Is U.S. economy headed for a crash?

#82

The sizzle in the Steak

Hang on kids....were not out of the woods yet.

#85

What Would Don Draper Do?

unfortunately, that's not always the case. it's quite sad.

#88

The sizzle in the Steak

#90

The sizzle in the Steak

#92

The sizzle in the Steak

^^ Sure but nothing like bank stocks.

#95

What Would Don Draper Do?

#96

What Would Don Draper Do?

#97

The sizzle in the Steak

#99

I feel the need...

#101

I feel the need...

But Have We Learned Enough?

LIKE most economists, those at the International Monetary Fund are lowering their growth forecasts. The financial turmoil gripping Wall Street will probably spill over onto every other street in America. Most likely, current job losses are only the tip of an ugly iceberg.

But when Olivier Blanchard, the I.M.F.’s chief economist, was asked about the possibility of the world sinking into another Great Depression, he reassuringly replied that the chance was “nearly nil.” He added, “We’ve learned a few things in 80 years.”

Yes, we have. But have we learned what caused the Depression of the 1930s? Most important, have we learned enough to avoid doing the same thing again?

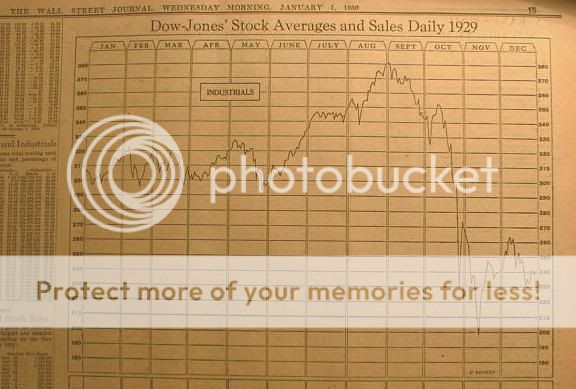

The Depression began, to a large extent, as a garden-variety downturn. The 1920s were a boom decade, and as it came to a close the Federal Reserve tried to rein in what might have been called the irrational exuberance of the era.....

But when Olivier Blanchard, the I.M.F.’s chief economist, was asked about the possibility of the world sinking into another Great Depression, he reassuringly replied that the chance was “nearly nil.” He added, “We’ve learned a few things in 80 years.”

Yes, we have. But have we learned what caused the Depression of the 1930s? Most important, have we learned enough to avoid doing the same thing again?

The Depression began, to a large extent, as a garden-variety downturn. The 1920s were a boom decade, and as it came to a close the Federal Reserve tried to rein in what might have been called the irrational exuberance of the era.....

#102

I feel the need...

Fed Battles `Big-Time' Economic Erosion With New Cuts

Less than three weeks after the Federal Reserve's emergency interest-rate reduction was, in the words of its vice chairman, ``overwhelmed'' by the collapse of financial markets, Ben S. Bernanke is about to try again.

The outlook has worsened since the Fed last acted on Oct. 8, and analysts now say the economy may shrink more than 2 percent in the final quarter of 2008, its steepest decline in at least 18 years. ``We're heading south big-time,'' says Lyle Gramley, a former Fed governor who is now senior economic adviser at Stanford Group Co. in Washington.

As a result, Fed Chairman Bernanke and his colleagues may eventually have to drive the benchmark overnight rate close to zero to resuscitate the economy. The next installment comes Oct. 29 when, says Gramley, ``the Fed is going to cut rates a half percentage point.''

That would reduce the central bank's target for the federal funds rate, which commercial banks charge each other for overnight loans, to 1 percent. The official rate hasn't been that low since 2004, and has never been lower since the Fed began trying to control it in the late 1980s. More cuts may follow if the economy doesn't recover.....

The outlook has worsened since the Fed last acted on Oct. 8, and analysts now say the economy may shrink more than 2 percent in the final quarter of 2008, its steepest decline in at least 18 years. ``We're heading south big-time,'' says Lyle Gramley, a former Fed governor who is now senior economic adviser at Stanford Group Co. in Washington.

As a result, Fed Chairman Bernanke and his colleagues may eventually have to drive the benchmark overnight rate close to zero to resuscitate the economy. The next installment comes Oct. 29 when, says Gramley, ``the Fed is going to cut rates a half percentage point.''

That would reduce the central bank's target for the federal funds rate, which commercial banks charge each other for overnight loans, to 1 percent. The official rate hasn't been that low since 2004, and has never been lower since the Fed began trying to control it in the late 1980s. More cuts may follow if the economy doesn't recover.....

#103

The sizzle in the Steak

Soon banks will be able to earn interest on the money they borrow.

#105

Safety Car

unless you are in the process of getting a loan for a house, i would say the larget impact of this crash is how it is/may jeopardize your current job.

if so, all other factors of the market will be so far down your list of priorities. obviously i am representing the voice of someone who is on the chopping block.

if so, all other factors of the market will be so far down your list of priorities. obviously i am representing the voice of someone who is on the chopping block.

#106

Safety Car

BTW, as much correlation that is being made between the current recession and the Great Depression, i do not think the two really compare. sure they are staple of all time lows in American economies, but the great depression was strictly a national dilemma. sure, our recession is mostly a cause of our own faults. but we cannot solve this problem from within. with emerging global markets, obviously china, and india, we will be doomed when it comes to reviving the national debt.

a recession implies that you will bounce back in due time. however, i do not see this happening, considering our competition. this current crisis may be the forefront of our demise.

sorry for being so gloomy. i just have a lot of disbelief in the american economy right now

a recession implies that you will bounce back in due time. however, i do not see this happening, considering our competition. this current crisis may be the forefront of our demise.

sorry for being so gloomy. i just have a lot of disbelief in the american economy right now

#107

I feel the need...

http://en.wikipedia.org/wiki/Great_Depression

#108

I feel the need...

Downturn Accelerates As It Circles The Globe

Economies Worse Off Than Predicted Just Weeks Ago

http://www.washingtonpost.com/wp-dyn...print/asection

Time to change the thread title?

The world economy is deteriorating more quickly than leading economists predicted only weeks ago, with Britain yesterday becoming the latest nation to surprise analysts with the depth of its economic pain.

Britain posted its worst quarterly contraction since 1980 on the heels of sharper than expected slowdowns reported from Germany to China to South Korea. The grim data, analysts said, underscores how the burst of the biggest credit bubble in history is seeping into the real economies around the world, silencing construction cranes, bankrupting businesses and throwing millions of people out of work.

"In just the past few days, we've had a big downward revision, we're seeing that an even bigger deceleration is on the way than we thought," said Simon Johnson, former chief economist at the International Monetary Fund and a senior fellow at the Peterson Institute for International Economics.

The depth of the troubles, analysts say, indicates that nations may need to spend more than the billions of dollars already planned on stimulus packages to jump-start their economies, and that a global recovery could take longer, perhaps pushing into 2010.....

Britain posted its worst quarterly contraction since 1980 on the heels of sharper than expected slowdowns reported from Germany to China to South Korea. The grim data, analysts said, underscores how the burst of the biggest credit bubble in history is seeping into the real economies around the world, silencing construction cranes, bankrupting businesses and throwing millions of people out of work.

"In just the past few days, we've had a big downward revision, we're seeing that an even bigger deceleration is on the way than we thought," said Simon Johnson, former chief economist at the International Monetary Fund and a senior fellow at the Peterson Institute for International Economics.

The depth of the troubles, analysts say, indicates that nations may need to spend more than the billions of dollars already planned on stimulus packages to jump-start their economies, and that a global recovery could take longer, perhaps pushing into 2010.....

Time to change the thread title?

#109

The $55 trillion question

The financial crisis has put a spotlight on the obscure world of credit default swaps - which trade in a vast, unregulated market that most people haven't heard of and even fewer understand. Will this be the next disaster?

http://money.cnn.com/2008/09/30/maga...ion=2008093012

The financial crisis has put a spotlight on the obscure world of credit default swaps - which trade in a vast, unregulated market that most people haven't heard of and even fewer understand. Will this be the next disaster?

http://money.cnn.com/2008/09/30/maga...ion=2008093012

#110

Team Owner

History Channel had a good show on tonight.

"Crash: The Next Great Depression?"

I don't see any re air dates but maybe you can pick it up on bit torrent.

http://www.history.com/shows.do?acti...isodeId=380298

"Crash: The Next Great Depression?"

I don't see any re air dates but maybe you can pick it up on bit torrent.

http://www.history.com/shows.do?acti...isodeId=380298

#111

A Turning Point in Financial History/When Financial Innovation Backfires - Interview with Harvard and Oxford Professor Niall Ferguson, Author of "The Ascent of Money":

"The Great Repression"

http://www.youtube.com/watch?v=sskRSfLGHlw

"The Great Repression"

http://www.youtube.com/watch?v=sskRSfLGHlw

#112

I feel the need...

^^ I used to think he was quite the fuddy duddy, historians tend to oversimplify economic trends to fit their narrative. BUT, the end of empires do occur on overextension: militarily, fiscally, etc...

Trying to connect the dots to this maelstrom has been quite the learning lesson in applied economics. I'm reminded of the old adage: the law of maximum ruin -- just when you get suckered in and think you've found the bottom.

I'm not cocky enough to think the US dollar is the end all, be all. When we get to the other side of this abyss, who knows what purchasing power a paper dollar will have.

Trying to connect the dots to this maelstrom has been quite the learning lesson in applied economics. I'm reminded of the old adage: the law of maximum ruin -- just when you get suckered in and think you've found the bottom.

I'm not cocky enough to think the US dollar is the end all, be all. When we get to the other side of this abyss, who knows what purchasing power a paper dollar will have.

#113

Moderator Alumnus

Stock market declines globally are increasingly correlated and emerging economies will follow developed nations into a “severe recession,” according to New York University Professor Nouriel Roubini.

Roubini said economic growth in China will slow to less than 5 percent and the U.S. will lose 6 million jobs. The American economy will expand 1 percent at most in 2010 as private spending falls and unemployment climbs to 9 percent, Roubini said.

“There is nowhere to hide,” Roubini, an economics professor at NYU’s Stern School of Business who predicted the financial crisis, said in an interview with Bloomberg Television. “We have for the first time in decades a global synchronized recession. Markets have become perfectly correlated and economies are also becoming perfectly correlated. This is not your kind of traditional minor recession.”

Roubini said the U.S. government should nationalize the biggest banks and absorb their bad holdings because losses will exceed assets, threatening to push them into bankruptcy. The banks could be privatized again in two or three years, Roubini said. The professor reiterated his previous prediction that U.S. financial losses may reach $3.6 trillion.

“Nobody’s in favor of long-term ownership of the U.S. banking system by the government, but if you don’t do it this way you end up like Japan where you kept alive for decade zombie banks that were never restructured,” he said. “That’s going to be much worse. It’s better to clean it up, nationalize it and sell it to the private sector.”

Japanese policy makers hesitated in addressing a banking crisis in the 1990s and then struggled to revive growth as deflation and recessions stranded the nation in what is known as the “Lost Decade.”

In July 2006, Roubini predicted the financial crisis. In February of last year, he forecast a “catastrophic” meltdown that central bankers would fail to prevent, leading to the bankruptcy of large banks with mortgage holdings and a “sharp drop” in equities. Since then, Bear Stearns Cos. was forced into a sale and Lehman Brothers Holdings Inc. went bankrupt, prompting banks to hoard cash and depriving businesses and households of access to capital.

The world’s biggest economies are sliding deeper into recession as the fall-out from the global financial crisis hobbles manufacturing output and punctures consumer spending from New York to Beijing. The U.S. economy probably contracted at 5.5 percent pace in the fourth quarter, the fastest in 26 years, a survey of economists showed.

http://www.bloomberg.com/apps/news?p...efer=worldwide

Roubini said economic growth in China will slow to less than 5 percent and the U.S. will lose 6 million jobs. The American economy will expand 1 percent at most in 2010 as private spending falls and unemployment climbs to 9 percent, Roubini said.

“There is nowhere to hide,” Roubini, an economics professor at NYU’s Stern School of Business who predicted the financial crisis, said in an interview with Bloomberg Television. “We have for the first time in decades a global synchronized recession. Markets have become perfectly correlated and economies are also becoming perfectly correlated. This is not your kind of traditional minor recession.”

Roubini said the U.S. government should nationalize the biggest banks and absorb their bad holdings because losses will exceed assets, threatening to push them into bankruptcy. The banks could be privatized again in two or three years, Roubini said. The professor reiterated his previous prediction that U.S. financial losses may reach $3.6 trillion.

“Nobody’s in favor of long-term ownership of the U.S. banking system by the government, but if you don’t do it this way you end up like Japan where you kept alive for decade zombie banks that were never restructured,” he said. “That’s going to be much worse. It’s better to clean it up, nationalize it and sell it to the private sector.”

Japanese policy makers hesitated in addressing a banking crisis in the 1990s and then struggled to revive growth as deflation and recessions stranded the nation in what is known as the “Lost Decade.”

In July 2006, Roubini predicted the financial crisis. In February of last year, he forecast a “catastrophic” meltdown that central bankers would fail to prevent, leading to the bankruptcy of large banks with mortgage holdings and a “sharp drop” in equities. Since then, Bear Stearns Cos. was forced into a sale and Lehman Brothers Holdings Inc. went bankrupt, prompting banks to hoard cash and depriving businesses and households of access to capital.

The world’s biggest economies are sliding deeper into recession as the fall-out from the global financial crisis hobbles manufacturing output and punctures consumer spending from New York to Beijing. The U.S. economy probably contracted at 5.5 percent pace in the fourth quarter, the fastest in 26 years, a survey of economists showed.

http://www.bloomberg.com/apps/news?p...efer=worldwide

#114

I feel the need...

Bear-Market Entry Risks Decade-Long Price Slump

How will you know when the bear retreats and it’s safe to invest in stocks?

Contrary to most Wall Street pundits and economists -- who have a bent for being consistently bullish -- you probably won’t know the right moment. Nor will the experts.

Bull and bear stock-market timing doesn’t necessarily follow any political, weather or cosmic cycles.

Only two variables hold true: If inflation is double-digit nasty or deflation rampant, hold on to your cash. It’s going to be a rough ride.

The Great Depression, which lasted from late 1929 to 1941, was a case in point. After a period of robust stock and housing markets in the 1920s, Wall Street sputtered for a decade.....

Contrary to most Wall Street pundits and economists -- who have a bent for being consistently bullish -- you probably won’t know the right moment. Nor will the experts.

Bull and bear stock-market timing doesn’t necessarily follow any political, weather or cosmic cycles.

Only two variables hold true: If inflation is double-digit nasty or deflation rampant, hold on to your cash. It’s going to be a rough ride.

The Great Depression, which lasted from late 1929 to 1941, was a case in point. After a period of robust stock and housing markets in the 1920s, Wall Street sputtered for a decade.....

#115

I feel the need...

Bank Stock Crash Surpasses Dot-Com Collapse: Chart of the Day

The collapse of U.S. financial stocks

to an almost 17-year low last week surpassed the crash in

technology shares after the dot-com bubble burst in 2000.

The CHART OF THE DAY shows the 84 percent decline in the

Standard & Poor’s 500 Financials Index from its high in February

2007. It retreated as subprime-mortgage defaults sparked a

worldwide credit freeze that saddled banks including Citigroup

Inc. and Bank of America Corp. with $1.2 trillion of losses.

The S&P 500 Information Technology Index tumbled 83 percent

from its peak in March 2000 to its trough in October 2002 as

investors concluded prices that had climbed eightfold in five

years weren’t supported by profits at companies such as

Amazon.com Inc. and Cisco Systems Inc.

“A crash in financials is much more pervasive than a crash

in technology, because the financial services industry greases

the wheels of commerce,” said Diane Garnick, who helps oversee

$354 billion as an investment strategist at Invesco Ltd. in New

York. The banking crisis “is going to take much longer to come

out of than the technology bust,” she said.

Howard Silverblatt, the senior index analyst at S&P in New

York, highlighted the relationship between the financials index

and the technology index in an e-mailed note on March 6.

For Related News and Information:

Top stock-market stories: TOP STK <GO>

More Chart of the Day stories: NI CHART <GO>

to an almost 17-year low last week surpassed the crash in

technology shares after the dot-com bubble burst in 2000.

The CHART OF THE DAY shows the 84 percent decline in the

Standard & Poor’s 500 Financials Index from its high in February

2007. It retreated as subprime-mortgage defaults sparked a

worldwide credit freeze that saddled banks including Citigroup

Inc. and Bank of America Corp. with $1.2 trillion of losses.

The S&P 500 Information Technology Index tumbled 83 percent

from its peak in March 2000 to its trough in October 2002 as

investors concluded prices that had climbed eightfold in five

years weren’t supported by profits at companies such as

Amazon.com Inc. and Cisco Systems Inc.

“A crash in financials is much more pervasive than a crash

in technology, because the financial services industry greases

the wheels of commerce,” said Diane Garnick, who helps oversee

$354 billion as an investment strategist at Invesco Ltd. in New

York. The banking crisis “is going to take much longer to come

out of than the technology bust,” she said.

Howard Silverblatt, the senior index analyst at S&P in New

York, highlighted the relationship between the financials index

and the technology index in an e-mailed note on March 6.

For Related News and Information:

Top stock-market stories: TOP STK <GO>

More Chart of the Day stories: NI CHART <GO>

#116

I feel the need...

Libor’s Creep Shows Credit Markets at Risk of Seizure

The cost of borrowing in dollars is rising as the global recession deepens and central bank efforts to prop up the financial system fail to prevent a growing number of banks from requiring government bailouts.

The London interbank offered rate, or Libor, that banks say they charge each other for three-month loans stayed at 1.33 percent today, near the highest level since Jan. 8 and up from this year’s low of 1.08 percent on Jan. 14, the British Bankers’ Association said. The Libor-OIS spread, a gauge of bank reluctance to lend, widened to the most since Jan. 9.

Short-term borrowing costs are increasing as banks hoard cash and governments struggle to thaw credit markets after finance companies reported almost $1.2 trillion of writedowns and losses since the start of 2007. Banco Popolare SC yesterday became Italy’s first lender to seek state aid. Lloyds Banking Group Plc, the U.K.’s largest mortgage provider, ceded control to the government March 7. U.S. regulators seized 17 failing banks so far this year.

“The market is beginning to think that the solution is either not politically possible, or we can’t afford it, or maybe there isn’t a solution,” said Bob Baur, chief global economist at Des Moines, Iowa-based Principal Global Investors, which manages $198 billion of assets. Libor’s rise “is just another indication of that concern,” he said.

The U.S. committed about $10 trillion to combat the financial crisis that started in August 2007 as losses on securities tied to subprime mortgages caused credit markets to seize up. European governments put up more than 1.2 trillion euros ($1.5 trillion) to protect their banking systems.....

The London interbank offered rate, or Libor, that banks say they charge each other for three-month loans stayed at 1.33 percent today, near the highest level since Jan. 8 and up from this year’s low of 1.08 percent on Jan. 14, the British Bankers’ Association said. The Libor-OIS spread, a gauge of bank reluctance to lend, widened to the most since Jan. 9.

Short-term borrowing costs are increasing as banks hoard cash and governments struggle to thaw credit markets after finance companies reported almost $1.2 trillion of writedowns and losses since the start of 2007. Banco Popolare SC yesterday became Italy’s first lender to seek state aid. Lloyds Banking Group Plc, the U.K.’s largest mortgage provider, ceded control to the government March 7. U.S. regulators seized 17 failing banks so far this year.

“The market is beginning to think that the solution is either not politically possible, or we can’t afford it, or maybe there isn’t a solution,” said Bob Baur, chief global economist at Des Moines, Iowa-based Principal Global Investors, which manages $198 billion of assets. Libor’s rise “is just another indication of that concern,” he said.

The U.S. committed about $10 trillion to combat the financial crisis that started in August 2007 as losses on securities tied to subprime mortgages caused credit markets to seize up. European governments put up more than 1.2 trillion euros ($1.5 trillion) to protect their banking systems.....

#117

Team Owner

What is Libor supposed to be at? This chart I got from the story shows that it was cruising along at around 2.9 for awhile. I'd like to understand why 1.33 is a concern over 1.08

#118

I feel the need...

Is this finally the economic collapse?

FORTUNE -- The Great Depression. Wall Street in 1987. Japan in 1997. Points of economic collapse are generally crystal clear in the rear-view mirror. Professional politicians in Japan have been telling stories for 20 years as to why they can prevent economic stagnation. In the US, the storytelling started in 2007. All the while, stock market and real-estate prices have repeatedly rallied to lower-highs, then collapsed again, to lower-lows.

Despite the many differences between Japan and the US, there is one similarity that continues to matter most in the risk management model my colleagues and I use at Hedgeye, our research firm -- debt as a percentage of GDP. Now that the US can't cut interest rates any lower, the only option left on the table is what the Fed just announced it would start doing -- buying Treasury debt. And that could lead the country to the brink of collapse: According to economists Carmen Reinhart & Ken Rogoff, whose views we share, crossing the 90% debt/GDP threshold is the equivalent of crossing the proverbial Rubicon of economic growth. It's a point from which it's almost impossible to return.....

.....Lest our doom and gloom seem built entirely on technical measurements, what they boil down to is actually quite simple -- an idea about our country which dates back to 1835. Alexis De Tocqueville, author of Democracy in America, which was published that year, seemed to warn of this day when he wrote: "The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money."

Despite the many differences between Japan and the US, there is one similarity that continues to matter most in the risk management model my colleagues and I use at Hedgeye, our research firm -- debt as a percentage of GDP. Now that the US can't cut interest rates any lower, the only option left on the table is what the Fed just announced it would start doing -- buying Treasury debt. And that could lead the country to the brink of collapse: According to economists Carmen Reinhart & Ken Rogoff, whose views we share, crossing the 90% debt/GDP threshold is the equivalent of crossing the proverbial Rubicon of economic growth. It's a point from which it's almost impossible to return.....

.....Lest our doom and gloom seem built entirely on technical measurements, what they boil down to is actually quite simple -- an idea about our country which dates back to 1835. Alexis De Tocqueville, author of Democracy in America, which was published that year, seemed to warn of this day when he wrote: "The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money."

#119

I feel the need...

Even Tony Robbins Is Warning That An Economic Collapse Is Coming

It seems like almost everyone is warning of a coming economic collapse these days. Do you remember Tony Robbins? He is probably the world's best known "motivational speaker" and his infomercials dominated late night television during the 80s and 90s. He was always urging all of us to "unleash the power within" and to take charge of our lives. Well guess what? Now Tony Robbins is warning that an economic collapse is coming. In fact, he has issued a special video warning about what he believes is about to happen. Considering the incredible connections that he has at the highest levels of the financial world, it makes a lot of sense to consider what he is trying to warn us about. Robbins says that a "major retracement" is coming to financial markets and that the coming collapse is going to be a "painful process" as we go through it. Those familiar with Tony Robbins know that he always goes out of his way to stress the positive, so if even he is openly warning the public about a coming economic nightmare than you know that things are starting to get really, really bad out there.

The video that Tony Robbins published where he gives his economic warning is posted in two parts below. This is unlike any Tony Robbins video that you have ever seen before and it is absolutely jaw dropping.... .

The video that Tony Robbins published where he gives his economic warning is posted in two parts below. This is unlike any Tony Robbins video that you have ever seen before and it is absolutely jaw dropping.... .

Yikes, now even the king of positive thinking is going dark.

Review from a respected trading buddy of mine:

Ugh. Don't watch it. It's like listening to a neighbor that just learned some basic economics, figured out what's going on, and is trying to "educate" you about it.

Main part: his call is late fall, early 2011 crash.

2012 in trailers (maybe mine) across America... "Dude, Tony Robbins totally called it!"

Main part: his call is late fall, early 2011 crash.

2012 in trailers (maybe mine) across America... "Dude, Tony Robbins totally called it!"

#120

I feel the need...

Celebs’ & Billionaires’ Economic Warnings ?

One of the things we have harped on around here is the tendency for humans to be backwards looking in their sentiment.

The Recency Effect means we monkeys place disproportionate emphasis on recent stimuli or observations, regardless of worth or significance. Indeed, investors become bullish after they buy stocks, bearish after they sell them, as part of the self-rationalization process to justify their actions.

Consider: In October 2007, 4 days from the all time market top, the WSJ discussed how unlikely another 1987-like crash was (Exorcising Ghosts of Octobers Past). That was a backwards looking perspective, coming after 5 years of upwards market movement.

Perspectives sure changed following the economic collapse: One week after the Flash Crash, the WSJ noted how “the May 6 selloff had parallels to 1987” (How the ‘Flash Crash’ Echoed Black Monday); Is it any surprise that a 55% collapse in indexes during the prior 30 months subsequently impacted the tone of that article? (Note: We discussed both of these articles here).

The above psychological factors are what makes me point out the following two economic comments making the rounds. They fall into the category of recession-porn, and are worth considering.....

The Recency Effect means we monkeys place disproportionate emphasis on recent stimuli or observations, regardless of worth or significance. Indeed, investors become bullish after they buy stocks, bearish after they sell them, as part of the self-rationalization process to justify their actions.

Consider: In October 2007, 4 days from the all time market top, the WSJ discussed how unlikely another 1987-like crash was (Exorcising Ghosts of Octobers Past). That was a backwards looking perspective, coming after 5 years of upwards market movement.

Perspectives sure changed following the economic collapse: One week after the Flash Crash, the WSJ noted how “the May 6 selloff had parallels to 1987” (How the ‘Flash Crash’ Echoed Black Monday); Is it any surprise that a 55% collapse in indexes during the prior 30 months subsequently impacted the tone of that article? (Note: We discussed both of these articles here).

The above psychological factors are what makes me point out the following two economic comments making the rounds. They fall into the category of recession-porn, and are worth considering.....

8579

8579