linkedin ipo anyone in?

#3

Team Owner

How do they make money? There are enough people paying for the "extra stuff"?

#5

The sizzle in the Steak

#6

Team Owner

Here she comes.

Trending Topics

#8

Burning Brakes

Join Date: Dec 2004

Location: Boston MA

Age: 44

Posts: 1,078

Likes: 0

Received 0 Likes

on

0 Posts

employers pay to post ads and contact potential employees. If the price is right, I would buy the stock, but I have a feeling that the price will be too high for my taste.

#10

Team Owner

$86.

$86.

#12

Team Owner

Only if you were in good with a broker that had shares.

#14

Team Owner

The speculators have now taken over, 121.

#15

The sizzle in the Steak

Stay tuned to watch it fall like a rock.

#19

Drifting

Yes- the bankers must be kicking themselves since they left a lot of money on the table for this one. LNKD is way over-valued at this level- reminds me of ETOY back in 2000 a little bit.

I too would short the stock and I have a margin account, so I just might.

I too would short the stock and I have a margin account, so I just might.

#20

Niner Faithful

Almost every IPO goes crazy in prices the first week....the bankers get paid 7% regardless of the price....but they don't want to over-price the stock in the event that they can't sell it all - their institution will be stuck with the remaining shares

I need to read up more on their business plan and need to see how they heck they valued thing thing....

I need to read up more on their business plan and need to see how they heck they valued thing thing....

#21

Drifting

I tried to short 100 shares today at E*Trade, but no shares are available. I guess I'll try again later this week. Has anyone shorted?

#22

Moderator Alumnus

FYI-

The lofty gain in LinkedIn Corp., notwithstanding Friday's small second-day drop, has many on Wall Street making the case to short the stock. But this could be a risky proposition.

LinkedIn soared 109% on Thursday and ended its first day with a market capitalization of about $9 billion and a closing price, $94.25, that was 592 times earnings. Shares were up for most of Friday, before turning down late in the session to end the day 1.2% lower at $93.09.

"Brokers are recommending to their clients to short it," said Timothy Murphy of youDevise Ltd., which tracks short-term trading ideas at more than 500 institutional brokerages. "Even if you think it's a great business model, the feeling is that the valuation is way beyond what even the most bullish guys were hoping for."

The problem is, carrying out a profitable short trade could be difficult.

One reason is that LinkedIn's stock is likely to be difficult to come by in the securities-lending business, where those who want to short the stock have to borrow the shares. But the float is limited—the company sold only 7.84 million shares in its initial public offering.

Investors who want to short shares borrow the stock and then sell it, betting that the price of the shares will fall and that they can buy them back at a lower price for return to the lender. In order to borrow the shares, the investors have to pay the owner a fee, normally an annualized percentage of the stock's value.

Such fees also play an important role in the short case. Traders who do manage to get their hands on the stock in order to sell it are expected to pay a princely sum, market observers said. That means they would need a very steep drop in LinkedIn's shares to profit.

"It's going to be a tough game and a dangerous game," said Jonathan Bensimon, Société Générale's head of equities and derivatives trading. "Even if someone thinks it is valued way too high, he should think twice before shorting the stock."

http://online.wsj.com/article/SB1000...985217084.html (full article)

The lofty gain in LinkedIn Corp., notwithstanding Friday's small second-day drop, has many on Wall Street making the case to short the stock. But this could be a risky proposition.

LinkedIn soared 109% on Thursday and ended its first day with a market capitalization of about $9 billion and a closing price, $94.25, that was 592 times earnings. Shares were up for most of Friday, before turning down late in the session to end the day 1.2% lower at $93.09.

"Brokers are recommending to their clients to short it," said Timothy Murphy of youDevise Ltd., which tracks short-term trading ideas at more than 500 institutional brokerages. "Even if you think it's a great business model, the feeling is that the valuation is way beyond what even the most bullish guys were hoping for."

The problem is, carrying out a profitable short trade could be difficult.

One reason is that LinkedIn's stock is likely to be difficult to come by in the securities-lending business, where those who want to short the stock have to borrow the shares. But the float is limited—the company sold only 7.84 million shares in its initial public offering.

Investors who want to short shares borrow the stock and then sell it, betting that the price of the shares will fall and that they can buy them back at a lower price for return to the lender. In order to borrow the shares, the investors have to pay the owner a fee, normally an annualized percentage of the stock's value.

Such fees also play an important role in the short case. Traders who do manage to get their hands on the stock in order to sell it are expected to pay a princely sum, market observers said. That means they would need a very steep drop in LinkedIn's shares to profit.

"It's going to be a tough game and a dangerous game," said Jonathan Bensimon, Société Générale's head of equities and derivatives trading. "Even if someone thinks it is valued way too high, he should think twice before shorting the stock."

http://online.wsj.com/article/SB1000...985217084.html (full article)

#23

Drifting

Not sure about this logic. That article makes shorting sound much more ominous than it really is.

To short, you pay a margin fee and it's not that high or a big deal. Shorting gets more expensive for a dividend-paying stock but LNKD isn't in that category yet. So if I were to short 100 shares and LNKD goes down $10, I make $1000. In today's action, I would have made almost $600 on 100 shares of LNKD- that's not a bad return for a day if I had the gonads and opportunity to short last Friday.

Anytime, I see a stock with a Price/Sales of 14.x I want to short it because stocks don't stay at those lofty levels very long. Shoot a P/S of 14 makes APPL and GOOG look like 'value' stocks at only 3.x P/S and 5.x P/S respectively. I happen to be short of AAPL at the moment. Apple is much more of a company than Linkedin will ever be IMHO.

I'll try shorting again later this week. You can make a lot of $ shorting and I play both sides of the trade long & short. Being flexible is especially important in a bear market that we appear to be beginning now.

To short, you pay a margin fee and it's not that high or a big deal. Shorting gets more expensive for a dividend-paying stock but LNKD isn't in that category yet. So if I were to short 100 shares and LNKD goes down $10, I make $1000. In today's action, I would have made almost $600 on 100 shares of LNKD- that's not a bad return for a day if I had the gonads and opportunity to short last Friday.

Anytime, I see a stock with a Price/Sales of 14.x I want to short it because stocks don't stay at those lofty levels very long. Shoot a P/S of 14 makes APPL and GOOG look like 'value' stocks at only 3.x P/S and 5.x P/S respectively. I happen to be short of AAPL at the moment. Apple is much more of a company than Linkedin will ever be IMHO.

I'll try shorting again later this week. You can make a lot of $ shorting and I play both sides of the trade long & short. Being flexible is especially important in a bear market that we appear to be beginning now.

#24

Drifting

Anytime, I see a stock with a Price/Sales of 14.x I want to short it because stocks don't stay at those lofty levels very long. Shoot a P/S of 14 makes APPL and GOOG look like 'value' stocks at only 3.x P/S and 5.x P/S respectively. I happen to be short of AAPL at the moment. Apple is much more of a company than Linkedin will ever be IMHO.

I can see with a small float and high demand to short it it may be difficult. There are not enough shares out there. I would bet that when we see their next Q earnings that thing takes a sizable hit. I could be wrong, as it seems people are willing to pay exorbitant $$ for "buzz".

I'm hoping that buzz brings some major $$ to my startup so I can get a nice exit.

#25

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#26

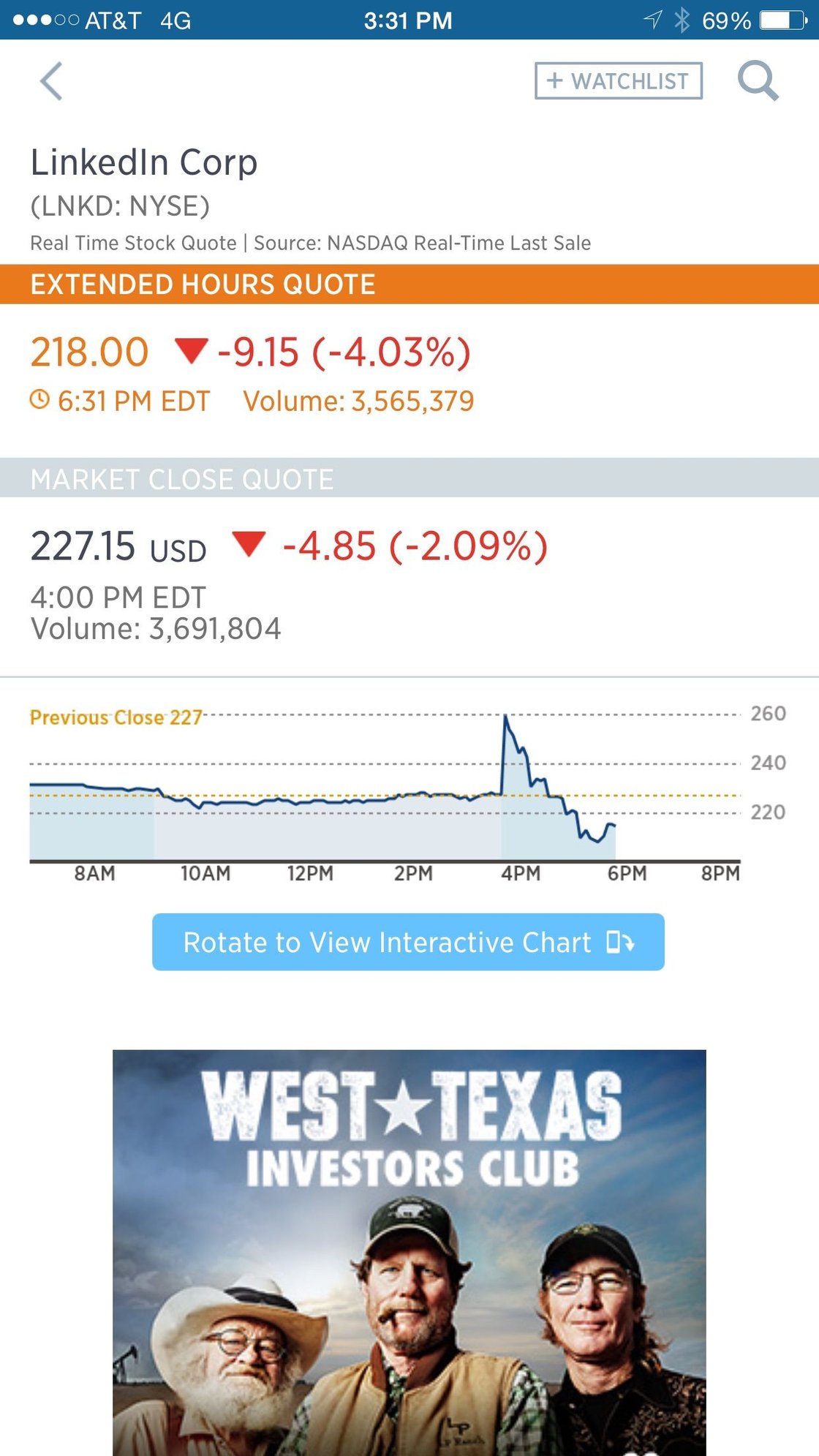

After Hours : $143.60 - Down $48.68 (-25.32%) 4:47PM EST

Forbes Welcome

LinkedIn Shares Plummet On Weak First Quarter Forecast

LinkedIn shared plummeted as much as 24% in after-hours trading after the professional networking site on Thursday released forecasts for the first quarter and all of 2016 that were well below analysts’ estimates.

LinkedIn said revenue for the first-quarter of 2016 would be about $820 million, compared with $867 million analysts were forecasting, according to First Call. LinkedIn’s guidance for first quarter net income, excluding certain expenses, was 55 cents per share, lower than analysts’ estimate of 74 cents. LinkedIn’s full-year revenue forecast of $3.6 billioin to $3.65 billion also fell short of the $3.91 billion expected by analysts.

Investors dumped shares in reaction to the weak guidance, even though LinkedIn’s fourth quarter results beat revenue and earnings estimates.

Revenue in the fourth quarter, ending December 31, was $862 million, up 34% from $643.4 million in the same period a year earlier, topping the $857.6 million expected on average.

The company posted a net loss of $8 million, or 6 cents a share, compared with a year-earlier profit of $3 million, or 2 cents a share. Excluding certain expenses, LinkedIn said it would have earned $126 million, or 94 cents a share, easily topping forecasts of 78 cents per share on that basis.

Globally, forecasting firm eMarketer expects the Mountain View, Calif.-based company to capture $1.13 billion in total ad revenue this year, or 3.4% of social network ad spending. In 2016, eMarketer predicts LinkedIn will have slower ad revenue growth than several major social networks. eMarketer expects LinkedIn to have ad revenue growth of 20.5% this year, slowing to 17.8% in 2017. By contrast, eMarketer says Twitter’s ad revenue will grow by 45% this year and that Facebook's will grow by 31.5%.

LinkedIn shared plummeted as much as 24% in after-hours trading after the professional networking site on Thursday released forecasts for the first quarter and all of 2016 that were well below analysts’ estimates.

LinkedIn said revenue for the first-quarter of 2016 would be about $820 million, compared with $867 million analysts were forecasting, according to First Call. LinkedIn’s guidance for first quarter net income, excluding certain expenses, was 55 cents per share, lower than analysts’ estimate of 74 cents. LinkedIn’s full-year revenue forecast of $3.6 billioin to $3.65 billion also fell short of the $3.91 billion expected by analysts.

Investors dumped shares in reaction to the weak guidance, even though LinkedIn’s fourth quarter results beat revenue and earnings estimates.

Revenue in the fourth quarter, ending December 31, was $862 million, up 34% from $643.4 million in the same period a year earlier, topping the $857.6 million expected on average.

The company posted a net loss of $8 million, or 6 cents a share, compared with a year-earlier profit of $3 million, or 2 cents a share. Excluding certain expenses, LinkedIn said it would have earned $126 million, or 94 cents a share, easily topping forecasts of 78 cents per share on that basis.

Globally, forecasting firm eMarketer expects the Mountain View, Calif.-based company to capture $1.13 billion in total ad revenue this year, or 3.4% of social network ad spending. In 2016, eMarketer predicts LinkedIn will have slower ad revenue growth than several major social networks. eMarketer expects LinkedIn to have ad revenue growth of 20.5% this year, slowing to 17.8% in 2017. By contrast, eMarketer says Twitter’s ad revenue will grow by 45% this year and that Facebook's will grow by 31.5%.

Last edited by AZuser; 02-04-2016 at 03:53 PM.

#27

Holy horse

$103.93 - Down $88.35 (-45.95%)

$103.93 - Down $88.35 (-45.95%)

#28

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#29

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

74¢ vs 60¢ expected

861 mill rev vs 828 expected

861 mill rev vs 828 expected

Last edited by Mizouse; 04-28-2016 at 03:15 PM.

#30

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

142.50 +19.49 (+15.84%) ah

#31

$192.84 -  $61.76 (47.12%)

$61.76 (47.12%)

Microsoft to Acquire LinkedIn for $26.2 Billion - WSJ

$61.76 (47.12%)

$61.76 (47.12%)Microsoft to Acquire LinkedIn for $26.2 Billion - WSJ

Microsoft to Acquire LinkedIn for $26.2 Billion

Deal is for $196 per LinkedIn share, a 50% premium to Friday’s close

June 13, 2016

Microsoft Corp. said Monday it has reached a deal to buy LinkedIn Corp. , the professional social-networking company, for $26.2 billion in cash.

Microsoft will pay $196 per LinkedIn share, a 50% premium to LinkedIn’s closing price on Friday.

In a blog post, Microsoft said LinkedIn will “retain its distinct brand, culture and independence,” with Chief Executive Jeff Weiner remaining at the helm, reporting to Microsoft CEO Satya Nadella.

The deal is expected to close within the year.

Shares of LinkedIn, which had dropped 42% so far this year through Friday’s close, jumped 47% to $193.25 in early trading. Microsoft shares fell 4.2%.

The companies see cost savings of about $150 million annually by 2018. LinkedIn would be required to pay $725 million breakup fee if it backs out of the deal.

“Today there is no one source of truth for an individual profile—the data is often scattered across many endpoints often with outdated or incomplete information,” Microsoft said in an investor presentation. “In the future, a professional’s profile will be unified and the right data at the right time will surface in an app, whether Outlook, Skype, Office, or elsewhere.”

Microsoft said it expects LinkedIn, which will be part of its productivity and business processes segment, will have a minimal negative impact—about 1%—on adjusted earnings for its fiscal 2017 and 2018 years. The deal is expected to add to Microsoft’s per-share earnings in 2019.

Mr. Weiner, in a letter to employees posted online, said the acquisition would help LinkedIn weather intensifying competition in the tech landscape.

“Imagine a world where we’re no longer looking up at Tech Titans such as Apple, Google, Microsoft, Amazon, and Facebook, and wondering what it would be like to operate at their extraordinary scale—because we’re one of them,” Mr. Weiner said. “With today’s news, we won’t need to imagine any of it because it’s now our reality.”

Mr. Weiner said “little is expected to change” for LinkedIn employees, except for those who jobs are entirely focused on maintaining LinkedIn’s status as a publicly traded company. “We’ll be helping you find your next play,” Mr. Weiner said of those employees.

Mr. Nadella pointed to LinkedIn’s professional-focused business as a good complement to its Office products.

“Together we can accelerate the growth of LinkedIn, as well as Microsoft Office 365 and Dynamics,” he said.

Deal is for $196 per LinkedIn share, a 50% premium to Friday’s close

June 13, 2016

Microsoft Corp. said Monday it has reached a deal to buy LinkedIn Corp. , the professional social-networking company, for $26.2 billion in cash.

Microsoft will pay $196 per LinkedIn share, a 50% premium to LinkedIn’s closing price on Friday.

In a blog post, Microsoft said LinkedIn will “retain its distinct brand, culture and independence,” with Chief Executive Jeff Weiner remaining at the helm, reporting to Microsoft CEO Satya Nadella.

The deal is expected to close within the year.

Shares of LinkedIn, which had dropped 42% so far this year through Friday’s close, jumped 47% to $193.25 in early trading. Microsoft shares fell 4.2%.

The companies see cost savings of about $150 million annually by 2018. LinkedIn would be required to pay $725 million breakup fee if it backs out of the deal.

“Today there is no one source of truth for an individual profile—the data is often scattered across many endpoints often with outdated or incomplete information,” Microsoft said in an investor presentation. “In the future, a professional’s profile will be unified and the right data at the right time will surface in an app, whether Outlook, Skype, Office, or elsewhere.”

Microsoft said it expects LinkedIn, which will be part of its productivity and business processes segment, will have a minimal negative impact—about 1%—on adjusted earnings for its fiscal 2017 and 2018 years. The deal is expected to add to Microsoft’s per-share earnings in 2019.

Mr. Weiner, in a letter to employees posted online, said the acquisition would help LinkedIn weather intensifying competition in the tech landscape.

“Imagine a world where we’re no longer looking up at Tech Titans such as Apple, Google, Microsoft, Amazon, and Facebook, and wondering what it would be like to operate at their extraordinary scale—because we’re one of them,” Mr. Weiner said. “With today’s news, we won’t need to imagine any of it because it’s now our reality.”

Mr. Weiner said “little is expected to change” for LinkedIn employees, except for those who jobs are entirely focused on maintaining LinkedIn’s status as a publicly traded company. “We’ll be helping you find your next play,” Mr. Weiner said of those employees.

Mr. Nadella pointed to LinkedIn’s professional-focused business as a good complement to its Office products.

“Together we can accelerate the growth of LinkedIn, as well as Microsoft Office 365 and Dynamics,” he said.

#32

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Must be nice

#33

Team Owner

Have to admit that I love LinkedIn since it found me my last job.

#34

Team Owner

Thread

Thread Starter

Forum

Replies

Last Post

the price will drop in a few weeks, people will want to double their money and then dump the stock.

the price will drop in a few weeks, people will want to double their money and then dump the stock.