Jumia Technologies

#1

Jumia Technologies

Jumia, the Amazon.com of Africa?

Ticker: JMIA

F-1 Filing : https://www.sec.gov/Archives/edgar/d...650749df1a.htm

https://www.cnbc.com/2019/04/12/the-...f-trading.html

https://techcrunch.com/2019/04/12/af...0-in-nyse-ipo/

Ticker: JMIA

F-1 Filing : https://www.sec.gov/Archives/edgar/d...650749df1a.htm

https://www.cnbc.com/2019/04/12/the-...f-trading.html

The ‘Amazon of Africa’ soars more than 75% on its first day of trading

Apr 12 2019

The largest e-commerce operator in Africa, Jumia Technologies, ended the day with its stock up more than 75.6% on its first day of trading at the New York Stock Exchange on Friday.

The stock ended the day trading at $25.46 per share, above the opening price of $14.50. It has a market cap of about $3.9 billion.

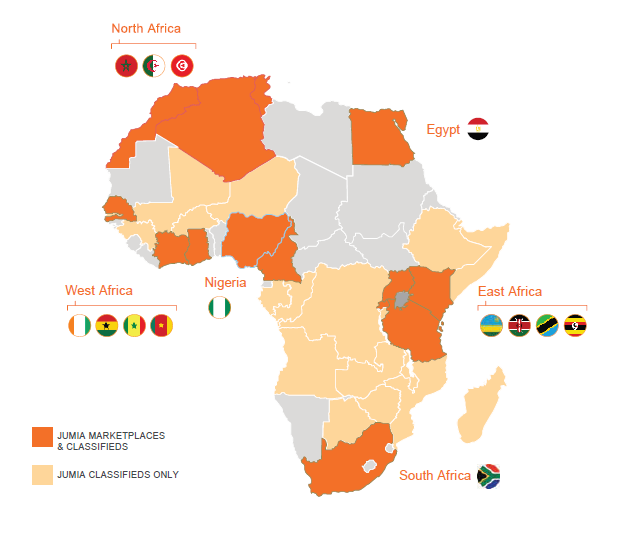

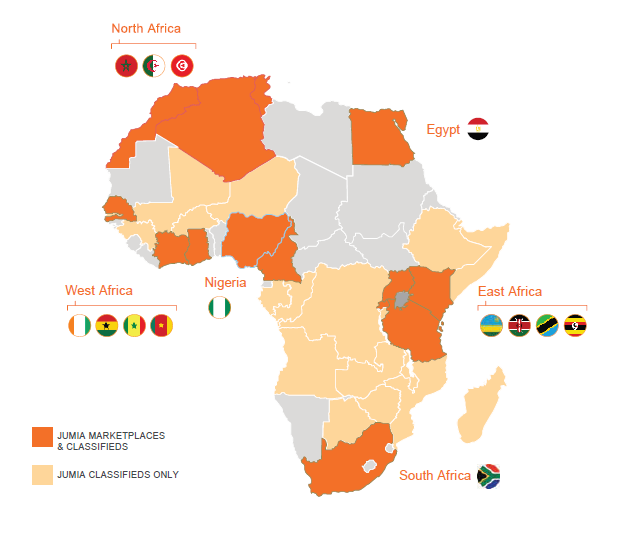

“The Amazon of Africa ” has 4 million active customers as of the fourth quarter of 2018, the company said in its S-1 filing. Jumia operates in 14 African countries, including Ghana, Kenya, Ivory Coast, Morocco and Egypt.

Jumia, founded in 2012, is the first African unicorn to go public.

As of December 2018, the company has accumulated losses of nearly $1 billion. Similar to Amazon, its initial shareholders will have to be patient on the path to profitability.

Jumia’s platform lets customers buy a smartphone, a pair of shoes or a load of groceries. Its logistics segment lets you book travel and hotels, and the fast-pay segment lets you pay your bills or order a pizza.

The difficulty for e-commerce in Africa is for the sellers because of the inefficient infrastructure of the continent, Jumia CEO Sacha Poignonnec told CNBC’s “Squawk Alley” on Friday.

“Its provides a lot of inclusion for consumers who have not necessarily the right access to retail,” Poignonnec said.

Poignonnec also said there’s a big opportunity in Africa because so many people haven’t yet experienced online shopping.

“When we ask the people who have never used online shopping yet, the No. 1 reason that comes out is, ‘I don’t know how to shop online,’” said Poignonnec. “That tells you it’s not about infrastructure, it’s about consumers getting used to it.”

Jumia, headquartered in Germany, works with local entrepreneurs and logistics companies to deliver the products. Half the packages are going into the major cities, and half into the secondary cities and rural areas.

Some of Jumia’s biggest customers are Apple, HP and Huawei.

Apr 12 2019

The largest e-commerce operator in Africa, Jumia Technologies, ended the day with its stock up more than 75.6% on its first day of trading at the New York Stock Exchange on Friday.

The stock ended the day trading at $25.46 per share, above the opening price of $14.50. It has a market cap of about $3.9 billion.

“The Amazon of Africa ” has 4 million active customers as of the fourth quarter of 2018, the company said in its S-1 filing. Jumia operates in 14 African countries, including Ghana, Kenya, Ivory Coast, Morocco and Egypt.

Jumia, founded in 2012, is the first African unicorn to go public.

As of December 2018, the company has accumulated losses of nearly $1 billion. Similar to Amazon, its initial shareholders will have to be patient on the path to profitability.

Jumia’s platform lets customers buy a smartphone, a pair of shoes or a load of groceries. Its logistics segment lets you book travel and hotels, and the fast-pay segment lets you pay your bills or order a pizza.

The difficulty for e-commerce in Africa is for the sellers because of the inefficient infrastructure of the continent, Jumia CEO Sacha Poignonnec told CNBC’s “Squawk Alley” on Friday.

“Its provides a lot of inclusion for consumers who have not necessarily the right access to retail,” Poignonnec said.

Poignonnec also said there’s a big opportunity in Africa because so many people haven’t yet experienced online shopping.

“When we ask the people who have never used online shopping yet, the No. 1 reason that comes out is, ‘I don’t know how to shop online,’” said Poignonnec. “That tells you it’s not about infrastructure, it’s about consumers getting used to it.”

Jumia, headquartered in Germany, works with local entrepreneurs and logistics companies to deliver the products. Half the packages are going into the major cities, and half into the secondary cities and rural areas.

Some of Jumia’s biggest customers are Apple, HP and Huawei.

https://techcrunch.com/2019/04/12/af...0-in-nyse-ipo/

. . . .

Since the original announcement (and reflected in the latest SEC docs), Mastercard Europe pre-purchased $50 million in Jumia ordinary shares.

The IPO creates another milestone for Jumia. The company in 2016 became the first African startup unicorn, achieving a $1 billion valuation after a funding round that included Goldman Sachs, AXA and MTN.

. . . .

About Jumia

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data.

Jumia’s original co-founders included Nigerian tech entrepreneurs Tunde Kehinde and Raphael Afaedor, but both departed in 2015 to form other startups in fintech and logistics.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape. Jumia has extended this infrastructure as an e-commerce fulfillment product called Jumia Services.

Jumia has also opened itself up to Africa’s traders by allowing local merchants to harness Jumia to sell online. The company has more than 80,000 active sellers on the platform using the company’s payment, delivery and data-analytics services, Jumia Nigeria CEO Juliet Anammah told TechCrunch previously.

The most popular goods on Jumia’s shopping site include smartphones, washing machines, fashion items, women’s hair care products and 32-inch TVs, according to Anammah.

Jumia an African startup?

Like Amazon, Jumia brings its own mix of supporters and critics. On the critical side, there are questions of whether it’s actually an African startup. The parent for Jumia Group is incorporated in Germany and current CEOs Jeremy Hodara and Sacha Poignonnec are French.

On the flipside, original Jumia co-founders (Kehinde and Afaedor) are African. The company is headquartered (and also incorporated) in Africa (Lagos), operates exclusively in Africa, pays taxes on the continent, employs 5,128 people in Africa and the CEO of its largest country operation (Nigeria) Juliet Anammah is Nigerian.

The Africa authenticity debate often shifts into questions of a Jumia diversity deficit, which is of course important from Silicon Valley to Nairobi. The company’s senior management and board is a mix of Africans and expats. Golden State Warriors basketball player and tech investor Andre Iguodala joined Jumia’s board this spring with a priority on “diversity and making sure the African culture is in the company,” he told TechCrunch.

Can Jumia turn a profit?

The Jumia authenticity and diversity debates will no doubt roll on. But the biggest question — the driver behind the VC, the IPO, the founders and the people buying Jumia’s shares — is whether the startup can generate profits and ROI.

Obviously some of the world’s top venture investors, such as Jumia backers Goldman, AXA and Mastercard, think so. But for Jumia skeptics, there are the big losses. The company has generated years and years of losses, including negative EBITDA of €172 million in 2018 compared to revenues of €139 that same year.

To be fair to Jumia, most startups (e-commerce startups in particular) rack up losses for years before getting into the black. And operating in a greenfield sector in Africa — where it had to create much of the surrounding infrastructure to do B2C online sales — has presented higher costs for Jumia than e-commerce startups elsewhere.

On the prospects for Jumia’s profitability, two things to watch will be Jumia’s fulfillment expenses and a shift to more revenue from its non-goods-delivery services, which offer lower unit costs and higher-margins. Per Jumia’s SEC F-1 index, freight and shipping make up more than half of its fulfillment expenses.

So Jumia has not turned a profit, but its revenues have increased steadily, up 11 percent to €93.8 million (roughly $106.2 million) in 2017 and up again to €130 million (or $147 million) in 2018. If the company boosts customer acquisition and lowers fulfillment costs — which could come from more internet services revenue and platform investment with IPO capital — it could close the gap between revenues and losses. This reflects the equation for most e-commerce startups. With the IPO, Jumia will have to publish its first full public financials in 2019, which will provide a better picture of profitability prospects.

Jumia’s IPO and African e-commerce?

There is, of course, a bigger play in Jumia’s IPO. One connected to global e-commerce and the future of online retail in Africa.

Jumia going public comes as Africa’s e-commerce landscape has seen its share of ups and downs, notably several failures in DealDey shutting down and the distressed acquisition of Nigerian e-commerce hopeful Konga.com.

As for the big global names, Alibaba has talked about Africa expansion, but for the moment has not entered in full.

Amazon offers limited e-commerce sales on the continent, but more notably, has started offering AWS services in Africa.

And this week, DHL came on the scene, launching its Africa eShop platform with 200 global retailers on board, in partnership with MallforAfrica’s Link Commerce fulfillment service.

Competition to capture Africa’s digitizing consumer markets — expected to spend $2 billion online by 2025, according to McKinsey — could get fierce, with more global entries, acquisitions and competition on fulfillment services all part of the mix.

And finally, the outcome of Jumia’s IPO carries weight even for its competitors. “Many things, like business decisions and VC investments across Africa’s e-commerce sector are on hold,” an African e-commerce exec told TechCrunch on background.

“Everyone’s waiting to see what happens with Jumia’s IPO and how they perform,” the exec said.

So the share price connected to NYSE ticker sign JMIA could reflect not just investor confidence in Jumia, but investor confidence in African e-commerce overall.

Since the original announcement (and reflected in the latest SEC docs), Mastercard Europe pre-purchased $50 million in Jumia ordinary shares.

The IPO creates another milestone for Jumia. The company in 2016 became the first African startup unicorn, achieving a $1 billion valuation after a funding round that included Goldman Sachs, AXA and MTN.

. . . .

About Jumia

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data.

Jumia’s original co-founders included Nigerian tech entrepreneurs Tunde Kehinde and Raphael Afaedor, but both departed in 2015 to form other startups in fintech and logistics.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape. Jumia has extended this infrastructure as an e-commerce fulfillment product called Jumia Services.

Jumia has also opened itself up to Africa’s traders by allowing local merchants to harness Jumia to sell online. The company has more than 80,000 active sellers on the platform using the company’s payment, delivery and data-analytics services, Jumia Nigeria CEO Juliet Anammah told TechCrunch previously.

The most popular goods on Jumia’s shopping site include smartphones, washing machines, fashion items, women’s hair care products and 32-inch TVs, according to Anammah.

Jumia an African startup?

Like Amazon, Jumia brings its own mix of supporters and critics. On the critical side, there are questions of whether it’s actually an African startup. The parent for Jumia Group is incorporated in Germany and current CEOs Jeremy Hodara and Sacha Poignonnec are French.

On the flipside, original Jumia co-founders (Kehinde and Afaedor) are African. The company is headquartered (and also incorporated) in Africa (Lagos), operates exclusively in Africa, pays taxes on the continent, employs 5,128 people in Africa and the CEO of its largest country operation (Nigeria) Juliet Anammah is Nigerian.

The Africa authenticity debate often shifts into questions of a Jumia diversity deficit, which is of course important from Silicon Valley to Nairobi. The company’s senior management and board is a mix of Africans and expats. Golden State Warriors basketball player and tech investor Andre Iguodala joined Jumia’s board this spring with a priority on “diversity and making sure the African culture is in the company,” he told TechCrunch.

Can Jumia turn a profit?

The Jumia authenticity and diversity debates will no doubt roll on. But the biggest question — the driver behind the VC, the IPO, the founders and the people buying Jumia’s shares — is whether the startup can generate profits and ROI.

Obviously some of the world’s top venture investors, such as Jumia backers Goldman, AXA and Mastercard, think so. But for Jumia skeptics, there are the big losses. The company has generated years and years of losses, including negative EBITDA of €172 million in 2018 compared to revenues of €139 that same year.

To be fair to Jumia, most startups (e-commerce startups in particular) rack up losses for years before getting into the black. And operating in a greenfield sector in Africa — where it had to create much of the surrounding infrastructure to do B2C online sales — has presented higher costs for Jumia than e-commerce startups elsewhere.

On the prospects for Jumia’s profitability, two things to watch will be Jumia’s fulfillment expenses and a shift to more revenue from its non-goods-delivery services, which offer lower unit costs and higher-margins. Per Jumia’s SEC F-1 index, freight and shipping make up more than half of its fulfillment expenses.

So Jumia has not turned a profit, but its revenues have increased steadily, up 11 percent to €93.8 million (roughly $106.2 million) in 2017 and up again to €130 million (or $147 million) in 2018. If the company boosts customer acquisition and lowers fulfillment costs — which could come from more internet services revenue and platform investment with IPO capital — it could close the gap between revenues and losses. This reflects the equation for most e-commerce startups. With the IPO, Jumia will have to publish its first full public financials in 2019, which will provide a better picture of profitability prospects.

Jumia’s IPO and African e-commerce?

There is, of course, a bigger play in Jumia’s IPO. One connected to global e-commerce and the future of online retail in Africa.

Jumia going public comes as Africa’s e-commerce landscape has seen its share of ups and downs, notably several failures in DealDey shutting down and the distressed acquisition of Nigerian e-commerce hopeful Konga.com.

As for the big global names, Alibaba has talked about Africa expansion, but for the moment has not entered in full.

Amazon offers limited e-commerce sales on the continent, but more notably, has started offering AWS services in Africa.

And this week, DHL came on the scene, launching its Africa eShop platform with 200 global retailers on board, in partnership with MallforAfrica’s Link Commerce fulfillment service.

Competition to capture Africa’s digitizing consumer markets — expected to spend $2 billion online by 2025, according to McKinsey — could get fierce, with more global entries, acquisitions and competition on fulfillment services all part of the mix.

And finally, the outcome of Jumia’s IPO carries weight even for its competitors. “Many things, like business decisions and VC investments across Africa’s e-commerce sector are on hold,” an African e-commerce exec told TechCrunch on background.

“Everyone’s waiting to see what happens with Jumia’s IPO and how they perform,” the exec said.

So the share price connected to NYSE ticker sign JMIA could reflect not just investor confidence in Jumia, but investor confidence in African e-commerce overall.

#2

Chapter Leader (Southern Region)

Interdasting

Going to see if there are any expectations for a dip and rebuy

Africa is definitely the next exploit.. pretty much call it New China, with all them Chinese there trying to get their exploits in

Going to see if there are any expectations for a dip and rebuy

Africa is definitely the next exploit.. pretty much call it New China, with all them Chinese there trying to get their exploits in

#3

No dip

$43.90 : +$3.69 (+9.18%)

$43.90 : +$3.69 (+9.18%)

#4

Chapter Leader (Southern Region)

I know the moment I buy it'll dip.. shit

#5

Chapter Leader (Southern Region)

Fucking Cramer endorsed.. it'll drop again.

#6

Chapter Leader (Southern Region)

I'll buy around 35

#7

Trending Topics

#8

Chapter Leader (Southern Region)

thirrrteee foo fidddeeeee

So auspicious

Also.. 34.50 x 2 = 6ixty9ineeee

Not like that fuccboi snitch

but like, you know

I'm researching

So auspicious

Also.. 34.50 x 2 = 6ixty9ineeee

Not like that fuccboi snitch

but like, you know

I'm researching

#9

#10

$33.11 : -$2.69 (-7.51%)

Holding off until after they report Q1 2019 results.

https://investor.jumia.com/Cache/100...2&iid=14406054

Lockup expiration is 10/9/2019

https://www.bloomberg.com/news/artic...agreed-lock-in

https://www.marketwatch.com/story/af...vor-2019-05-07

Holding off until after they report Q1 2019 results.

https://investor.jumia.com/Cache/100...2&iid=14406054

Lagos, Nigeria, 7 May, 2019 - Jumia Technologies AG (NYSE: JMIA), (“Jumia”), today announced that it will release its results for the quarter ended March 31, 2019 before the U.S. market opens on Thursday, May 16, 2019. Management will host a conference call at 8:30 a.m. US Eastern Time on the same day.

Lockup expiration is 10/9/2019

https://www.bloomberg.com/news/artic...agreed-lock-in

MTN Plans Sale of Jumia Stake After Agreed Lock-In

April 30, 2019

MTN Group Ltd. plans to sell at least half of its $655 million interest in newly listed Jumia Technologies AG as Africa’s biggest wireless carrier looks to pay down debt and enter new markets, according to people familiar with the matter.

A selldown of the 19 percent stake in the online retailer could happen before the end of the year, said the people, who asked to remain anonymous as the deliberations are private. Johannesburg-based MTN first needs to wait out a half-year investor lock-in period that followed Jumia’s successful share sale in New York, they said.

“We have a six-month lock-up period where we can’t sell our shareholding,” an MTN spokesman said. “Post that period we will apply our minds on what to do with the investment.”

MTN is the biggest investor in Jumia, the best performing IPO in New York this year with its share price more than tripling since its April 12 debut. Yet MTN has earmarked e-commerce assets as not central to the company’s main business of phone and data services, and has announced a 15 billion-rand ($1 billion) disposal plan.

April 30, 2019

MTN Group Ltd. plans to sell at least half of its $655 million interest in newly listed Jumia Technologies AG as Africa’s biggest wireless carrier looks to pay down debt and enter new markets, according to people familiar with the matter.

A selldown of the 19 percent stake in the online retailer could happen before the end of the year, said the people, who asked to remain anonymous as the deliberations are private. Johannesburg-based MTN first needs to wait out a half-year investor lock-in period that followed Jumia’s successful share sale in New York, they said.

“We have a six-month lock-up period where we can’t sell our shareholding,” an MTN spokesman said. “Post that period we will apply our minds on what to do with the investment.”

MTN is the biggest investor in Jumia, the best performing IPO in New York this year with its share price more than tripling since its April 12 debut. Yet MTN has earmarked e-commerce assets as not central to the company’s main business of phone and data services, and has announced a 15 billion-rand ($1 billion) disposal plan.

https://www.marketwatch.com/story/af...vor-2019-05-07

African e-tailer Jumia shares soar as analysts see a number of tailwinds working in its favor

May 8, 2019

Analysts are bullish about the future of African e-commerce company Jumia Technologies Inc., identifying a number of favorable tailwinds for long-term growth including the adoption potential for e-commerce across the continent.

Right now, e-commerce penetration in Africa is about 0.5%, compared with about 20% for China, according to Raymond James analyst Aaron Kessler.

“While early, we believe a number of factors should drive strong e-commerce growth in Africa going forward, including a growing middle class, a fast-growing young population more digitally inclined, increasing urbanization, and increasing smartphone adoption,” Kessler said.

Jumia was founded in 2012 and is now active in 14 countries that account for 74% of Africa’s consumer spending. It calls itself the top online shopping site in Nigeria. As of Dec. 31, 2018, it had 81,000 active sellers and 4 million active shoppers.

“We believe Jumia’s reach and scale positions the company to be a preferred shopping destination in Africa,” Kessler wrote, noting the company’s investments tailored for the region.

The company also has JumiaPay and Jumia One for online transactions and payments.

“We believe this deep local knowledge and [these] payments and logistics systems provide Jumia with competitive advantages versus potential new market entrants,” said Raymond James.

Jumia’s services go beyond its core e-commerce business, including food delivery, travel booking and utility bill payment. Jumia’s online capabilities have earned it the nickname “Amazon of Africa.” In a region where services and financial institutions are fragmented, Jumia is well-positioned.

“Jumia has developed an advanced and sophisticated payment infrastructure, including its own e-wallet, which integrates its payments and certain financial services relevant to its sellers and consumers,” Raymond James said. “Longer term, Jumia also aims to use JumiaPay as the cornerstone of a wider financial services platform and also plans to allow other companies, particularly those located outside of Africa, to use it as a unified payments service.”

Raymond James initiated Jumia stock at market perform, saying that shares are fairly valued.

Stifel initiated Jumia shares at hold with a $40 price target.

“In effect, Jumia has already done the heavy lifting in building out a logistics network and a digital payments platform,” wrote analysts led by Scott Devitt. “However, Jumia’s relatively high valuation and long path to profitability drives our hold rating as we await a more attractive entry point. With e-commerce in Africa still in its infancy, Jumia’s growth is likely to be bumpy as the e-commerce landscape needs to catch up to the platform.”

May 8, 2019

Analysts are bullish about the future of African e-commerce company Jumia Technologies Inc., identifying a number of favorable tailwinds for long-term growth including the adoption potential for e-commerce across the continent.

Right now, e-commerce penetration in Africa is about 0.5%, compared with about 20% for China, according to Raymond James analyst Aaron Kessler.

“While early, we believe a number of factors should drive strong e-commerce growth in Africa going forward, including a growing middle class, a fast-growing young population more digitally inclined, increasing urbanization, and increasing smartphone adoption,” Kessler said.

Jumia was founded in 2012 and is now active in 14 countries that account for 74% of Africa’s consumer spending. It calls itself the top online shopping site in Nigeria. As of Dec. 31, 2018, it had 81,000 active sellers and 4 million active shoppers.

“We believe Jumia’s reach and scale positions the company to be a preferred shopping destination in Africa,” Kessler wrote, noting the company’s investments tailored for the region.

The company also has JumiaPay and Jumia One for online transactions and payments.

“We believe this deep local knowledge and [these] payments and logistics systems provide Jumia with competitive advantages versus potential new market entrants,” said Raymond James.

Jumia’s services go beyond its core e-commerce business, including food delivery, travel booking and utility bill payment. Jumia’s online capabilities have earned it the nickname “Amazon of Africa.” In a region where services and financial institutions are fragmented, Jumia is well-positioned.

“Jumia has developed an advanced and sophisticated payment infrastructure, including its own e-wallet, which integrates its payments and certain financial services relevant to its sellers and consumers,” Raymond James said. “Longer term, Jumia also aims to use JumiaPay as the cornerstone of a wider financial services platform and also plans to allow other companies, particularly those located outside of Africa, to use it as a unified payments service.”

Raymond James initiated Jumia stock at market perform, saying that shares are fairly valued.

Stifel initiated Jumia shares at hold with a $40 price target.

“In effect, Jumia has already done the heavy lifting in building out a logistics network and a digital payments platform,” wrote analysts led by Scott Devitt. “However, Jumia’s relatively high valuation and long path to profitability drives our hold rating as we await a more attractive entry point. With e-commerce in Africa still in its infancy, Jumia’s growth is likely to be bumpy as the e-commerce landscape needs to catch up to the platform.”

#11

Chapter Leader (Southern Region)

I think it's getting close to floor

People that initially invested are getting scared and trying to sell before they lose anymore

The closer it gets to releasing financials, I see it taking a bump

Once the info is public it'll either dump or pump as these things usually go

High risk, but reward could be good

I'd either buy during off hours or see some more fluctuation and buy around lunch tomorrow

That's the gamble, or wait til financials and hope it dumps, then get in.. make about 5-10% on the short-term.. dump it.

Long-term.. idk.. that really depends on the world economy, but Africa will continue to grow, there's no other way

I've heard of supply issues and reliability of goods coming out have been hit and miss by those in India and China

But it's exploitative, so overall, it'll grow

People that initially invested are getting scared and trying to sell before they lose anymore

The closer it gets to releasing financials, I see it taking a bump

Once the info is public it'll either dump or pump as these things usually go

High risk, but reward could be good

I'd either buy during off hours or see some more fluctuation and buy around lunch tomorrow

That's the gamble, or wait til financials and hope it dumps, then get in.. make about 5-10% on the short-term.. dump it.

Long-term.. idk.. that really depends on the world economy, but Africa will continue to grow, there's no other way

I've heard of supply issues and reliability of goods coming out have been hit and miss by those in India and China

But it's exploitative, so overall, it'll grow

#12

#13

Chapter Leader (Southern Region)

You mean 30

#14

Chapter Leader (Southern Region)

Morgan Stanley.. underweight.. $27

#15

Chapter Leader (Southern Region)

I got in a couple hundred shares at 29.8.. high risk.. but could net even 5-10% today.

#16

Chapter Leader (Southern Region)

Unrelated but watch semicon right now.. AMD is looking tasty.

#17

Chapter Leader (Southern Region)

Already got my 10% shiett...

#18

$30 was tempting, but gotta stick to my plan and wait until after earnings

#19

Senior Moderator

I'll bite at 30 ..

#20

Chapter Leader (Southern Region)

I bit because it dropped 10% on MS valuation

I'm not a day trader, but these things always rebound in the day

I'll bite again too if they don't meet guidance...

I'm not a day trader, but these things always rebound in the day

I'll bite again too if they don't meet guidance...

#21

Chapter Leader (Southern Region)

#22

Senior Moderator

30 cents to go...

#23

^ Alternative to buying 100 shares at $30 .... sell a May 17 $30 put for $4.10. $25.90 cost basis if shares get put to you, or pocket the $410 if they don't.

#24

Last edited by AZuser; 05-09-2019 at 12:03 PM.

#25

Senior Moderator

put a limit order at 30

waiting for that rebound .

anytime now....

waiting for that rebound .

anytime now....

#26

Chapter Leader (Southern Region)

#27

Chapter Leader (Southern Region)

#28

Chapter Leader (Southern Region)

Shitron just said Jumia is a fraud, that's why it's extra tanking.. get ready to buy more

#29

$25.40 : -$7.70 (-23.29%)

$25.40 : -$7.70 (-23.29%)A lot of May 17 $30 and $25 put buyers. The June $25/$20 put spread has doubled in value too.

#30

Chapter Leader (Southern Region)

I'm going to hold off until earnings.. too volatile.. good thing I got my bump

#31

Chapter Leader (Southern Region)

#32

Senior Moderator

#33

$21.97 : -$4.92 (-18.30%)

Should... coulda... but didn't

https://acurazine.com/forums/money-i.../#post16423573

Now they're jumping in on the May 17 $20 puts

.

Last edited by AZuser; 05-10-2019 at 08:59 AM.

#34

Chapter Leader (Southern Region)

There's money to be made, but the hype train is over.. fucking shitron

#35

Chapter Leader (Southern Region)

When Cramer says buy.. don't.. he already owns that shit and is trying to pump and dump.

When Shitron says something is shit.. wait for floor, that's when they buy.. and you should too.

I heard some offices are looking for evidence of impropriety now.. not sure if SEC is actually involved.

When Shitron says something is shit.. wait for floor, that's when they buy.. and you should too.

I heard some offices are looking for evidence of impropriety now.. not sure if SEC is actually involved.

#36

Chapter Leader (Southern Region)

#37

Chapter Leader (Southern Region)

eh.. not sure the validity of that.

#38

Chapter Leader (Southern Region)

I bought 50 at 21.80.. ride baby ride.

I would have parlayed from yesterday, but it's still pretty nuts.. if it goes lower, i'll bite again.

I would have parlayed from yesterday, but it's still pretty nuts.. if it goes lower, i'll bite again.

#39

Chapter Leader (Southern Region)

I'm not too keen on the CEO, but I don't think he's an Elizabeth Holmes type a la Theranos

#40

https://finance.yahoo.com/news/why-j...223600423.html

Why Jumia Technologies Stock Plunged Today

May 9, 2019

Shares of Jumia Technologies (NYSE: JMIA) were tumbling today after the African e-commerce company got attacked by a short-seller. Jumia shares, which had surged since its initial public offering (IPO) a few weeks ago, closed down 18.8% on the news.

Well-known short-seller Citron Research, headed by Andrew Left, called Jumia an "obvious fraud" in a screed of a report published today, saying that it's the worst such scam the company has seen in 18 years.

Citron claims that Jumia filed to go public because its two largest investors, MTN and Rocket Internet, wanted an exit, and it fudged its numbers in order to win interest from American investors. Citron says it got access to a confidential investor report from October 2018 and that the numbers Jumia presented in its F-1 prospectus in March 2019 are materially different from what it showed to investors last October. In particular, the company inflated its active customers and merchants numbers by 20%-30%, according to Citron. Finally, Citron said that Jumia declined to say in the F-1 that 41% of orders were returned, not delivered, or cancelled in 2018.

Citron's claims deserve to be taken seriously, but the company has been wrong before. In 2017, the company recommended shorting Shopify, the fast-growing Canadian e-commerce software company, but the stock has doubled since then. Citron came out again last month in a new report against Shopify.

Some of the short-seller's criticisms of Jumia resemble those of Shopify, as Citron argued that Shopify had its sales force pump up numbers with what essentially amounted to shell accounts. It made a similar claim about Jumia's sales force, Jforce Consultants. Furthermore, growth in active customers or even a high order cancellation rate is not necessarily a sign of fraud.

Expect Jumia to respond to the report, which could reassure investors and help the stock recover some of today's losses.

Whether or not Citron's charges are true, Jumia deserves to be treated with caution. The stock is trading at a price-to-sales ratio of 24, even after today's slide, and is deeply unprofitable with a loss of $195.2 million on revenue of $149.6 million last year.

May 9, 2019

Shares of Jumia Technologies (NYSE: JMIA) were tumbling today after the African e-commerce company got attacked by a short-seller. Jumia shares, which had surged since its initial public offering (IPO) a few weeks ago, closed down 18.8% on the news.

Well-known short-seller Citron Research, headed by Andrew Left, called Jumia an "obvious fraud" in a screed of a report published today, saying that it's the worst such scam the company has seen in 18 years.

Citron claims that Jumia filed to go public because its two largest investors, MTN and Rocket Internet, wanted an exit, and it fudged its numbers in order to win interest from American investors. Citron says it got access to a confidential investor report from October 2018 and that the numbers Jumia presented in its F-1 prospectus in March 2019 are materially different from what it showed to investors last October. In particular, the company inflated its active customers and merchants numbers by 20%-30%, according to Citron. Finally, Citron said that Jumia declined to say in the F-1 that 41% of orders were returned, not delivered, or cancelled in 2018.

Citron's claims deserve to be taken seriously, but the company has been wrong before. In 2017, the company recommended shorting Shopify, the fast-growing Canadian e-commerce software company, but the stock has doubled since then. Citron came out again last month in a new report against Shopify.

Some of the short-seller's criticisms of Jumia resemble those of Shopify, as Citron argued that Shopify had its sales force pump up numbers with what essentially amounted to shell accounts. It made a similar claim about Jumia's sales force, Jforce Consultants. Furthermore, growth in active customers or even a high order cancellation rate is not necessarily a sign of fraud.

Expect Jumia to respond to the report, which could reassure investors and help the stock recover some of today's losses.

Whether or not Citron's charges are true, Jumia deserves to be treated with caution. The stock is trading at a price-to-sales ratio of 24, even after today's slide, and is deeply unprofitable with a loss of $195.2 million on revenue of $149.6 million last year.