RLX 2019 ..Design Direction

#1

RLX 2019 ..Design Direction

This article applies to 2018 Accord.. as well as the sedan market in general.........However ...I believe this design direction may be the underpinning for the 2019 Acura RLX..

..................nonetheless its informative reading

__________________________________________________ __________________________________________________ ________________________________________________

A sedan shakeout could leave a handful of healthy competitors

The redesigned 2018 Honda Accord boasts numerous upscale features.

With all the action in midsize sedans these days, talk has turned to whether the segment's long, gloomy slide is about to end.

Just don't bet on it. Redesigns of the three top-selling midsize cars could slow the category's decline, but probably not for long, industry executives and analysts say.

The longtime No. 1 category fell from first to second place in 2015 behind compact crossovers and has slipped behind compact cars and full-size pickups in 2017. Last year, 2.1 million midsize cars were sold, but the segment has fallen 18 percent through the first seven months.

This year's launches of the new-generation Toyota Camry and Honda Accord and the redesigned Nissan Altima early next year are set to give the category a boost. Still, IHS Markit says the beleaguered sector could shrink a further 20 percent by 2025.

Executives touting the new Camry and Accord say the 2018 models will spark fresh interest throughout the segment. The Camry is sportier and introduces new engines and transmissions that boost fuel economy and horsepower. The Accord has a trio of modern engines including a first-ever turbocharged version and optional 10-speed automatic and a series of upscale features.

But even Toyota and Honda execs carefully parse expectations. Citing "innovative products and investment for the first time in years," Bob Carter, executive vice president of sales for Toyota Motor North America, said this month "we will see some stabilization of the midsize sedan market."

And as much as Jeff Conrad, senior vice president of the auto division at American Honda, thinks the technology-laden new Accord will command attention, he's cautious about the segment.

"Will it stop the shrinking? Maybe slow it down a bit," he said in July.

Toyota’s Bob Carter says he expects “some stabilization of the midsize sedan market.” Photo credit: Joe WilssensA healthier segment?

Others see continued declines in midsize car volume and the number of competitors, but potential for a healthier segment for the survivors.

Kelley Blue Book analyst Akshay Anand says new versions of the two best-selling midsize cars will help an aging segment.

"The Camry and Accord, along with the Tesla Model 3, are the three biggest launches of 2017," he said. And a redesigned No. 3 Nissan Altima in early 2018 will help renew consumer interest in the segment, he added.

The segment could use some help. Once the core product and best-seller of most full-range automotive brands, midsize sedans have taken a pounding in recent years. Amid the U.S. auto industry's longest sales boom in nearly a century, midsize sedan sales fell to 2.1 million units in 2016, tumbling 16 percent from 2012.

"Midsize sedan segment volume decline has been pretty dramatic since 2000 when it was 3 million units," said Stephanie Brinley, senior automotive analyst for IHS Markit. "But the 2017 to 2025 decline shouldn't be as sharp."

IHS Markit forecasts U.S. midsize car sales at 1.80 million in 2020 and 1.72 million by 2025.

As consumers in the U.S. and worldwide drive a profound shift from cars toward taller and roomier crossovers and SUVs, sedans and coupes lose economies of scale and profitability. As a result, cars will receive less investment, and some midsize segment entries likely will receive less innovation, longer product cycles or even model consolidation, analysts say.

Turning to trucks

Mark Wakefield, head of the Americas automotive practice for consultancy AlixPartners, said reduced midsize car investment is baked into manufacturers' plans for the next three years.

"Between 2017 and 2020, 68 percent of U.S. product launches are light trucks, even higher than light trucks' market share" he said. "The volume of launches is moving toward light trucks and sales typically follow new product."

The top midsize car players have high volumes they are likely to defend, Wakefield said. But smaller players may choose to emphasize hotter segments.

"For them the decision is this: If you make a great product in crossovers, you're a winner. If you make a great product in midsize cars, you're a player," he said. "In looking at opportunity, you always want to invest where you have the wind at your back."

Anand said most midsize car competitors lack the marketing cachet of sales leaders Camry, Accord and Altima.

"It's almost the inverse of full-size pickups [where] it's all Detroit, and Toyota and Nissan struggle to break through," he said. "In midsize sedans, if you are anybody but Toyota, Honda or Nissan, then you have to wrestle with the top dogs forever."

IHS Markit's Brinley sees a different segment split. She says the top seven entries will remain indefinitely, citing the Ford Fusion, Chevrolet Malibu, Hyundai Sonata and Kia Optima in addition to the top three.

But if segment volume declines 300,000 by 2020 and a further 100,000 by 2025, she says there may be more segment attrition akin to Fiat Chrysler's decision last year to kill the Chrysler 200.

"The question isn't the current generation, but the next generation of products," she said. Stressing that automakers haven't yet decided, she said possibilities include dropping out, shifting from North America production to low-volume imports of a midsize model that sells well overseas or consolidating midsize and large models. Her list of large-car platforms that face long-term decisions on consolidation includes Toyota Avalon, Nissan Maxima and Chevrolet Impala.

"Some nameplates will go away," Brinley said. If so, the midsize survivors can focus more on features and technology than incentives, she added.

"Even a midsize sedan segment at 1.7 million can be healthier for those that stay, especially if manufacturers get more scale by parts sharing between cars and crossovers and SUVs."

#2

Azine Jabroni

The RLX is DOA if they hug the Honda Accord again. Acura needs to generate more separation.

The following users liked this post:

hadokenuh (09-07-2017)

#4

Burning Brakes

Some separation would be nice. It is cost effective to share the underpinnings of the vehicles, but they could do some things to better distinguish the brands. That Accord picture screams front of a Mazda 6 and body of a Hyundai Sonata.

#5

Understood...

I,m constantly reminded..about my" Honda Accord" ..As I attempt to explain its an RLX..and I get the blank stares...and a few 'whatever'

As the article stated.. the sedan world is changing..And...Im troubled with the extreme design direction Honda has taken....

When I speak to my friends at Honda.. they tell me that Acura is positioned as a Luxury Performance Automobile..

That being said.. I informed them the NEXT Flagship best not look like a Civic Type R

I,m constantly reminded..about my" Honda Accord" ..As I attempt to explain its an RLX..and I get the blank stares...and a few 'whatever'

As the article stated.. the sedan world is changing..And...Im troubled with the extreme design direction Honda has taken....

When I speak to my friends at Honda.. they tell me that Acura is positioned as a Luxury Performance Automobile..

That being said.. I informed them the NEXT Flagship best not look like a Civic Type R

The following users liked this post:

demosan (09-02-2017)

#6

Grandpa

Join Date: Dec 2003

Location: Virginia, Besieged

Age: 68

Posts: 7,596

Received 2,609 Likes

on

1,475 Posts

I would not necessarily object if we got a smaller Legend design with struts, and based on the Civic platform (the 2018 Accord is based on the Civic platform).

But this means that the rear end would have to be designed in a way that would accommodate batteries and hybrid SH-AWD, and it seems to me that it would take up too much room if this is based on the Civic platform. You wouldn't have enough trunk space left over, and I don't see how you could have enough travel in the rear suspension pickup points.

I don't think they care if they make money on the Legend. So my bet is that 2020 is going to see a new design that still uses the expensive double wishbone, multi-composition, multi-ball joint suspension, but modified enough with the lessons learned with the KC1 and KC2 that it'll be a better ride overall.

I also think they might have enough batteries being manufactured now that they can produce more hybrids for us.

We'll see.

I wouldn't mind a smaller Legend. I just don't see how they're going to be fitting all that technology and the power train in what is basically a Civic chassis.

But this means that the rear end would have to be designed in a way that would accommodate batteries and hybrid SH-AWD, and it seems to me that it would take up too much room if this is based on the Civic platform. You wouldn't have enough trunk space left over, and I don't see how you could have enough travel in the rear suspension pickup points.

I don't think they care if they make money on the Legend. So my bet is that 2020 is going to see a new design that still uses the expensive double wishbone, multi-composition, multi-ball joint suspension, but modified enough with the lessons learned with the KC1 and KC2 that it'll be a better ride overall.

I also think they might have enough batteries being manufactured now that they can produce more hybrids for us.

We'll see.

I wouldn't mind a smaller Legend. I just don't see how they're going to be fitting all that technology and the power train in what is basically a Civic chassis.

Trending Topics

#8

Grandpa

Join Date: Dec 2003

Location: Virginia, Besieged

Age: 68

Posts: 7,596

Received 2,609 Likes

on

1,475 Posts

I am not sure that Honda means for the Legend to be in any of those classes of vehicle. At least, it's clear that's not what they intended with the KC2, the KB1, KB2 or the KA9.

None of those vehicles competed with typical luxury marque of their day.

The Honda Legend of the 1986-1990 era, the time of cooperation with Rover, probably tried to compete one on one with "luxury" cars of approximately the same price range, and that really didn't produce huge sales either.

The reputation of the Legend was made by the 1991 cars, when they stepped away from Rover and did their own thing regardless of whether they got sales and regardless of whether they competed with "luxury" cars in the price range.

1991 was a big sales year for the Legend, cross the 65,000 car threshold.

And that's another thing: Remember that Honda's a pretty small company compared to Toyota and General Motors. :-)

It's possible they'll never be able to go for the 100,000$ market very well. Perhaps their niche is somewhere else.

#9

Grandpa

Join Date: Dec 2003

Location: Virginia, Besieged

Age: 68

Posts: 7,596

Received 2,609 Likes

on

1,475 Posts

I went to look to be sure I knew what I was talking about.

The KB1 is probably the best reviewed Legend of all time, and even it was a very low production, very manual labour intensive vehicle. Its peak year was 2005, with 17,500 of them being sold.

Despite how well the market reviewed the KB1, that is still very, very low volume for a car company. :-)

The KB1 is probably the best reviewed Legend of all time, and even it was a very low production, very manual labour intensive vehicle. Its peak year was 2005, with 17,500 of them being sold.

Despite how well the market reviewed the KB1, that is still very, very low volume for a car company. :-)

#10

Advanced

iTrader: (1)

I went to look to be sure I knew what I was talking about.

The KB1 is probably the best reviewed Legend of all time, and even it was a very low production, very manual labour intensive vehicle. Its peak year was 2005, with 17,500 of them being sold.

Despite how well the market reviewed the KB1, that is still very, very low volume for a car company. :-)

The KB1 is probably the best reviewed Legend of all time, and even it was a very low production, very manual labour intensive vehicle. Its peak year was 2005, with 17,500 of them being sold.

Despite how well the market reviewed the KB1, that is still very, very low volume for a car company. :-)

#11

Advanced

iTrader: (1)

The Genesis is sort of a poor man's substitute for the LS460, which is itself a poor man's substitute for a Bentley.

I am not sure that Honda means for the Legend to be in any of those classes of vehicle. At least, it's clear that's not what they intended with the KC2, the KB1, KB2 or the KA9.

I am not sure that Honda means for the Legend to be in any of those classes of vehicle. At least, it's clear that's not what they intended with the KC2, the KB1, KB2 or the KA9.

Agreed, but this is also the reason why a lot of consumers doesn't view Acura as a luxury brand. The Legend is supposed to be the company's flagship.

The following users liked this post:

justnspace (09-07-2017)

#12

Burning Brakes

The SH-AWD and Hybrid powertrain along with its high quality interior should be enough to separate Acura from Honda, I think.

What is wrong with the current RLX? IMHO:

1. Price to high

2. Exteior styling while nice but not nice enough

3. SH-AWD should be standard - I never could understand why they decided to make FWD standard on the RLX. And with $50K or more price tag???

What is wrong with the current RLX? IMHO:

1. Price to high

2. Exteior styling while nice but not nice enough

3. SH-AWD should be standard - I never could understand why they decided to make FWD standard on the RLX. And with $50K or more price tag???

#13

Burning Brakes

We may need to review and evaluate the true definition of flagship and not just rely on what we have seen or been accustomed to seeing with other manufacturers. For all practical purposed, the MDX might be what Acura considers its flagship, regardless of what we think it should be. If we are looking at the sales figures, it is clear the MDX meets part of the definition of a flagship, most important. The other part of the definition, the best, IS NOT what we are getting with the RLX.

#14

How Honda lost its mojo — and is on a mission to get it back

The company has a plan to rediscover its engineering heritage

TOKYO — The driver punched the air as his red and white Honda McLaren roared over the finish line. It was Suzuka, Japan, 1988, and Ayrton Senna had just become Formula One world champion for the first time. The McLaren racing team and its engine maker, Honda, were unstoppable that year, their drivers winning all but one of the 16 grand prix races.

Off the track, Honda had been tasting success, too. In the 1970s, its engineers had raised the bar for fuel efficiency and cleaner emissions with the CVCC engine. In the 1980s, as its engines were propelling Senna to multiple victories, the Civic and Accord cars were redefining the American family sedan. In 1997, Honda became one of the first modern carmakers to unveil an all-electric battery car, the EV Plus, capable of meeting California's zero emission requirement.

There's no doubt we lost our mojo — our way as an engineering company that made Honda Honda."

Jump forward almost 30 years from that Senna moment, and Honda is flailing:

On the racetrack, the Honda McLaren partnership is in trouble: The team is without a single win this season, and McLaren is losing patience with its engine supplier and speaking of a parting of the ways.

On the road, the Honda fleet has been dogged by recalls. More than 11 million vehicles have been recalled in the United States since 2008 due to faulty airbags. In 2013 and 2014, there were five back-to-back recalls for the Fit and Vezel hybrid vehicles due to transmission defects. Honda has lost ground in electric cars to Tesla and others.

"There's no doubt we lost our mojo — our way as an engineering company that made Honda Honda," Chief Executive Takahiro Hachigo told Reuters.

Hachigo joined Honda as an engineer in 1982 and became CEO in June 2015. Now he wants to revive a culture that encouraged engineers to take risks and return to a corporate structure that protected innovators from bureaucrats focused on cost-cutting. To help him achieve this, he says he has tapped into the ideas of a small group of Honda engineers, managers and planners. This group is modeled on the freewheeling "skunkworks" teams that drove aircraft development at Lockheed Martin, computer design at Apple and self-drive technology at Google.

In interviews, more than 20 current and former Honda executives and engineers at the company's facilities in Japan, China and the United States recounted the missteps that they say contributed to Honda's decline as an innovator. They also revealed new details of the firm's efforts to rediscover its creative spark.

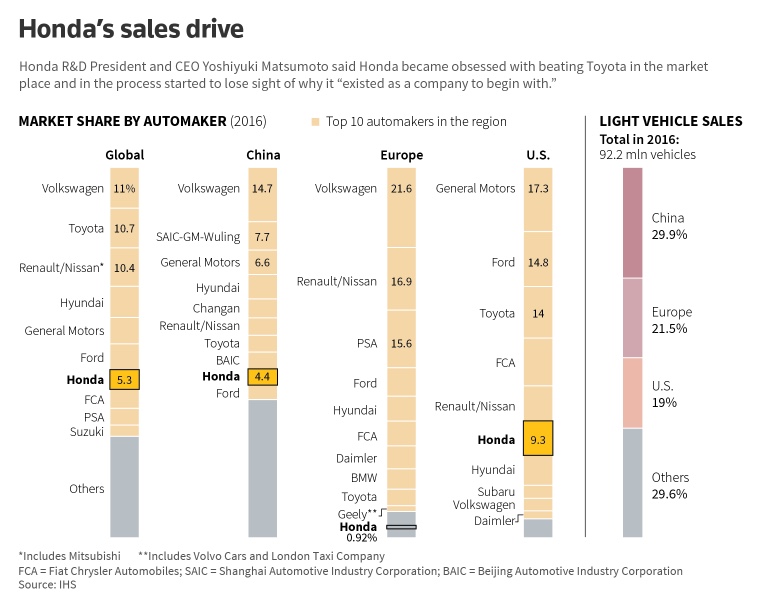

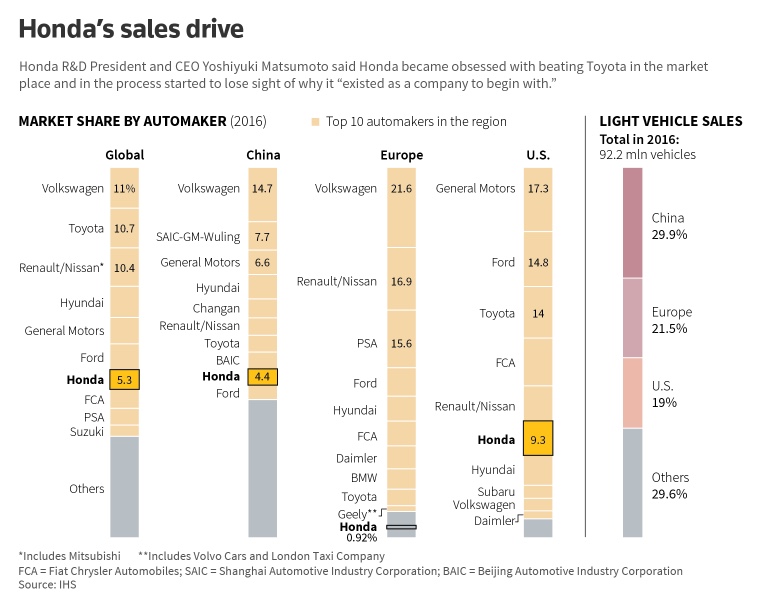

"The upshot was, as we obsessed about Toyota and beating it in the marketplace, we started to look like Toyota."

They said Honda had become trapped by Japan's "monozukuri" (literally, "making things") approach to manufacturing. This culture of incremental improvement and production-line efficiency, called "kaizen," served the company well in the decades after World War II, they said, but today's challenges — electrification, computerization, self-driving cars — demand a more nimble and flexible approach.

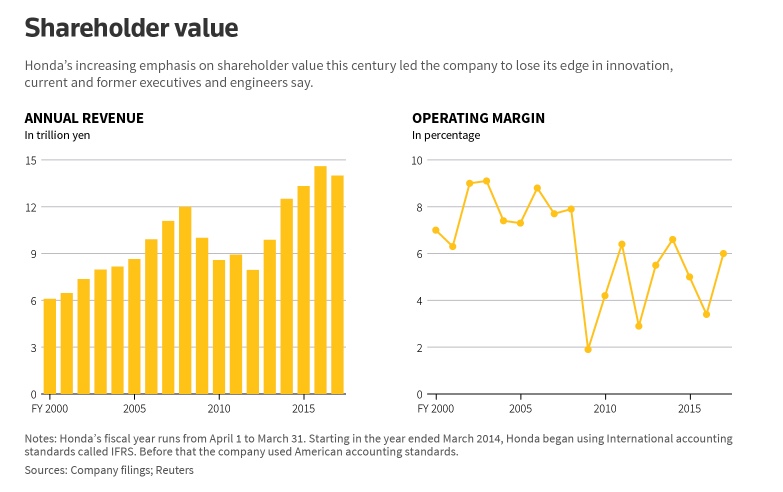

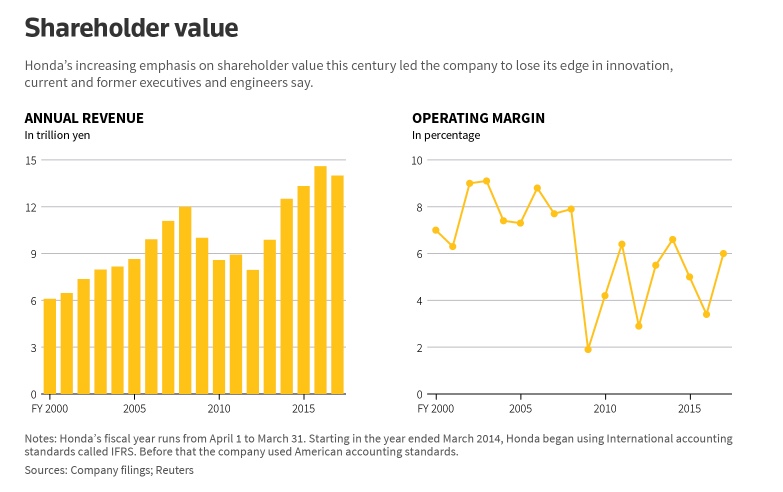

Most important, they said, over the past two decades company executives in Tokyo were given too much control over research and development. In their view, this led to shareholder value being prioritized over innovation.

There was a reluctance to draw on talent from outside Japan. In its quest to deliver for shareholders, Honda sought to maximize volume and profit and match the product range of its main Japanese rival, Toyota.

"The upshot was, as we obsessed about Toyota and beating it in the marketplace[

[b] we started to look like Toyota. We started to forget why we existed as a company to begin with,"

Honda R&D President and CEO Yoshiyuki Matsumoto

Honda's revenues have grown strongly since 2000, and its operating margin stood at 6.0 percent in the financial year ended March 31, 2017, compared with 7.2 percent at Toyota. But Honda's cars have slipped down quality rankings, from seventh in market research firm J.D. Power's initial quality study in 2000 to 20th in 2017.

HONDA CIVIC LOSES ITS SHINE

Striving to satisfy shareholders meant controlling costs. Honda's chief executive from 2003 to 2009, Takeo Fukui, broke with the firm's tradition of giving tech managers discretion over how to spend the roughly 5 percent of revenue allocated to the tech arm, according to the current and former Honda executives and engineers.

When Takanobu Ito replaced Fukui as CEO in 2009, he further tightened control over the design phase. He did this, the sources added, by moving several senior posts in the tech division to corporate headquarters in Tokyo from the research and development unit, whose main automotive center is near Utsunomiya, an hour north of the capital city by bullet train.

Ito and Fukui did not respond to written questions from Reuters.

Honda's popular Civic car was one of the casualties of these changes, according to the engineer in charge of the model's redesign beginning in 2007. With a reputation for outstanding engineering, reliability and affordability, the Civic was one of Honda's top-selling cars.

"Right from the get-go, the program was about making cost savings in real terms," the chief engineer for the redesign, Mitsuru Horikoshi, told Reuters.

To that end the global automotive business unit, headed at the time by future CEO Ito, and the tech division decided that the redesigned Civic would use many of the same components and systems as the previous model, including the front and rear suspension systems and the front section of the car.

By the end of 2008, Horikoshi's team was still $200 short of the cost target per Civic. "I already had my pants down to my ankles — nothing more to shed."

Civic engineer Horikoshi had finished a first design setting down the basic engineering points by February 2008 and a more detailed design by April. When rising gasoline, steel and other prices pushed up manufacturing costs by between $1,200 and $1,400 per vehicle, Horikoshi's team refined their design to improve the car's fuel economy. In early July 2008, they sought management approval for their plan at a meeting in Torrance, California, Honda's U.S. sales headquarters.

Global automotive head Ito said he would review the design overnight, Horikoshi recalled. The next morning, Ito came back and told the team to make the car smaller and cheaper to produce, and complete the redesign by the end of that month.

"With one blow of a cost-chopping knife, Ito basically told us to take our design back" to the first plan. "It's just unheard of. It was unprecedented," Horikoshi said.

"IT WAS CUT, CUT, CUT"

To meet Ito's specifications, Horikoshi used cheaper materials and made the car smaller, cutting its length by 45 millimeters and its width by 25 millimeters. He also reduced the wheelbase, the distance between the front and rear axle, by 30 millimeters.

A former leader of Honda's R&D unit said the firm "lapsed deeper into a bunker mentality, and that translated into our products. It was cut, cut, cut, and it cheapened our cars."

By the end of 2008, Horikoshi's team was wrapping up the Civic design. Half a year behind schedule, they were still $200 short of the cost target per car.

"I already had my pants down to my ankles — nothing more to shed," Horikoshi said.

When the 2012 model year Civic went on sale in 2011, it was met with a barrage of criticism. Influential U.S. magazine Consumer Reports dropped the car from its recommended list for the first time since it began rating vehicles in 1993. It criticized the new Civic for a poor quality interior and uneven ride.

R&D chief Matsumoto said the episode is a lesson that creativity should not be sacrificed on the altar of short-term shareholder value. During previous assignments for Honda in Thailand and India, Matsumoto said he had looked at headquarters from afar and recognized a lack of creativity there.

"We have to be allowed to go wild at times. If you operated a technology center only from an efficiency perspective, you'd kill the place. Which is exactly what happened at Honda. We don't want headquarters people telling engineers what to do," he said.

Honda went back to the drawing board. The redesigned model that replaced the 2012 Civic was named the 2016 North American Car of the Year by car journalists.

"NO LONGER LEADING"

Ito and Fukui did not respond to questions from Reuters about the Civic. A former senior executive said the decision to reduce costs was taken in the context of a global economic slowdown. Honda's chief spokesperson, Natsuno Asanuma, said the focus on shareholder value under previous management was "for the sake of the company's future."

James Chao, Asia-Pacific chief of consultancy at IHS Markit Automotive, said Honda failed to keep up with developments in suspension and transmission during Fukui and Ito's tenure, but the firm was doing well enough financially, which masked the problem.

"One could argue that Honda nonetheless performed nearly as well with the lower investment, but it was hard not to see that they were no longer leading in some technology areas," said Chao, who is based in Shanghai. Honda's rivals, such as Ford, were not reining in costs to the same degree, Chao said.

At the same time as Honda bosses were tightening the budget for the 2012 Civic, they were also looking for savings in research and development.

"We don't want to be indentured servants. My attitude is: 'This is my company too.'"

Other car firms were investing heavily in green technology, an area where Honda had already established itself as a leader with the unveiling of its EV Plus battery car in 1997, one of the first electric vehicles from a major carmaker. But just as its competitors were investing more, Honda began holding back.

Fukui, who became CEO in 2003, felt Honda was engaged in too many areas of research, four current and former executives and engineers said. As a result, Honda scaled back work on plug-in battery electric vehicles and put its faith in the hydrogen-fueled car. By the time Honda turned back to plug-in cars in the late 2000s, it had already lost several years to its competitors. Honda finally came up with a competitive plug-in car in 2013, 16 years after its original EV Plus. It is still playing catch up with the likes of Tesla.

Fukui did not respond to questions from Reuters. Two former engineers said Fukui was calculating that advanced battery technology would become commoditized and so Honda would be able to buy in if necessary. This assumption was correct, the former engineers said.

FRUSTRATED TALENT

For too long, Honda has overlooked the potential of its workforce outside Japan, and that has harmed the firm, said Erik Berkman, a former head of Honda's technology unit in the United States, the carmaker's biggest market.

Honda's management team, board of directors and operating officers were until recently all male and Japanese. The company named its first foreign (Japanese-Brazilian) and first female board members only three years ago.

In the fall of 2013, Berkman gave a speech in Motegi, Japan, at a meeting of Honda engineers and researchers. His message was clear: It was time for Honda to tap the brainpower of all its engineers. Research staff in the United States, some of whom had worked at Honda for more than two decades, were being treated like students, Berkman told an audience of roughly 500, including the company's top leaders, according to a transcript of the speech seen by Reuters.

"We don't want to be 'indentured servants'," Berkman said. "My attitude is: 'This is my company too.' Increasing diversity within Honda, and specifically Honda R&D, is our path forward."

Berkman told Reuters in an interview that many capable engineers and researchers in the United States had left Honda over the years out of frustration at being disregarded. "Many associates (in the U.S.) felt Japan bosses were too controlling and unwilling to take on what we thought were reasonable risks," said Berkman.

Many of those in the audience at Motegi, including senior managers, congratulated Berkman on his speech, according to Berkman and two other participants at the meeting. But shortly afterwards Berkman was demoted from his role as Honda's North American technology chief and reassigned to a more junior planning position in another unit.

"Maybe it had nothing to do with the speech. In my mind, it did. I kind of bit the hand that feeds me," he said.

Honda declined to comment on the episode.

Berkman said he decided to retire from the company where he had worked for 33 years. "I had been planning for retirement for many years, and felt this was the right time to go," he said.

Speaking to Reuters, R&D head Matsumoto acknowledged that Honda's technology and research staff lack diversity.

"You only see Japanese faces in the place," he said. "But we are repositioning tech centers in places like the United States, Thailand and China to function more like satellite centers to our central labs in Japan, so as to encourage exchanges of people. Pureblood-ism doesn't cut it. That's our growing consensus."

SKUNKWORKS

Japan's manufacturing sector, especially the auto industry, prospered in the post-war era by harnessing monozukuri principles of steady design improvement and lean manufacturing that encapsulate the Japanese reverence for craftsmanship in manufacturing. The aim was to produce vehicles with one-third of the defects of other mass-produced cars using half the factory space, half the capital, and half the engineering time. Those efforts, honed over years, elevated the quality and reliability of Japanese cars to the point that by the 1980s consumers in the United States began choosing Japanese cars over U.S.-made vehicles.

Today the industry is facing new challenges, however. Artificial intelligence and self-driving cars are forcing carmakers to rethink the way they design and produce vehicles.

"Japan's auto industry emerged in the post World War II era by chipping away day in day out to improve products. That's not going to cut it in the face of the rise of disruptive self-drive, connected car technology and electrification," Matsumoto said. "The new era calls for a totally new approach."

Some changes are under way at Honda to address these disruptive forces. These include moving tech management jobs out of Tokyo to give the technology division more autonomy.

"The new era calls for a totally new approach."

Honda has struck deals with third parties to accelerate progress on its smart-connected electric car. These include an agreement with Hitachi to develop and produce motors for plug-in electric cars and a deal with General Motors to produce hydrogen fuel cell power systems in the United States. Honda is also in talks with Alphabet Inc's Google to supply vehicles to jointly test self-driving technology.

A key force for change inside the company is the small group of engineers, managers and planners who are working quietly behind the scenes to revamp the company, according to Hachigo and Matsumoto.

The group's existence is little known inside the company. The team works out of Kyobashi, a neighborhood near Tokyo Station. Honda bosses declined to share the identities of its members.

They did share some of the ideas the team is advocating. These include streamlining Honda's product development process, which became bloated as the company got bigger, and developing underlying technologies for a range of vehicles to develop cars more efficiently and respond more quickly to changes in customer tastes. The group also wants to increase the use of virtual engineering tools, such as computer-aided design, to speed development, and it is working on an improved design for plug-in battery cars.

Matsumoto is hoping the group will be transformative. But he doesn't expect change to be instant.

"Almost always change — any change — starts on the fringes," he said. "This group is evidence that we still somewhere inside this company have the mojo we lost. There is that DNA left in us."

Reporting by Norihiko Shirouzu

The company has a plan to rediscover its engineering heritage

TOKYO — The driver punched the air as his red and white Honda McLaren roared over the finish line. It was Suzuka, Japan, 1988, and Ayrton Senna had just become Formula One world champion for the first time. The McLaren racing team and its engine maker, Honda, were unstoppable that year, their drivers winning all but one of the 16 grand prix races.

Off the track, Honda had been tasting success, too. In the 1970s, its engineers had raised the bar for fuel efficiency and cleaner emissions with the CVCC engine. In the 1980s, as its engines were propelling Senna to multiple victories, the Civic and Accord cars were redefining the American family sedan. In 1997, Honda became one of the first modern carmakers to unveil an all-electric battery car, the EV Plus, capable of meeting California's zero emission requirement.

There's no doubt we lost our mojo — our way as an engineering company that made Honda Honda."

Jump forward almost 30 years from that Senna moment, and Honda is flailing:

On the racetrack, the Honda McLaren partnership is in trouble: The team is without a single win this season, and McLaren is losing patience with its engine supplier and speaking of a parting of the ways.

On the road, the Honda fleet has been dogged by recalls. More than 11 million vehicles have been recalled in the United States since 2008 due to faulty airbags. In 2013 and 2014, there were five back-to-back recalls for the Fit and Vezel hybrid vehicles due to transmission defects. Honda has lost ground in electric cars to Tesla and others.

"There's no doubt we lost our mojo — our way as an engineering company that made Honda Honda," Chief Executive Takahiro Hachigo told Reuters.

Hachigo joined Honda as an engineer in 1982 and became CEO in June 2015. Now he wants to revive a culture that encouraged engineers to take risks and return to a corporate structure that protected innovators from bureaucrats focused on cost-cutting. To help him achieve this, he says he has tapped into the ideas of a small group of Honda engineers, managers and planners. This group is modeled on the freewheeling "skunkworks" teams that drove aircraft development at Lockheed Martin, computer design at Apple and self-drive technology at Google.

In interviews, more than 20 current and former Honda executives and engineers at the company's facilities in Japan, China and the United States recounted the missteps that they say contributed to Honda's decline as an innovator. They also revealed new details of the firm's efforts to rediscover its creative spark.

"The upshot was, as we obsessed about Toyota and beating it in the marketplace, we started to look like Toyota."

They said Honda had become trapped by Japan's "monozukuri" (literally, "making things") approach to manufacturing. This culture of incremental improvement and production-line efficiency, called "kaizen," served the company well in the decades after World War II, they said, but today's challenges — electrification, computerization, self-driving cars — demand a more nimble and flexible approach.

Most important, they said, over the past two decades company executives in Tokyo were given too much control over research and development. In their view, this led to shareholder value being prioritized over innovation.

There was a reluctance to draw on talent from outside Japan. In its quest to deliver for shareholders, Honda sought to maximize volume and profit and match the product range of its main Japanese rival, Toyota.

"The upshot was, as we obsessed about Toyota and beating it in the marketplace[

[b] we started to look like Toyota. We started to forget why we existed as a company to begin with,"

Honda R&D President and CEO Yoshiyuki Matsumoto

Honda's revenues have grown strongly since 2000, and its operating margin stood at 6.0 percent in the financial year ended March 31, 2017, compared with 7.2 percent at Toyota. But Honda's cars have slipped down quality rankings, from seventh in market research firm J.D. Power's initial quality study in 2000 to 20th in 2017.

HONDA CIVIC LOSES ITS SHINE

Striving to satisfy shareholders meant controlling costs. Honda's chief executive from 2003 to 2009, Takeo Fukui, broke with the firm's tradition of giving tech managers discretion over how to spend the roughly 5 percent of revenue allocated to the tech arm, according to the current and former Honda executives and engineers.

When Takanobu Ito replaced Fukui as CEO in 2009, he further tightened control over the design phase. He did this, the sources added, by moving several senior posts in the tech division to corporate headquarters in Tokyo from the research and development unit, whose main automotive center is near Utsunomiya, an hour north of the capital city by bullet train.

Ito and Fukui did not respond to written questions from Reuters.

Honda's popular Civic car was one of the casualties of these changes, according to the engineer in charge of the model's redesign beginning in 2007. With a reputation for outstanding engineering, reliability and affordability, the Civic was one of Honda's top-selling cars.

"Right from the get-go, the program was about making cost savings in real terms," the chief engineer for the redesign, Mitsuru Horikoshi, told Reuters.

To that end the global automotive business unit, headed at the time by future CEO Ito, and the tech division decided that the redesigned Civic would use many of the same components and systems as the previous model, including the front and rear suspension systems and the front section of the car.

By the end of 2008, Horikoshi's team was still $200 short of the cost target per Civic. "I already had my pants down to my ankles — nothing more to shed."

Civic engineer Horikoshi had finished a first design setting down the basic engineering points by February 2008 and a more detailed design by April. When rising gasoline, steel and other prices pushed up manufacturing costs by between $1,200 and $1,400 per vehicle, Horikoshi's team refined their design to improve the car's fuel economy. In early July 2008, they sought management approval for their plan at a meeting in Torrance, California, Honda's U.S. sales headquarters.

Global automotive head Ito said he would review the design overnight, Horikoshi recalled. The next morning, Ito came back and told the team to make the car smaller and cheaper to produce, and complete the redesign by the end of that month.

"With one blow of a cost-chopping knife, Ito basically told us to take our design back" to the first plan. "It's just unheard of. It was unprecedented," Horikoshi said.

"IT WAS CUT, CUT, CUT"

To meet Ito's specifications, Horikoshi used cheaper materials and made the car smaller, cutting its length by 45 millimeters and its width by 25 millimeters. He also reduced the wheelbase, the distance between the front and rear axle, by 30 millimeters.

A former leader of Honda's R&D unit said the firm "lapsed deeper into a bunker mentality, and that translated into our products. It was cut, cut, cut, and it cheapened our cars."

By the end of 2008, Horikoshi's team was wrapping up the Civic design. Half a year behind schedule, they were still $200 short of the cost target per car.

"I already had my pants down to my ankles — nothing more to shed," Horikoshi said.

When the 2012 model year Civic went on sale in 2011, it was met with a barrage of criticism. Influential U.S. magazine Consumer Reports dropped the car from its recommended list for the first time since it began rating vehicles in 1993. It criticized the new Civic for a poor quality interior and uneven ride.

R&D chief Matsumoto said the episode is a lesson that creativity should not be sacrificed on the altar of short-term shareholder value. During previous assignments for Honda in Thailand and India, Matsumoto said he had looked at headquarters from afar and recognized a lack of creativity there.

"We have to be allowed to go wild at times. If you operated a technology center only from an efficiency perspective, you'd kill the place. Which is exactly what happened at Honda. We don't want headquarters people telling engineers what to do," he said.

Honda went back to the drawing board. The redesigned model that replaced the 2012 Civic was named the 2016 North American Car of the Year by car journalists.

"NO LONGER LEADING"

Ito and Fukui did not respond to questions from Reuters about the Civic. A former senior executive said the decision to reduce costs was taken in the context of a global economic slowdown. Honda's chief spokesperson, Natsuno Asanuma, said the focus on shareholder value under previous management was "for the sake of the company's future."

James Chao, Asia-Pacific chief of consultancy at IHS Markit Automotive, said Honda failed to keep up with developments in suspension and transmission during Fukui and Ito's tenure, but the firm was doing well enough financially, which masked the problem.

"One could argue that Honda nonetheless performed nearly as well with the lower investment, but it was hard not to see that they were no longer leading in some technology areas," said Chao, who is based in Shanghai. Honda's rivals, such as Ford, were not reining in costs to the same degree, Chao said.

At the same time as Honda bosses were tightening the budget for the 2012 Civic, they were also looking for savings in research and development.

"We don't want to be indentured servants. My attitude is: 'This is my company too.'"

Other car firms were investing heavily in green technology, an area where Honda had already established itself as a leader with the unveiling of its EV Plus battery car in 1997, one of the first electric vehicles from a major carmaker. But just as its competitors were investing more, Honda began holding back.

Fukui, who became CEO in 2003, felt Honda was engaged in too many areas of research, four current and former executives and engineers said. As a result, Honda scaled back work on plug-in battery electric vehicles and put its faith in the hydrogen-fueled car. By the time Honda turned back to plug-in cars in the late 2000s, it had already lost several years to its competitors. Honda finally came up with a competitive plug-in car in 2013, 16 years after its original EV Plus. It is still playing catch up with the likes of Tesla.

Fukui did not respond to questions from Reuters. Two former engineers said Fukui was calculating that advanced battery technology would become commoditized and so Honda would be able to buy in if necessary. This assumption was correct, the former engineers said.

FRUSTRATED TALENT

For too long, Honda has overlooked the potential of its workforce outside Japan, and that has harmed the firm, said Erik Berkman, a former head of Honda's technology unit in the United States, the carmaker's biggest market.

Honda's management team, board of directors and operating officers were until recently all male and Japanese. The company named its first foreign (Japanese-Brazilian) and first female board members only three years ago.

In the fall of 2013, Berkman gave a speech in Motegi, Japan, at a meeting of Honda engineers and researchers. His message was clear: It was time for Honda to tap the brainpower of all its engineers. Research staff in the United States, some of whom had worked at Honda for more than two decades, were being treated like students, Berkman told an audience of roughly 500, including the company's top leaders, according to a transcript of the speech seen by Reuters.

"We don't want to be 'indentured servants'," Berkman said. "My attitude is: 'This is my company too.' Increasing diversity within Honda, and specifically Honda R&D, is our path forward."

Berkman told Reuters in an interview that many capable engineers and researchers in the United States had left Honda over the years out of frustration at being disregarded. "Many associates (in the U.S.) felt Japan bosses were too controlling and unwilling to take on what we thought were reasonable risks," said Berkman.

Many of those in the audience at Motegi, including senior managers, congratulated Berkman on his speech, according to Berkman and two other participants at the meeting. But shortly afterwards Berkman was demoted from his role as Honda's North American technology chief and reassigned to a more junior planning position in another unit.

"Maybe it had nothing to do with the speech. In my mind, it did. I kind of bit the hand that feeds me," he said.

Honda declined to comment on the episode.

Berkman said he decided to retire from the company where he had worked for 33 years. "I had been planning for retirement for many years, and felt this was the right time to go," he said.

Speaking to Reuters, R&D head Matsumoto acknowledged that Honda's technology and research staff lack diversity.

"You only see Japanese faces in the place," he said. "But we are repositioning tech centers in places like the United States, Thailand and China to function more like satellite centers to our central labs in Japan, so as to encourage exchanges of people. Pureblood-ism doesn't cut it. That's our growing consensus."

SKUNKWORKS

Japan's manufacturing sector, especially the auto industry, prospered in the post-war era by harnessing monozukuri principles of steady design improvement and lean manufacturing that encapsulate the Japanese reverence for craftsmanship in manufacturing. The aim was to produce vehicles with one-third of the defects of other mass-produced cars using half the factory space, half the capital, and half the engineering time. Those efforts, honed over years, elevated the quality and reliability of Japanese cars to the point that by the 1980s consumers in the United States began choosing Japanese cars over U.S.-made vehicles.

Today the industry is facing new challenges, however. Artificial intelligence and self-driving cars are forcing carmakers to rethink the way they design and produce vehicles.

"Japan's auto industry emerged in the post World War II era by chipping away day in day out to improve products. That's not going to cut it in the face of the rise of disruptive self-drive, connected car technology and electrification," Matsumoto said. "The new era calls for a totally new approach."

Some changes are under way at Honda to address these disruptive forces. These include moving tech management jobs out of Tokyo to give the technology division more autonomy.

"The new era calls for a totally new approach."

Honda has struck deals with third parties to accelerate progress on its smart-connected electric car. These include an agreement with Hitachi to develop and produce motors for plug-in electric cars and a deal with General Motors to produce hydrogen fuel cell power systems in the United States. Honda is also in talks with Alphabet Inc's Google to supply vehicles to jointly test self-driving technology.

A key force for change inside the company is the small group of engineers, managers and planners who are working quietly behind the scenes to revamp the company, according to Hachigo and Matsumoto.

The group's existence is little known inside the company. The team works out of Kyobashi, a neighborhood near Tokyo Station. Honda bosses declined to share the identities of its members.

They did share some of the ideas the team is advocating. These include streamlining Honda's product development process, which became bloated as the company got bigger, and developing underlying technologies for a range of vehicles to develop cars more efficiently and respond more quickly to changes in customer tastes. The group also wants to increase the use of virtual engineering tools, such as computer-aided design, to speed development, and it is working on an improved design for plug-in battery cars.

Matsumoto is hoping the group will be transformative. But he doesn't expect change to be instant.

"Almost always change — any change — starts on the fringes," he said. "This group is evidence that we still somewhere inside this company have the mojo we lost. There is that DNA left in us."

Reporting by Norihiko Shirouzu

Last edited by Philisophe; 09-08-2017 at 06:51 PM. Reason: Readability

The following 6 users liked this post by Philisophe:

hadokenuh (09-11-2017),

holografique (09-10-2017),

hondamore (09-09-2017),

JSakaBuck (09-14-2017),

Rocket_man (09-11-2017),

and 1 others liked this post.

#15

Three Wheelin'

OOOO...That last picture looks like it could be a design mock up of the rumored fuel-cell, Quad-electric motor, front AND rear torque vectoring super sedan to be positioned above the RLX. I'm officially excited.

#16

Instructor

^^^ Don't get too excited there Hondamore, that looks more like a cutaway of the existing Clarity Hydrogen-fueled car. I sure don't see where they'd fit the TMU for the rear axle under that huge tank right over the rear axle line.

That article does give me some hope they are turning it around and will live up to their new 'Precision Crafted Performance' mantra. If one looks at the NSX, we do see them living up to more international cooperation in all areas of vehicle development (drivetrain: Japan, chassis and body: US, overall project leadership: US) and greater diversity (female lead designer). Hopefully that will spread to the rest of the product line efforts.

The fact that the motorsports arm actually has a functioning quad-motor SH NSX EV also gives me hope for a street vehicle with that architecture in the future. A 'baby' NSX EV sports car maybe?

That article does give me some hope they are turning it around and will live up to their new 'Precision Crafted Performance' mantra. If one looks at the NSX, we do see them living up to more international cooperation in all areas of vehicle development (drivetrain: Japan, chassis and body: US, overall project leadership: US) and greater diversity (female lead designer). Hopefully that will spread to the rest of the product line efforts.

The fact that the motorsports arm actually has a functioning quad-motor SH NSX EV also gives me hope for a street vehicle with that architecture in the future. A 'baby' NSX EV sports car maybe?

Last edited by JonFo; 09-09-2017 at 06:20 AM. Reason: add link

The following users liked this post:

hondamore (09-09-2017)

#17

Senior Moderator

I met and listened to Dave Marek last night at NSXPO speak on how the original NSX was designed, his part in the design of the new NSX, and Acura's new design direction. Listening to him, it appears that he's taken to heart some of the criticism levied against Acura for its designs and is very proud of the new design direction, embodied by the Precision concept. He spoke at length on how the design process works and how sometimes his design decisions are affected by the greater group of executives at Honda; he travels to Japan up to a couple times a month! I like where Acura is going right now and if they continue to execute, hope is not lost for them. PS Marek is a super-nice guy! Spoke to him about the Beak vs the new grille and design elements in terms of the TLX.

The following 4 users liked this post by neuronbob:

#19

Three Wheelin'

Man, that article sure explains a lot....and I mean ALOT. If not clearly explains the disaster that Acura became over the past 5-7 years, including the disaster that was the RLX. Also confirms a lot of what many of us have been saying/complaining about here for awhile in terms of overall product quality, design elements, etc. Where things just didn't make any sense whatsoever for how the brand was trying to market itself. The product just didn't align with the marketing.

I really do hope they finally get it together this time. I hope things like the 2018 MMC RLX are the last "left-overs" from that era. I really don't like the MMC. Lipstick on a pig IMO.

I really do hope they finally get it together this time. I hope things like the 2018 MMC RLX are the last "left-overs" from that era. I really don't like the MMC. Lipstick on a pig IMO.

The following users liked this post:

demosan (09-14-2017)