Banking 2007 .vs. 2013

#1

Banking 2007 .vs. 2013

I decided to clean up my files today and got to a file with my bank statements. It was a nice to review that in 2007 you could make a decent return on your cash.

Here's what I found from looking at an old statement:

Interest Checking: 0.5% interest

Normal Savings: 1.2% interest

Money Market Savings: 3.1%

One Year CD: 5.13%

Credit Card Interest: 12.9% purchase & 12.9% cash advance

A 2013 Statement from same institution:

Interest Checking: 0.03%

Savings: 0.05%

Money Market Savings: 0.1%

CDs - I don't own any, but a 10yr U.S. bond pays 1.9%

Credit Card Interest: 9.99% purchase & 13.99% cash advance

This was just 6 years ago and I would say the economy was much better then than now (pre real estate bubble).

One way to compare is to look at the Average Hourly wage with data provided by the BLS via Yahoo (http://ycharts.com/indicators/average_hourly_earnings) .

In 2008 this time, the average hourly wage was $20.89. Today it is: $23.87. The CPI in 2008 was 218.567 while the last read for 2013 is: 235.511 two months ago. A 2008 wage would be $22.51 in 2013. So wages really only grew by perhaps one dollar in 6 years time.

So we have had a period of extremely low interest rates, but yet the economy is still in a state of funk and there is no end to QE. Real world wages have barely moved. I don't have the data to back this up easily but I imagine wages grew faster before the QE started.

Here's what I found from looking at an old statement:

Interest Checking: 0.5% interest

Normal Savings: 1.2% interest

Money Market Savings: 3.1%

One Year CD: 5.13%

Credit Card Interest: 12.9% purchase & 12.9% cash advance

A 2013 Statement from same institution:

Interest Checking: 0.03%

Savings: 0.05%

Money Market Savings: 0.1%

CDs - I don't own any, but a 10yr U.S. bond pays 1.9%

Credit Card Interest: 9.99% purchase & 13.99% cash advance

This was just 6 years ago and I would say the economy was much better then than now (pre real estate bubble).

One way to compare is to look at the Average Hourly wage with data provided by the BLS via Yahoo (http://ycharts.com/indicators/average_hourly_earnings) .

In 2008 this time, the average hourly wage was $20.89. Today it is: $23.87. The CPI in 2008 was 218.567 while the last read for 2013 is: 235.511 two months ago. A 2008 wage would be $22.51 in 2013. So wages really only grew by perhaps one dollar in 6 years time.

So we have had a period of extremely low interest rates, but yet the economy is still in a state of funk and there is no end to QE. Real world wages have barely moved. I don't have the data to back this up easily but I imagine wages grew faster before the QE started.

#2

Nope.

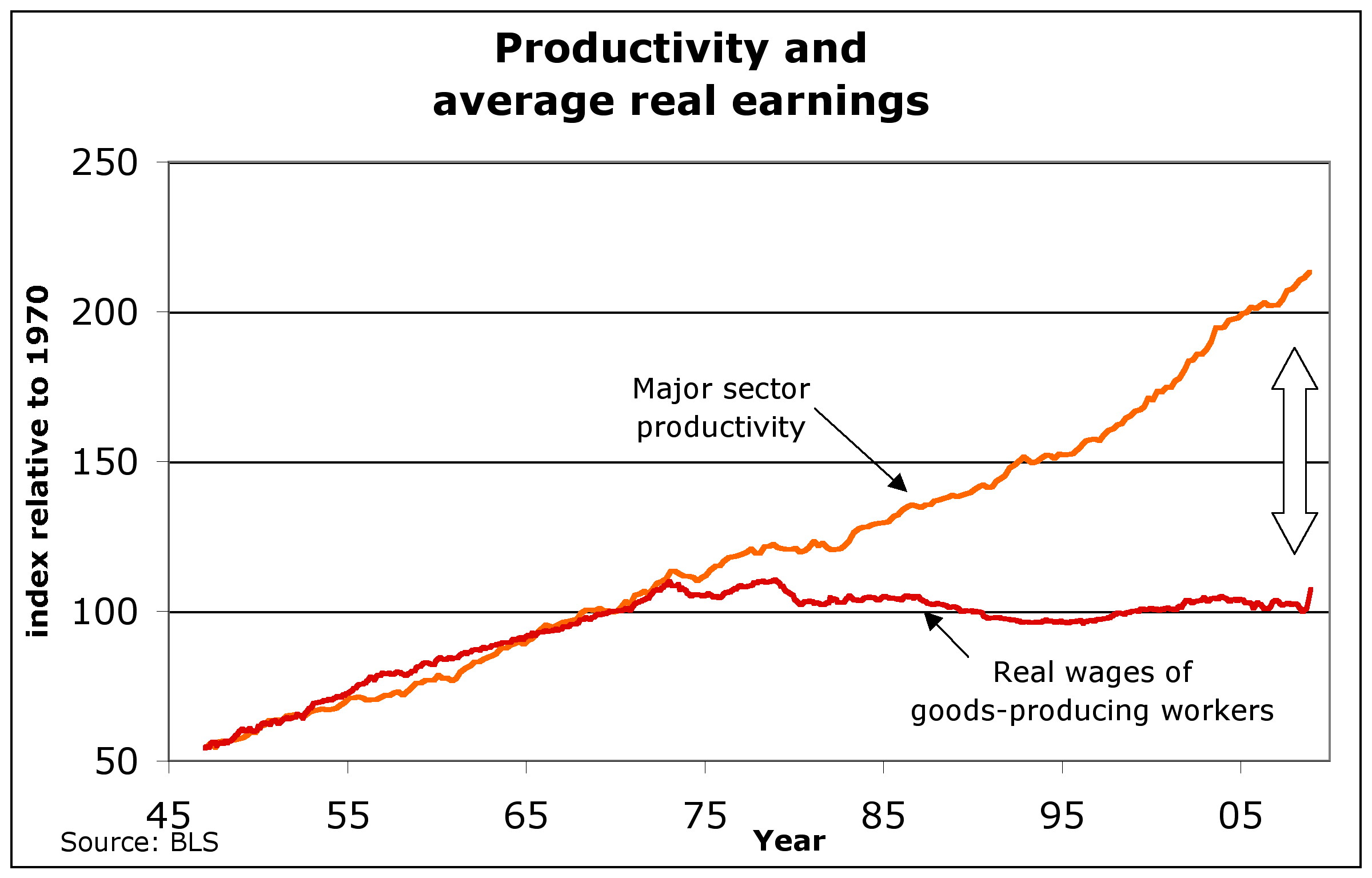

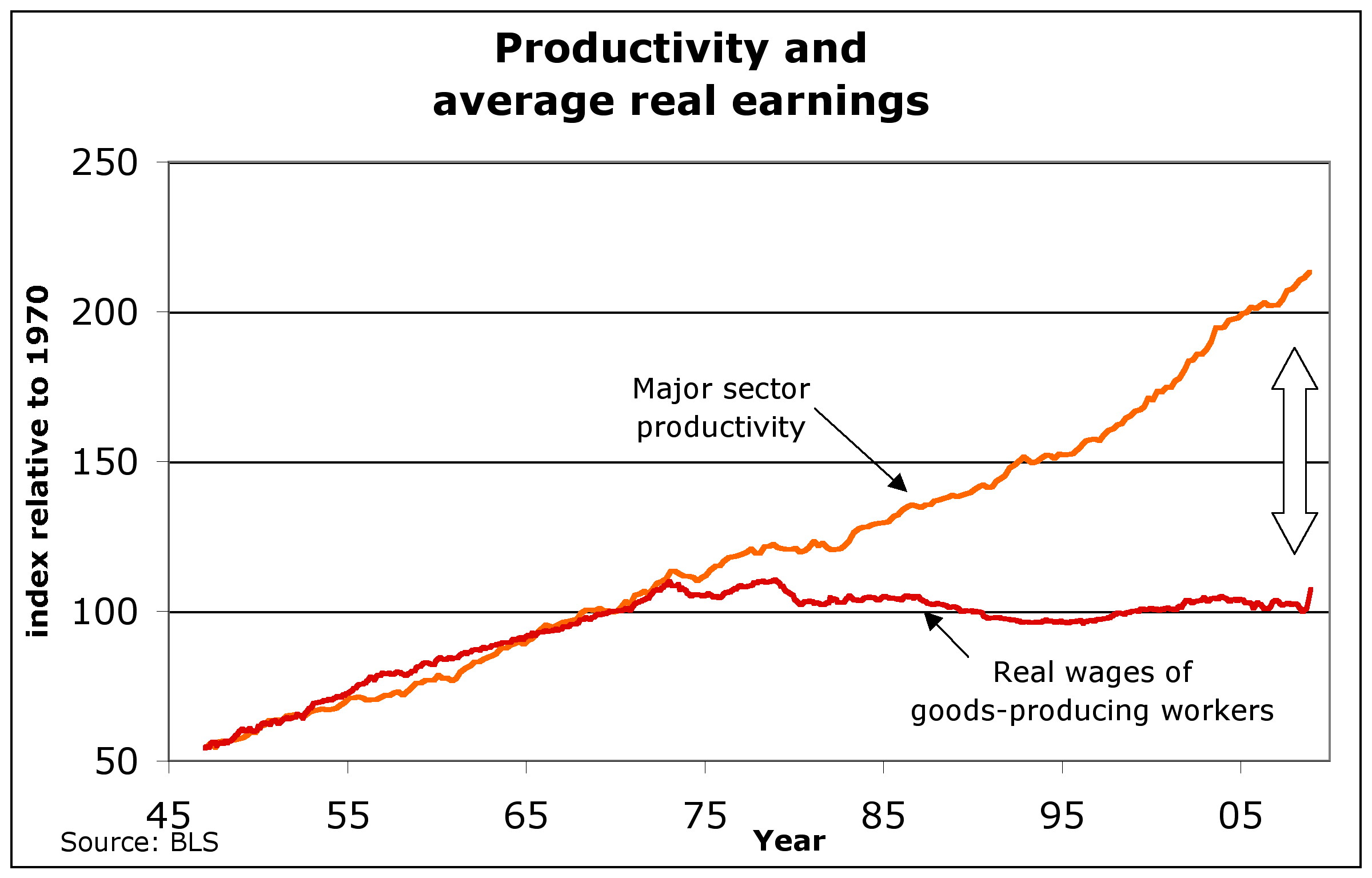

Real wages have been approximately flat since ~1980 or so.

And it's worse if you include inflation in food and fuel, which are excluded from typical CPI statements.

Have you been to the grocery lately?

Real wages have been approximately flat since ~1980 or so.

And it's worse if you include inflation in food and fuel, which are excluded from typical CPI statements.

Have you been to the grocery lately?

#5

^ It does go both ways. I notice that CC interest rates went down 3% but savings rates went down a lot more. The recent rates favor spenders over savers in a big way. Unfortunately it used to be saving that fueled the banks and made the economy grow. It's no wonder there is no real growth now because there is no incentive to save anymore

#6

^ It does go both ways. I notice that CC interest rates went down 3% but savings rates went down a lot more. The recent rates favor spenders over savers in a big way. Unfortunately it used to be saving that fueled the banks and made the economy grow. It's no wonder there is no real growth now because there is no incentive to save anymore

And, yes, while CC rates went down less than savings rates, other rates, mortgages for example, went down more proportionally.

It has always cost more to borrow money than you were paid for savings .... it's how banks used to make money. Now it's on fees, speculative investment and CC interest.

Trending Topics

#8

Bearcat if you look at a graph of personal savings, you'll see that savings peaked in 1976. You'll also see a steady increase in savings rate from 1959 - 1976 which has been considered some of the strongest economic times we had in this country. Those were the days when almost everything good was 'Made in USA' and things that were considered cheap had the 'Made in Japan' or 'Made in China' stampings. These were also the times when lots of exportable goods were made. These were also the times when wages matched productivity in your graph above which is a healthy trend to also have.

Since 1976, we have declining savings trend so savings is not the only driver of economic growth- immigration, technology, and the rise of service businesses can also lead to economic growth. I do think savings is a 'fuel' for economic growth to sustain itself for longer than one election cycle.

The savings rate in the 80's was mostly at 6% or above (peak of 12% in 1982) with one dip in 87 where it dropped to 3%. The savings rate was easily double the rate that we have now. The 80's and 90's did have some decent growth with advent of the PC, Internet, Medical, and Telecommunications industries- not to mention the Service industry as well.

The rates of the 2000's have been mostly 4% +/- 2% most of the time (one peak of 8% in 08)- so mostly 1/2 of the 'booms' you point out in the 80's/90's.

One of the reasons the savings rate has dropped over the years is that real income has also dropped as pointed out by the graph above- hard to save a lot when your income is dropping each year. It's easier to spend and take on personal debt which today's low interest rates promote doing- that's fine as long as you have an income to make those payments.

All I'm saying is this financial world rewards the 'spenders' at the expense of the 'savers'- at some point the house of cards will topple because you cannot sustain this situation forever. In similar fashion, a Service economy is not nearly as good as a manufacturing based economy that we once had. Service implies spending which drys up if the jobs are not there.

Since 1976, we have declining savings trend so savings is not the only driver of economic growth- immigration, technology, and the rise of service businesses can also lead to economic growth. I do think savings is a 'fuel' for economic growth to sustain itself for longer than one election cycle.

The savings rate in the 80's was mostly at 6% or above (peak of 12% in 1982) with one dip in 87 where it dropped to 3%. The savings rate was easily double the rate that we have now. The 80's and 90's did have some decent growth with advent of the PC, Internet, Medical, and Telecommunications industries- not to mention the Service industry as well.

The rates of the 2000's have been mostly 4% +/- 2% most of the time (one peak of 8% in 08)- so mostly 1/2 of the 'booms' you point out in the 80's/90's.

One of the reasons the savings rate has dropped over the years is that real income has also dropped as pointed out by the graph above- hard to save a lot when your income is dropping each year. It's easier to spend and take on personal debt which today's low interest rates promote doing- that's fine as long as you have an income to make those payments.

All I'm saying is this financial world rewards the 'spenders' at the expense of the 'savers'- at some point the house of cards will topple because you cannot sustain this situation forever. In similar fashion, a Service economy is not nearly as good as a manufacturing based economy that we once had. Service implies spending which drys up if the jobs are not there.

#9

I think we're pretty much in agreement on those points.

Part of my 'argument' is affected by the definition of 'savings', which in economic reporting (iirc) is usually meant to be money set aside in 'guaranteed' or 'secure' accounts - CD's, 'passbook' savings, etc. Prior to the changes in Glass-Stegal, retail banks (I said 'commercial' before, but meant retail) could not invest in speculative markets, so bank savings accounts did not provide as much fuel to the overall speculative financial markets. They had more impact on local economies (home/development loans, small business loans, personal loans, etc.); banking was a more local, loan-based business.

Also with the advent of Roth IRA/401k type accounts, a lot of 'savings' became investments .... therefore reducing 'savings' in economic reporting, but adding a LOT of fuel to speculative financial markets. This had a lot to do with growth ~1990's and beyond.

Part of my 'argument' is affected by the definition of 'savings', which in economic reporting (iirc) is usually meant to be money set aside in 'guaranteed' or 'secure' accounts - CD's, 'passbook' savings, etc. Prior to the changes in Glass-Stegal, retail banks (I said 'commercial' before, but meant retail) could not invest in speculative markets, so bank savings accounts did not provide as much fuel to the overall speculative financial markets. They had more impact on local economies (home/development loans, small business loans, personal loans, etc.); banking was a more local, loan-based business.

Also with the advent of Roth IRA/401k type accounts, a lot of 'savings' became investments .... therefore reducing 'savings' in economic reporting, but adding a LOT of fuel to speculative financial markets. This had a lot to do with growth ~1990's and beyond.

Last edited by Bearcat94; 05-17-2013 at 08:40 AM.

#10

^ Good thoughts! I think all these investment alternatives add much more volatility to the markets now. Any seemingly minor event can cause a crash akin to the financial crisis of 2007/08. It certainly was simple having money in a passbook savings and knowing your return was going to be a few percent. Now you get .25% yield on a 2 year treasury and people think those are 'risk' free. I'm afraid there will be a bunch of people that are going to learn how risk free their treasuries really are- it won't be pretty.

Thread

Thread Starter

Forum

Replies

Last Post

MetalGearTypeS

3G TL Audio, Bluetooth, Electronics & Navigation

6

08-29-2016 08:28 PM

rcs86

Car Parts for Sale

3

08-02-2016 06:52 PM