Wall St vs Main St: Wallstreetbets’ battle against scummy hedge funds

#161

Safety Car

Big players, the rich and elite...they play by a diff set of rules than the peasants.

Of course they get to trade "after hours."

#162

Suzuka Master

#163

Safety Car

That scum bag (looks like a real life vampire) doesn't give ANY reason as to why buying was limited but selling was not.

Gives some BS technocratic rules of "SEC net capital" and "clearinghouse deposit" requirements and "volatility" and to "protect" the customers. Why doesn't he explain exactly why buying is restricted but not selling?

CNBC also is predictably soft and doesn't go after Robinhood with any hard questions at all. Basically the last chick comes in to give them a compliment/question combo.

What a load of BS. You can tell by his language that it is well crafted/PR-polished and it sounds like that vampire-douche is lying through his teeth.

People need to start boycotting robinhood.

#165

Sanest Florida Man

#166

Suzuka Master

Again just robot answers. Glad Cuomo pressed him

#167

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,640

Received 2,329 Likes

on

1,309 Posts

My remaining GME stocks sold at $395 first thing

#169

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

Iirc Robinhood gold let’s you trade in after hours.

#170

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

#171

Three Wheelin'

Keith Gill Drove the GameStop Reddit Mania. He Talked to the Journal.

The investor who helpeddirect the world’s attention to GameStop, leading a horde of online followers in a bizarre market rally that made and lost fortunes from one day to the next, says he’s just a normal guy.“I didn’t expect this,” said Keith Gill, 34 years old, known as “DeepF—ingValue” by fans on Reddit’s WallStreetBets forum and “Dada” by his 2-year-old daughter. He said he didn’t set out to draw the attention of Congress, the Federal Reserve, hedge funds, the media, trading platforms and hundreds of thousands of investors.

“This story is so much bigger than me,” Mr. Gill told The Wall Street Journal in his first interview since the unboxing this week of a volatile new stock market game. “I support these retail investors, their ability to make a statement.”

To many of them, Mr. Gill—who until recently worked in marketing for Massachusetts Mutual Life Insurance Co.—is the force behind the triple-digit gains in shares of the videogame retailer GameStop, up more than 900% this year through Thursday. On Wednesday, the stock jumped 135% to $347.51, a record, before plunging to $194 a share Thursday as online brokerages clamped down. At the start of the year, GameStop shares went for around $18.

Many online investors say his advocacy helped turn them into a force powerful enough to cause big losses for established hedge funds and, for the moment, turn the investing world upside down.

Mr. Gill posted a screenshot of his brokerage account Wednesday, showing a roughly $20 million daily gain on GameStop shares and options. “Your steady hand convinced many of us to not only buy, but hold. Your example has literally changed the lives of thousands of ordinary normal people. Seriously thank you. You deserve every penny,” replied one Reddit user, reality_czech.

The next day, Mr. Gill posted another screenshot—showing about a $15 million loss. After Thursday’s market close, his E*Trade brokerage account, viewed by the Journal, held around $33 million, including GameStop stock, options and millions in cash.

“He always liked money,” said Elaine Gill, his mother. As a child, she said, “he would get money from those scratch tickets that people didn’t know they’d won. People would throw them on the ground…A lot of times there was still money on them.”

Mr. Gill’s online persona—he goes by “Roaring Kitty” on YouTube—has drawn tens of thousands of fans and copycats who share screenshots of their own brokerage accounts. As the GameStop frenzy peaked this week, hundreds of thousands of new investors downloaded applications like Robinhood to join the action, according to Apptopia Inc.

Mr. Gill said he wasn’t a rabble-rouser out to take on the establishment, just someone who believes investors can find value in unloved stocks. He never expected to have a legion of fans debating his identity online, or millions of dollars in his trading account, he said. He was just a dad with an online hobby and a plastic kiddie slide on the front lawn of a Boston suburb.

Mr. Gill began investing in GameStop around June 2019, he said, when it was hovering around $5 a share. Earlier that year, the game retailer was hunting for its fifth chief executive in a little over 12 months. Mr. Gill kept buying. Although he never played much besides Super Mario or Donkey Kong, he saw potential for the struggling retailer to reinvigorate itself by attracting new customers with the latest videogame consoles.

“People were doing a quick take, saying GameStop was the next Blockbuster, ” he said, a chain caught in a retail decline. “It appeared many folks just weren’t digging in deeper. It was a gross misclassification of the opportunity.”

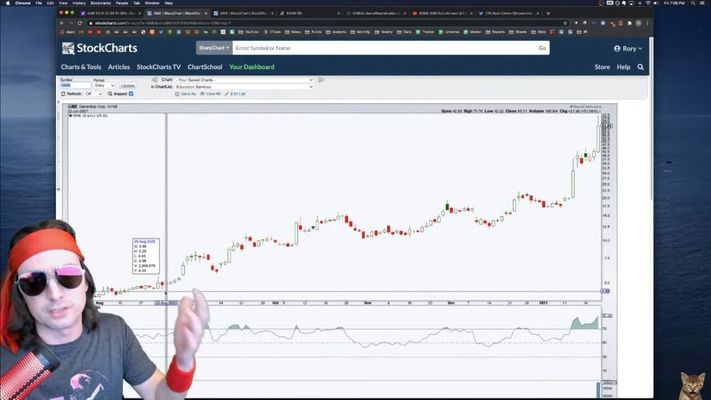

Mr. Gill, tall with shoulder-length hair, opened a YouTube channel last summer, and he worked in the basement of the home he rents in Wilmington, Mass., to avoid disturbing his daughter after bedtime, he said. On his channel, he touted GameStop and Belgian beers. His favorite is Delirium Tremens.

On a recent YouTube live-stream, he wore a red headband and aviator sunglasses while fielding questions on stocks. He poured himself Prosecco then switched to beer as he celebrated big gains and gave shout-outs to legions of viewers and traders in a seven-hour-plus extravaganza. The stream has tallied more than 200,000 views.

Mr. Gill’s obscene username on Reddit’s WallStreetBets forum is supposed to reflect a belief in value investing—buying shares of companies that are inexpensive relative to the underlying business.

Among his many Reddit fans, Mr. Gill “will go down as the greatest legend in the history of WallStreetBets,” said Jon Hagedorn, a 34-year-old training supervisor based in Ronkonkoma, N.Y. “He’s the original OG.”

The stock’s wild ride, seemingly divorced from standard measures of corporate value, has spurred complaints that investors banding together to provoke this kind of frenzy amounts to market manipulation.

The Securities and Exchange Commission said Friday it would “act to protect retail investors when the facts demonstrate abusive or manipulative trading activity.” Mr. Gill said he hasn’t heard from the SEC.

In high school, Mr. Gill was a distance runner, and he earned national honors on the team at nearby Stonehill College, where he graduated in 2009 with an accounting major. He ran a four-minute mile until sidelined by an Achilles injury.

Mr. Gill moved to New Hampshire for a few years and found a mentor, an investor and software developer his aunt introduced him to. He holds a designation as a Chartered Financial Analyst and said he was drawn by the complexity and challenge of stock picking, which became an outlet for the energy he once put into running. He started working at MassMutual in 2019.

In the summer of 2019, he started building his position in GameStop and would post screenshots of his E*Trade account’s options positions on WallStreetBets forum. “Holy s— bro, what made you drop 53K on GameStop?” one trader posted about one of Mr. Gill’s screenshots in September 2019.

In the months that followed, he posted regularly, putting up a “GME YOLO update,” a reference to GameStop’s ticker and the mantra “you only live once.” He showed off gains in the five- and six-digits, and times when his investments plunged.

Mr. Gill stuck with GameStop, and his wagers became day-trader lore.

To fans, he tapped into the desire by millions of amateur investors around the U.S. to try their hand at stock trading. Trading fees have fallen to zero, and apps allow investors to buy and sell on their phones. The easy market access is augmented by an online community swelled with eager helpers.

Many first-time investors stuck at home in the pandemic said they found solace in chatting with others online about trading stocks or options, as well as hearing from those making profitable bets.

The discourse isn’t always positive. An off-Reddit chat room associated with WallStreetBets is filled with obscenity, racism and antigay screeds. Many on the platforms lash out against Wall Street power players, and some express a desire to see the financial pros reel from losses.

“I’m not out for anybody,” Mr. Gill said. “Roaring Kitty was an educational channel where I was showcasing my investment philosophy.”

To bet against a stock, hedge funds borrow shares and sell them, hoping to buy them back later at a lower price and return them. That allows them to pocket the difference between the prices. But when a shorted stock stages such a dramatic rally, it turns painful, often forcing them to exit from the positions by purchasing shares at a loss. In turn, that can inspire sharp gains in stocks, known as a “short squeeze.”

The bearish positioning of hedge funds was part of what drew many small GameStop investors, anticipating a short squeeze. Mr. Gill said his investing strategy didn’t entirely depend on a short squeeze, but he knew others were potentially betting on it.

So far, the professionals have been wrong, giving a win to Mr. Gill and other individual investors who bet big on GameStop. Hedge funds like Melvin Capital Management and Maplelane Capital were the ones burned, as well as jeered by boastful Reddit investors.

Many others have piled into GameStop, trying to ride the rally “to the moon,” as many Reddit investors say. Individual investors have also piled into shares of companies like AMC Entertainment Holdings Inc. in the hopes of catching similar momentum and making a quick buck.

GameStop has garnered hundreds of thousands of posts over the past month across Reddit, Twitter and Facebook, according to data this week from Meltwater, a global media intelligence company. As the stock has vaulted higher, its shares have traded in a frenzy, making it one of the most popular bets in the U.S. market in recent days, according to Dow Jones Market Data.

Seasoned traders are starting to take into account the behavior of influential investors like Mr. Gill and others.

Mark Sebastian, founder of Chicago-based Options Pit and an options trader for around 20 years, has developed a screener analyzing reams of stocks to spot those with heavy activity from individual investors. He buys or sells options based on which stocks are gaining momentum, trying to ride the wave higher or lower. Recently, this included AMC, though he said he wasn’t a fan.

“We’re trying to get on these names before they completely take off,” Mr. Sebastian said, calling one recent trade “free money.”

Mr. Gill said his life has changed overnight and hasn’t set his future plans. He would like to continue the “Roaring Kitty” YouTube channel, maybe buy a house. “I thought this trade would be successful,” he said, “but I never expected what happened over the past week.”

He has one dream in mind. “I always wanted to build an indoor track facility or a field house in Brockton,” he said of his hometown. “And now, it looks like I actually could do that.”

—Elisa Cho, Jim Oberman and Caitlin McCabe contributed to this article.

Write to Julia-Ambra Verlaine at Julia.Verlaine@wsj.com and Gunjan Banerji at Gunjan.Banerji@wsj.com

“This story is so much bigger than me,” Mr. Gill told The Wall Street Journal in his first interview since the unboxing this week of a volatile new stock market game. “I support these retail investors, their ability to make a statement.”

To many of them, Mr. Gill—who until recently worked in marketing for Massachusetts Mutual Life Insurance Co.—is the force behind the triple-digit gains in shares of the videogame retailer GameStop, up more than 900% this year through Thursday. On Wednesday, the stock jumped 135% to $347.51, a record, before plunging to $194 a share Thursday as online brokerages clamped down. At the start of the year, GameStop shares went for around $18.

Many online investors say his advocacy helped turn them into a force powerful enough to cause big losses for established hedge funds and, for the moment, turn the investing world upside down.

Mr. Gill posted a screenshot of his brokerage account Wednesday, showing a roughly $20 million daily gain on GameStop shares and options. “Your steady hand convinced many of us to not only buy, but hold. Your example has literally changed the lives of thousands of ordinary normal people. Seriously thank you. You deserve every penny,” replied one Reddit user, reality_czech.

The next day, Mr. Gill posted another screenshot—showing about a $15 million loss. After Thursday’s market close, his E*Trade brokerage account, viewed by the Journal, held around $33 million, including GameStop stock, options and millions in cash.

“He always liked money,” said Elaine Gill, his mother. As a child, she said, “he would get money from those scratch tickets that people didn’t know they’d won. People would throw them on the ground…A lot of times there was still money on them.”

Mr. Gill’s online persona—he goes by “Roaring Kitty” on YouTube—has drawn tens of thousands of fans and copycats who share screenshots of their own brokerage accounts. As the GameStop frenzy peaked this week, hundreds of thousands of new investors downloaded applications like Robinhood to join the action, according to Apptopia Inc.

Mr. Gill said he wasn’t a rabble-rouser out to take on the establishment, just someone who believes investors can find value in unloved stocks. He never expected to have a legion of fans debating his identity online, or millions of dollars in his trading account, he said. He was just a dad with an online hobby and a plastic kiddie slide on the front lawn of a Boston suburb.

Mr. Gill began investing in GameStop around June 2019, he said, when it was hovering around $5 a share. Earlier that year, the game retailer was hunting for its fifth chief executive in a little over 12 months. Mr. Gill kept buying. Although he never played much besides Super Mario or Donkey Kong, he saw potential for the struggling retailer to reinvigorate itself by attracting new customers with the latest videogame consoles.

“People were doing a quick take, saying GameStop was the next Blockbuster, ” he said, a chain caught in a retail decline. “It appeared many folks just weren’t digging in deeper. It was a gross misclassification of the opportunity.”

Mr. Gill, tall with shoulder-length hair, opened a YouTube channel last summer, and he worked in the basement of the home he rents in Wilmington, Mass., to avoid disturbing his daughter after bedtime, he said. On his channel, he touted GameStop and Belgian beers. His favorite is Delirium Tremens.

On a recent YouTube live-stream, he wore a red headband and aviator sunglasses while fielding questions on stocks. He poured himself Prosecco then switched to beer as he celebrated big gains and gave shout-outs to legions of viewers and traders in a seven-hour-plus extravaganza. The stream has tallied more than 200,000 views.

Mr. Gill’s obscene username on Reddit’s WallStreetBets forum is supposed to reflect a belief in value investing—buying shares of companies that are inexpensive relative to the underlying business.

Among his many Reddit fans, Mr. Gill “will go down as the greatest legend in the history of WallStreetBets,” said Jon Hagedorn, a 34-year-old training supervisor based in Ronkonkoma, N.Y. “He’s the original OG.”

The stock’s wild ride, seemingly divorced from standard measures of corporate value, has spurred complaints that investors banding together to provoke this kind of frenzy amounts to market manipulation.

The Securities and Exchange Commission said Friday it would “act to protect retail investors when the facts demonstrate abusive or manipulative trading activity.” Mr. Gill said he hasn’t heard from the SEC.

Fast times

“The first thing that I had asked him when this craziness started was: is this illegal or anything dishonest? He said, ‘No mom, it’s not,’” recalled Ms. Gill, who lives in Brockton, Mass., where she and Steve Gill raised their son.In high school, Mr. Gill was a distance runner, and he earned national honors on the team at nearby Stonehill College, where he graduated in 2009 with an accounting major. He ran a four-minute mile until sidelined by an Achilles injury.

Mr. Gill moved to New Hampshire for a few years and found a mentor, an investor and software developer his aunt introduced him to. He holds a designation as a Chartered Financial Analyst and said he was drawn by the complexity and challenge of stock picking, which became an outlet for the energy he once put into running. He started working at MassMutual in 2019.

In the summer of 2019, he started building his position in GameStop and would post screenshots of his E*Trade account’s options positions on WallStreetBets forum. “Holy s— bro, what made you drop 53K on GameStop?” one trader posted about one of Mr. Gill’s screenshots in September 2019.

In the months that followed, he posted regularly, putting up a “GME YOLO update,” a reference to GameStop’s ticker and the mantra “you only live once.” He showed off gains in the five- and six-digits, and times when his investments plunged.

Mr. Gill stuck with GameStop, and his wagers became day-trader lore.

To fans, he tapped into the desire by millions of amateur investors around the U.S. to try their hand at stock trading. Trading fees have fallen to zero, and apps allow investors to buy and sell on their phones. The easy market access is augmented by an online community swelled with eager helpers.

Many first-time investors stuck at home in the pandemic said they found solace in chatting with others online about trading stocks or options, as well as hearing from those making profitable bets.

The discourse isn’t always positive. An off-Reddit chat room associated with WallStreetBets is filled with obscenity, racism and antigay screeds. Many on the platforms lash out against Wall Street power players, and some express a desire to see the financial pros reel from losses.

“I’m not out for anybody,” Mr. Gill said. “Roaring Kitty was an educational channel where I was showcasing my investment philosophy.”

Bear bust

Many on Wall Street disagreed with Mr. Gill’s bullish view on GameStop and have taken a big hit as a result. Hedge funds and other investment professionals piled into wagers that the shares would tumble.To bet against a stock, hedge funds borrow shares and sell them, hoping to buy them back later at a lower price and return them. That allows them to pocket the difference between the prices. But when a shorted stock stages such a dramatic rally, it turns painful, often forcing them to exit from the positions by purchasing shares at a loss. In turn, that can inspire sharp gains in stocks, known as a “short squeeze.”

The bearish positioning of hedge funds was part of what drew many small GameStop investors, anticipating a short squeeze. Mr. Gill said his investing strategy didn’t entirely depend on a short squeeze, but he knew others were potentially betting on it.

So far, the professionals have been wrong, giving a win to Mr. Gill and other individual investors who bet big on GameStop. Hedge funds like Melvin Capital Management and Maplelane Capital were the ones burned, as well as jeered by boastful Reddit investors.

Many others have piled into GameStop, trying to ride the rally “to the moon,” as many Reddit investors say. Individual investors have also piled into shares of companies like AMC Entertainment Holdings Inc. in the hopes of catching similar momentum and making a quick buck.

GameStop has garnered hundreds of thousands of posts over the past month across Reddit, Twitter and Facebook, according to data this week from Meltwater, a global media intelligence company. As the stock has vaulted higher, its shares have traded in a frenzy, making it one of the most popular bets in the U.S. market in recent days, according to Dow Jones Market Data.

Seasoned traders are starting to take into account the behavior of influential investors like Mr. Gill and others.

Mark Sebastian, founder of Chicago-based Options Pit and an options trader for around 20 years, has developed a screener analyzing reams of stocks to spot those with heavy activity from individual investors. He buys or sells options based on which stocks are gaining momentum, trying to ride the wave higher or lower. Recently, this included AMC, though he said he wasn’t a fan.

“We’re trying to get on these names before they completely take off,” Mr. Sebastian said, calling one recent trade “free money.”

Mr. Gill said his life has changed overnight and hasn’t set his future plans. He would like to continue the “Roaring Kitty” YouTube channel, maybe buy a house. “I thought this trade would be successful,” he said, “but I never expected what happened over the past week.”

He has one dream in mind. “I always wanted to build an indoor track facility or a field house in Brockton,” he said of his hometown. “And now, it looks like I actually could do that.”

—Elisa Cho, Jim Oberman and Caitlin McCabe contributed to this article.

Write to Julia-Ambra Verlaine at Julia.Verlaine@wsj.com and Gunjan Banerji at Gunjan.Banerji@wsj.com

Last edited by Curious3GTL; 01-29-2021 at 09:46 AM.

#172

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,640

Received 2,329 Likes

on

1,309 Posts

The following users liked this post:

Mizouse (01-29-2021)

#174

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,640

Received 2,329 Likes

on

1,309 Posts

#175

Suzuka Master

I've been reading this section of the forum for a couple years but never really contributed. What do you og guys (Ken/AZuser/Miz/etc) think of all this

Do you see this as insulting to traditional investing?

hedge funds ?

hedge funds ?

$GME to the moon?

Hey im just here to make a couple bucks?

Do you see this as insulting to traditional investing?

hedge funds ?

hedge funds ?$GME to the moon?

Hey im just here to make a couple bucks?

#176

Suzuka Master

I dont think AZ has commented in this thread yet. Is he already on the moon lol?

#177

Safety Car

I personally detest Fox News as a whole. But Tucker sometimes have GREAT segments, this is one of them.

When AOC and Donald Jr and Fox News all are aligned on one side....you KNOW its really bad.

The following users liked this post:

Mizouse (01-29-2021)

#178

Safety Car

I've been reading this section of the forum for a couple years but never really contributed. What do you og guys (Ken/AZuser/Miz/etc) think of all this

Do you see this as insulting to traditional investing?

hedge funds ?

hedge funds ?

$GME to the moon?

Hey im just here to make a couple bucks?

Do you see this as insulting to traditional investing?

hedge funds ?

hedge funds ?$GME to the moon?

Hey im just here to make a couple bucks?

And George Carlin's legendary segment is oh so relevant many years later:

Relevant part starts at about 1:20

Last edited by nist7; 01-29-2021 at 11:34 AM.

The following users liked this post:

Ken1997TL (01-29-2021)

#180

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,640

Received 2,329 Likes

on

1,309 Posts

I've been reading this section of the forum for a couple years but never really contributed. What do you og guys (Ken/AZuser/Miz/etc) think of all this

Do you see this as insulting to traditional investing?

hedge funds ?

hedge funds ?

$GME to the moon?

Hey im just here to make a couple bucks?

Do you see this as insulting to traditional investing?

hedge funds ?

hedge funds ?$GME to the moon?

Hey im just here to make a couple bucks?

Imagine if VW Vortex as a forum banded together and got some PR to go along with it back in 2008 or whenever that whole VW shorting incident was.

The following users liked this post:

Mizouse (01-29-2021)

#181

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,640

Received 2,329 Likes

on

1,309 Posts

On the other hand with RobinHood and most of the more traditional guys no longer charging commissions on trades these days maybe that's what it took to get mass involvement.

#182

Safety Car

From what I've learned....they do the exact OPPOSITE of their name sake...they actually steal from the poor to give to the rich. It's insane how their business model is pretty much selling retail investor trade data first to the hedge funds who then profit off of that information. That's why it's "free" to trade on Robinhood. Like the saying goes....when it's free...YOU are the product. Completely insane and I hope more people expose that scum of a company.

#183

Go Giants

This is almost as fun as blackjack

#184

Senior Moderator

@AZuser is rich and is about to buy out AZ and give

a raise for all the great work he's been doing.

a raise for all the great work he's been doing. Probably clean up the mod list as well

The following users liked this post:

Mizouse (01-29-2021)

#185

Safety Car

@Mizouse or other mods.....could it be reasonable to change the title of the thread?

Started with GME but looks like this is spreading into a general topic of the hedge funds/robinhood vs the peasants. Wall St vs Main St. Rich vs masses. Elite vs working class. etc. etc.

GME short squeeze is merely a symbol of the bigger issue at hand.

Interesting to watch. Great start to 2021. Eat the rich.

Started with GME but looks like this is spreading into a general topic of the hedge funds/robinhood vs the peasants. Wall St vs Main St. Rich vs masses. Elite vs working class. etc. etc.

GME short squeeze is merely a symbol of the bigger issue at hand.

Interesting to watch. Great start to 2021. Eat the rich.

#186

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

If you guys can suggest a proper title, please let me know and I can try to change it.

I was thinking the same thing yesterday

I was thinking the same thing yesterday

The following users liked this post:

nist7 (01-29-2021)

#188

Suzuka Master

Upvote Wall vs Main

#189

Senior Moderator

My vote is for that as well.

The following users liked this post:

Mizouse (01-29-2021)

#191

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

Updated the title. Hope it’s acceptable.

#192

Senior Moderator

I like it.

The following users liked this post:

Mizouse (01-29-2021)

#193

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

#195

#196

RAR

TF??

https://www.washingtonpost.com/lifes...rWo_gdnBtk3Img

“It’s about sex,” Scott Galloway tweeted in a viral thread earlier this week. “Specifically, young men not having (enough) sex.” Regularly available sex, Galloway argued, was a stabilizing force that led to “relationships, obligations and guardrails.” When sex was lacking, men were forced to act out: “Arm young men, in a basement, not at work, not having sex, not forming connection, with an RH account, a phone and stimulus and you have the perfect storm of volatility as they wage war against established players.”

Give the basement men sex, implied this tweet thread. Or they will take down the economy.

Give the basement men sex, implied this tweet thread. Or they will take down the economy.

#197

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

#198

Senior Moderator

cry more

#199

Suzuka Master

All we're doing is getting back our fair share of trade in money from gamestop. Relax Scott

The following users liked this post:

Mizouse (01-29-2021)

#200

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 40

Posts: 63,245

Received 2,787 Likes

on

1,987 Posts

he might be on to something thou.

I’ll be first to test his hypothesis, please send hot women to my basement to have sex with. I’ll let you guys know if I feel like selling my GME position.

The following users liked this post:

nist7 (01-29-2021)