Gold?

#241

Drifting

I realize i-shares are different so I'm not going to push this argument for paper holdings like i-shares.

Mind you we have the potential for a silver bubble at some point- I'm just saying it's not now- that's all. I would need to see a 1:15 gold/silver ratio before I would get into the Silver is a bubble camp and start selling some shares of SLV and maybe even some bullion too. As far as gold, I have given you guys targets for the dow/gold ratio which I have found as the best indicator of value. If this gets to 2 to 5 (it's now 8ish), then I will start lightening up on some holdings but not until that happens. At that level, I would move $ into more blue chip type stocks that would be very cheap in gold terms.

Everyone and there grandma weren't trading dot-coms. The overall percentage of the american people actively engaged in trading those stocks was comparatively small. You don't need a huge population of investors to create a bubble.

But look at how gold has changed in just the last few years with ETF's. The ability to trade gold has dramatically increased. Millions of more people are trading gold. And have you seen a jewelry store now without a sign declaring that they will buy gold. I was in one store browsing with my wife and talked to the owner who said nearly half his business is now buying gold.

Gold is being driven in large part by FUD.

Fear - The dollar will collapse, the world economy will collapse, the banks will all fail

Uncertainty - No one knows where to put their assets. Which bubble will pop next.

Dollars - Hundreds of billions of QE2, Chinese stimulus, etc... chasing limited returns.

But look at how gold has changed in just the last few years with ETF's. The ability to trade gold has dramatically increased. Millions of more people are trading gold. And have you seen a jewelry store now without a sign declaring that they will buy gold. I was in one store browsing with my wife and talked to the owner who said nearly half his business is now buying gold.

Gold is being driven in large part by FUD.

Fear - The dollar will collapse, the world economy will collapse, the banks will all fail

Uncertainty - No one knows where to put their assets. Which bubble will pop next.

Dollars - Hundreds of billions of QE2, Chinese stimulus, etc... chasing limited returns.

Regarding FUD, I think the most obvious issue is "D". That you can measure objectively and it's dropping big time. The $USD index (stockcharts.com) took another dive- it's at 73.52. I posted back in early January when it was 79 and projected that it was going to be 72 by end of the year.

(another example of me giving an overly conservative target). If things don't change quickly the $USD is going to test 71 and could drop below 70.

In closing, it's great to read all the posts on this thread. I wish you the best luck in navigating this stuff because it's not only scary but very important for all of you. If you pick right, you (might) prosper. If you pick wrong, it could be a painful decade. I'm afraid we are in store for a difficult 10 years as individuals and as a nation unfortunately.

#242

The sizzle in the Steak

#243

Moderator Alumnus

The mania for silver has spread to the stock market as day traders pile into the buying.

Trading got so heated during the past two days that shares traded in the iShares Silver Trust, the biggest exchange-traded fund tracking the price of silver, topped that of the SPDR S&P 500 ETF, usually one of the most actively traded securities in the world.

Day traders "are going crazy," says Joseph Saluzzi, co-head of trading at brokerage firm Themis Trading. "It's typical of the bubbly speculation that's been going on in silver."

On Monday, trading in the silver ETF was especially heavy, as silver prices soared to new 31-year highs and approached $50 an ounce. Silver is up 46% this year, part of a nine-month rally. The heavy ETF trading continued on Tuesday, as silver prices retreated.

Volume in the silver ETF on Monday reached a record 189 million shares, compared with an unusually low 65 million for the SPDR. The trading in the silver ETF was five times that of the 37 million daily average of the first quarter and blew past its previous daily peak of 149 million shares set in early November. On Tuesday, the silver ETF's trading was 125 million shares, falling just 21 million short of the SPDR volume.

The volume in silver ETFs is remarkable because the ETF until recently was relatively small and was shunned by mainstream traders. Its ascent reflects a surge in appetite for silver, which itself is reflecting a rise in the price of gold.

Investors have turned to precious metals amid worries about inflation and the weakness in the U.S. dollar. The metals are increasingly considered attractive as a permanent store of value that doesn't diminish like paper currencies.

Trading volume of silver futures contracts on the commodities exchange owned by CME Group rose to 319,205 contracts on Monday, a 58.6% jump from its prior record hit in November. Month to date, the contract's average daily volume has more than tripled compared with the same period last year. Total outstanding contracts in the silver-options market also reached a record on Monday.

http://online.wsj.com/article_email/...jEyNDYyWj.html

Trading got so heated during the past two days that shares traded in the iShares Silver Trust, the biggest exchange-traded fund tracking the price of silver, topped that of the SPDR S&P 500 ETF, usually one of the most actively traded securities in the world.

Day traders "are going crazy," says Joseph Saluzzi, co-head of trading at brokerage firm Themis Trading. "It's typical of the bubbly speculation that's been going on in silver."

On Monday, trading in the silver ETF was especially heavy, as silver prices soared to new 31-year highs and approached $50 an ounce. Silver is up 46% this year, part of a nine-month rally. The heavy ETF trading continued on Tuesday, as silver prices retreated.

Volume in the silver ETF on Monday reached a record 189 million shares, compared with an unusually low 65 million for the SPDR. The trading in the silver ETF was five times that of the 37 million daily average of the first quarter and blew past its previous daily peak of 149 million shares set in early November. On Tuesday, the silver ETF's trading was 125 million shares, falling just 21 million short of the SPDR volume.

The volume in silver ETFs is remarkable because the ETF until recently was relatively small and was shunned by mainstream traders. Its ascent reflects a surge in appetite for silver, which itself is reflecting a rise in the price of gold.

Investors have turned to precious metals amid worries about inflation and the weakness in the U.S. dollar. The metals are increasingly considered attractive as a permanent store of value that doesn't diminish like paper currencies.

Trading volume of silver futures contracts on the commodities exchange owned by CME Group rose to 319,205 contracts on Monday, a 58.6% jump from its prior record hit in November. Month to date, the contract's average daily volume has more than tripled compared with the same period last year. Total outstanding contracts in the silver-options market also reached a record on Monday.

http://online.wsj.com/article_email/...jEyNDYyWj.html

#245

Team Owner

I'm afraid to walk into a jewelry store to see what a gold ring costs.

#246

Drifting

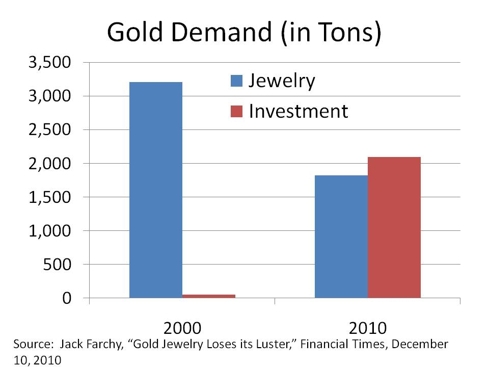

You also need to consider the current 'float' of gold though where you evaluate all the gold existing and how it is owned. Wikipedia lists the float as 50% jewelry, 40% investment, and 10% industrial. Maybe this has changed a little now but probably not a bunch. In this light, the 40%+ investment is not super extreme if you compare this percentage of institutional ownership to stocks we know and love.

As a side note, institutions own 71% of apple which is a bigger statement than 2010 gold demand shifting from jewelry to investors or the way the gold float is held now. I wouldn't say that this company is in a bubble because of that fact only. It is telling that <1% of APPL is owned by insiders though- not exactly a vote of confidence.

#247

Drifting

Here's a link from Bloomberg regarding how central banks (mostly china) are buying gold. One guy has a $5000/oz price target on Gold in 4 years time. Why would central banks be so interested in holding gold if it was in such a bubble?

http://www.bloomberg.com/news/2011-0...ice-rally.html

http://www.bloomberg.com/news/2011-0...ice-rally.html

#248

Drifting

Here's a link to a Motley Fool article about why silver may fall. I respect those guys and they have some good points. Here's the link: http://www.fool.com/investing/genera...all-by-66.aspx

I especially like the comments this article generated. For those Silver Bears, there are some good points to ponder.

The one point missed is how monetary policy might alter things this time. Even the article states that prices might begin their decline at the end of 2012- by that account there is a year+ of profit potential. That and the valuation metrics with gold and dow will make me hold positions for some time to come. Once SLV hits 75, I'll start selling some IRA positions possibly. I'll let my taxable positions hang on a little farther.

I especially like the comments this article generated. For those Silver Bears, there are some good points to ponder.

The one point missed is how monetary policy might alter things this time. Even the article states that prices might begin their decline at the end of 2012- by that account there is a year+ of profit potential. That and the valuation metrics with gold and dow will make me hold positions for some time to come. Once SLV hits 75, I'll start selling some IRA positions possibly. I'll let my taxable positions hang on a little farther.

#249

I feel the need...

Gilt-edged argument

The battle to explain the remorseless rise of the bullion price

http://www.economist.com/node/186208...ness_this_week

THOSE people who thought that reaching $1,000 an ounce was a sign that the bull market in gold was about to collapse have been proved wrong. The price of bullion recently passed $1,500.

Gold can be viewed in many ways: as a “barbarous relic” that is currently the subject of a speculative bubble; as the one reliable source of value over history; as a harbinger of hyperinflation; as a hedge against global financial or economic collapse; or even as a sign of the rising power of China and India.

Whichever factor you choose to explain gold’s bull run, it is not a short-term phenomenon. Since 2002 the average annual price of gold has risen by double digits in percentage terms in every year bar one (2005, when it gained 8.7%). As yet gold’s price chart does not display the classic bubble characteristic whereby the pace of increase seems to accelerate (although silver has been conforming to that pattern lately).

Gold does exhibit another bubble-like feature, however—the increasing participation of the public.....

Gold can be viewed in many ways: as a “barbarous relic” that is currently the subject of a speculative bubble; as the one reliable source of value over history; as a harbinger of hyperinflation; as a hedge against global financial or economic collapse; or even as a sign of the rising power of China and India.

Whichever factor you choose to explain gold’s bull run, it is not a short-term phenomenon. Since 2002 the average annual price of gold has risen by double digits in percentage terms in every year bar one (2005, when it gained 8.7%). As yet gold’s price chart does not display the classic bubble characteristic whereby the pace of increase seems to accelerate (although silver has been conforming to that pattern lately).

Gold does exhibit another bubble-like feature, however—the increasing participation of the public.....

#250

Moderator Alumnus

The only time that has happened in the last few decades was during the last bubble...

In this light, the 40%+ investment is not super extreme if you compare this percentage of institutional ownership to stocks we know and love.

Not following the correlation between stock institutional ownership percentages and the demand for a speculative commodity with little industrial usage.

As a side note, institutions own 71% of apple which is a bigger statement than 2010 gold demand shifting from jewelry to investors or the way the gold float is held now. I wouldn't say that this company is in a bubble because of that fact only. It is telling that <1% of APPL is owned by insiders though- not exactly a vote of confidence.

And how has the ratio of insider holdings in Apple changed over the last decade?

Could it have more to do with their compensation plan not allocating large ammounts of stock options?

#251

Drifting

^ I was trying to show a connection between individuals buying jewelry and institutions buying a stock- the institutions buying stock is similar to the original point that there are more 'investors' buying gold than individuals buying jewelry. I realize it's not a 100% correlation but there is a connection. One party buys either jewelry for a long term hold while another party may not and is in the position to make a quick (or slow) buck.

The point about Apple is that lots of institution investors hold that stock on the speculation it will continue to go up as opposed to insiders (who don't need options to buy stock- they can always buy it on the open market too if they want) that should have possibly more faith in their company than they appear to show by their ownership percentage. There are lots of companies that have higher insider ownership than Apple these days. It's just another of showing how speculation works where outsiders show more speculation than people that should really know about the internals of their own company better than the outsiders.

Anyway, tomorrow should be a painful day for those of us holding gold and silver long. The big question I have is if it's just one day of pain or weeks. My guess is both metals will open low and then start trending up from its lows- it will be a good indicator if these prices close above their midpoint between high & low prices for the day.

Key support levels for GLD:

20 day EMA - 145.38 (this is a exponential moving average that tends to be support)

50 day EMA - 141.54 (a decent entry point for new positions)

100 day EMA - 137.98 (a real decent entry point for new positions but will it go this far?)

Key support levels for SLV:

20 day EMA - 42.48 (I'll be selling IRA shares if it breaks this)

50 day EMA - 39.18 (I'll be buying if it gets down here)

100 day EMA - 34.07 (I'll be buying more if it gets down here)

I guess killing Osama might have an impact on the U.S. monetary policy in some way- maybe the war will end sooner? It might be a buying opportunity for gold this week when the dust settles and people realize that Osama's death won't increase the strength in the Dollar in the long term.

The point about Apple is that lots of institution investors hold that stock on the speculation it will continue to go up as opposed to insiders (who don't need options to buy stock- they can always buy it on the open market too if they want) that should have possibly more faith in their company than they appear to show by their ownership percentage. There are lots of companies that have higher insider ownership than Apple these days. It's just another of showing how speculation works where outsiders show more speculation than people that should really know about the internals of their own company better than the outsiders.

Anyway, tomorrow should be a painful day for those of us holding gold and silver long. The big question I have is if it's just one day of pain or weeks. My guess is both metals will open low and then start trending up from its lows- it will be a good indicator if these prices close above their midpoint between high & low prices for the day.

Key support levels for GLD:

20 day EMA - 145.38 (this is a exponential moving average that tends to be support)

50 day EMA - 141.54 (a decent entry point for new positions)

100 day EMA - 137.98 (a real decent entry point for new positions but will it go this far?)

Key support levels for SLV:

20 day EMA - 42.48 (I'll be selling IRA shares if it breaks this)

50 day EMA - 39.18 (I'll be buying if it gets down here)

100 day EMA - 34.07 (I'll be buying more if it gets down here)

I guess killing Osama might have an impact on the U.S. monetary policy in some way- maybe the war will end sooner? It might be a buying opportunity for gold this week when the dust settles and people realize that Osama's death won't increase the strength in the Dollar in the long term.

#252

Team Owner

Looks like the air has been let out of SLV.

If it finally settles at some level I may look to enter but right now the action is too risky for me.

If it finally settles at some level I may look to enter but right now the action is too risky for me.

#253

Drifting

As indicated a couple of posts ago, I'm back in the market buying both SLV & coins.

Perhaps this is a little early, but I'm averaging in on new money positions and holding existing positions. I'm hoping my 38.02 Limit order hits on SLV- perhaps tomorrow.

Perhaps this is a little early, but I'm averaging in on new money positions and holding existing positions. I'm hoping my 38.02 Limit order hits on SLV- perhaps tomorrow.

#254

I feel the need...

#255

Drifting

^Indeed! It should be fun for some of us to look back at the fear today a year from now. I'm sure we'll have a different perspective much like the early posts in this thread when silver was half the price that is is now- even after this week's haircut.

Gold is actually holding up pretty well which makes sense based on the run up in silver prices. The last time SLV hit the 100 day EMA was late January and that proved to be a great time to add positions- it's now at 33.72 with the 100 day EMA at 34.43. ** THIS IS LIKELY SUPPORT **

Gold is actually holding up pretty well which makes sense based on the run up in silver prices. The last time SLV hit the 100 day EMA was late January and that proved to be a great time to add positions- it's now at 33.72 with the 100 day EMA at 34.43. ** THIS IS LIKELY SUPPORT **

#256

The sizzle in the Steak

#257

I feel the need...

If you are measuring it by weeks and months perhaps. But the sooner you recognize that the speculative fervor in metals is largely being driven by ZIRP, the better you'll be able to recover from your party when the punch bowl disappears.

If you are measuring it by weeks and months perhaps. But the sooner you recognize that the speculative fervor in metals is largely being driven by ZIRP, the better you'll be able to recover from your party when the punch bowl disappears.Just pointing out that the historical return of precious metals is not too impressive over the long run.

#258

Drifting

If you are measuring it by weeks and months perhaps. But the sooner you recognize that the speculative fervor in metals is largely being driven by ZIRP, the better you'll be able to recover from your party when the punch bowl disappears.

If you are measuring it by weeks and months perhaps. But the sooner you recognize that the speculative fervor in metals is largely being driven by ZIRP, the better you'll be able to recover from your party when the punch bowl disappears.Just pointing out that the historical return of precious metals is not too impressive over the long run.

#259

Drifting

You don't really need a hyper-inflationary time to bolster the price of gold or silver. You could have a moderate 8-10% inflation rate and accomplish a rapid increase in commodity prices too.

I understand the arguments stated in this forum, but the bears need to ask themselves this simple question:

If the Euro goes down because of a probable Greek and Portugal default and the U.S. Dollar goes down because of a looming debt ceiling hike and inflation caused by QE1, QE2 and a probable round of QE3, just what are you going to invest in?

Stocks don't historically do that well in inflationary times- especially dividend paying stocks. Guns and ammo are not that practical as a preservation of wealth. Housing is not super liquid or portable for that matter. Bonds suck during inflationary times. Cigarettes might do well possibly, but smokers are a declining population and sizable quantities take up too much storage space. The stock market is closer to a top than a bottom based on the indicators I use. Shoot the U.S. killed OBL and the stock market couldn't even make a weekly gain last week- what's up with that performance? The only thing worse would have been a down Friday/Monday combo I guess.

Meanwhile, SLV made a nice recovery bounce and is now trading at 37.04. So far the support level I stated earlier held up and I have a nice 10% gain for a couple of days holding. Mark my words, some of you guys will be wishing you got in last week a year from now.

I understand the arguments stated in this forum, but the bears need to ask themselves this simple question:

If the Euro goes down because of a probable Greek and Portugal default and the U.S. Dollar goes down because of a looming debt ceiling hike and inflation caused by QE1, QE2 and a probable round of QE3, just what are you going to invest in?

Stocks don't historically do that well in inflationary times- especially dividend paying stocks. Guns and ammo are not that practical as a preservation of wealth. Housing is not super liquid or portable for that matter. Bonds suck during inflationary times. Cigarettes might do well possibly, but smokers are a declining population and sizable quantities take up too much storage space. The stock market is closer to a top than a bottom based on the indicators I use. Shoot the U.S. killed OBL and the stock market couldn't even make a weekly gain last week- what's up with that performance? The only thing worse would have been a down Friday/Monday combo I guess.

Meanwhile, SLV made a nice recovery bounce and is now trading at 37.04. So far the support level I stated earlier held up and I have a nice 10% gain for a couple of days holding. Mark my words, some of you guys will be wishing you got in last week a year from now.

#260

I feel the need...

Slim, Soros Slam Silver

by Todd Shriber

No need to try saying that headline five times fast, but it is certainly worth noting that a couple of members of the smart money crowd aren’t doing silver any favors these days. Billionaire investor George Soros has been reducing exposure to the white metal. And as if that wasn’t bad enough for silver bulls, CNBC reported on Wednesday afternoon that Carlos Slim, the richest man in the world, according to Forbes, has been selling silver futures “for weeks.”

Silver touched a 31-year high recently. But a combination of margin increases by the CME Group (CME), parent company of silver exchange Comex, and news that guys like Slim and Soros are dumping the metal, are proving to be a toxic brew. How toxic? Well, the five-day chart of the iShares Silver Trust paints the picture pretty well.

For almost two years, Soros’ hedge fund, Soros Fund Management, was a devoted gold and silver buyer, The Wall Street Journal reported. So intense was Soros’ devotion to precious metals that he became the seventh-largest shareholder of the SPDR Gold Shares (GLD), holding 4.7 million shares at the end of last year of the world’s second-largest ETF, according to Tickerspy.com.

Put in very simple terms, it’s kind of a big deal when someone like Soros decides it’s time to take his profits in almost any security, let alone in a market where the chorus singing about a bubble has been growing ever louder, as it has recently with silver.....

No need to try saying that headline five times fast, but it is certainly worth noting that a couple of members of the smart money crowd aren’t doing silver any favors these days. Billionaire investor George Soros has been reducing exposure to the white metal. And as if that wasn’t bad enough for silver bulls, CNBC reported on Wednesday afternoon that Carlos Slim, the richest man in the world, according to Forbes, has been selling silver futures “for weeks.”

Silver touched a 31-year high recently. But a combination of margin increases by the CME Group (CME), parent company of silver exchange Comex, and news that guys like Slim and Soros are dumping the metal, are proving to be a toxic brew. How toxic? Well, the five-day chart of the iShares Silver Trust paints the picture pretty well.

For almost two years, Soros’ hedge fund, Soros Fund Management, was a devoted gold and silver buyer, The Wall Street Journal reported. So intense was Soros’ devotion to precious metals that he became the seventh-largest shareholder of the SPDR Gold Shares (GLD), holding 4.7 million shares at the end of last year of the world’s second-largest ETF, according to Tickerspy.com.

Put in very simple terms, it’s kind of a big deal when someone like Soros decides it’s time to take his profits in almost any security, let alone in a market where the chorus singing about a bubble has been growing ever louder, as it has recently with silver.....

Read more: http://www.traderdaily.com/05/slim-s...#ixzz1MEFLf1Td

#261

I feel the need...

Gold Coins Show Bull Market Unbowed in Commodities Decline

.....The banks were also boosting holdings in 1980 when gold rose to a then-record $850, only to fall for most of the next 20 years. That high is equal to $2,299 in inflation-adjusted terms, according to a calculator on the website of the Federal Reserve Bank of Minneapolis. Prices tripled from 1999 through the beginning of 2008 as the banks sold more than 4,000 tons.

“Central banks don’t have the best track record trading gold,” said Malcolm Freeman, managing director of Ambrian Commodities Ltd. in London. He pointed to the U.K., which sold about 400 tons over about a two-year period ending in 2002, getting no more than $296.50 an ounce.

Rising interest rates could also diminish the appeal of gold, which generally earns investors returns only through price gains. At least two dozen nations and the European Central Bank raised rates this year, data compiled by Bloomberg show. The Fed will probably hold its benchmark rate in a range of zero to 0.25 percent through the fourth quarter, according to the median forecast of 72 economists surveyed by Bloomberg.....

“Central banks don’t have the best track record trading gold,” said Malcolm Freeman, managing director of Ambrian Commodities Ltd. in London. He pointed to the U.K., which sold about 400 tons over about a two-year period ending in 2002, getting no more than $296.50 an ounce.

Rising interest rates could also diminish the appeal of gold, which generally earns investors returns only through price gains. At least two dozen nations and the European Central Bank raised rates this year, data compiled by Bloomberg show. The Fed will probably hold its benchmark rate in a range of zero to 0.25 percent through the fourth quarter, according to the median forecast of 72 economists surveyed by Bloomberg.....

Figured LaCosta would appreciate the (central banks = dumb money) commentary.

#262

Drifting

^ I did appreciate those comments. I remember the IMF selling gold a couple years ago too- not a smart move in hindsight.

While central banks are interesting, I'm much more interested in Soros and if he's done selling silver at the moment. He had 5 million SLV shares and 4.7 million GLD shares. SLV trades in the 87 million share/day range and GLD is near 5 million. So he might be done selling since things have tanked already on a lot more volume that he and others have to sell. I'm comforted to see that volumes were down on today's down day, so perhaps the selling pressure of Soros and rising margin rates are fading.

I traded SGG (sugar) last year and took a beating last March through May with those positions and sugar vaulted after all the weak holders got out of it. I think things will work very similar this time with SLV. Time will tell. In fact, I almost punched out today on a long-term gain of SGG, but decided to hold on for a bit longer.

SLV is 32.77 with 200 day EMA support at 30 (so there's still more downside risk at these levels). GLD is looking more extended at 145.30 with the 200 day EMA at 133.81. So I would be much more eager to add silver positions than gold and probably will later this week. SIL (miners index) is looking very interesting for a purchase tomorrow.

While central banks are interesting, I'm much more interested in Soros and if he's done selling silver at the moment. He had 5 million SLV shares and 4.7 million GLD shares. SLV trades in the 87 million share/day range and GLD is near 5 million. So he might be done selling since things have tanked already on a lot more volume that he and others have to sell. I'm comforted to see that volumes were down on today's down day, so perhaps the selling pressure of Soros and rising margin rates are fading.

I traded SGG (sugar) last year and took a beating last March through May with those positions and sugar vaulted after all the weak holders got out of it. I think things will work very similar this time with SLV. Time will tell. In fact, I almost punched out today on a long-term gain of SGG, but decided to hold on for a bit longer.

SLV is 32.77 with 200 day EMA support at 30 (so there's still more downside risk at these levels). GLD is looking more extended at 145.30 with the 200 day EMA at 133.81. So I would be much more eager to add silver positions than gold and probably will later this week. SIL (miners index) is looking very interesting for a purchase tomorrow.

#263

The sizzle in the Steak

QE3 is a coming!!! QE3 is a coming!!!!

Commodities gonna skyrocket!!!

The inflation monster cometh!

The summer-fall of QE3...coming soon.

Commodities gonna skyrocket!!!

The inflation monster cometh!

The summer-fall of QE3...coming soon.

#264

APMex just dropped their pricing over spot on Silver. Makes me want to pickup a few 10oz bars. Kinda regret waiting to see if it'd drop under $30.00 (hit $32.xx) but I think we'll see $50-$60 by end of the year. Probably still worth buying at below $38

#265

Drifting

I think we'll see QE5 in the future so this easing is just beginning and there is lots of upside left in this trade. The down days like we had in silver will shake out weak holders and let bulls acquire more on weakness.

^ I think you'll be fine buying silver at these levels as long as you intend to hold them for a while. Silver is historically weak the first 2/3 of June so it might be good to average in with a few buys scattered about this month.

I'm not sure about APMex, but with BullionDirect there really is no penalty spreading my orders across a few days or a weekend since the commission is based on the sales price and not a per-trade type of pricing. I might buy some more 1oz silver rounds tomorrow and keep adding more positions this next week if there is any more weakness.

SLV at 35.75 is just above the 100 day EMA of 34.68 which SLV=34.69 should be the great time to buy bullion. I use SLV to track technicals and this governs how I trade the actual metal- SLV and GLD work well for technical analysis and are the best tools I have for entry/exit points- much more actively traded than Maples, Eagles, Pandas or Krugs.

The promising thing for me is that the Dow/Gold ratio just broke below 8.0 today to the downside and is now 7.99. I think this ratio is going to trend down more this year which means either the Dow will continue to go down, or gold will go up, or both will happen. Silver will eventually snap to pricing of Gold so this is also bullish for Silver too.

^ I think you'll be fine buying silver at these levels as long as you intend to hold them for a while. Silver is historically weak the first 2/3 of June so it might be good to average in with a few buys scattered about this month.

I'm not sure about APMex, but with BullionDirect there really is no penalty spreading my orders across a few days or a weekend since the commission is based on the sales price and not a per-trade type of pricing. I might buy some more 1oz silver rounds tomorrow and keep adding more positions this next week if there is any more weakness.

SLV at 35.75 is just above the 100 day EMA of 34.68 which SLV=34.69 should be the great time to buy bullion. I use SLV to track technicals and this governs how I trade the actual metal- SLV and GLD work well for technical analysis and are the best tools I have for entry/exit points- much more actively traded than Maples, Eagles, Pandas or Krugs.

The promising thing for me is that the Dow/Gold ratio just broke below 8.0 today to the downside and is now 7.99. I think this ratio is going to trend down more this year which means either the Dow will continue to go down, or gold will go up, or both will happen. Silver will eventually snap to pricing of Gold so this is also bullish for Silver too.

#267

Drifting

Anyone notice how SLV bounced off the 34.68 level today I referenced as support? SLV closed at 35.33.

That was a textbook bounce off the 100 day EMA. An entry point doesn't get any better than that. There's a decent chance this level gets tested again so don't fret if you didn't get in today. The more bounces off support the stronger the support is.

That was a textbook bounce off the 100 day EMA. An entry point doesn't get any better than that. There's a decent chance this level gets tested again so don't fret if you didn't get in today. The more bounces off support the stronger the support is.

#268

The sizzle in the Steak

$5k/oz?!?!!?

An exhaustive report by Standard Chartered predicts that gold [GCCV1 1526.70 11.10 (+0.73%) ] will more than triple to $5,000 an ounce because of a lack of supply, not just because of a surge in demand that most bullion bugs cite in their bullish calls.

“There are very few large gold mines set to commence operation in the next five years,” said Standard’s analyst Yan Chen in a report Monday. “The limited new supply comes at a time when central banks have turned from being net sellers to significant net buyers of gold. The result, in our view, will be a gold market in deficit, even assuming flat growth in demand. With the supply-demand balance so out of kilter, we see the gold price potentially going to US$5,000/oz.”

The London-based firm is among the first to focus on the supply-side of the gold equation amid the many bullish forecasts out there on the metal. After analyzing 345 gold mines and 30 copper/base metal gold mines around the globe, the team estimates annual gold production will be just 3.6 percent over the next five years.

“They make a pretty compelling argument, especially when it comes to mine supply,” said Brian Kelly, head of Brian Kelly Capital and a ‘Fast Money’ trader. “Most analysis focuses on demand from China and India, which of course can disappear as quickly as it materialized.”

But that’s unlikely to happen over the next five years as central banks look to further diversify their holdings of U.S. dollars and as emerging countries buy more gold in the aftermath of the global paper currency crisis.

“Currently, only 1.8 percent of China’s foreign exchange reserves is in gold,” wrote Chen and the Standard team in the 68-page report. “If the country were to bring this proportion in line with the global average of 11 percent, it would have to buy 6,000 more tonnes of gold, equivalent to more than 2 years of gold production.”

The bold call is among the most bullish out there. In a Bank of America/Merrill Lynch survey of global money managers released Tuesday, just about a third of money managers felt gold was overvalued. However, that is the highest reading in that survey in more than a year.

Standard Chartered recommends that clients buy shares of smaller gold miners to get the most upside from its prediction but also said clients could buy physical gold and gold exchange-traded funds.

“There are very few large gold mines set to commence operation in the next five years,” said Standard’s analyst Yan Chen in a report Monday. “The limited new supply comes at a time when central banks have turned from being net sellers to significant net buyers of gold. The result, in our view, will be a gold market in deficit, even assuming flat growth in demand. With the supply-demand balance so out of kilter, we see the gold price potentially going to US$5,000/oz.”

The London-based firm is among the first to focus on the supply-side of the gold equation amid the many bullish forecasts out there on the metal. After analyzing 345 gold mines and 30 copper/base metal gold mines around the globe, the team estimates annual gold production will be just 3.6 percent over the next five years.

“They make a pretty compelling argument, especially when it comes to mine supply,” said Brian Kelly, head of Brian Kelly Capital and a ‘Fast Money’ trader. “Most analysis focuses on demand from China and India, which of course can disappear as quickly as it materialized.”

But that’s unlikely to happen over the next five years as central banks look to further diversify their holdings of U.S. dollars and as emerging countries buy more gold in the aftermath of the global paper currency crisis.

“Currently, only 1.8 percent of China’s foreign exchange reserves is in gold,” wrote Chen and the Standard team in the 68-page report. “If the country were to bring this proportion in line with the global average of 11 percent, it would have to buy 6,000 more tonnes of gold, equivalent to more than 2 years of gold production.”

The bold call is among the most bullish out there. In a Bank of America/Merrill Lynch survey of global money managers released Tuesday, just about a third of money managers felt gold was overvalued. However, that is the highest reading in that survey in more than a year.

Standard Chartered recommends that clients buy shares of smaller gold miners to get the most upside from its prediction but also said clients could buy physical gold and gold exchange-traded funds.

...a bit over-the-top....but interesting.

#269

Has anyone read this. Buying gold/silver will be illegal and apparently Barack stated that it will be illegal to own over a 1/4 ounce of gold.

Also the only people who will be able to purchase PMs are those with a Net Worth over 1,000,000 or a Net Income of 300,000

http://www.zerohedge.com/article/tra...inning-july-15

Also the only people who will be able to purchase PMs are those with a Net Worth over 1,000,000 or a Net Income of 300,000

http://www.zerohedge.com/article/tra...inning-july-15

#270

Drifting

Has anyone read this. Buying gold/silver will be illegal and apparently Barack stated that it will be illegal to own over a 1/4 ounce of gold.

Also the only people who will be able to purchase PMs are those with a Net Worth over 1,000,000 or a Net Income of 300,000

http://www.zerohedge.com/article/tra...inning-july-15

Also the only people who will be able to purchase PMs are those with a Net Worth over 1,000,000 or a Net Income of 300,000

http://www.zerohedge.com/article/tra...inning-july-15

#271

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,634

Received 2,328 Likes

on

1,308 Posts

Just someone trying to drive up prices

x (true inflation rate)

x (true inflation rate)

x (true inflation rate)

x (true inflation rate)

#272

Drifting

I'm back in the hunt buying Silver- have a number of open trades now at BullionDirect that hopefully will fire this weekend. Silver looks to be at a support level- it sure got hammered this last week though.

From a technical viewpoint, I think Silver looks to be consolidating and digesting the gains from Feb-May, which were pretty stellar. I would love to see silver flatline for a month or so in the mean time. Once Silver moves up, it's going to move quickly. As I write this the SLV ishare is 33.00 and I think $40 will be in quick order when it wakes up. I expect August-October to be a strong market interval so it's nice to get in now while it's easier.

From a technical viewpoint, I think Silver looks to be consolidating and digesting the gains from Feb-May, which were pretty stellar. I would love to see silver flatline for a month or so in the mean time. Once Silver moves up, it's going to move quickly. As I write this the SLV ishare is 33.00 and I think $40 will be in quick order when it wakes up. I expect August-October to be a strong market interval so it's nice to get in now while it's easier.

#273

Drifting

It's amazing how well last weekend's trading went at BullionDirect so far. SLV was 33.00 on Saturday and it's now 35.50 on Thursday. Conversely I got some SIB999:0001:R silver rounds for as low as $34.50 and those are going for $36.90 now. The .1oz Krugerands had reasonable gains and I was able to snag some of those for $161 and those are now trading for $164. This should show how silver can outperform gold- you get higher gains per coin for a 5th of the outlay cost.

From a technical standpoint, SLV is looking to breakout back to its previous highs having busted through its 20 day EMA this week- hello 45-ish before year end. GLD at 149.15 looks to be up against some resistance soon at 152.

From a technical standpoint, SLV is looking to breakout back to its previous highs having busted through its 20 day EMA this week- hello 45-ish before year end. GLD at 149.15 looks to be up against some resistance soon at 152.

#274

^ Very much appreciate your insight. I think I have to go into gold, even though the smart money says stay away

What I know is Greece is going down, unavoidable. Somebody told me "no big deal, only half the size of Lehman". I let out a howl.

Germans will never do the right thing, seem to welcome GDII. PIIGS all go down. Sets off world wide financial crisis 100 times bigger than what we are going through.

Who cares about Greece? Guess who insures all that debt, we think CDS in US banks and insurance.

Never paid a claim, never will. Did not set aside anything near sufficient reserves, thats why

What I know is Greece is going down, unavoidable. Somebody told me "no big deal, only half the size of Lehman". I let out a howl.

Germans will never do the right thing, seem to welcome GDII. PIIGS all go down. Sets off world wide financial crisis 100 times bigger than what we are going through.

Who cares about Greece? Guess who insures all that debt, we think CDS in US banks and insurance.

Never paid a claim, never will. Did not set aside anything near sufficient reserves, thats why

#275

Drifting

^thanks.

Today was a turn-around day in Silver. Silver opened down and closed strong. I would have felt better if SLV recovered 1/2 its losses from monday but it looks like futures are strong for tomorrow doing this feat and more possibly. I like adding positions this time of year because they tend to make money if you hold them until February since prices tend to have a seasonal low this time of year and gain demand for the jewelry business for weddings and gifts into V-day. For these reasons, the next few weeks are the sweet spot to get into the gold/silver trade.

Gold has been strong on both days so it looks like there might be some demand on using Gold as a hedge against other currencies possibly. This action could accelerate once the US and Dollar is deemed the next financial issue of focus. Just because the U.S. raises the debt limit (and it will just maybe at the very end of this month at the current pace) doesn't mean its problems are behind it. The first step in balancing a budget is deciding not to continue raising limits and this doesn't look to be in the cards this time around. Greece had no choice, but the U.S. seems to think it has a choice still. There will be a time when nobody wants our bonds and this attitude will abruptly change. When that happens, gold and silver is going to soar.

Today was a turn-around day in Silver. Silver opened down and closed strong. I would have felt better if SLV recovered 1/2 its losses from monday but it looks like futures are strong for tomorrow doing this feat and more possibly. I like adding positions this time of year because they tend to make money if you hold them until February since prices tend to have a seasonal low this time of year and gain demand for the jewelry business for weddings and gifts into V-day. For these reasons, the next few weeks are the sweet spot to get into the gold/silver trade.

Gold has been strong on both days so it looks like there might be some demand on using Gold as a hedge against other currencies possibly. This action could accelerate once the US and Dollar is deemed the next financial issue of focus. Just because the U.S. raises the debt limit (and it will just maybe at the very end of this month at the current pace) doesn't mean its problems are behind it. The first step in balancing a budget is deciding not to continue raising limits and this doesn't look to be in the cards this time around. Greece had no choice, but the U.S. seems to think it has a choice still. There will be a time when nobody wants our bonds and this attitude will abruptly change. When that happens, gold and silver is going to soar.

#277

Why didn't I buy at $32.xx =(

#279

Drifting

SLV at 37.41 has had a nice run this week and 37.72 may prove to be a resistance level in the near term. Watch out if this breaks to the upside this next week because SLV will move UP afterwards. I look for a 3% upside break or $38.86 or higher- if that happens I'll be buying a lot more. It's nice to try to bottom-fish but I make a lot more money buying when levels like this bust to the upside. Anyone fretting about not getting in could have a prime opportunity as soon as tomorrow possibly. So far the futures are weak. Even a down day tomorrow should yield a weekly gain for SLV of 2+% which I'll take any time.

#280

Drifting

Martin Armstrong posted an essay on Gold and his analysis of price movement with a lot of history on the subject. In short, he thinks gold will hit a near term high in late August and there could be a correction in price later this year possibly with 1300 being support.

Here's the link for anyone interested: http://www.martinarmstrong.org/files...07-13-2011.pdf

Here's the link for anyone interested: http://www.martinarmstrong.org/files...07-13-2011.pdf