Rivian IPO

#121

Sanest Florida Man

He's right about one thing... comparison is "Absolutely ridiculous"

The only fair comparison would be to compare the companies to one another during the same point in their business operations. That means looking at the sales/deliveries and operating expenses for Tesla when they started producing their first vehicle, which would be the Roadster in 2008, to the sales/deliveries and operating expenses of Rivian when they started producing their first vehicle(s).

Per Tesla's S-1 IPO filing:

In September 2008,...

Tesla auto sales (less zero emission vehicle credit sales of $495,000) = $85,000

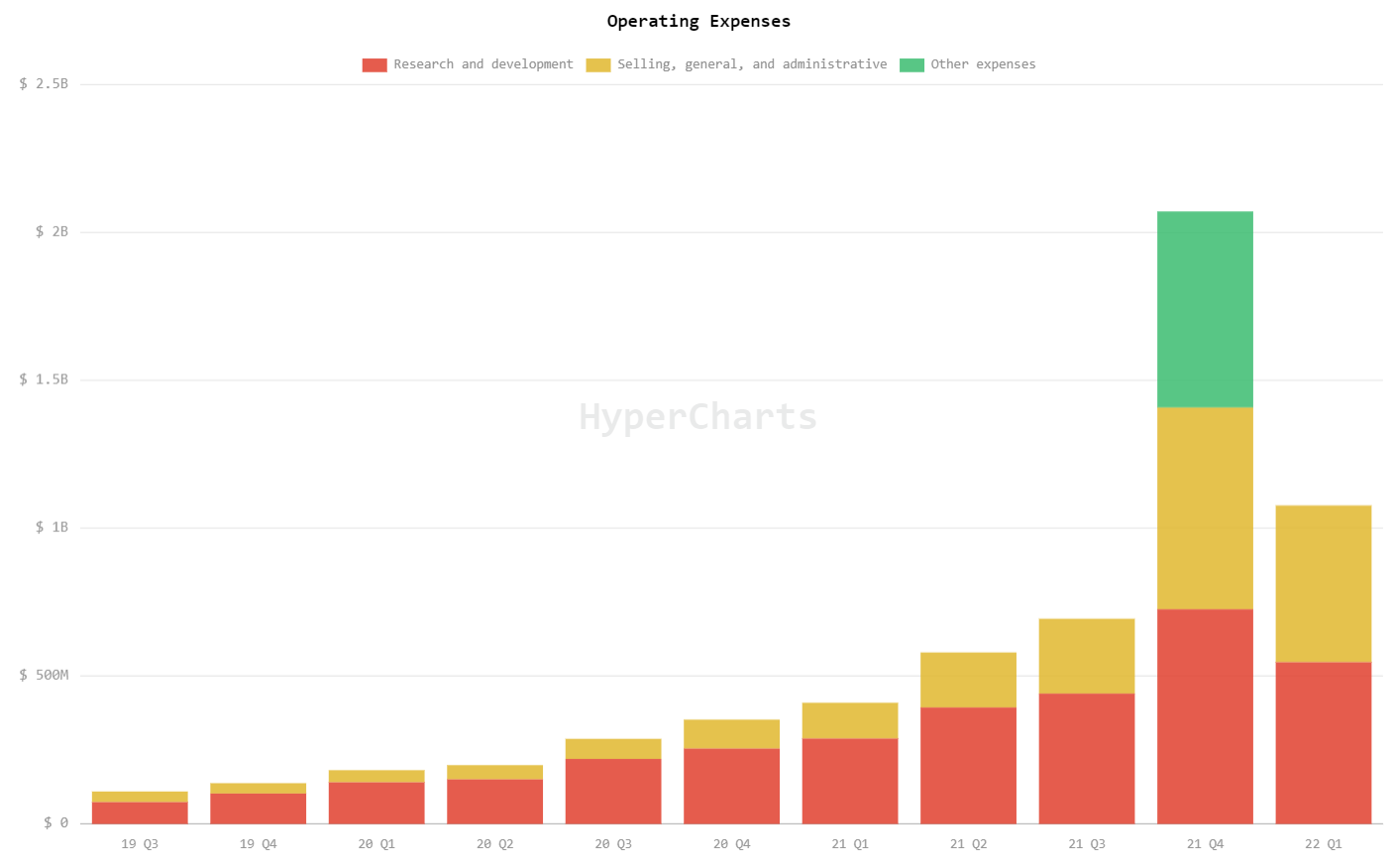

Tesla's total operating expenses ($41,888,000 R&D, $13,953,000 SG&A) = $55,841,000

That means Tesla operating expenses were 656.95x that of sales.

Rivian? Operating expenses were only 42x that of sales. If you remove the stock-based compensation charges Rivian incurred due to IPO (Tesla had none since their numbers are pre-IPO), then Rivian's operating expenses were even lower relative to sales.

I'm not that good at math so someone's going to have to help me out, but wouldn't a lower number better?

The only fair comparison would be to compare the companies to one another during the same point in their business operations. That means looking at the sales/deliveries and operating expenses for Tesla when they started producing their first vehicle, which would be the Roadster in 2008, to the sales/deliveries and operating expenses of Rivian when they started producing their first vehicle(s).

Per Tesla's S-1 IPO filing:

In September 2008,...

Tesla auto sales (less zero emission vehicle credit sales of $495,000) = $85,000

Tesla's total operating expenses ($41,888,000 R&D, $13,953,000 SG&A) = $55,841,000

That means Tesla operating expenses were 656.95x that of sales.

Rivian? Operating expenses were only 42x that of sales. If you remove the stock-based compensation charges Rivian incurred due to IPO (Tesla had none since their numbers are pre-IPO), then Rivian's operating expenses were even lower relative to sales.

I'm not that good at math so someone's going to have to help me out, but wouldn't a lower number better?

Last edited by #1 STUNNA; 04-21-2022 at 06:48 PM.

#122

How is comparing an auto maker who's been making autos for what, 14 years, and has already invested billions to ramp up production and is much much further along in its business to one who's just starting out remotely fair?

Musk said it himself, "Production is hard. Production with positive cash flow is extremely hard." and "Prototypes are easy, production is hard." Starting a new car company requires a lot of working capital and spending. But you already know this.

From 2015 https://www.wsj.com/articles/teslas-...ors-1434922026

[ . . . ]

Tesla recently took out a revolving credit agreement with several major banks, with capacity to borrow up to $750 million as needed for general corporate purposes. Company assets have been pledged as collateral for the majority of the credit line. The announcement came three days after current finance chief Deepak Ahuja said he would retire, pending the naming of his successor.

Mr. Ahuja’s successor will likely need to make use of the new funding. Auto manufacturing is capital intensive, especially when developing a new type of car, so spending money is nothing new for Tesla. In its history as a public company, Tesla’s capital expenditures have outpaced its operating cash flow, adjusted for changes in working capital, by a cumulative $2.7 billion, according to FactSet.

Tesla’s spending has increased just as rapidly as its ambitions.

[ . . . ]

To meet these longer-term goals, however, Tesla will need a lot of cash.

Tesla recently took out a revolving credit agreement with several major banks, with capacity to borrow up to $750 million as needed for general corporate purposes. Company assets have been pledged as collateral for the majority of the credit line. The announcement came three days after current finance chief Deepak Ahuja said he would retire, pending the naming of his successor.

Mr. Ahuja’s successor will likely need to make use of the new funding. Auto manufacturing is capital intensive, especially when developing a new type of car, so spending money is nothing new for Tesla. In its history as a public company, Tesla’s capital expenditures have outpaced its operating cash flow, adjusted for changes in working capital, by a cumulative $2.7 billion, according to FactSet.

Tesla’s spending has increased just as rapidly as its ambitions.

[ . . . ]

To meet these longer-term goals, however, Tesla will need a lot of cash.

and https://www.cnbc.com/2020/11/03/musk...el-3-ramp.html

On Tuesday, Tesla CEO Elon Musk tweeted that his electric car company had been about a month away from bankruptcy in recent years when it was still figuring out how to mass produce the Model 3 electric sedan.

In the middle of a discussion about Tesla’s fundraising history, a follower asked, “How close was Tesla from bankruptcy when bringing the Model 3 to mass production?”

Musk replied: “Closest we got was about a month. The Model 3 ramp was extreme stress & pain for a long time — from mid-2017 to mid-2019. Production & logistics hell.”

Musk has often spoken about what he calls the “production and logistics hell” of taking a new electric vehicle into high-volume manufacturing. However, Musk and the company had never disclosed exactly how little runway they had before facing a possible bankruptcy.

In the middle of a discussion about Tesla’s fundraising history, a follower asked, “How close was Tesla from bankruptcy when bringing the Model 3 to mass production?”

Musk replied: “Closest we got was about a month. The Model 3 ramp was extreme stress & pain for a long time — from mid-2017 to mid-2019. Production & logistics hell.”

Musk has often spoken about what he calls the “production and logistics hell” of taking a new electric vehicle into high-volume manufacturing. However, Musk and the company had never disclosed exactly how little runway they had before facing a possible bankruptcy.

Last edited by AZuser; 04-21-2022 at 09:05 PM.

#123

Sanest Florida Man

#124

Team Owner

Reading stuff like this makes me feel better about not selling my bag in November, or December, or January, or well you get the idea.

#125

Sanest Florida Man

Because it makes Tesla look not so good?

How is comparing an auto maker who's been making autos for what, 14 years, and has already invested billions to ramp up production and is much much further along in its business to one who's just starting out remotely fair?

Musk said it himself, "Production is hard. Production with positive cash flow is extremely hard." and "Prototypes are easy, production is hard." Starting a new car company requires a lot of working capital and spending. But you already know this.

How is comparing an auto maker who's been making autos for what, 14 years, and has already invested billions to ramp up production and is much much further along in its business to one who's just starting out remotely fair?

Musk said it himself, "Production is hard. Production with positive cash flow is extremely hard." and "Prototypes are easy, production is hard." Starting a new car company requires a lot of working capital and spending. But you already know this.

Rivian just hired former Tesla employees with lots of EV knowlege, according to Tesla also stole their IP (lawsuit pending), and Rivian can just copy Tesla's strategy and designs that Tesla figured out on their own, access a much more mature EV parts industry that was beefed up because of Tesla. Of course Rivian has to execute well but they're standing on the shoulders of Tesla. They've got a massive head start compared to what Tesla had when they started.

Last edited by #1 STUNNA; 04-27-2022 at 10:12 PM.

#126

Ex-OEM King

Because in 2008 Tesla was doing things that no one had done before, using thousands of laptop batteries to power a car, by the time Rivian did that it had already been done millions of times, it was proven tech. The EV parts suppliers were scarce, there was no shining example to look at and copy, there weren't employees to hire with a decade of knowledge.

Rivian just hired former Tesla employees with lots of EV knowlege, according to Tesla also stole their IP (lawsuit pending), and Rivian can just copy Tesla's strategy and designs that Tesla figured out on their own, access a much more mature EV parts industry that was beefed up because of Tesla. Of course Rivian has to execute well but they're standing on the shoulders of Tesla. They've got a massive head start compared to what Tesla had when they started.

Rivian just hired former Tesla employees with lots of EV knowlege, according to Tesla also stole their IP (lawsuit pending), and Rivian can just copy Tesla's strategy and designs that Tesla figured out on their own, access a much more mature EV parts industry that was beefed up because of Tesla. Of course Rivian has to execute well but they're standing on the shoulders of Tesla. They've got a massive head start compared to what Tesla had when they started.

#127

My first Avatar....

The price anyone pays for being first.

#128

Sanest Florida Man

#129

Team Owner

Are they able to report these loses without selling shares, or have they been selling shares?

#130

Team Owner

https://www.cnbc.com/2022/05/08/ford...urces-say.html

Ford Motor is selling 8 million of its Rivian Automotive shares, with the insider lockup for the stock of the once high-flying electric vehicle maker is set to expire on Sunday, sources told CNBC’s David Faber.

The automaker currently owns 102 million shares of Rivian. Ford will be selling the shares through Goldman Sachs, sources said.

JPMorgan Chase also plans to sell a Rivian share block of between 13 million and 15 million for an unknown seller, sources told Faber.

Ford Motor is selling 8 million of its Rivian Automotive shares, with the insider lockup for the stock of the once high-flying electric vehicle maker is set to expire on Sunday, sources told CNBC’s David Faber.

The automaker currently owns 102 million shares of Rivian. Ford will be selling the shares through Goldman Sachs, sources said.

JPMorgan Chase also plans to sell a Rivian share block of between 13 million and 15 million for an unknown seller, sources told Faber.

Last edited by doopstr; 05-07-2022 at 10:01 PM.

The following users liked this post:

#1 STUNNA (05-08-2022)

#131

Sanest Florida Man

Are you guys that bought at $100+ still holding?

#132

Team Owner

23.49-5.30 (-18.41%)

Pre-Market: 8:26AM EDT

#133

2014 RDX AWD Tech

Thread Starter

https://twitter.com/davidfaber/statu...78685200306176

Are you guys that bought at $100+ still holding?

Are you guys that bought at $100+ still holding?

If Amazon also decides to dump Rivian, then they could be in a really tough situation.

If Amazon also decides to dump Rivian, then they could be in a really tough situation.My estimate for Rivian share price is somewhere between $10-15, and give it five years for some real movement (if at all).

#134

AZ Community Team

Because in 2008 Tesla was doing things that no one had done before, using thousands of laptop batteries to power a car, by the time Rivian did that it had already been done millions of times, it was proven tech. The EV parts suppliers were scarce, there was no shining example to look at and copy, there weren't employees to hire with a decade of knowledge.

Rivian just hired former Tesla employees with lots of EV knowlege, according to Tesla also stole their IP (lawsuit pending), and Rivian can just copy Tesla's strategy and designs that Tesla figured out on their own, access a much more mature EV parts industry that was beefed up because of Tesla. Of course Rivian has to execute well but they're standing on the shoulders of Tesla. They've got a massive head start compared to what Tesla had when they started.

Rivian just hired former Tesla employees with lots of EV knowlege, according to Tesla also stole their IP (lawsuit pending), and Rivian can just copy Tesla's strategy and designs that Tesla figured out on their own, access a much more mature EV parts industry that was beefed up because of Tesla. Of course Rivian has to execute well but they're standing on the shoulders of Tesla. They've got a massive head start compared to what Tesla had when they started.

A great big Meh, GM already did the EV1 a decade before Tesla and forged ahead with literally no established tech.

A great big Meh, GM already did the EV1 a decade before Tesla and forged ahead with literally no established tech.GM certainly felt the pain, using the NiMH batteries

#135

Ex-OEM King

There was a time when TSLA was a similar price point. Once they get the production process up and running and resolve supply chain issues, the price should start to creep higher. Investors want to see income and progress, not excuses. RIVN is a longer play at this point...especially if you bought in at IPO.

#136

We'll find out what progress they're making tomorrow as they are scheduled to report Q1 2022 earnings after the market closes

Play the long game and stay invested if they're making progress. If the story changes, that's when you reassess.

Play the long game and stay invested if they're making progress. If the story changes, that's when you reassess.

https://www.bloomberg.com/news/artic...o-reduce-stake

Play the long game and stay invested if they're making progress. If the story changes, that's when you reassess.

Play the long game and stay invested if they're making progress. If the story changes, that's when you reassess.https://www.bloomberg.com/news/artic...o-reduce-stake

Rivian Holder Abdul Latif Jameel Says ‘No Plans’ to Reduce Stake

May 9, 2022

Abdul Latif Jameel, the third-largest shareholder of Rivian Automotive Inc., has no plans to sell down its stake in the EV-maker after a lockup on the stock expired Sunday.

Jameel, a Jeddah, Saudi Arabia-based group, holds almost 114 million shares through a subsidiary called Global Oryx Co., according to data compiled by Bloomberg.

“We stand firmly behind Rivian and its management. As of today we have no plans of selling any shares,” an Abdul Latif Jameel spokesperson said by email.

Jameel, which operates businesses ranging from transportation and engineering to health and real estate, trails only Amazon.com Inc., which owns more than 158 million shares, and T. Rowe Price, with 162.2 million shares, among Rivian investors.

May 9, 2022

Abdul Latif Jameel, the third-largest shareholder of Rivian Automotive Inc., has no plans to sell down its stake in the EV-maker after a lockup on the stock expired Sunday.

Jameel, a Jeddah, Saudi Arabia-based group, holds almost 114 million shares through a subsidiary called Global Oryx Co., according to data compiled by Bloomberg.

“We stand firmly behind Rivian and its management. As of today we have no plans of selling any shares,” an Abdul Latif Jameel spokesperson said by email.

Jameel, which operates businesses ranging from transportation and engineering to health and real estate, trails only Amazon.com Inc., which owns more than 158 million shares, and T. Rowe Price, with 162.2 million shares, among Rivian investors.

#137

Sanest Florida Man

So are we expecting RIVN to drop even more after the earnings call today? Can it get any worse?

If it continues to drop after earnings call maybe I'll check in between my couch cushions to see if I can find enough money to buy a few shares

If it continues to drop after earnings call maybe I'll check in between my couch cushions to see if I can find enough money to buy a few shares

#138

Ex-OEM King

Make sure you spend hundreds of hours in researching it before you buy anything.

#139

Sanest Florida Man

Last edited by #1 STUNNA; 05-11-2022 at 03:33 PM.

#140

After Hours: Last | 4:33 PM EDT

Rivian stock jumps as EV automaker maintains its 2022 production goals

11 May 2022

Electric vehicle maker Rivian Automotive on Wednesday maintained its 2022 production target, saying it still expects to build just 25,000 vehicles this year.

Here are the key numbers from Rivian's first-quarter earnings report:

Loss per share: $1.43, narrower than Wall Street's $1.44 consensus estimate per Refinitiv.

Revenue: $95 million, versus $130.5 million per Refinitiv consensus estimates.

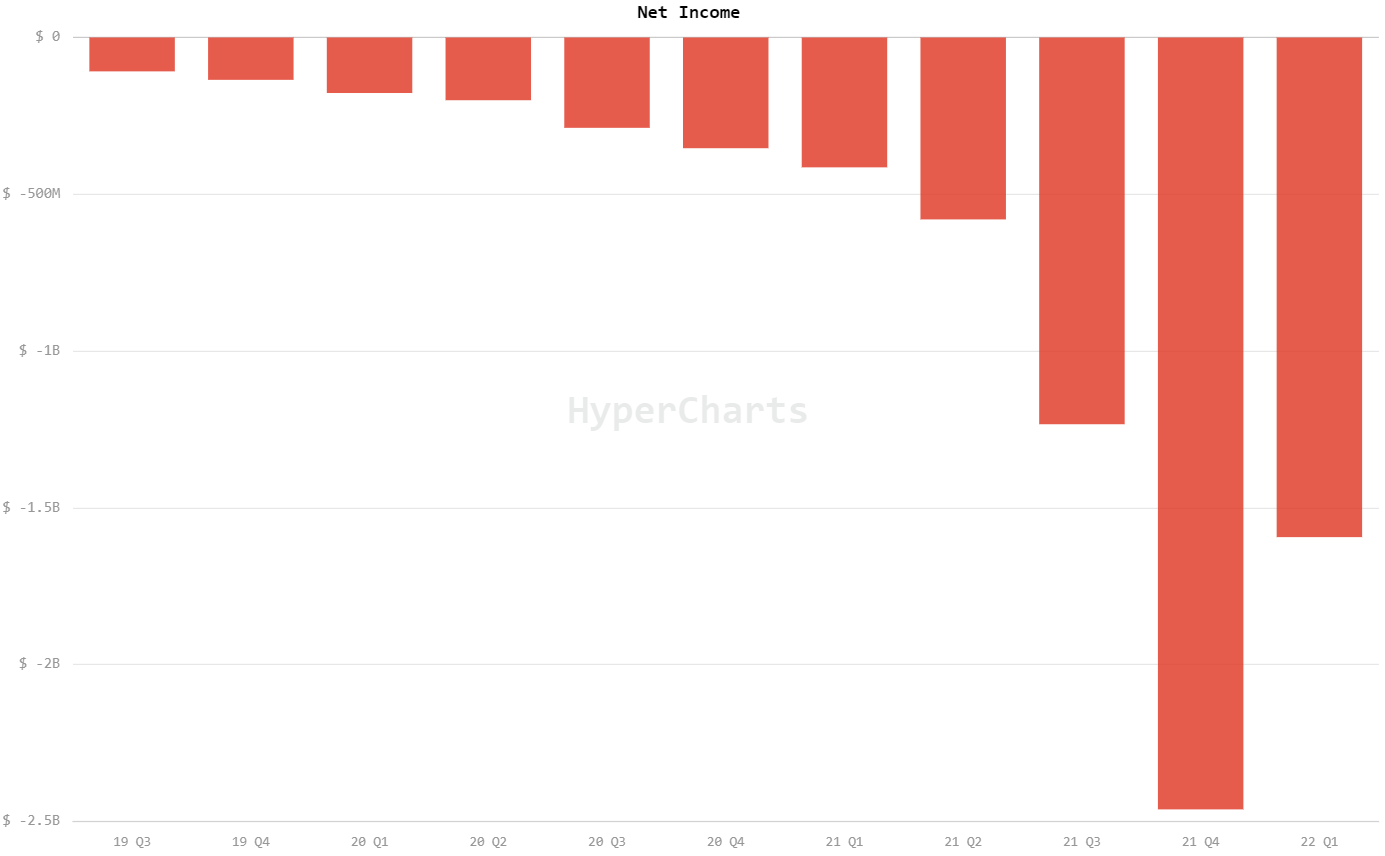

Net loss: $1.59 billion.

Vehicle reservations: Over 90,000, up from 83,000 as of Rivian's last update in March.

Rivian's 2022 production goals reflect supply chain constraints and internal manufacturing issues. The 25,000 target is half the full-year number that Rivian laid out in its roadshow presentation to investors ahead of its IPO last November.

#141

Sanest Florida Man

Vehicle reservations: Over 90,000, up from 83,000 as of Rivian's last update in March.

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

Last edited by #1 STUNNA; 05-11-2022 at 06:39 PM.

#142

Ex-OEM King

the f150 Lightning has 200,000 reservations, the cybertruck has 1.4 million. Elon said yesterday that they have so many orders for their models that they may need to stop taking pre-orders because the wait time is so far out at this point that they can’t really estimate what the prices and features will be a year from now, even though they’re making million vehicles per year.

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

#143

F150 Lightning also has a starting price ($39,947) that's much lower than the R1T ($67,500).

Same with the Cybertruck ($39,900) before prices were removed

Same with the Cybertruck ($39,900) before prices were removed

The following users liked this post:

civicdrivr (05-12-2022)

#144

Sanest Florida Man

The base model F150 is decent, especially for the price, watch the video I posted today in the F series thread. A 100kwh battery in a $40k EV! How are they making money on that? They could be selling at a loss to take over the market and rely on their more profitable ICE cars for a few years and hope that EV production costs drop over the next few years so it's not such a financial hit and by that time Rivian has gone out of business since they can't compete on price.

#145

Ex-OEM King

F150 Lightning also has a starting price ($39,947) that's much lower than the R1T ($67,500).

Same with the Cybertruck ($39,900) before prices were removed

Same with the Cybertruck ($39,900) before prices were removed

Also, the F150 has ~500hp with the larger battery pack whereas the Rivian has 830hp out of the quad motor setup.

The base model F150 is decent, especially for the price, watch the video I posted today in the F series thread. A 100kwh battery in a $40k EV! How are they making money on that? They could be selling at a loss to take over the market and rely on their more profitable ICE cars for a few years and hope that EV production costs drop over the next few years so it's not such a financial hit and by that time Rivian has gone out of business since they can't compete on price.

#146

Sanest Florida Man

the f150 Lightning has 200,000 reservations, the cybertruck has 1.4 million. Elon said yesterday that they have so many orders for their models that they may need to stop taking pre-orders because the wait time is so far out at this point that they can’t really estimate what the prices and features will be a year from now, even though they’re making million vehicles per year.

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

#nodemand #thecompetitioniscoming

#147

Right, but when you get the F150 optioned up to be similar to the feature content of the Rivian, it ends up being about the same. Especially so if you have an existing preorder for the R1T. I looked because I was curious about dropping my R1T order and getting a F150 instead. By the time you get it optioned up to the higher trim level of R1T, you're into the Platinum trim level which is $90k and are now about $20k more than a similar Rivian.

https://www.motorbiscuit.com/most-po...rim-isnt-best/

Edmunds says the F-150 XL Regular cab is one of the most popular versions. It starts at $28,940 with the 6.5-foot bed or $29,240 for the 8-foot bed. The Regular cab is the smallest and seats three.

https://www.lairdnoller.com/explaini...50-trim-level/

The F-150 has several different trim levels and we will delve deeper into those later this week but we wanted to focus on the most popular option today. The XLT 302a package is the most popular 2017 F-150 package. It accounts for nearly 50% of Ford’s F-150 sales which is why we want to inform Kansas Ford Truck buyers on this package!

With the electric F-150, the Pro and XLT will likely make up the overall majority of sales too.

https://www.motorbiscuit.com/2022-fo...ing-youll-get/

If you want the cheapest, most basic Ford Lightning model, take a look at the 2022 Ford Lightning Pro. The Lightning Pro price starts at $41,669, and according to Edmunds, is the most popular trim level.

We expect the XLT to be the most popular F-150 Lightning trims, partly because of its low price and impressive standard equipment. Lightning XLT gets you more standard convenience and comfort features

Again, Ford and GM and even Tesla have more reservations/interest in their electric trucks because of lower entry price.

Electric Silverado has a starting price of $39,900

It's the same reason why Tesla sells more Model 3 (starting price of $48,490) and Model Y (starting price of $64,990) than the Model S (starting price of $104,490) and Model X (starting price of $120,490).

Not many people can afford to pay $80K+, let alone $50K, for a vehicle. I mean, isn't that one of the reasons why you don't have a Tesla yet (poor) in spite of how much you talk up Tesla?

#148

Sanest Florida Man

Does it make more sense for me to buy a house, and continue use the paid off car that I have now? Or should I continue to rent another 5 to 10 years so that I can buy an EV?

Last edited by #1 STUNNA; 05-14-2022 at 02:12 PM.

#149

Ex-OEM King

If a buyer adds all those options. How many buyers choose the higher trims though? With the ICE version of the F-150, the XL and XLT make up a large majority of overall sales compared to the King Ranch, Limited, and Platinum trims.

With the electric F-150, the Pro and XLT will likely make up the overall majority of sales too.

With the electric F-150, the Pro and XLT will likely make up the overall majority of sales too.

#150

Sanest Florida Man

#151

Sanest Florida Man

Rivian loses head of manufacturing engineering, reorganizes leadership

I wonder if Amazon is forcing them to split the business

Rivian is losing its head of manufacturing engineering at a critical time. The company is trying to sustainably ramp up the production of its R1T electric pickup truck as it reorganizes its leadership.

Charly Mwangi has been a longtime automotive engineer. Mwangi rose to the level of senior director of engineering at Tesla during his six-year tenure at the company and has been executive vice president in charge of manufacturing engineering at Rivian since 2020.

In an email obtained by Bloomberg, Rivian CEO R.J. Scaringe confirmed that Mwangi is leaving and that the company’s leadership is undergoing a reorganization. Most notably in the reorganization, Rivian will bring on Frank Klein, a former Magna executive, as chief operating officer (COO) – most of the top manufacturing leadership will now report to him.

Scaringe wrote in the email:

This is an important time for our growing business, all of which is happening in an extremely challenging environment. We are well-positioned for long-term success, but we must continuously evaluate how we operate.

Another important part of the reorganization is the splitting of Rivian’s commercial business, which mainly consists of its electric van for Amazon, and its retail business, which consists of the R1T electric pickup truck and R1S electric SUV.

The reorganization comes as Rivian is ramping up production of those vehicles but not without issues. The company has already reduced its guidance for production this year due to supply chain issues.

Last quarter, Rivian produced 2,553 electric vehicles and delivered 1,227 of them. It is currently losing a lot of money on those vehicles during the production ramp-up. Right now, Rivian is in a race to continue increasing production to satisfy demand while trying to improve its gross margin to produce the EVs profitably and stop hemorrhaging money.

Charly Mwangi has been a longtime automotive engineer. Mwangi rose to the level of senior director of engineering at Tesla during his six-year tenure at the company and has been executive vice president in charge of manufacturing engineering at Rivian since 2020.

In an email obtained by Bloomberg, Rivian CEO R.J. Scaringe confirmed that Mwangi is leaving and that the company’s leadership is undergoing a reorganization. Most notably in the reorganization, Rivian will bring on Frank Klein, a former Magna executive, as chief operating officer (COO) – most of the top manufacturing leadership will now report to him.

Scaringe wrote in the email:

This is an important time for our growing business, all of which is happening in an extremely challenging environment. We are well-positioned for long-term success, but we must continuously evaluate how we operate.

Another important part of the reorganization is the splitting of Rivian’s commercial business, which mainly consists of its electric van for Amazon, and its retail business, which consists of the R1T electric pickup truck and R1S electric SUV.

The reorganization comes as Rivian is ramping up production of those vehicles but not without issues. The company has already reduced its guidance for production this year due to supply chain issues.

Last quarter, Rivian produced 2,553 electric vehicles and delivered 1,227 of them. It is currently losing a lot of money on those vehicles during the production ramp-up. Right now, Rivian is in a race to continue increasing production to satisfy demand while trying to improve its gross margin to produce the EVs profitably and stop hemorrhaging money.

#152

Ex-OEM King

They are probably splitting the business because it makes sense to do so. No reason to have engineers who work and focus on consumer vehicles switch back and forth to working on commercial vehicles. The result is that both vehicles are worse than they could be. Keep people focused and things tend to go better.

#153

AZ Community Team

It should be noted how many head of manufacturing exec's Tesla had in the last decade, as well as engineering exec's as well.

#154

Sanest Florida Man

#155

Sanest Florida Man

the f150 Lightning has 200,000 reservations, the cybertruck has 1.4 million. Elon said yesterday that they have so many orders for their models that they may need to stop taking pre-orders because the wait time is so far out at this point that they can’t really estimate what the prices and features will be a year from now, even though they’re making million vehicles per year.

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

Only 90,000? They were announced first and available first so why are their reservations so low compared to their competition? I think the F-150 ev may kill Rivian.

Why are they building a 2nd factory when they’re nowhere close to maxing out their first and reservations aren’t pouring in like their competition?

#156

Safety Car

Nah, buy the EV bro. All the cool kids are doing it. Besides, renting is the future and the progressive thing to do.

Last edited by Acura TL Builder; 06-23-2022 at 03:41 PM.

#157

$29.81 : +$2.95 (+10.98%)

https://www.wsj.com/articles/rivian-...ry-11657115404

https://www.wsj.com/articles/rivian-...ry-11657115404

Rivian Cranked Up Production in Second Quarter at Illinois Factory

July 6, 2022

Rivian Automotive Inc. said it produced 4,401 vehicles in the second quarter, the latest in the electric-vehicle maker’s efforts to overcome parts shortages and production snarls to fulfill orders for waiting customers.

Rivian’s second-quarter production figures, released Wednesday morning in a regulatory filing, are a sharp increase over the 2,553 vehicles it manufactured in the first three months of 2022. The company also said it delivered 4,467 vehicles to customers, compared with 1,227 vehicles in the previous quarter.

Rivian reiterated that it was on track to hit its target of producing 25,000 vehicles this year -- a goal that would require it to manufacture 9,000 vehicles in each of the final two quarters of 2022.

The results beat expectations. Analysts at RBC Capital Markets had forecast production of 3,400 vehicles for the second quarter.

July 6, 2022

Rivian Automotive Inc. said it produced 4,401 vehicles in the second quarter, the latest in the electric-vehicle maker’s efforts to overcome parts shortages and production snarls to fulfill orders for waiting customers.

Rivian’s second-quarter production figures, released Wednesday morning in a regulatory filing, are a sharp increase over the 2,553 vehicles it manufactured in the first three months of 2022. The company also said it delivered 4,467 vehicles to customers, compared with 1,227 vehicles in the previous quarter.

Rivian reiterated that it was on track to hit its target of producing 25,000 vehicles this year -- a goal that would require it to manufacture 9,000 vehicles in each of the final two quarters of 2022.

The results beat expectations. Analysts at RBC Capital Markets had forecast production of 3,400 vehicles for the second quarter.

The following users liked this post:

civicdrivr (07-06-2022)

#158

https://www.bloomberg.com/news/artic...ge-in-staffing

Rivian Plans Hundreds of Job Cuts Following Surge in Staffing

July 11, 2022

Rivian Automotive Inc. is planning hundreds of layoffs to trim its workforce in areas where the electric-vehicle maker has grown too quickly, according to people familiar with the matter.

The cuts will focus on nonmanufacturing roles, including teams with duplicate functions, said the people, who asked not to be identified discussing private information. The actions could be announced in the coming weeks, the people said.

The company, which has more than 14,000 employees, could target an overall reduction of around 5%, the people said. The layoffs are still in the planning stage and nothing has been decided. Rivian has operations in California, Michigan and Illinois, where its plant operates, as well as a presence in the UK and Canada.

The company is pulling back after roughly doubling its headcount over the past year to support a ramp-up in production.

The Irvine, California-based manufacturer is poised to join companies across corporate America pruning their operations amid growing worries about an economic downturn. Tesla is cutting 10% of its salaried workforce, while protecting manufacturing jobs, after Chief Executive Officer Elon Musk said he sees a recession as inevitable.

July 11, 2022

Rivian Automotive Inc. is planning hundreds of layoffs to trim its workforce in areas where the electric-vehicle maker has grown too quickly, according to people familiar with the matter.

The cuts will focus on nonmanufacturing roles, including teams with duplicate functions, said the people, who asked not to be identified discussing private information. The actions could be announced in the coming weeks, the people said.

The company, which has more than 14,000 employees, could target an overall reduction of around 5%, the people said. The layoffs are still in the planning stage and nothing has been decided. Rivian has operations in California, Michigan and Illinois, where its plant operates, as well as a presence in the UK and Canada.

The company is pulling back after roughly doubling its headcount over the past year to support a ramp-up in production.

The Irvine, California-based manufacturer is poised to join companies across corporate America pruning their operations amid growing worries about an economic downturn. Tesla is cutting 10% of its salaried workforce, while protecting manufacturing jobs, after Chief Executive Officer Elon Musk said he sees a recession as inevitable.

#159

Ex-OEM King

That's not all that surprising. They went on a hiring binge and now found out that they are overstaffed. This happens all the time with most start ups. My guess is they'll start laying off people in support functions (HR, finance, marketing, etc) rather than those core to the business.

#160

AZ Community Team

That's not all that surprising. They went on a hiring binge and now found out that they are overstaffed. This happens all the time with most start ups. My guess is they'll start laying off people in support functions (HR, finance, marketing, etc) rather than those core to the business.

I've been at three startups, one was a optical networking company and our hiring binge in 2000 (same as the IPO) was sad. Company lowered the competency bar too low and brought on too many people that we wound up laying off virtually all of them in the first wave of layoffs in the optical bust of 2001/2.

I've been at three startups, one was a optical networking company and our hiring binge in 2000 (same as the IPO) was sad. Company lowered the competency bar too low and brought on too many people that we wound up laying off virtually all of them in the first wave of layoffs in the optical bust of 2001/2.