Marijuana Stock = bee's knees?

#41

Sanest Florida Man

Thread Starter

#42

Team Owner

Canopy Growth Corporation (CGC)

42.49+4.24 (+11.08%)

At close: 4:00PM EST

https://www.thestreet.com/investing/...HOO&yptr=yahoo

42.49+4.24 (+11.08%)

At close: 4:00PM EST

Canopy Growth Shares Surge on NY State Hemp Farm License

https://www.thestreet.com/investing/...HOO&yptr=yahoo

#43

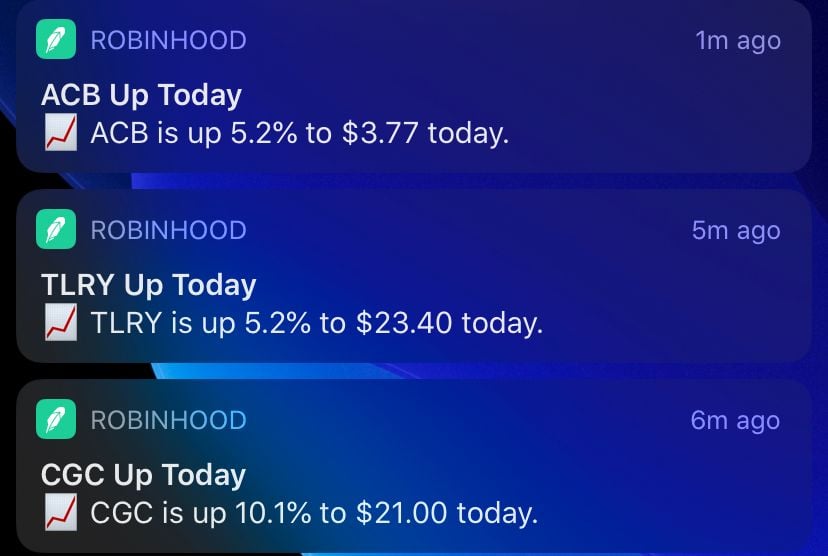

CRON: $21.14 : +$1.46 (+7.42%)

Up 103% YTD

CGC = $49.94 : +$0.96 (+1.96%)

Up 86% YTD

ACB: $7.41 : +$0.32 (+4.58%)

Up 49% YTD

APHA: $9.95 : +$1.21 (+13.85%)

Up 74.7% YTD

https://finance.yahoo.com/news/watch...180500910.html

Watch These 4 Marijuana Stocks Set The Standard on Friday (2/1/19)

February 1, 2019

The marijuana stock market has seen a massive increase in positive sentiment following the recent passing of the U.S. Farm Bill. The monumental piece of legislation formally legalized hemp to be planted as a major crop for the agricultural industry in the country. Although the Farm Bill doesn't explicitly reference anything about marijuana, the bill's section on hemp will have major implications for companies that manufacture and distribute products containing hemp. The cannabis industry as a whole is scheduled to be worth as much as $31 billion by the year 2022, which means that there is a large amount of room left still to grow. Nabis Holdings (INNPF) (NAB), Cronos Group Inc (NASDAQ: CRON, TSX: CRON), New Age Beverages Corporation (NBEV), and Pyxus International Inc (PYX) are four cannabis companies focused on improving the quality of life for their consumers.

. . .

Cronos Group Inc (CRON) saw its shares climb 7.66% in early-afternoon trading on Friday, with shares trading at $21.19 per share. Just before the new year, the Company announced that it had entered into a subscription agreement with Altria Group, Inc pursuant to which Altria agreed to to make an approximately C$2.4 billion equity investment in Cronos Group on a private placement basis in exchange for common shares in the capital of the Company. Per the details of the agreement, Altria would also receive Warrants of Cronos Group, that if fully exercised, would provide the Company with an additional approximately C$1.4 billion of proceeds.

The Company will hold a shareholder meeting later this month to determine how they will go about handling the subscription agreement with Altria. The Transaction must be approved by at least a majority of the votes cast by Shareholders, in person or by proxy, at the Meeting.

February 1, 2019

The marijuana stock market has seen a massive increase in positive sentiment following the recent passing of the U.S. Farm Bill. The monumental piece of legislation formally legalized hemp to be planted as a major crop for the agricultural industry in the country. Although the Farm Bill doesn't explicitly reference anything about marijuana, the bill's section on hemp will have major implications for companies that manufacture and distribute products containing hemp. The cannabis industry as a whole is scheduled to be worth as much as $31 billion by the year 2022, which means that there is a large amount of room left still to grow. Nabis Holdings (INNPF) (NAB), Cronos Group Inc (NASDAQ: CRON, TSX: CRON), New Age Beverages Corporation (NBEV), and Pyxus International Inc (PYX) are four cannabis companies focused on improving the quality of life for their consumers.

. . .

Cronos Group Inc (CRON) saw its shares climb 7.66% in early-afternoon trading on Friday, with shares trading at $21.19 per share. Just before the new year, the Company announced that it had entered into a subscription agreement with Altria Group, Inc pursuant to which Altria agreed to to make an approximately C$2.4 billion equity investment in Cronos Group on a private placement basis in exchange for common shares in the capital of the Company. Per the details of the agreement, Altria would also receive Warrants of Cronos Group, that if fully exercised, would provide the Company with an additional approximately C$1.4 billion of proceeds.

The Company will hold a shareholder meeting later this month to determine how they will go about handling the subscription agreement with Altria. The Transaction must be approved by at least a majority of the votes cast by Shareholders, in person or by proxy, at the Meeting.

Last edited by AZuser; 02-01-2019 at 12:20 PM.

#44

Team Owner

:regret:

#45

https://www.thestreet.com/markets/au...urges-14862290

https://www.barrons.com/articles/aur...gs-51549933079

Canopy Growth (CGC) reports on Thursday after markets close.

Aurora Cannabis Posts Big Revenue Surge but Swings to a Loss

Feb 12, 2019

Aurora Cannabis Inc., the Canadian cannabis producer, posted a fiscal second-quarter loss of C$237.8 million on revenue of C$54.2 million, compared with year-earlier profit of C$7.7 million on revenue of C$11.7 million. Two analysts surveyed by FactSet had expected the company to post revenue of C$51.8 million.

Losses in the latest quarter resulted largely from investments Aurora Cannabis made in other cannabis producers, the company said.

The company attributed the revenue surge to its launch in the Canadian consumer market, where it reported sales of C$21.6 million, and international medical markets.

Aurora Cannabis said it sold 6,999 kg of cannabis in the quarter. The company said it accounted for 20% of consumer sales in Canada.

Aurora Cannabis projected it will reach sustained positive EBITDA beginning in its fiscal fourth quarter.

Feb 12, 2019

Aurora Cannabis Inc., the Canadian cannabis producer, posted a fiscal second-quarter loss of C$237.8 million on revenue of C$54.2 million, compared with year-earlier profit of C$7.7 million on revenue of C$11.7 million. Two analysts surveyed by FactSet had expected the company to post revenue of C$51.8 million.

Losses in the latest quarter resulted largely from investments Aurora Cannabis made in other cannabis producers, the company said.

The company attributed the revenue surge to its launch in the Canadian consumer market, where it reported sales of C$21.6 million, and international medical markets.

Aurora Cannabis said it sold 6,999 kg of cannabis in the quarter. The company said it accounted for 20% of consumer sales in Canada.

Aurora Cannabis projected it will reach sustained positive EBITDA beginning in its fiscal fourth quarter.

https://www.barrons.com/articles/aur...gs-51549933079

Aurora Cannabis Stock Is Falling Because Pot Is Getting Cheaper in Canada

Feb. 11, 2019

The back story. It’s been an eventful 2019 for Aurora Cannabis (ACB). Its stock skyrocketed 43% in January, even after its sales guidance for its fiscal second-quarter put sales at $50 million to $55 million. That was below the forecasts of the two analysts that cover the stock; they expected $60 million and $74.8 million. It helped that Aurora announced the acquisition of medical-marijuana producer Whistler Medical Marijuana for C$175 million in an all-stock deal last month. Still, Aurora dropped 35% in 2018 amid concerns about soaring expenses with production and acquisition costs outpacing revenue growth. Also adding to the worries: a production shortfall that left companies unable to fulfill weed demand across Canada after pot was legalized.

The plot twist: On Monday after the bell, Aurora reported a net revenue of C$54.2 million, a 363% rise compared with the same period in 2018. The sales figure puts revenue at the high end of the range that Aurora forecast last month.

But the company also reported losses of C$239.6 million versus earnings of C$7.2 million a year ago. The net income figure is complicated by noncash losses related to the company’s investments in other pot-industry players. On an operating basis, Aurora lost C$80 million in the quarter.

One closely watched number, Aurora’s cannabis production, came in a good bit ahead of Wall Street’s consensus. Aurora produced 7,822 kilograms of cannabis in the quarter versus an expected 7,000. Its production was up 550% from a year ago.

One wrinkle, though: Aurora’s per gram selling price for its cannabis fell 21% from a year ago to $6.23, a decline the company blamed largely on a new excise tax, as well as “the wholesale pricing structure in the Canadian consumer market.”

Moving forward: Aurora shares closed the day down 5.5%, to $7.17. From here, Wall Street will be looking for clues that the company can profitably support its surging business. Perhaps more than numbers, investors want to see that expansion costs are under control, while new products such as soft gels and vape-ready CBD oil help profit margins.

Feb. 11, 2019

The back story. It’s been an eventful 2019 for Aurora Cannabis (ACB). Its stock skyrocketed 43% in January, even after its sales guidance for its fiscal second-quarter put sales at $50 million to $55 million. That was below the forecasts of the two analysts that cover the stock; they expected $60 million and $74.8 million. It helped that Aurora announced the acquisition of medical-marijuana producer Whistler Medical Marijuana for C$175 million in an all-stock deal last month. Still, Aurora dropped 35% in 2018 amid concerns about soaring expenses with production and acquisition costs outpacing revenue growth. Also adding to the worries: a production shortfall that left companies unable to fulfill weed demand across Canada after pot was legalized.

The plot twist: On Monday after the bell, Aurora reported a net revenue of C$54.2 million, a 363% rise compared with the same period in 2018. The sales figure puts revenue at the high end of the range that Aurora forecast last month.

But the company also reported losses of C$239.6 million versus earnings of C$7.2 million a year ago. The net income figure is complicated by noncash losses related to the company’s investments in other pot-industry players. On an operating basis, Aurora lost C$80 million in the quarter.

One closely watched number, Aurora’s cannabis production, came in a good bit ahead of Wall Street’s consensus. Aurora produced 7,822 kilograms of cannabis in the quarter versus an expected 7,000. Its production was up 550% from a year ago.

One wrinkle, though: Aurora’s per gram selling price for its cannabis fell 21% from a year ago to $6.23, a decline the company blamed largely on a new excise tax, as well as “the wholesale pricing structure in the Canadian consumer market.”

Moving forward: Aurora shares closed the day down 5.5%, to $7.17. From here, Wall Street will be looking for clues that the company can profitably support its surging business. Perhaps more than numbers, investors want to see that expansion costs are under control, while new products such as soft gels and vape-ready CBD oil help profit margins.

Canopy Growth (CGC) reports on Thursday after markets close.

#46

CGC: $47.57 : +$1.45 (+3.14%)

https://www.canopygrowth.com/wp-cont...-Results-1.pdf

https://www.cnbc.com/2019/02/15/mari...-earnings.html

https://www.canopygrowth.com/wp-cont...-Results-1.pdf

https://www.cnbc.com/2019/02/15/mari...-earnings.html

Cannabis producer Canopy Growth rallied Friday after it reported third-quarter revenue rose 282 percent over the last year in what represented one of Wall Street's first looks into the legal recreational marijuana market in Canada.

Here's how the company did compared with what Wall Street expected when it reported earnings on Thursday:

.

Despite missing profit expectations, investors appeared relieved by the sales numbers, which were supported by sales of legal marijuana in Canada. Revenue numbers fell short of expectations in the prior quarter.

Here's how the company did compared with what Wall Street expected when it reported earnings on Thursday:

.

- Net loss per share: 38 Canadian cents ($0.28) vs. a loss of 16 Canadian cents expected by analysts polled by Refinitiv. That compared with net income of 1 Canadian cent per share in the year-ago period.

- Revenue: CA$83 million ($62.5 million) vs. CA$81.2 million expected by analysts polled by Refinitiv. That compared to net sales of CA$21.7 million in the year-ago period.

- Canopy sold 10,102 kilograms of pot and equivalents during the fiscal third-quarter. Of that total, the company sold 7,381 kilograms of recreational cannabis in business-to-business transactions and 1,611 kilograms of medical cannabis.

- Chief Financial Officer Tim Saunders has informed the company of his decision to retire from that position in mid- to late-2019.

Despite missing profit expectations, investors appeared relieved by the sales numbers, which were supported by sales of legal marijuana in Canada. Revenue numbers fell short of expectations in the prior quarter.

#47

Team Owner

Anybody got any thoughts on Cresco Labs?

CRLBF

CRLBF

#48

#49

TLRY: $81.10 : +$4.07 (+5.28%)

https://www.bloomberg.com/news/artic...a-harvest-deal

https://www.bloomberg.com/news/artic...a-harvest-deal

Tilray Taps U.S. Hemp-Food Market With Manitoba Harvest Deal

February 20, 2019

Tilray Inc. is acquiring a Manitoba hemp-food manufacturer for up to C$419 million ($316 million), tapping into its extensive U.S. distribution network and an upcoming line of CBD products.

Manitoba Harvest sells hemp-based granola, protein powder, milk and other food products at more than 13,000 points of sale across the U.S., including Walmart Inc., Costco Wholesale Corp., CVS Health Corp., Kroger Co., and online at Amazon.com Inc.

The closely held company also plans to launch a line of products containing CBD, the popular non-intoxicating compound found in hemp and cannabis. Proponents argue cannabidiol, the formal name for CBD, can help with everything from arthritis to insomnia, and retailers are watching the growing demand with interest.

“Retailers are seeing hemp mania, it’s one of the fastest-growing products right now,” said Bill Chiasson, chief executive officer of the Winnipeg-based company. “All of them are looking at bringing on products that contain CBD into their portfolio and every one of them has come to us and said they see us as a natural partner.”

CBD’s legal status remains somewhat opaque in the U.S. While Congress passed a farm bill in December that made hemp and its compounds, including CBD, legal under certain circumstances, the Food and Drug Administration has said it’s illegal to market the products as dietary supplements. Some jurisdictions, including New York City, have been cracking down on sales. In Canada, CBD-infused food and beverages won’t be legal until later this year.

The deal, announced Wednesday, will see Tilray pay C$277.5 million in cash and stock up front and an additional C$92.5 million six months after closing. It will issue another C$49 million in Tilray shares to Manitoba Harvest based on the company achieving certain financial milestones in 2019.

Manitoba Harvest posted C$94 million in gross revenue in 2018. Tilray, the second-biggest cannabis company by market value, is expected to report revenue of $40 million for the full year when it releases results on March 18, according to the average of five analyst estimates compiled by Bloomberg.

“We see potential for Manitoba Harvest to materially contribute to Tilray’s top line and Ebitda as it realizes synergies from Tilray and enters into the CBD market in a meaningful way,” Eight Capital analyst Graeme Kreindler wrote in a note Wednesday. However, he cautioned about the uncertainty surrounding the U.S. regulatory environment and the lack of visibility on Tilray’s planned CBD commercialization activities.

“When we looked at Manitoba Harvest we saw a trusted brand with a multi-national supply chain,” said Brendan Kennedy, CEO of Nanaimo, British Columbia-based Tilray. “That was extremely appealing.” Manitoba Harvest’s Canadian farmers jointly grow up to 30,000 acres of hemp and the company has two manufacturing facilities, in Winnipeg and Ste. Agathe, Manitoba.

“We think that supply chain is going to be a valuable asset as we look to the future of the cannabis industry,” Kennedy said.

It’s currently illegal to transport CBD across the Canada-U.S. border, so Tilray is looking closely at developing hemp processing facilities in the U.S., Kennedy said.

“It’s very likely that we will deploy capital in the U.S. to take advantage of the opportunities presented through the farm bill at some point in the next 12 months,” he said. “This is an important first step.”

February 20, 2019

Tilray Inc. is acquiring a Manitoba hemp-food manufacturer for up to C$419 million ($316 million), tapping into its extensive U.S. distribution network and an upcoming line of CBD products.

Manitoba Harvest sells hemp-based granola, protein powder, milk and other food products at more than 13,000 points of sale across the U.S., including Walmart Inc., Costco Wholesale Corp., CVS Health Corp., Kroger Co., and online at Amazon.com Inc.

The closely held company also plans to launch a line of products containing CBD, the popular non-intoxicating compound found in hemp and cannabis. Proponents argue cannabidiol, the formal name for CBD, can help with everything from arthritis to insomnia, and retailers are watching the growing demand with interest.

“Retailers are seeing hemp mania, it’s one of the fastest-growing products right now,” said Bill Chiasson, chief executive officer of the Winnipeg-based company. “All of them are looking at bringing on products that contain CBD into their portfolio and every one of them has come to us and said they see us as a natural partner.”

CBD’s legal status remains somewhat opaque in the U.S. While Congress passed a farm bill in December that made hemp and its compounds, including CBD, legal under certain circumstances, the Food and Drug Administration has said it’s illegal to market the products as dietary supplements. Some jurisdictions, including New York City, have been cracking down on sales. In Canada, CBD-infused food and beverages won’t be legal until later this year.

The deal, announced Wednesday, will see Tilray pay C$277.5 million in cash and stock up front and an additional C$92.5 million six months after closing. It will issue another C$49 million in Tilray shares to Manitoba Harvest based on the company achieving certain financial milestones in 2019.

Manitoba Harvest posted C$94 million in gross revenue in 2018. Tilray, the second-biggest cannabis company by market value, is expected to report revenue of $40 million for the full year when it releases results on March 18, according to the average of five analyst estimates compiled by Bloomberg.

“We see potential for Manitoba Harvest to materially contribute to Tilray’s top line and Ebitda as it realizes synergies from Tilray and enters into the CBD market in a meaningful way,” Eight Capital analyst Graeme Kreindler wrote in a note Wednesday. However, he cautioned about the uncertainty surrounding the U.S. regulatory environment and the lack of visibility on Tilray’s planned CBD commercialization activities.

“When we looked at Manitoba Harvest we saw a trusted brand with a multi-national supply chain,” said Brendan Kennedy, CEO of Nanaimo, British Columbia-based Tilray. “That was extremely appealing.” Manitoba Harvest’s Canadian farmers jointly grow up to 30,000 acres of hemp and the company has two manufacturing facilities, in Winnipeg and Ste. Agathe, Manitoba.

“We think that supply chain is going to be a valuable asset as we look to the future of the cannabis industry,” Kennedy said.

It’s currently illegal to transport CBD across the Canada-U.S. border, so Tilray is looking closely at developing hemp processing facilities in the U.S., Kennedy said.

“It’s very likely that we will deploy capital in the U.S. to take advantage of the opportunities presented through the farm bill at some point in the next 12 months,” he said. “This is an important first step.”

#50

GWPH: $167.00 : +$14.11 (+9.23%)

After hours: 7:57PM EST

https://www.benzinga.com/markets/can...-epidiolex-lau

After hours: 7:57PM EST

https://www.benzinga.com/markets/can...-epidiolex-lau

GW Pharmaceuticals Sees 68% Q1 Revenue Growth Following Epidiolex Launch

February 26, 2019

GW Pharmaceuticals plc reported its financial results Tuesday for the first quarter of fiscal 2019. The company reported revenue growth of 67.5 percent.

One highlight: the report includes sales of the company's Epidiolex drug, which last year became the first cannabis-based drug approved by the Food and Drug Administration. Sales began in November.

What Happened

The company reported revenue of $6.7 million for the quarter, beating analyst expectations of $5.35 million. On the bottom line, GW Pharmaceuticals posted a net loss of 20 cents versus a consensus estimate of 23 cents.

Sales of Epidiolex amounted to $4.7 million between Nov. 1 and Dec. 31. The company said it registered around 4,500 new patient enrollment forms in the first two-month sales period.

Epidiolex is under review by the European Medicines Agency, with a recommendation from the Committee for Medicinal Products for Human Use expected in the second quarter of 2019. The company already has a commercial footprint in five European markets.

Why It's Important

As the first and only FDA-approved cannabis-based drug, Epidiolex is expected to be a blockbuster. Bank of America analysts estimate that sales of Epidiolex will amount to $74 million this year, but could reach $2.2 billion by 2027.

Epidiolex is a CBD drug for the treatment of two rare and severe types of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome.

What's Next

The company also provided some updates on its pipeline. GW is working on launching Sativex in the U.S. and plans to launch a Phase 3 pivotal study in the fourth quarter of 2019.

The British biopharma is also planning an open-label study in Rett syndrome and seizures for its CBDV drug candidate in the first half of 2019.

For the current quarter, analysts expect GW Pharmaceuticals to record sales of $22 million and a net loss of $0.22 per share.

February 26, 2019

GW Pharmaceuticals plc reported its financial results Tuesday for the first quarter of fiscal 2019. The company reported revenue growth of 67.5 percent.

One highlight: the report includes sales of the company's Epidiolex drug, which last year became the first cannabis-based drug approved by the Food and Drug Administration. Sales began in November.

What Happened

The company reported revenue of $6.7 million for the quarter, beating analyst expectations of $5.35 million. On the bottom line, GW Pharmaceuticals posted a net loss of 20 cents versus a consensus estimate of 23 cents.

Sales of Epidiolex amounted to $4.7 million between Nov. 1 and Dec. 31. The company said it registered around 4,500 new patient enrollment forms in the first two-month sales period.

Epidiolex is under review by the European Medicines Agency, with a recommendation from the Committee for Medicinal Products for Human Use expected in the second quarter of 2019. The company already has a commercial footprint in five European markets.

Why It's Important

As the first and only FDA-approved cannabis-based drug, Epidiolex is expected to be a blockbuster. Bank of America analysts estimate that sales of Epidiolex will amount to $74 million this year, but could reach $2.2 billion by 2027.

Epidiolex is a CBD drug for the treatment of two rare and severe types of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome.

What's Next

The company also provided some updates on its pipeline. GW is working on launching Sativex in the U.S. and plans to launch a Phase 3 pivotal study in the fourth quarter of 2019.

The British biopharma is also planning an open-label study in Rett syndrome and seizures for its CBDV drug candidate in the first half of 2019.

For the current quarter, analysts expect GW Pharmaceuticals to record sales of $22 million and a net loss of $0.22 per share.

#51

Team Owner

https://www.cbsnews.com/news/martha-...owth-cannabis/

Martha Stewart is teaming with a leading cannabis company to develop cannabidiol, or CBD, products for consumers. Canopy Growth, a publicly traded Canadian vendor of marijuana, oils, and other products for medical and recreational use, said Thursday that the lifestyle guru will advise the company on coming up with and marketing a broad line of CBD products derived from hemp.

#52

TLRY: $74.00 : +$1.76 (+2.44%)

After hours: 7:59PM EDT

Q4 2018 results

Loss of $0.33 per share or $31 million (up from loss of $0.04 per share or $2.9 million a year ago) vs analyst estimates for loss of $0.14 per share -- big miss

Revenue of $15.5 million (up from $5.1 million a year ago) vs analyst estimates for $14.1 million -- beat

https://ir.tilray.com/news-releases/...ancial-results

https://www.marketwatch.com/story/ti...pot-2019-03-18

After hours: 7:59PM EDT

Q4 2018 results

Loss of $0.33 per share or $31 million (up from loss of $0.04 per share or $2.9 million a year ago) vs analyst estimates for loss of $0.14 per share -- big miss

Revenue of $15.5 million (up from $5.1 million a year ago) vs analyst estimates for $14.1 million -- beat

https://ir.tilray.com/news-releases/...ancial-results

Fourth Quarter 2018 Financial Highlights

.

2018 Financial Highlights

.

.

- Revenue increased to $15.5 (C$20.9) million, up 203.8% compared to the fourth quarter of last year, driven by bulk sales, inaugural sales in the Canadian adult-use market and accelerated wholesale distribution in export markets.

- Total kilogram equivalents sold increased almost three-fold to 2,053 kilograms from 694 kilograms in the prior year period.

- Average net selling price per gram increased to $7.52 (C$10.05) compared to $7.13 (C$9.12) in the prior year period.

- Net loss for the quarter was $31.0 million or $0.33 per share compared to $3.0 million or $0.04 per share for the prior year period. Net loss includes non-cash stock-based compensation charges of $4.1 million compared to $34 thousand in the prior year period. Adjusted EBITDA was a loss of $17.8 million compared to a loss of $2.1 million the prior year period. The increased net loss and Adjusted EBITDA declines were primarily due to the increase in operating expenses related to growth initiatives, expansion of international teams and costs related to financings and M&A activities.

2018 Financial Highlights

.

- Revenue increased to $43.1 (C$56.4) million, up 110.0% compared to last year. The increase in revenue was driven by bulk sales, the inaugural sales for the Canadian adult-use market and accelerated wholesale distribution in export markets.

- Total kilogram equivalents sold increased over two-fold to 6,478 kilograms from 3,024 kilograms in the prior year.

- Average net selling price per gram increased to $6.61 (C$8.59) compared to $6.52 (C$8.42) in the prior year. In 2018, there was significant revenue growth for extract products compared to dried flower, where extracts represented 49% of the sales mix in 2018 compared to 20% in 2017.

- Net loss for the year was $67.7 million, or $0.82 per share, compared to $7.8 million, or $0.10 per share, for 2017. Net loss includes non-cash stock-based compensation charges of $21.0 million compared to a $0.1 million charge in the prior-year. Adjusted EBITDA was a loss of $33.1 million compared to a loss of $5.5 million the prior year. The increased net loss and Adjusted EBITDA declines were primarily due to the increase in operating expenses related to continued growth, expansion of international teams, and costs related to financings and the initial public offering (“IPO”).

#53

Team Owner

I bought some IIPR. If I can get it for under $80 I will buy more. It's a REIT. They buy land from growers and lease it back to them. The management team has prior experience with REITs. They sold BioMed Realty Trust to Blackstone for $8B. https://innovativeindustrialproperties.com/

#54

CRON: $18.33 : -$1.91 (-9.41%)

Q4 2018 results

Loss of C$11.8 million ($8.8 million) or $loss of 0.06 per share vs expectations for loss of $0.01 -- miss

Revenue of C$5.6 million (up from up from C$1.6 million a year ago) vs expectations for C$10.4 million -- miss

https://www.marketwatch.com/story/po...ery-2019-03-26

Q4 2018 results

Loss of C$11.8 million ($8.8 million) or $loss of 0.06 per share vs expectations for loss of $0.01 -- miss

Revenue of C$5.6 million (up from up from C$1.6 million a year ago) vs expectations for C$10.4 million -- miss

https://www.marketwatch.com/story/po...ery-2019-03-26

Pot maker Cronos Group losses widen, but recreational sales remain a mystery

Mar 27, 2019

Investors still have no idea how much recreational pot Cronos Group Inc. sold as its losses continued to mount, according to fourth-quarter earnings it reported Tuesday before the opening bell.

As the last of the world’s largest cannabis companies by market valuation reported results, it remains clear that Canada’s recreational market has not yet proven as lucrative or efficient as its boosters had hoped. Cronos echoed its much larger rivals Aurora Cannabis Inc. and Canopy Growth Corp. - in terms of sales - describing challenges it faced packaging recreational pot and growing uncertainty over the now-outlawed edibles regime set to take effect this year.

And like many of its rivals in Canada and the U.S., Cronos did not make it easy for investors to quickly figure out what happened during the quarter.

Buried deep in the company’s financial statements — and not included in the company’s earnings press release — Cronos disclosed fourth-quarter losses widened to C$11.8 million ($8.8 million), which amounts to six cents a share. That’s compared with profits of C$667,000, or a penny a share in the year-ago quarter.

Like its rivals, revenue increased substantially. Cronos logged fourth-quarter gross sales of C$5.6 million, up from C$1.6 million in the year-ago period. The Toronto-based company sold 1,040 kilograms of cannabis, which includes dried flower and cannabis oil. Wall Street expected revenue of C$10.4 million, according to analysts polled by FactSet.

But, Cronos did not disclose how much pot it sold into the recreational market for adult use, which Canada legalized October 17. Chief Executive Mike Gorenstein said in the conference call early Tuesday that Canada continued to face a significant “shortage situation” and that executives planned to tell investors more about its recreational sales in the future, when the market was more stable.

“We’re incentivized to sell less oil because the excise tax can be punishing,” Gorenstein said in the call, referring to cannabis oil versus flower for smoking. Because of that, Cronos sales were skewed toward flower, which accounted for roughly 75% of fourth-quarter revenue. Oil accounted for the vast majority of the remaining 25%.

Cronos also did not disclose the amount of recreational pot after the company’s September earnings but said they accounted for a “major” part.

Processing cannabis for the recreational market continues to be a challenge for Cronos, much like its rivals. It can grow enough pot to meet its current demands, executives say, but taking the raw marijuana plants, and transforming them into packaged goods, including adding the federally mandated excise stamp, remains a problem.

Cronos is planning to expand beyond the four provinces it ships to now into large markets such as Quebec and Alberta, but will not do so until “we can get everything right in terms of automation before we expand across the country.”

. . . .

Mar 27, 2019

Investors still have no idea how much recreational pot Cronos Group Inc. sold as its losses continued to mount, according to fourth-quarter earnings it reported Tuesday before the opening bell.

As the last of the world’s largest cannabis companies by market valuation reported results, it remains clear that Canada’s recreational market has not yet proven as lucrative or efficient as its boosters had hoped. Cronos echoed its much larger rivals Aurora Cannabis Inc. and Canopy Growth Corp. - in terms of sales - describing challenges it faced packaging recreational pot and growing uncertainty over the now-outlawed edibles regime set to take effect this year.

And like many of its rivals in Canada and the U.S., Cronos did not make it easy for investors to quickly figure out what happened during the quarter.

Buried deep in the company’s financial statements — and not included in the company’s earnings press release — Cronos disclosed fourth-quarter losses widened to C$11.8 million ($8.8 million), which amounts to six cents a share. That’s compared with profits of C$667,000, or a penny a share in the year-ago quarter.

Like its rivals, revenue increased substantially. Cronos logged fourth-quarter gross sales of C$5.6 million, up from C$1.6 million in the year-ago period. The Toronto-based company sold 1,040 kilograms of cannabis, which includes dried flower and cannabis oil. Wall Street expected revenue of C$10.4 million, according to analysts polled by FactSet.

But, Cronos did not disclose how much pot it sold into the recreational market for adult use, which Canada legalized October 17. Chief Executive Mike Gorenstein said in the conference call early Tuesday that Canada continued to face a significant “shortage situation” and that executives planned to tell investors more about its recreational sales in the future, when the market was more stable.

“We’re incentivized to sell less oil because the excise tax can be punishing,” Gorenstein said in the call, referring to cannabis oil versus flower for smoking. Because of that, Cronos sales were skewed toward flower, which accounted for roughly 75% of fourth-quarter revenue. Oil accounted for the vast majority of the remaining 25%.

Cronos also did not disclose the amount of recreational pot after the company’s September earnings but said they accounted for a “major” part.

Processing cannabis for the recreational market continues to be a challenge for Cronos, much like its rivals. It can grow enough pot to meet its current demands, executives say, but taking the raw marijuana plants, and transforming them into packaged goods, including adding the federally mandated excise stamp, remains a problem.

Cronos is planning to expand beyond the four provinces it ships to now into large markets such as Quebec and Alberta, but will not do so until “we can get everything right in terms of automation before we expand across the country.”

. . . .

#55

Sanest Florida Man

Thread Starter

LOL

#56

Team Owner

#57

Team Owner

I bought some IIPR. If I can get it for under $80 I will buy more. It's a REIT. They buy land from growers and lease it back to them. The management team has prior experience with REITs. They sold BioMed Realty Trust to Blackstone for $8B. https://innovativeindustrialproperties.com/

#58

New all time high

New all time high$190.70 : +$10.61 (+5.89%)

After hours: 4:37PM EDT

https://www.investors.com/news/techn...nings-q2-2019/

Biotech Stock Pops After Cannabis Medicine Outsells Expectations

May 6, 2019

GW Pharmaceuticals (GWPH) on Monday reported $39.2 million in revenue for its first quarter ended March 31, compared with $3 million in year-earlier sales. Losses declined to $50.1 million from $69.46 million in the year-ago period.

On average, analysts polled by Zacks Investment Research expected GW to report $21 million in sales and a per-share loss of $2.48.

May 6, 2019

GW Pharmaceuticals (GWPH) on Monday reported $39.2 million in revenue for its first quarter ended March 31, compared with $3 million in year-earlier sales. Losses declined to $50.1 million from $69.46 million in the year-ago period.

On average, analysts polled by Zacks Investment Research expected GW to report $21 million in sales and a per-share loss of $2.48.

GW Pharma's epilepsy drug meets main goal in late-stage trial

May 6, 2019

GW Pharmaceuticals Plc said on Monday its drug Epidiolex was successful in treating seizures in patients with a rare form of childhood epilepsy called tuberous sclerosis complex during a late-stage trial.

In June, the drug became the first cannabis-based medicine to be approved in the United States after regulators permitted the treatment for two other forms of childhood epilepsy.

The trial tested two doses of the drug against a placebo in treatment-resistant tuberous sclerosis complex (TSC) patients aged between 1 and 65.

The doses were able to reduce seizures by 47.5 percent and 48.6 percent, compared with a 26.5 percent reduction in patients taking a placebo, the company said.

It expects to focus on the lower 25 mg/kg per day dose as it was associated with fewer side effects.

The company plans to file for a U.S. approval in the fourth quarter.

TSC is a rare genetic condition that causes tumors to grow in different organs and affects as many as 40,000 to 80,000 people in the United States. GW estimates over 90 percent of TSC patients have epilepsy, many of whom do not respond to existing treatments.

May 6, 2019

GW Pharmaceuticals Plc said on Monday its drug Epidiolex was successful in treating seizures in patients with a rare form of childhood epilepsy called tuberous sclerosis complex during a late-stage trial.

In June, the drug became the first cannabis-based medicine to be approved in the United States after regulators permitted the treatment for two other forms of childhood epilepsy.

The trial tested two doses of the drug against a placebo in treatment-resistant tuberous sclerosis complex (TSC) patients aged between 1 and 65.

The doses were able to reduce seizures by 47.5 percent and 48.6 percent, compared with a 26.5 percent reduction in patients taking a placebo, the company said.

It expects to focus on the lower 25 mg/kg per day dose as it was associated with fewer side effects.

The company plans to file for a U.S. approval in the fourth quarter.

TSC is a rare genetic condition that causes tumors to grow in different organs and affects as many as 40,000 to 80,000 people in the United States. GW estimates over 90 percent of TSC patients have epilepsy, many of whom do not respond to existing treatments.

#59

CRON tomorrow

https://www.barrons.com/articles/cro...ew-51557260743

https://www.barrons.com/articles/cro...ew-51557260743

May 8, 2019

When Canadian pot producer Cronos Group reports March quarter results on Thursday morning, investors should brace for a disappointment.

The Toronto-based company is one of the fledgling marijuana industry’s under-performers, and that’s why most of the analysts polled by FactSet have slapped Cronos stock with an Underperform rating.

From a February peak of $25.10 per share, Cronos stock (ticker: CRON) has tripped downhill to a recent level around $15.50. But that still leaves the stock valued at hundreds of times the cash flow expected in 2020—the first year in which the analyst consensus thinks Cronos might see a profit.

Expectations ran high for Cronos after its December deal with tobacco giant Altria Group to sell the Marlboro maker a 45% interest for C$2.4 billion (or US$1.8 billion), plus a warrant to lift Altria’s ownership to 55% for another C$1.4 billion.

Since then, however, Cronos hasn’t done much to prove it can actually sell cannabis. The consensus expectation for Thurday’s announcement is for a March quarter loss of C$0.03 per share, on sales of C$6.4 million (or less than US$5 million).

December quarter results at Cronos were among the feeblest among the larger-cap pot producers, with disappointing revenue of just 5.6 million Canadian dollars. By comparison, Canadian leaders Canopy Growth (CGC) and Aurora Cannabis (ACB) sold more than 10-times that amount each. So Cronos has just a sliver of Canada’s medical and recreational pot markets—it even refused to break out the revenue contributions of each segment. Cronos also realized one of the Canadian industry’s lowest average prices on the 1,040 kilogram-equivalents of pot that it sold: averaging C$5.40 a kilo for the December quarter, compared with more than C$10 at Tilray (TLRY).

Jefferies analyst Owen Bennett has had a Sell rating on Cronos stock since he launched coverage on the industry in February, but last week he further reduced his financial forecasts and stock price target. Bennett now expects 2019 cash flow of negative C$34 million, compared with his previous expectation of a positive C$44 million. For 2020, he now expects C$18 million in cash flow, compared with his previous forecast for C$118 million. The analyst trimmed his target for the stock by 10%, to C$15 from C$17—compared to a current price around C$21 on the Toronto exchange, where it has a dual-listing.

When Canadian pot producer Cronos Group reports March quarter results on Thursday morning, investors should brace for a disappointment.

The Toronto-based company is one of the fledgling marijuana industry’s under-performers, and that’s why most of the analysts polled by FactSet have slapped Cronos stock with an Underperform rating.

From a February peak of $25.10 per share, Cronos stock (ticker: CRON) has tripped downhill to a recent level around $15.50. But that still leaves the stock valued at hundreds of times the cash flow expected in 2020—the first year in which the analyst consensus thinks Cronos might see a profit.

Expectations ran high for Cronos after its December deal with tobacco giant Altria Group to sell the Marlboro maker a 45% interest for C$2.4 billion (or US$1.8 billion), plus a warrant to lift Altria’s ownership to 55% for another C$1.4 billion.

Since then, however, Cronos hasn’t done much to prove it can actually sell cannabis. The consensus expectation for Thurday’s announcement is for a March quarter loss of C$0.03 per share, on sales of C$6.4 million (or less than US$5 million).

December quarter results at Cronos were among the feeblest among the larger-cap pot producers, with disappointing revenue of just 5.6 million Canadian dollars. By comparison, Canadian leaders Canopy Growth (CGC) and Aurora Cannabis (ACB) sold more than 10-times that amount each. So Cronos has just a sliver of Canada’s medical and recreational pot markets—it even refused to break out the revenue contributions of each segment. Cronos also realized one of the Canadian industry’s lowest average prices on the 1,040 kilogram-equivalents of pot that it sold: averaging C$5.40 a kilo for the December quarter, compared with more than C$10 at Tilray (TLRY).

Jefferies analyst Owen Bennett has had a Sell rating on Cronos stock since he launched coverage on the industry in February, but last week he further reduced his financial forecasts and stock price target. Bennett now expects 2019 cash flow of negative C$34 million, compared with his previous expectation of a positive C$44 million. For 2020, he now expects C$18 million in cash flow, compared with his previous forecast for C$118 million. The analyst trimmed his target for the stock by 10%, to C$15 from C$17—compared to a current price around C$21 on the Toronto exchange, where it has a dual-listing.

#60

CRON: $14.04 : -$1.42 (-9.18%)

https://www.marketwatch.com/story/cr...mbs-2019-05-09

Marijuana Grower Cronos Group Has a Big Market Capitalization — and Tiny Marijuana Sales

https://www.barrons.com/articles/mar...ak-51557408137

TLRY reports on Tuesday after the close

.

https://www.marketwatch.com/story/cr...mbs-2019-05-09

Canadian cannabis company Cronos Group Inc. said Thursday it had income of C$427,812 ($317,380), or 48 cents a share, in the first quarter, after a loss of C$1,085, or 1 cent a share, in the year-earlier period. Revenue rose to C$6.470 million from C$2.945 million a year ago. The FactSet consensus of six analysts was for a loss per share of 3 cents and revenue of C$6.390 million.

The company sold 1,111 kg of cannabis in the quarter, up from 501 kg in the year-earlier period. Revenue per gram sold came to C$5.73 compared with C$5.67 a year ago.

The company sold 1,111 kg of cannabis in the quarter, up from 501 kg in the year-earlier period. Revenue per gram sold came to C$5.73 compared with C$5.67 a year ago.

Marijuana Grower Cronos Group Has a Big Market Capitalization — and Tiny Marijuana Sales

https://www.barrons.com/articles/mar...ak-51557408137

TLRY reports on Tuesday after the close

.

Last edited by AZuser; 05-09-2019 at 02:47 PM.

#61

$52.30 : +$3.56 (+7.30%)

After hours: 4:38PM EDT

https://www.marketwatch.com/story/ti...ter-2019-05-14

After hours: 4:38PM EDT

https://www.marketwatch.com/story/ti...ter-2019-05-14

Tilray stock rises after pot company’s sales nearly triple, but losses grow faster

May 14, 2019

The company reported first-quarter net losses of $30.3 million, or 32 cents a share, widening from $5.2 million, or 7 cents a share, in the year-ago period. Tilray’s revenue rose to $23 million from $7.8 million in the year-ago period. Analysts surveyed by FactSet had estimated losses of 25 cents a share on revenue of $20.5 million. For the second quarter, analysts model losses of 25 cents a share on sales of $42.2 million.

Tilray said it sold $7.9 million worth of recreational marijuana in the quarter, and $7.8 million worth of medical cannabis — directly to patients and in bulk. Overall, it sold the equivalent of 3,012 kilograms of pot.

May 14, 2019

The company reported first-quarter net losses of $30.3 million, or 32 cents a share, widening from $5.2 million, or 7 cents a share, in the year-ago period. Tilray’s revenue rose to $23 million from $7.8 million in the year-ago period. Analysts surveyed by FactSet had estimated losses of 25 cents a share on revenue of $20.5 million. For the second quarter, analysts model losses of 25 cents a share on sales of $42.2 million.

Tilray said it sold $7.9 million worth of recreational marijuana in the quarter, and $7.8 million worth of medical cannabis — directly to patients and in bulk. Overall, it sold the equivalent of 3,012 kilograms of pot.

#62

Team Owner

https://www.thestreet.com/investing/...HOO&yptr=yahoo

Aurora Cannabis Revenue Surges 367% to C$75 Million in Fiscal Third Quarter

#63

Team Owner

#64

Team Owner

Up to $106. Just announced next dividend, 0.60.

Dividend History | Innovative Industrial Properties

Dividend History | Innovative Industrial Properties

#65

Team Owner

Squeeze those shorts

115.89+7.41 (+6.83%)At close: 4:02PM EDT

115.89+7.41 (+6.83%)At close: 4:02PM EDT

#66

Team Owner

Cashed out at $124. Parabolic low volume stocks no bueno. I still think it's a great business idea, will look to get back in lower.

#67

Team Owner

134.71+9.40 (+7.50%)

At close: 4:02PM EDT

At close: 4:02PM EDT

#68

Team Owner

Bought back in at $89. Missed the dip to $83.

Now$91.33. Dividend increased.

https://finance.yahoo.com/news/innov...103000553.html

Now$91.33. Dividend increased.

https://finance.yahoo.com/news/innov...103000553.html

Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (IIPR) focused on the regulated U.S. cannabis industry, announced today that its board of directors has declared a third quarter 2019 dividend of $0.78 per share of common stock, representing a 30% increase over IIP's second quarter 2019 dividend of $0.60 per share of common stock, and an approximately 123% increase over IIP's third quarter 2018 dividend of $0.35 per share of common stock. The dividend is equivalent to an annualized dividend of $3.12 per common share, and is the fifth dividend increase since the Company completed its initial public offering in December 2016.

Additionally, IIP announced today that its board of directors has declared a regular quarterly dividend of $0.5625 per share of IIP's 9.00% Series A Cumulative Redeemable Preferred Stock.

The dividends are payable on October 15, 2019 to stockholders of record at the close of business on September 30, 2019.

Additionally, IIP announced today that its board of directors has declared a regular quarterly dividend of $0.5625 per share of IIP's 9.00% Series A Cumulative Redeemable Preferred Stock.

The dividends are payable on October 15, 2019 to stockholders of record at the close of business on September 30, 2019.

#69

Team Owner

https://www.marketwatch.com/story/ho...cky-2019-09-24

House passes cannabis-banking bill, but getting Senate’s OK still looks tricky

#70

Team Owner

https://finance.yahoo.com/m/ee83cc42...e-roughly.html

CRON

8.40+0.08 (+0.96%)At close: 4:00PM EDT

10.77 +2.37 (28.21%)

CRON

8.40+0.08 (+0.96%)At close: 4:00PM EDT

10.77 +2.37 (28.21%)

After hours: 6:50PM EDT

Cronos shares surge roughly 33% in after hours

Shares of Cronos Group Inc. rampaged in the extended session Wednesday, gaining as much as 41.5% as of 6:22 p.m. Eastern time on heavy volume, before dropping to a 33% gain at 6:45 p.m. Eastern time. It was not immediately clear why the stock surged in the extended session but two block trades totaling roughly 1.2 million shares crossed at 5:09 p.m. Eastern time at a price of $8.40 a share. If Cronos shares hold on to the gains, the late Wednesday move will be the second largest in the company's history and the largest since the company began trading on the New York Stock Exchange. Previously other cannabis companies' stocks, such as CannTrust Holdings Inc. have notched double-digit gains because an exchange traded fund has re-balanced its portfolio after significant changes to the market price. Cronos Group stock closed up roughly 1% to $8.40 during the regular session.

Last edited by doopstr; 10-16-2019 at 05:55 PM.

#71

Team Owner

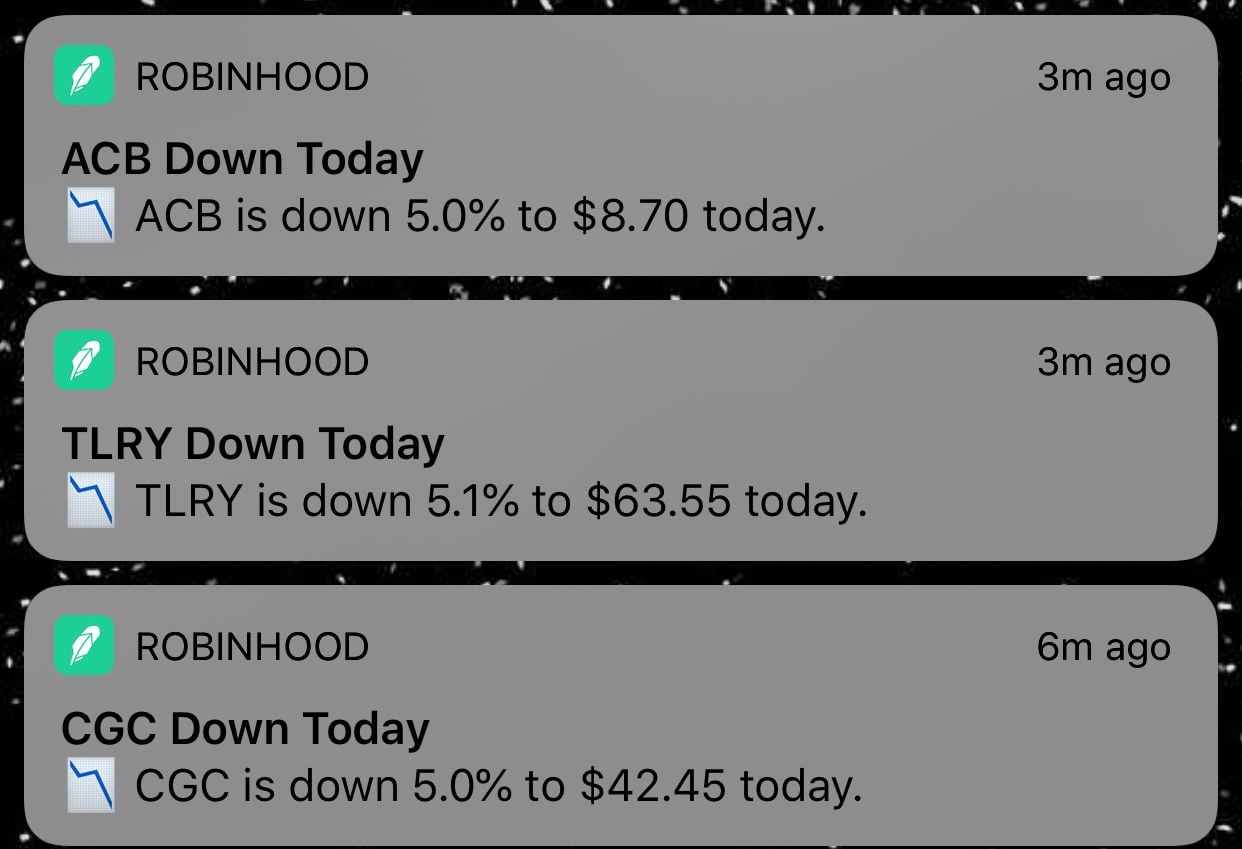

All  stocks getting slammed.

stocks getting slammed.

stocks getting slammed.

stocks getting slammed.

#72

Team Owner

Hope this helps it reverse direction

Innovative Industrial Properties Reports Third Quarter 2019 Results | Innovative Industrial Properties

SAN DIEGO--(BUSINESS WIRE)-- Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today results for the quarter ended September 30, 2019.

Third Quarter 2019 Highlights

Financial Results and Financing Activity

Innovative Industrial Properties Reports Third Quarter 2019 Results | Innovative Industrial Properties

Innovative Industrial Properties Reports Third Quarter 2019 Results

Acquisitions Drive 201% Q3 Rental Revenue, 314% Q3 Net Income and 270% Q3 AFFO Growth Year-over-YearSAN DIEGO--(BUSINESS WIRE)-- Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today results for the quarter ended September 30, 2019.

Third Quarter 2019 Highlights

Financial Results and Financing Activity

- IIP generated rental revenues of approximately $11.2 million in the quarter, representing a 201% increase from the prior year’s third quarter.

- IIP recorded net income available to common stockholders of approximately $6.2 million for the quarter, or $0.55 per diluted share, and adjusted funds from operations (AFFO) of approximately $9.5 million, or $0.86 per diluted share. Net income available to common stockholders and AFFO increased by 314% and 270% from the prior year’s third quarter, respectively.

- IIP paid a quarterly dividend of $0.78 per share on October 15, 2019 to common stockholders of record as of September 30, 2019, representing a 30% increase from IIP’s second quarter 2019 dividend and an approximately 123% increase over the third quarter 2018’s dividend.

- In July, IIP completed an underwritten public offering of 1,495,000 shares of common stock, including the exercise in full of the underwriters’ option to purchase an additional 195,000 shares, resulting in net proceeds of approximately $180.1 million.

- In September and October, IIP issued shares of common stock for net proceeds of approximately $46.9 million under an “at-the-market” equity offering program.

#73

Team Owner

79.83+7.23 (+9.96%)At close: 4:04PM EST

82.39 +2.56 (3.21%)

After hours: 6:21PM EST

#74

Sanest Florida Man

Thread Starter

#75

Team Owner

IIPR dividend raised

https://finance.yahoo.com/news/innov...113000766.html

https://finance.yahoo.com/news/innov...113000766.html

Common Stock Dividend Increased 28% from Prior Quarter and 186% from Q4 2018

Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today that its board of directors has declared a fourth quarter 2019 dividend of $1.00 per share of common stock, representing an approximately 28% increase over IIP's third quarter 2019 dividend of $0.78 per share of common stock, and an approximately 186% increase over IIP's fourth quarter 2018 dividend of $0.35 per share of common stock. The dividend is equivalent to an annualized dividend of $4.00 per common share, and is the sixth dividend increase since IIP completed its initial public offering in December 2016.

Additionally, IIP announced today that its board of directors has declared a regular quarterly dividend of $0.5625 per share of IIP's 9.00% Series A Cumulative Redeemable Preferred Stock.

The dividends are payable on January 15, 2020 to stockholders of record at the close of business on December 31, 2019.

Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today that its board of directors has declared a fourth quarter 2019 dividend of $1.00 per share of common stock, representing an approximately 28% increase over IIP's third quarter 2019 dividend of $0.78 per share of common stock, and an approximately 186% increase over IIP's fourth quarter 2018 dividend of $0.35 per share of common stock. The dividend is equivalent to an annualized dividend of $4.00 per common share, and is the sixth dividend increase since IIP completed its initial public offering in December 2016.

Additionally, IIP announced today that its board of directors has declared a regular quarterly dividend of $0.5625 per share of IIP's 9.00% Series A Cumulative Redeemable Preferred Stock.

The dividends are payable on January 15, 2020 to stockholders of record at the close of business on December 31, 2019.

#76

Team Owner

IIPR

84.97+4.21 (+5.21%)

At close: 4:03PM EST

https://finance.yahoo.com/news/innov...225500254.html

Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today that it closed on the acquisition of a property in Ohio, which comprises approximately 50,000 square feet of industrial space in the aggregate.

The purchase price for the property was approximately $10.6 million in total (excluding transaction costs).

84.97+4.21 (+5.21%)

At close: 4:03PM EST

Innovative Industrial Properties Acquires Property in Ohio and Enters Into Long-Term Lease with Cresco Labs

https://finance.yahoo.com/news/innov...225500254.html

Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today that it closed on the acquisition of a property in Ohio, which comprises approximately 50,000 square feet of industrial space in the aggregate.

The purchase price for the property was approximately $10.6 million in total (excluding transaction costs).

#77

Team Owner

Innovative Industrial Properties Reports Fourth Quarter and Full-Year 2019 Results | Innovative Industrial Properties

Fourth Quarter 2019 and Year-to-Date Highlights

Financial Results and Financing Activity

Fourth Quarter 2019 and Year-to-Date Highlights

Financial Results and Financing Activity

- IIP generated total revenues of approximately $17.7 million in the quarter, representing a 269% increase from the prior year’s quarter.

- IIP recorded net income available to common stockholders of approximately $9.6 million for the quarter, or $0.78 per diluted share, and adjusted funds from operations (“AFFO”) of approximately $14.3 million, or $1.18 per diluted share. AFFO and AFFO per diluted share represented increases of 293% and 211% from the prior year’s quarter, respectively.

- IIP paid a quarterly dividend of $1.00 per common share on January 15, 2020 to stockholders of record as of December 31, 2019, representing a 186% increase from the prior year’s quarter and a 28% increase from IIP’s third quarter 2019 dividend of $0.78 per common share.

- In September, IIP established an “at-the-market” equity offering program, issuing shares of common stock from September through today for net proceeds totaling approximately $184.8 million.

- Subsequent to the end of the quarter, in January, IIP completed an underwritten public offering of 3,412,969 shares of common stock, including the exercise in full of the underwriters’ option to purchase an additional 445,170 shares, resulting in gross proceeds of approximately $250.0 million.

#78

Team Owner

Thread

Thread Starter

Forum

Replies

Last Post

I bought in when aapl was at 226

I bought in when aapl was at 226