just to name a few—have all hit their record low share price levels due to a mixed impact from a never-ending trade war, recession fears and these companies’ own subpar performances.

All the embattled companies mentioned above have a common investor behind the scenes—Japan’s telecom giant SoftBank Group. SoftBank’s venture capital arm, the $100 billion Vision Fund, owns sizable stakes in Uber, Lyft and Slack and has seen hundreds of millions of dollars dissipate after the market rout lately.

Adding to the piling bad news, this week another SoftBank heavy bet, WeWork, said it might have to slash its IPO valuation by more than half from the previously estimated $47 billion to somewhere between $20 billion and $30 billion.

The New York-based office space-sharing startup reached its sky-high valuation earlier this year after SoftBank infused $2 billion into the unprofitable company. But its staggering losses ($1.6 billion last year) look increasingly bothersome to many Wall Street analysts as the company nears its IPO date.

Since 2017, SoftBank has invested a total of around $10.4 billion in WeWork through multiple funding rounds. The Japanese conglomerate currently owns 29% of WeWork, the startup disclosed on Wednesday. That’s a larger stake than that of WeWork’s own CEO and co-founder, Adam Neumann, who owns 22%.

WeWork said Neumann will eventually own 29% of the company, too, after his stock options fully vest.

For SoftBank, the WeWork account is already over $4 billion in red ink at the company’s new lower-end IPO valuation. There’s no guarantee that the share price will take off once the trading begins, either. After all, for now WeWork shows no more promise of profitability than its peer SoftBank-backed unicorns, whose share prices have all tanked over 20% since going public.

#4

https://www.cnbc.com/2019/09/17/wewo...-response.html

WeWork delays IPO after frosty investor response

Sep 17 2019

WeWork owner The We Company has postponed its initial public offering (IPO), walking away from preparations to launch it this month after a lackluster response from investors to its plans.

The U.S. office-sharing startup was getting ready to launch an investor road show for its IPO this week before making the last-minute decision on Monday to stand down, people familiar with the matter said.

The company has been under pressure to proceed with the stock market flotation to secure funding for its operations.

In the run-up to the launch of its IPO, We Company has faced concerns about its corporate governance standards, as well as the sustainability of its business model, which relies on a mix of long-term liabilities and short-term revenue, and how such a model would weather an economic downturn.

Reuters reported last week that We Company might seek a valuation in its IPO of between $10 billion and $12 billion, a dramatic discount to the $47 billion valuation it achieved in January.

“The We Company is looking forward to our upcoming IPO, which we expect to be completed by the end of the year. We want to thank all of our employees, members and partners for their ongoing commitment,” the company said in a short statement.

Were We Company to have pressed on with the IPO at such a low valuation, it would have represented a major turning point in the growth over the last decade of the venture capital industry, which has led to the rise of startups such as Uber Technologies, Snap, and Airbnb.

It would have meant that We Company would be valued at less than the $12.8 billion in equity it has raised since it was founded in 2010, according to data provider Crunchbase. And it would have been a blow to its biggest backer, Japan’s SoftBank, at a time when it is trying to amass $108 billion from investors for its second Vision Fund.

SoftBank was discussing supporting the IPO by snapping up shares worth between $750 million and $1 billion, the sources said. However, We Company decided on Monday that even with SoftBank’s support, the IPO would have raised a little over than $2 billion, short of its target of at least $3 billion.

This target is tied to a $6 billion credit line We Company secured from banks last month, that calls for an IPO to take place by the end of the year and raise at least $3 billion, one of the sources said.

Were the New York-based company to fail to meet this target by the end of the year, it would need to secure alternative funding.

Sep 17 2019

WeWork owner The We Company has postponed its initial public offering (IPO), walking away from preparations to launch it this month after a lackluster response from investors to its plans.

The U.S. office-sharing startup was getting ready to launch an investor road show for its IPO this week before making the last-minute decision on Monday to stand down, people familiar with the matter said.

The company has been under pressure to proceed with the stock market flotation to secure funding for its operations.

In the run-up to the launch of its IPO, We Company has faced concerns about its corporate governance standards, as well as the sustainability of its business model, which relies on a mix of long-term liabilities and short-term revenue, and how such a model would weather an economic downturn.

Reuters reported last week that We Company might seek a valuation in its IPO of between $10 billion and $12 billion, a dramatic discount to the $47 billion valuation it achieved in January.

“The We Company is looking forward to our upcoming IPO, which we expect to be completed by the end of the year. We want to thank all of our employees, members and partners for their ongoing commitment,” the company said in a short statement.

Were We Company to have pressed on with the IPO at such a low valuation, it would have represented a major turning point in the growth over the last decade of the venture capital industry, which has led to the rise of startups such as Uber Technologies, Snap, and Airbnb.

It would have meant that We Company would be valued at less than the $12.8 billion in equity it has raised since it was founded in 2010, according to data provider Crunchbase. And it would have been a blow to its biggest backer, Japan’s SoftBank, at a time when it is trying to amass $108 billion from investors for its second Vision Fund.

SoftBank was discussing supporting the IPO by snapping up shares worth between $750 million and $1 billion, the sources said. However, We Company decided on Monday that even with SoftBank’s support, the IPO would have raised a little over than $2 billion, short of its target of at least $3 billion.

This target is tied to a $6 billion credit line We Company secured from banks last month, that calls for an IPO to take place by the end of the year and raise at least $3 billion, one of the sources said.

Were the New York-based company to fail to meet this target by the end of the year, it would need to secure alternative funding.

#5

Senior Moderator

I occasionally work in WeWork offices. The fitout of the office space is very bad. Poor craftsmanship and materials used. Their design/construction philosophy is basically to use cheap but modern paint, flooring, and wall paper. Add in some fruit water, cold brew on tap, and voila.

#6

Sanest Florida Man

#7

Sanest Florida Man

The following users liked this post:

doopstr (09-18-2019)

Trending Topics

#8

https://www.wsj.com/articles/neumann...eo-11569343912

WeWork CEO Adam Neumann Expected to Step Down

Sept. 24, 2019

WeWork co-founder and Chief Executive Adam Neumann is expected to step down after the company’s much-anticipated initial public offering was derailed, capping a remarkably swift fall from grace for the leader of one of the country’s most valuable startups.

Mr. Neumann and the company’s advisers have agreed that the best path forward for the office-sharing startup is for him to relinquish the CEO role, people familiar with the matter said. He is expected to remain nonexecutive chairman of We Co., as the company is officially known.

An announcement of the move could come as soon as today, the people said, assuming the decision isn’t reversed at the last minute.

Mr. Neumann’s position at the company became tenuous after We postponed an IPO earlier this month amid concerns from prospective investors about its governance and ability to reverse big losses. That skepticism has placed a major dent in the company’s expected valuation, which has plummeted from $47 billion earlier this year to as low as $15 billion.

Mr. Neumann will cede majority control of We, with his voting shares being reduced to 3-to-1 from 10-to-1, the people said.

The company plans to name two internal executives as Co-CEOs: Artie Minson, currently the company’s chief financial officer, and Sebastian Gunningham, a veteran of Amazon.com Inc., a person familiar with the decision said.

Further undercutting his position: eccentric behavior that was detailed in a Wall Street Journal article last week, including a party-heavy lifestyle that included marijuana use in an airplane and unpredictable management decisions.

Mr. Neumann has been in meetings with JPMorgan Chase & Co. Chief Executive James Dimon at the bank’s headquarters throughout this week and separately met with WeWork director Bruce Dunlevie Sunday to discuss his fate, the people said.

The situation is delicate because Mr. Neumann controls the nine-year-old company and its board, which he could summarily dismiss if he wanted.

But pressure on Mr. Neumann from SoftBank Group Corp. appears to have marked a major turning point. The Japanese technology conglomerate is among those pushing for his ouster, the Journal first reported Sunday. In addition to being We’s biggest shareholder, SoftBank has influence by virtue of its willingness to pump much-needed cash into the company. SoftBank was expected to contribute as much as a third of the $3 billion or so of IPO proceeds. Without its support, there would have been few other places for We to look for the multiple billions of dollars it needs to keep growing at its present pace.

. . . .

The fate of the IPO now remains to be seen. The company said when it was postponed that the offering would take place by year-end, but people familiar with the matter now say that with a new CEO coming in, a further delay may be necessary.

Sept. 24, 2019

WeWork co-founder and Chief Executive Adam Neumann is expected to step down after the company’s much-anticipated initial public offering was derailed, capping a remarkably swift fall from grace for the leader of one of the country’s most valuable startups.

Mr. Neumann and the company’s advisers have agreed that the best path forward for the office-sharing startup is for him to relinquish the CEO role, people familiar with the matter said. He is expected to remain nonexecutive chairman of We Co., as the company is officially known.

An announcement of the move could come as soon as today, the people said, assuming the decision isn’t reversed at the last minute.

Mr. Neumann’s position at the company became tenuous after We postponed an IPO earlier this month amid concerns from prospective investors about its governance and ability to reverse big losses. That skepticism has placed a major dent in the company’s expected valuation, which has plummeted from $47 billion earlier this year to as low as $15 billion.

Mr. Neumann will cede majority control of We, with his voting shares being reduced to 3-to-1 from 10-to-1, the people said.

The company plans to name two internal executives as Co-CEOs: Artie Minson, currently the company’s chief financial officer, and Sebastian Gunningham, a veteran of Amazon.com Inc., a person familiar with the decision said.

Further undercutting his position: eccentric behavior that was detailed in a Wall Street Journal article last week, including a party-heavy lifestyle that included marijuana use in an airplane and unpredictable management decisions.

Mr. Neumann has been in meetings with JPMorgan Chase & Co. Chief Executive James Dimon at the bank’s headquarters throughout this week and separately met with WeWork director Bruce Dunlevie Sunday to discuss his fate, the people said.

The situation is delicate because Mr. Neumann controls the nine-year-old company and its board, which he could summarily dismiss if he wanted.

But pressure on Mr. Neumann from SoftBank Group Corp. appears to have marked a major turning point. The Japanese technology conglomerate is among those pushing for his ouster, the Journal first reported Sunday. In addition to being We’s biggest shareholder, SoftBank has influence by virtue of its willingness to pump much-needed cash into the company. SoftBank was expected to contribute as much as a third of the $3 billion or so of IPO proceeds. Without its support, there would have been few other places for We to look for the multiple billions of dollars it needs to keep growing at its present pace.

. . . .

The fate of the IPO now remains to be seen. The company said when it was postponed that the offering would take place by year-end, but people familiar with the matter now say that with a new CEO coming in, a further delay may be necessary.

#9

Going from a $48 billion to an $8 billion valuation?

SoftBank's escalation of commitment

https://www.wsj.com/articles/softban...rk-11571746483

SoftBank's escalation of commitment

https://www.wsj.com/articles/softban...rk-11571746483

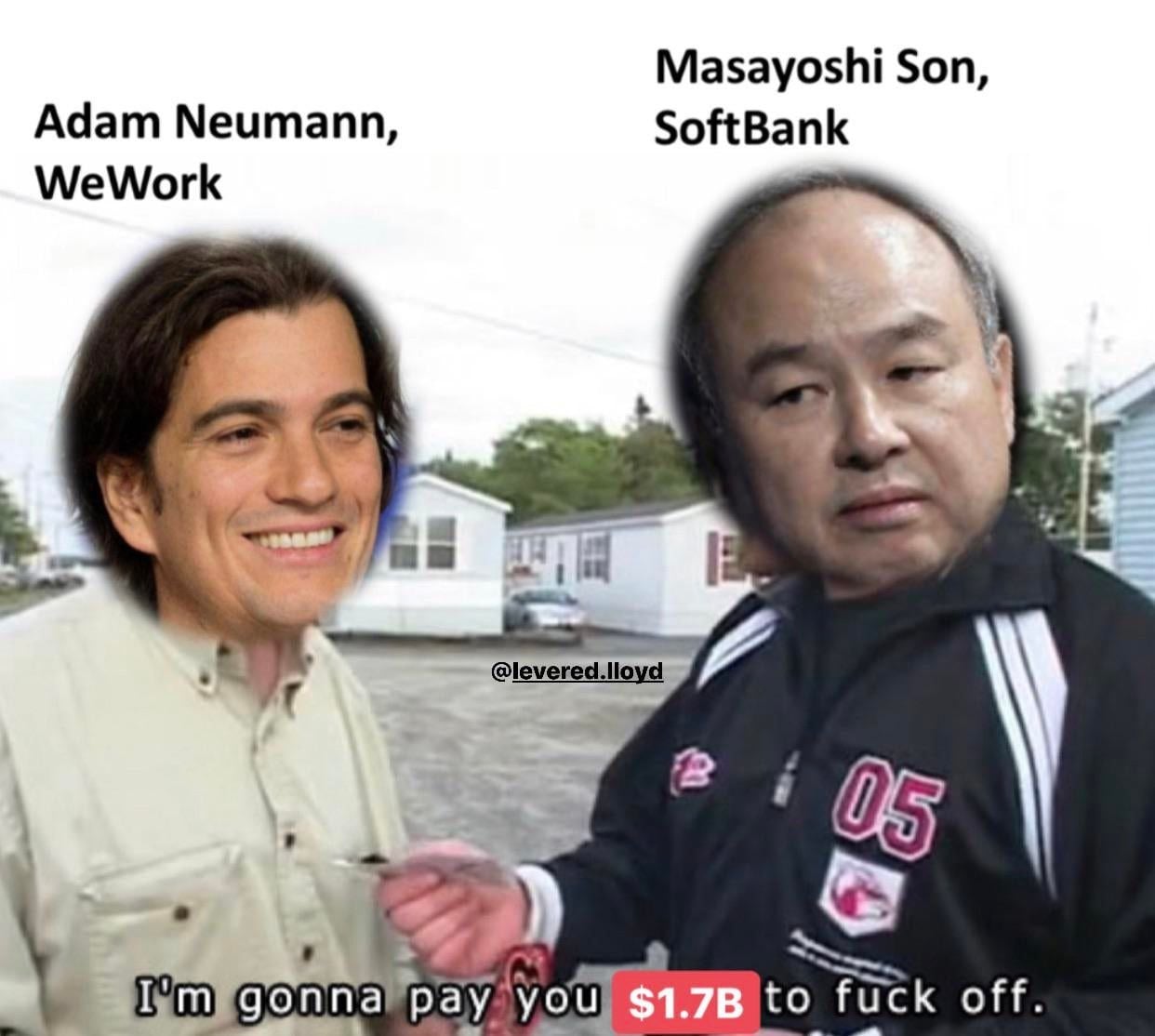

SoftBank to Take Control of WeWork

Oct. 22, 2019

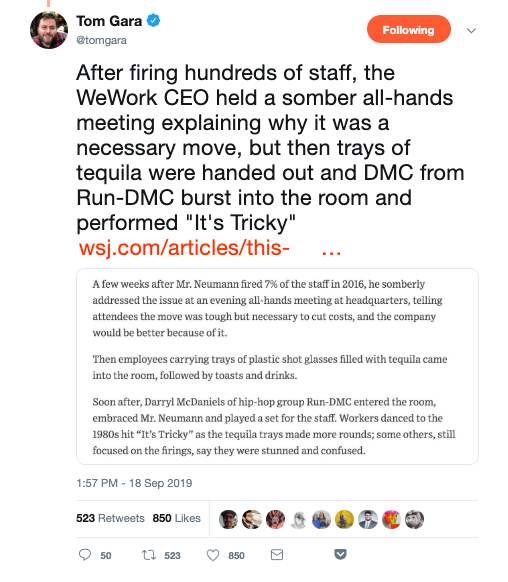

SoftBank Group Corp. won approval from WeWork’s board to take control of the troubled co-working startup, in a deal that would hand co-founder Adam Neumann nearly $1.7 billion and sever most of his ties with the company.

WeWork, in danger of running out of cash in the coming weeks, chose a rescue offer from SoftBank over a competing proposal from JPMorgan Chase & Co., according to people familiar with the matter. It had asked both parties to submit proposals by a deadline yesterday.

The deal is expected to value the company at about $8 billion, a far cry from what it was expected to fetch in an initial public offering earlier this year and even less than the $47 billion at which a January investment from SoftBank pegged its worth.

As part of the deal, SoftBank, which already owns about a third of the company, is to buy nearly $1 billion of stock in WeWork’s parent from Mr. Neumann, who was forced out as chief executive after pushback from prospective investors scuttled the IPO. The Japanese conglomerate will also extend him roughly $500 million in credit to help repay a loan facility of the same amount led by JPMorgan, and also pay Mr. Neumann a $185 million consulting fee, the people said.

Mr. Neumann, who is still chairman of We Co., as the parent is known, is also expected to step down from the board, the people said. He will maintain a stake in the company and remain a board observer.

The nearly $1 billion share purchase is part of a tender offer of as much as $3 billion from SoftBank to be extended to the company’s employees and other investors.

WeWork’s board is expected to announce this deal Tuesday, though the people warned it could be delayed.

SoftBank’s Vision Fund was expected to move up a $1.5 billion investment in WeWork that it had been scheduled to make next year. There is also a $5 billion loan component.

Mr. Neumann, who co-founded WeWork in 2010, once had a block of shares in WeWork that gave him as much as 20 votes per share. As part of this deal, all We stock now will have the same voting power. Mr. Neumann’s stake in the company is expected to fall to below 10% after he sells shares.

. . ..

Oct. 22, 2019

SoftBank Group Corp. won approval from WeWork’s board to take control of the troubled co-working startup, in a deal that would hand co-founder Adam Neumann nearly $1.7 billion and sever most of his ties with the company.

WeWork, in danger of running out of cash in the coming weeks, chose a rescue offer from SoftBank over a competing proposal from JPMorgan Chase & Co., according to people familiar with the matter. It had asked both parties to submit proposals by a deadline yesterday.

The deal is expected to value the company at about $8 billion, a far cry from what it was expected to fetch in an initial public offering earlier this year and even less than the $47 billion at which a January investment from SoftBank pegged its worth.

As part of the deal, SoftBank, which already owns about a third of the company, is to buy nearly $1 billion of stock in WeWork’s parent from Mr. Neumann, who was forced out as chief executive after pushback from prospective investors scuttled the IPO. The Japanese conglomerate will also extend him roughly $500 million in credit to help repay a loan facility of the same amount led by JPMorgan, and also pay Mr. Neumann a $185 million consulting fee, the people said.

Mr. Neumann, who is still chairman of We Co., as the parent is known, is also expected to step down from the board, the people said. He will maintain a stake in the company and remain a board observer.

The nearly $1 billion share purchase is part of a tender offer of as much as $3 billion from SoftBank to be extended to the company’s employees and other investors.

WeWork’s board is expected to announce this deal Tuesday, though the people warned it could be delayed.

SoftBank’s Vision Fund was expected to move up a $1.5 billion investment in WeWork that it had been scheduled to make next year. There is also a $5 billion loan component.

Mr. Neumann, who co-founded WeWork in 2010, once had a block of shares in WeWork that gave him as much as 20 votes per share. As part of this deal, all We stock now will have the same voting power. Mr. Neumann’s stake in the company is expected to fall to below 10% after he sells shares.

. . ..

#10

Sucks for the employees.

https://www.wsj.com/articles/wework-...ap-11571870011

https://www.wsj.com/articles/wework-...ap-11571870011

WeWork Employee Options Underwater as Ex-CEO Reaps

Oct. 23, 2019

Adam Neumann stands to receive up to $1.7 billion as part of a deal with SoftBank Group Corp. to step away from office-space startup WeWork. The company’s employees aren’t doing as well.

Thousands of staff are slated to be laid off soon as the company rapidly tries to cut costs and steer the money-losing company toward a path to profit, according to people familiar with the strategy. And for more than 90% of current and former employees, the price of the SoftBank deal, which values WeWork at about $8 billion, is below the grant price for stock awards and options they hold, former executives said. That means the vast majority of employees would get nothing if they sold their holdings today.

The rich exit deal for Mr. Neumann as SoftBank wrested control of the company from the former chief executive officer this week has led to frustration, current and former employees said. The Japanese conglomerate agreed to provide a multibillion-dollar rescue financing package to ease WeWork’s cash crunch after the company decided to pull a planned initial public offering last month.

As part of the package, SoftBank will give Mr. Neumann a $185 million consulting fee, let him sell up to $970 million of his stock as part of a larger offering to investors and employees and extend a $500 million credit line to him that replaces one from a set of banks. The deal, which removes Mr. Neumann from the board of directors, calls for SoftBank to buy WeWork’s private shares from investors and some employees at $19.19 each, a fraction of the $110 a share price reached in January, when WeWork was valued at $47 billion.

At a meeting with employees Wednesday morning, Marcelo Claure, a top SoftBank official and WeWork’s new executive chairman, said that some of the payout to Mr. Neumann was necessary to persuade him to give up his substantial control over the company, according to a person who heard the remarks.

Mr. Claure said he understood the plight of employees and was looking at ways to improve their financial situation but didn’t yet have specifics.

Numerous employees on the company’s internal Slack messaging service expressed frustration with Mr. Neumann’s exit package on Tuesday, with some noting the irony of an individual benefiting so much at a company known as We.

At startups, a large share of compensation is often in the form of stock options, which allow the purchase of stock at a price set when employees are hired. When a startup turns into a successful large company, the options can prove hugely lucrative because they allow early employees to buy stock at a cheap price and cash out at a much higher one.

But with We, the share price for options has been above $20 a share since January 2016, when the company had just 1,000 employees. Employee options after that date wouldn’t have any value if exercised now at SoftBank’s new price of $19.19. As of June, the company had more than 12,000 employees.

Mr. Claure indicated in his remarks to staff he may reprice options, although such a move could take a while, and it’s unclear if it would apply to former employees or those laid off.

Mr. Neumann’s situation differs from most of the employees because he owns most of his stock outright, as is typical of company founders.

. . . .

Oct. 23, 2019

Adam Neumann stands to receive up to $1.7 billion as part of a deal with SoftBank Group Corp. to step away from office-space startup WeWork. The company’s employees aren’t doing as well.

Thousands of staff are slated to be laid off soon as the company rapidly tries to cut costs and steer the money-losing company toward a path to profit, according to people familiar with the strategy. And for more than 90% of current and former employees, the price of the SoftBank deal, which values WeWork at about $8 billion, is below the grant price for stock awards and options they hold, former executives said. That means the vast majority of employees would get nothing if they sold their holdings today.

The rich exit deal for Mr. Neumann as SoftBank wrested control of the company from the former chief executive officer this week has led to frustration, current and former employees said. The Japanese conglomerate agreed to provide a multibillion-dollar rescue financing package to ease WeWork’s cash crunch after the company decided to pull a planned initial public offering last month.

As part of the package, SoftBank will give Mr. Neumann a $185 million consulting fee, let him sell up to $970 million of his stock as part of a larger offering to investors and employees and extend a $500 million credit line to him that replaces one from a set of banks. The deal, which removes Mr. Neumann from the board of directors, calls for SoftBank to buy WeWork’s private shares from investors and some employees at $19.19 each, a fraction of the $110 a share price reached in January, when WeWork was valued at $47 billion.

At a meeting with employees Wednesday morning, Marcelo Claure, a top SoftBank official and WeWork’s new executive chairman, said that some of the payout to Mr. Neumann was necessary to persuade him to give up his substantial control over the company, according to a person who heard the remarks.

Mr. Claure said he understood the plight of employees and was looking at ways to improve their financial situation but didn’t yet have specifics.

Numerous employees on the company’s internal Slack messaging service expressed frustration with Mr. Neumann’s exit package on Tuesday, with some noting the irony of an individual benefiting so much at a company known as We.

At startups, a large share of compensation is often in the form of stock options, which allow the purchase of stock at a price set when employees are hired. When a startup turns into a successful large company, the options can prove hugely lucrative because they allow early employees to buy stock at a cheap price and cash out at a much higher one.

But with We, the share price for options has been above $20 a share since January 2016, when the company had just 1,000 employees. Employee options after that date wouldn’t have any value if exercised now at SoftBank’s new price of $19.19. As of June, the company had more than 12,000 employees.

Mr. Claure indicated in his remarks to staff he may reprice options, although such a move could take a while, and it’s unclear if it would apply to former employees or those laid off.

Mr. Neumann’s situation differs from most of the employees because he owns most of his stock outright, as is typical of company founders.

. . . .

#11

Sanest Florida Man

#12

https://www.cnbc.com/2019/11/13/wewo...n-revenue.html

WeWork tells investors it lost $1.25 billion in the third quarter

Nov 13 2019

WeWork’s losses continued to mount in the third quarter, reflecting a fast-growth strategy undertaken by ousted CEO Adam Neumann, according to a slide deck the company presented to investors.

The deck showed losses of $1.25 billion (unadjusted), up more than 150% from a loss of $497 million in the same period a year earlier. Revenue almost doubled to $934 million from $482 million. The company also said that occupancy rates had decreased to 79%, its lowest figure since mid-2017, as a result of a rapid buildout of new space.

WeWork added 115,000 new desks during the quarter, which the company called a record. According to a report last week from real estate firm CBRE, WeWork accounted for 69% of U.S. coworking space leases in the third quarter and was the top leaser in nine of the 10 biggest markets for flexible space growth.

WeWork, which withdrew its IPO in September and replaced Neumann before taking a $5 billion bailout from SoftBank, showed solid growth in enterprise memberships to 264,000 (up from 214,000 at the end of the prior period), and committed revenue of $4.3 billion. A big part of the strategy under the leadership of SoftBank, which now controls 80% of the company, is to focus on larger enterprise customers.

Nov 13 2019

WeWork’s losses continued to mount in the third quarter, reflecting a fast-growth strategy undertaken by ousted CEO Adam Neumann, according to a slide deck the company presented to investors.

The deck showed losses of $1.25 billion (unadjusted), up more than 150% from a loss of $497 million in the same period a year earlier. Revenue almost doubled to $934 million from $482 million. The company also said that occupancy rates had decreased to 79%, its lowest figure since mid-2017, as a result of a rapid buildout of new space.

WeWork added 115,000 new desks during the quarter, which the company called a record. According to a report last week from real estate firm CBRE, WeWork accounted for 69% of U.S. coworking space leases in the third quarter and was the top leaser in nine of the 10 biggest markets for flexible space growth.

WeWork, which withdrew its IPO in September and replaced Neumann before taking a $5 billion bailout from SoftBank, showed solid growth in enterprise memberships to 264,000 (up from 214,000 at the end of the prior period), and committed revenue of $4.3 billion. A big part of the strategy under the leadership of SoftBank, which now controls 80% of the company, is to focus on larger enterprise customers.

https://www.nytimes.com/2019/11/17/b...k-layoffs.html

WeWork May Lay Off Thousands

Nov. 17, 2019

WeWork is preparing to cut at least 4,000 people from its work force as it tries to stabilize itself after the company’s breakneck growth racked up heavy losses and led it to the brink of collapse, two people with knowledge of the matter said.

The cuts are expected to be announced as early as this week and will take place across WeWork’s sprawling global operation. Under the plan, the company’s core business of subletting office space would lay off 2,000 to 2,500 employees, one of the people said. An additional 1,000 employees will leave as WeWork sells or closes down noncore businesses, like a private school in Manhattan that WeWork set up. Additionally, roughly 1,000 building maintenance employees will be transferred to an outside contractor. Together, these employees would represent around a third of the 12,500 people WeWork employed at the end of June.

But one of the people said the company could shed as many as 5,000 to 6,000 employees.

The staff reductions will be included in a five-year plan to overhaul WeWork that could be presented to employees as early as Tuesday, said the people, who spoke on the condition of anonymity to discuss the layoff plans.

The layoffs represent the human cost of a remarkable reversal in WeWork’s fortunes. Under its co-founder and former chief executive, Adam Neumann, the company piled billions of dollars into an erratic expansion that included adding huge office spaces in the world’s most expensive cities, offering discounts to lure tenants and buying other businesses. WeWork, which leases office space from landlords, refurbishes it and rents it out to its customers, shelved plans for an initial public offering in late September after investors were put off by the company’s losses and had questions about its corporate governance.

SoftBank, the Japanese conglomerate that is WeWork’s largest outside shareholder, last month announced a plan to bail out the company and is now trying to stabilize the business. But it is not clear how far the plan, which rests on selling billions of dollars of new WeWork bonds to investors, has progressed. The prices of the company’s existing bonds have tumbled in recent days, a sign that investors are worried about its prospects.

WeWork last week reported that it lost $1.25 billion in the three months that ended in September, more than twice as much as the company had lost in the same period a year earlier. A corporate presentation provided to investors revealed that WeWork opened nearly half of its locations in the 12 months that ended in September. Many of these locations are losing money and are likely to be depleting WeWork’s cash, which stood at $2 billion at the end of September.

Mr. Neumann, who agreed to cede control over WeWork after stepping down from the chief executive post in September, stands to receive an exit package worth around $1 billion. As part of that, he will receive a $185 million consulting fee for four years and can sell nearly $1 billion of his shares in the company to SoftBank. The soft landing for Mr. Neumann deepened anger among employees as the layoffs loomed.

Nov. 17, 2019

WeWork is preparing to cut at least 4,000 people from its work force as it tries to stabilize itself after the company’s breakneck growth racked up heavy losses and led it to the brink of collapse, two people with knowledge of the matter said.

The cuts are expected to be announced as early as this week and will take place across WeWork’s sprawling global operation. Under the plan, the company’s core business of subletting office space would lay off 2,000 to 2,500 employees, one of the people said. An additional 1,000 employees will leave as WeWork sells or closes down noncore businesses, like a private school in Manhattan that WeWork set up. Additionally, roughly 1,000 building maintenance employees will be transferred to an outside contractor. Together, these employees would represent around a third of the 12,500 people WeWork employed at the end of June.

But one of the people said the company could shed as many as 5,000 to 6,000 employees.

The staff reductions will be included in a five-year plan to overhaul WeWork that could be presented to employees as early as Tuesday, said the people, who spoke on the condition of anonymity to discuss the layoff plans.

The layoffs represent the human cost of a remarkable reversal in WeWork’s fortunes. Under its co-founder and former chief executive, Adam Neumann, the company piled billions of dollars into an erratic expansion that included adding huge office spaces in the world’s most expensive cities, offering discounts to lure tenants and buying other businesses. WeWork, which leases office space from landlords, refurbishes it and rents it out to its customers, shelved plans for an initial public offering in late September after investors were put off by the company’s losses and had questions about its corporate governance.

SoftBank, the Japanese conglomerate that is WeWork’s largest outside shareholder, last month announced a plan to bail out the company and is now trying to stabilize the business. But it is not clear how far the plan, which rests on selling billions of dollars of new WeWork bonds to investors, has progressed. The prices of the company’s existing bonds have tumbled in recent days, a sign that investors are worried about its prospects.

WeWork last week reported that it lost $1.25 billion in the three months that ended in September, more than twice as much as the company had lost in the same period a year earlier. A corporate presentation provided to investors revealed that WeWork opened nearly half of its locations in the 12 months that ended in September. Many of these locations are losing money and are likely to be depleting WeWork’s cash, which stood at $2 billion at the end of September.

Mr. Neumann, who agreed to cede control over WeWork after stepping down from the chief executive post in September, stands to receive an exit package worth around $1 billion. As part of that, he will receive a $185 million consulting fee for four years and can sell nearly $1 billion of his shares in the company to SoftBank. The soft landing for Mr. Neumann deepened anger among employees as the layoffs loomed.

#13

Senior Moderator

I was working at a WeWork in NYC last week. The beer tap was dry, and there were no more clean coffee cups. The end is near.

#14

Senior Moderator

https://www.wsj.com/articles/wework-...s&page=1&pos=1

We suing Softbank for backing out of the $3b share purchase.

My company has offices at WeWork. Over the last week we were given new contract extensions to sign for our space that are a lot more expensive than before with more restrictions. We are setting up contingency plans to move out soon. Doubtful that We will survive at this point.

We suing Softbank for backing out of the $3b share purchase.

My company has offices at WeWork. Over the last week we were given new contract extensions to sign for our space that are a lot more expensive than before with more restrictions. We are setting up contingency plans to move out soon. Doubtful that We will survive at this point.

Thread

Thread Starter

Forum

Replies

Last Post

kansaiwalker1

Automotive News

5

11-15-2005 10:09 PM