Gold?

#201

Moderator Alumnus

#202

The sizzle in the Steak

Moogs, I'm curious as to your allocation in precious metals and is it greater than 10% of your overall portfolio? Sure, its great to have a winning position no matter what time of year, but to think that you've found a magic carpet ride to the promised land is a bit premature.

You never see an asset class win year after year. It wouldn't shock me to see precious metals make a correction when the Fed takes away the punch bowl. Granted, the Fed Funds futures market is not indicating an upward bias very soon, but just keep that in mind - you want to be ahead of the curve not behind.

You never see an asset class win year after year. It wouldn't shock me to see precious metals make a correction when the Fed takes away the punch bowl. Granted, the Fed Funds futures market is not indicating an upward bias very soon, but just keep that in mind - you want to be ahead of the curve not behind.

It's not the bulk of my portfolio...not by a long shot.....but they have always been a part of my "investments".

Everything rises and falls...that's a given, but people screaming about the commodities "bubble" for the past 2-3 years is nuts. They missed the boat.

Sure it will come down at some point....but it makes zero sense to me looking back 2-3 years ago that anyone wanted to stay away from commodities....and not just precious metals either.

#203

Moderator Alumnus

Let's just say I got into precious metals back when silver was about 4-5 bucks and gold was around 300 bucks.....many many moons ago.

It's not the bulk of my portfolio...not by a long shot.....but they have always been a part of my "investments".

Everything rises and falls...that's a given, but people screaming about the commodities "bubble" for the past 2-3 years is nuts. They missed the boat.

Sure it will come down at some point....but it makes zero sense to me looking back 2-3 years ago that anyone wanted to stay away from commodities....and not just precious metals either.

It's not the bulk of my portfolio...not by a long shot.....but they have always been a part of my "investments".

Everything rises and falls...that's a given, but people screaming about the commodities "bubble" for the past 2-3 years is nuts. They missed the boat.

Sure it will come down at some point....but it makes zero sense to me looking back 2-3 years ago that anyone wanted to stay away from commodities....and not just precious metals either.

Who are these people you keep referring to that have said to stay completely out of commodities for the last 2-3 years?

And how much do you allocate towards precious metals? 20%, 30%, ?

#204

Senior Moderator

Join Date: May 2003

Location: Better Neighborhood, Arizona

Posts: 45,634

Received 2,328 Likes

on

1,308 Posts

Same here. Throw in some Ford stock and Norwegian/Canadian oil stocks and lets just say I did well. Hell, we need a thread entitled 'Tell us a little about your portfolio'

Gold has its purpose. The people who were smart and bought up some early in the game almost certainly have no regrets.

#205

Moderator Alumnus

#206

The sizzle in the Steak

Same here. Throw in some Ford stock and Norwegian/Canadian oil stocks and lets just say I did well. Hell, we need a thread entitled 'Tell us a little about your portfolio'

Gold has its purpose. The people who were smart and bought up some early in the game almost certainly have no regrets.

Have you been looking at my portfolio?!?!?!?

Have you been looking at my portfolio?!?!?!?

#207

The sizzle in the Steak

How much is my allocation for precious metals?....well it varies depending on my considerations of market conditions. I move up and down in allocation....just like everyone else.....there is no set percentage.

#208

Moderator Alumnus

No.

I think we have discussed oil and corn and China's role in rising prices in R&P. But I haven't said much about commodities until this thread last year. And I certainly wouldn't wouldn't say that anyone should stay completely out by any means.

How much is my allocation for precious metals?....well it varies depending on my considerations of market conditions. I move up and down in allocation....just like everyone else.....there is no set percentage.

Todays approximate percentage?

#209

#210

I feel the need...

#211

The sizzle in the Steak

#212

Drifting

Happy New Year! For a two year old thread, this has as much significance now as it did in 2009. People investing in Gold or Silver in 2009 have made a great investment.

I'm expecting another good year with Gold and particularly Silver again for all the same reasons I have written in previous posts in this thread.

It was a great buying opportunity in early December in retrospect.

Today's price for SLV is: 30.18 , 13 day EMA= 29.06 20 day EMA= 28.65, 50 day EMA= 26.86

Today's price for GLD is: 138.62, 13 day EMA =136.28 20 day EMA= 135.86, 50 day EMA=133.96

SLV (Silver) will most-likely test and possibly break 40 this year. I think GLD will break 160 this year. So this post will be good to verify in a year from now to see how close I got in these projections.

I'm expecting another good year with Gold and particularly Silver again for all the same reasons I have written in previous posts in this thread.

It was a great buying opportunity in early December in retrospect.

Today's price for SLV is: 30.18 , 13 day EMA= 29.06 20 day EMA= 28.65, 50 day EMA= 26.86

Today's price for GLD is: 138.62, 13 day EMA =136.28 20 day EMA= 135.86, 50 day EMA=133.96

SLV (Silver) will most-likely test and possibly break 40 this year. I think GLD will break 160 this year. So this post will be good to verify in a year from now to see how close I got in these projections.

SLV ( now at 41.84) just met my year price target of $40 in just 4 months while I was away on a nice family cruise this past week.

GLD(145.51) is still on track to meet the 160 year end objective though and seems like the better value possibly. I'm actually buying more gold these days than silver since gold is likely to catchup at some point. The .1oz coins seem like a great deal at today's prices. So it's not too late for anyone with no exposure even at these extended levels IMHO.

I'm now raising my target for SLV to be $48 and will hold the GLD target of $160. There will always be a debate on bubble status and I will continue to argue that it's not so much gold/silver in a bubble as the dollar being in a slump- this is holding more true as the weeks and months go buy. Anyone notice that the Dollar index broke 75? This index was around 81 a year ago. I think this index could test 70 before year end if trends continue.

I have about 30% on investable assets in gold/silver/oil commodities in some form or another and will hold this exposure for some time longer. My main price target is the Dow/Gold ratio and that needs to come down a lot lower before I contemplate selling anything- it's only at 8.3 at the moment. I have a target for the next two years of 5.0 so I would be a fool selling now and so would anyone. If 5.0 hits, it means gold is either going higher or the Dow has some correcting to do or a little bit of both scenarios which is my hunch.

I love hearing the experts on CNBC talk about Gold being in a bubble because they are dead wrong now and will continue to be in the foreseeable future.

#213

Wow a quick 3 months and an annual price target for SLV has already been met. Yikes, but not a huge surprise with current monetary policy.

SLV ( now at 41.84) just met my year price target of $40 in just 4 months while I was away on a nice family cruise this past week.

GLD(145.51) is still on track to meet the 160 year end objective though and seems like the better value possibly. I'm actually buying more gold these days than silver since gold is likely to catchup at some point. The .1oz coins seem like a great deal at today's prices. So it's not too late for anyone with no exposure even at these extended levels IMHO.

I'm now raising my target for SLV to be $48 and will hold the GLD target of $160. There will always be a debate on bubble status and I will continue to argue that it's not so much gold/silver in a bubble as the dollar being in a slump- this is holding more true as the weeks and months go buy. Anyone notice that the Dollar index broke 75? This index was around 81 a year ago. I think this index could test 70 before year end if trends continue.

I have about 30% on investable assets in gold/silver/oil commodities in some form or another and will hold this exposure for some time longer. My main price target is the Dow/Gold ratio and that needs to come down a lot lower before I contemplate selling anything- it's only at 8.3 at the moment. I have a target for the next two years of 5.0 so I would be a fool selling now and so would anyone. If 5.0 hits, it means gold is either going higher or the Dow has some correcting to do or a little bit of both scenarios which is my hunch.

I love hearing the experts on CNBC talk about Gold being in a bubble because they are dead wrong now and will continue to be in the foreseeable future.

SLV ( now at 41.84) just met my year price target of $40 in just 4 months while I was away on a nice family cruise this past week.

GLD(145.51) is still on track to meet the 160 year end objective though and seems like the better value possibly. I'm actually buying more gold these days than silver since gold is likely to catchup at some point. The .1oz coins seem like a great deal at today's prices. So it's not too late for anyone with no exposure even at these extended levels IMHO.

I'm now raising my target for SLV to be $48 and will hold the GLD target of $160. There will always be a debate on bubble status and I will continue to argue that it's not so much gold/silver in a bubble as the dollar being in a slump- this is holding more true as the weeks and months go buy. Anyone notice that the Dollar index broke 75? This index was around 81 a year ago. I think this index could test 70 before year end if trends continue.

I have about 30% on investable assets in gold/silver/oil commodities in some form or another and will hold this exposure for some time longer. My main price target is the Dow/Gold ratio and that needs to come down a lot lower before I contemplate selling anything- it's only at 8.3 at the moment. I have a target for the next two years of 5.0 so I would be a fool selling now and so would anyone. If 5.0 hits, it means gold is either going higher or the Dow has some correcting to do or a little bit of both scenarios which is my hunch.

I love hearing the experts on CNBC talk about Gold being in a bubble because they are dead wrong now and will continue to be in the foreseeable future.

#214

Drifting

May 2012 & May 2013 Price targets for Silver mostly

I have been getting lots of emails on my thoughts about a price target for an ounce of Silver, so I thought I would share this info with you guys as well since it seems like a topic of interest these days. Most of this email are from friends or acquaintances that know I'm bullish on gold/silver and are inquiring on if it's going to continue going up. Naturally they don't want to buy and have it crash on them. Meanwhile prices continue to go up and they're starting to think it's too late to invest. I keep telling them not to worry and just do it.

The price targets I'm looking at are: $75/ounce by May 2012 and $100 by May 2013. Read further if you want to understand my rationale, otherwise those are my numbers.

Rationale:

Silver has historically traded with a 20:1 ratio to gold. When the U.S. was on a gold standard we had $20 gold pieces and Silver Dollars- hence 20:1. With gold trading now at $1500/oz, Silver would need to trade at $75. I think it will take a years time before the historic ratio materializes. The ratio has been out of whack for a long time and was as high as 80:1 in recent years- now it's 35:1 so it has moved closer to target and quickly. Things will probably snap to historic ratios in a year's time.

The longer term $100 target is based on the simple observation that gold is also going up, but a lot slower than Silver at the moment. I figure gold will hit $2000/oz in two years and silver will be snapped to the 20:1 ratio. I'm factoring gold going up about 40% in two years time which seems very plausible considering the move that Silver has done in 5 months time: 90%.

I guess these are numbers that I'm pretty confident in seeing occurring. I have been known to be overly conservative in my forecasting, so we could see much higher numbers too. It's anybody's guess at this stuff, but that's the best working data I have at the moment and I'm definitely LONG in this market.

For those of you thinking it's just a bubble, ask yourself how many people you know that actually buy Gold & Silver? At my work, I'm the only one that I know of in a 50 person small company. I would need to see half the people I know be actively buying gold and silver before I would think of bubble status and that is not the case. No neighbors are buying, only my brother, father, and cousin are buying bullion and they are very happy with the results they are seeing. My Wife is also very happy too because I convinced her to put some 'her' account money into Silver in November and that has almost doubled. So there you go- I know of only 4 people in the 100's of people in my domain of influence that are doing this on the sly or not buying (yet) until it's painfully obvious that they're missing the boat.

I love these forums because now you have my targets and we'll see how accurate they prove to actually be.

The price targets I'm looking at are: $75/ounce by May 2012 and $100 by May 2013. Read further if you want to understand my rationale, otherwise those are my numbers.

Rationale:

Silver has historically traded with a 20:1 ratio to gold. When the U.S. was on a gold standard we had $20 gold pieces and Silver Dollars- hence 20:1. With gold trading now at $1500/oz, Silver would need to trade at $75. I think it will take a years time before the historic ratio materializes. The ratio has been out of whack for a long time and was as high as 80:1 in recent years- now it's 35:1 so it has moved closer to target and quickly. Things will probably snap to historic ratios in a year's time.

The longer term $100 target is based on the simple observation that gold is also going up, but a lot slower than Silver at the moment. I figure gold will hit $2000/oz in two years and silver will be snapped to the 20:1 ratio. I'm factoring gold going up about 40% in two years time which seems very plausible considering the move that Silver has done in 5 months time: 90%.

I guess these are numbers that I'm pretty confident in seeing occurring. I have been known to be overly conservative in my forecasting, so we could see much higher numbers too. It's anybody's guess at this stuff, but that's the best working data I have at the moment and I'm definitely LONG in this market.

For those of you thinking it's just a bubble, ask yourself how many people you know that actually buy Gold & Silver? At my work, I'm the only one that I know of in a 50 person small company. I would need to see half the people I know be actively buying gold and silver before I would think of bubble status and that is not the case. No neighbors are buying, only my brother, father, and cousin are buying bullion and they are very happy with the results they are seeing. My Wife is also very happy too because I convinced her to put some 'her' account money into Silver in November and that has almost doubled. So there you go- I know of only 4 people in the 100's of people in my domain of influence that are doing this on the sly or not buying (yet) until it's painfully obvious that they're missing the boat.

I love these forums because now you have my targets and we'll see how accurate they prove to actually be.

#215

I feel the need...

Up until this thread, where is your posting of wealth creating genius? You don't strike me as a cheerleader for The Greater Fool Theory, so why start now?

Up until this thread, where is your posting of wealth creating genius? You don't strike me as a cheerleader for The Greater Fool Theory, so why start now? You of all people should know and recognize that gold doesn't provide any cash flow. Its only a gain when you monetize. Albert Einstein didn't call gold the eighth wonder of the world, but he did allegedly say that about compound interest.

Dude we all get it. Uncle Ben is a bit punchdrunk right now, he'll get sober eventually - and when that happens, easy money asset bubbles will burst just like they all do.

#216

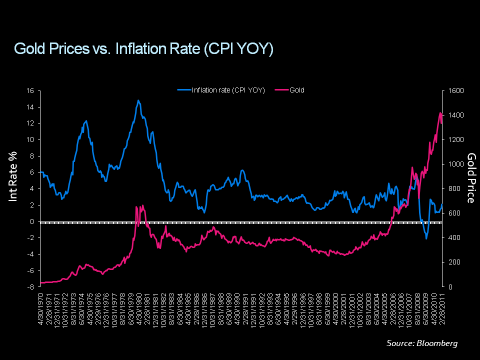

Gold is not meant to give you wealth, it's meant to maintain your purchasing power especially when Intrest rates begin to rape the populace......just as is happening now........

#217

I feel the need...

I agree with you 100% Near zero short term interest rates caused by Uncle Ben forces investors to speculate with enhanced fervor and reduces the incentive to hold dollar denominated assets. We can't stay here forever though, just sayin...

#218

Drifting

Up until this thread, where is your posting of wealth creating genius? You don't strike me as a cheerleader for The Greater Fool Theory, so why start now?

Up until this thread, where is your posting of wealth creating genius? You don't strike me as a cheerleader for The Greater Fool Theory, so why start now? You of all people should know and recognize that gold doesn't provide any cash flow. Its only a gain when you monetize. Albert Einstein didn't call gold the eighth wonder of the world, but he did allegedly say that about compound interest.

Dude we all get it. Uncle Ben is a bit punchdrunk right now, he'll get sober eventually - and when that happens, easy money asset bubbles will burst just like they all do.

I would say the last two other worthwhile threads I have started or contributed to are:

1. Millionaire Next Door- next page of postings

2. Tips for trading stocks on line.

You do those things described in those threads and you will become wealthy- might take 20 years, but you will become wealthy. Gaining wealth is as much having discipline as having luck or good stock picking abilities.

Regarding Bernanke (and even Geitner), I would say those two guys are lost causes and they will never sober up on their own. I think parties outside of the U.S. are going to sober them up and that is a bad thing. Come on, Geitner has the arrogance to say this week that there is no way the U.S. is going to default on the debt? Really, no way the U.S. can default? . It's looking more and more like a default every month we go since the debt is only rising and not dropping like it needs to. At least Greece is making some hard decisions and doing something with their debt- we are not.

Meanwhile gold will increase in value and the dollar will decrease in value while the snooze button is continuously pushed. I'm sensing a push of the snooze button soon when the debt limit increases.

#219

#220

I feel the need...

Commodities May Swing as Fed Steps Aside

By CAROLYN CUI

One of the biggest impacts of the end of the Federal Reserve's bond-buying program may be felt in the commodities markets, where the injection of liquidity has helped send prices of metals, grains and energy to multiyear highs.

Commodities are especially sensitive to Fed policies, as prices are driven by inflation expectations, which are closely tied to the Fed's every move. Also, these markets are much smaller in size than stocks and bonds, suggesting they tend to swing more in response to changing policies.

As the Fed prepares to end its $600 billion bond-buying program, known as quantitative easing, or QE2, some money managers are preparing their own withdrawal.

London-based Diapason Commodities Management SA, which oversees $9 billion in assets, is likely to cut back on some exposure to more cyclical commodities, such as energy and base metals, if they think risk is increasing, said Sean Corrigan, Diapason's chief investment strategist.

"We have had a one-way run for six months. We can't be too greedy," Mr. Corrigan said.

Commodities under management, including mutual funds and exchange-traded funds, have seen a record inflow of $48.8 billion since the Fed's QE2 announcement last August, with total managed assets in commodities hitting $412 billion by the end of March, according to Barclays Capital.

Given how profitable and crowded the markets are, "once the liquidation begins, you don't know how far it will run," he said.....

One of the biggest impacts of the end of the Federal Reserve's bond-buying program may be felt in the commodities markets, where the injection of liquidity has helped send prices of metals, grains and energy to multiyear highs.

Commodities are especially sensitive to Fed policies, as prices are driven by inflation expectations, which are closely tied to the Fed's every move. Also, these markets are much smaller in size than stocks and bonds, suggesting they tend to swing more in response to changing policies.

As the Fed prepares to end its $600 billion bond-buying program, known as quantitative easing, or QE2, some money managers are preparing their own withdrawal.

London-based Diapason Commodities Management SA, which oversees $9 billion in assets, is likely to cut back on some exposure to more cyclical commodities, such as energy and base metals, if they think risk is increasing, said Sean Corrigan, Diapason's chief investment strategist.

"We have had a one-way run for six months. We can't be too greedy," Mr. Corrigan said.

Commodities under management, including mutual funds and exchange-traded funds, have seen a record inflow of $48.8 billion since the Fed's QE2 announcement last August, with total managed assets in commodities hitting $412 billion by the end of March, according to Barclays Capital.

Given how profitable and crowded the markets are, "once the liquidation begins, you don't know how far it will run," he said.....

And as for your views on a pending fiscal crisis...

S&P warning on U.S. debt could make bonds more attractive

One reason that traders say Treasuries have looked surprisingly stable is the belief that S&P's move could spur action in Washington to tackle the country's debt.

http://www.latimes.com/business/la-f...0,302188.story

#221

I feel the need...

I agreed with YeuEmMaiMai in the sense that Gold is an (expensive) insurance policy for loose Fed action, not in the sense that Gold is a perfect hedge for inflation. A broader basket of commodities makes more sense, but probably not anywhere close to 30% of your supposed portfolio, UNLESS you truly believe we're at imminent risk of losing our reserve currency status or at imminent risk of a major fiscal crisis (neither of which I believe will happen soon). If our policy makers can't get their shit together, we're probably looking at a slow motion train wreck.

To put it in layman's terms, in the Goldilocks scheme of things:

Deflation, a little to cold.

Hyperinflation, a little to hot.

Stagflation, just about right.

To put it in layman's terms, in the Goldilocks scheme of things:

Deflation, a little to cold.

Hyperinflation, a little to hot.

Stagflation, just about right.

#222

have you noticed that a lot of food (chips for example) used to come in 1 lb bag and now it's more like 12-14oz- for more money....inflation is here and it is large and in charge.......won't even get into the weakening of the USD......

#223

Drifting

^Amen- this should be an interesting week when Bernanke speaks on Wednesday. You can not ignore the weakness of the USD dollar index- it is taking a beating. Food inflation is very present now in packaging changes. I'm wondering how much longer the .99 cent only store will be able to stay named this way because products are likely to become more expensive now.

The U.S. Bond view points are all over the map now. Generally inflation is bad for bonds- I'm short these bonds at the moment and will be until there is some clarity as to what is really going to happen with the budget. Are politicians going to continue to make claims of savings over 12 years or actually make cuts that are realized in the next year ? The short term cuts have more impact on a fiscal issue than long-term cuts.

The U.S. Bond view points are all over the map now. Generally inflation is bad for bonds- I'm short these bonds at the moment and will be until there is some clarity as to what is really going to happen with the budget. Are politicians going to continue to make claims of savings over 12 years or actually make cuts that are realized in the next year ? The short term cuts have more impact on a fiscal issue than long-term cuts.

#224

considering what companies are doing to hide inflation, I am not going to change my mind any time soon......

have you noticed that a lot of food (chips for example) used to come in 1 lb bag and now it's more like 12-14oz- for more money....inflation is here and it is large and in charge.......won't even get into the weakening of the USD......

have you noticed that a lot of food (chips for example) used to come in 1 lb bag and now it's more like 12-14oz- for more money....inflation is here and it is large and in charge.......won't even get into the weakening of the USD......

#225

Карты убийцы

Say what you want...

purchase an 08-08-08 Prosperity Set for $1799 about 2 years ago...

have a slew of UHR gold coins MS70's around $1631...

Go to eBay and see the profits.

purchase an 08-08-08 Prosperity Set for $1799 about 2 years ago...

have a slew of UHR gold coins MS70's around $1631...

Go to eBay and see the profits.

#227

I feel the need...

Lets separate deficits and the debt issue from the gold debate for sec. Friedman said "inflation is always and everywhere a monetary phenomenon" - NOT inflation is always and everywhere a fiscal phenomenon.

Lets separate deficits and the debt issue from the gold debate for sec. Friedman said "inflation is always and everywhere a monetary phenomenon" - NOT inflation is always and everywhere a fiscal phenomenon. BTW, I'm not picking on you, merely playing :devilgrin 's advocate since you seem so highly confident in your 'predictions'. You must not be much of a hockey fan because Toe Blake famously said "Predictions are for gypsies".

So do us all a favor and tell us when to hit the bid. After all we wanna see your length AND girth! :wink:

#228

I feel the need...

Debunking Anti-Gold Propaganda

http://www.caseyresearch.com/article...old-propaganda

Why We See Gold Going Lower Long-Term

http://seekingalpha.com/article/2650...rm?source=feed

http://www.caseyresearch.com/article...old-propaganda

Why We See Gold Going Lower Long-Term

http://seekingalpha.com/article/2650...rm?source=feed

#229

Drifting

Here's a nice chart, comparing 1971-82 gold prices to 2001-2010 along with the Nasdaq. Enjoy!

here's the link to article:http://www.istockanalyst.com/finance...back-in-prices

here's the link to article:http://www.istockanalyst.com/finance...back-in-prices

Last edited by LaCostaRacer; 04-25-2011 at 09:26 PM.

#230

Here's a nice chart, comparing 1971-82 gold prices to 2001-2010 along with the Nasdaq. Enjoy!

here's the link to article:http://www.istockanalyst.com/finance...back-in-prices

here's the link to article:http://www.istockanalyst.com/finance...back-in-prices

I plotted the price of gold 2000-now, real estate 1997-mid 2006, and NASDAQ 1990-2000. They all seem pretty similar to me...

#231

Drifting

Lets separate deficits and the debt issue from the gold debate for sec. Friedman said "inflation is always and everywhere a monetary phenomenon" - NOT inflation is always and everywhere a fiscal phenomenon.

Lets separate deficits and the debt issue from the gold debate for sec. Friedman said "inflation is always and everywhere a monetary phenomenon" - NOT inflation is always and everywhere a fiscal phenomenon. BTW, I'm not picking on you, merely playing :devilgrin 's advocate since you seem so highly confident in your 'predictions'. You must not be much of a hockey fan because Toe Blake famously said "Predictions are for gypsies".

So do us all a favor and tell us when to hit the bid. After all we wanna see your length AND girth! :wink:

My guess is silver will dip a bit because it has gained a bunch recently- not a prediction just a hunch that I'm prepared to trade in and yes I'll be buying if it should dip notably.

My Commodity Almanac mentions silver historically dipping from 5/13 - 6/24 with a 64% success rate- I have learned to trust it because these things tend to prove out. So would I be buying now? Probably not. In June- quite possibly. There you go consider yourself forewarned on my buying intentions for silver.

I don't think I'll be selling, but who knows I might want to unload my 390% gain 11/2008 SLV position for bragging rights possibly, but the taxes would kill me, so probably not.

#232

Drifting

Here's another decent article about Silver and why it might not be in a bubble (yet). The author points out some body builders talking about silver in the gym so the cat might be out of the bag.

Here's the link: http://www.robertsinn.com/2011/04/24...-bodybuilders/

Here's the link: http://www.robertsinn.com/2011/04/24...-bodybuilders/

#233

Team Owner

Buyers Beware: Silver Crashed 11% in 24 Hours

http://www.cnbc.com/id/42726288

click link for full story.

http://www.cnbc.com/id/42726288

Shortly after the start of overnight trading at 12:10 a.m. on Monday, silver futures surged to a multi-year high of $49.82 per ounce. Nine hours later, by the start of stock market trading in the U.S., the May Silver contract was down eight percent. Shortly before midnight Monday, the futures would touch a low of $44.61, completing a 10.5 percent correction in less than 24 hours.

Because the bulk of those moves took place in off-hours electronic trading, and because the metal pared some of the losses quickly, many investors may have not even noticed the wipeout. Silver ended regular trading at $45.06 on Tuesday.

Because the bulk of those moves took place in off-hours electronic trading, and because the metal pared some of the losses quickly, many investors may have not even noticed the wipeout. Silver ended regular trading at $45.06 on Tuesday.

#234

Moderator Alumnus

I was talking to someone about this the other day, serving sizes getting smaller.

One thing that came up is that it is likely going to cause some people to eat healthier and be less likely to get sick/chronic diseases related to obesity.

As healthcare costs having been one of the biggest contributors to overal household inflation, it might have an overal positive effect in the long term.

Just interesting how there can be unintended consequences...

#235

Moderator Alumnus

Remember you supposedly called the housing bubble back in 2001-2002, so you of all people should know it can take a while for the bubble to pop

Everyone and there grandma weren't trading dot-coms. The overall percentage of the american people actively engaged in trading those stocks was comparatively small. You don't need a huge population of investors to create a bubble.

But look at how gold has changed in just the last few years with ETF's. The ability to trade gold has dramatically increased. Millions of more people are trading gold. And have you seen a jewelry store now without a sign declaring that they will buy gold. I was in one store browsing with my wife and talked to the owner who said nearly half his business is now buying gold.

Gold is being driven in large part by FUD.

Fear - The dollar will collapse, the world economy will collapse, the banks will all fail

Uncertainty - No one knows where to put their assets. Which bubble will pop next.

Dollars - Hundreds of billions of QE2, Chinese stimulus, etc... chasing limited returns.

#236

The sizzle in the Steak

Buyers Beware: Silver Crashed 11% in 24 Hours

http://www.cnbc.com/id/42726288

click link for full story.

http://www.cnbc.com/id/42726288

click link for full story.

It will continue to rise.

#237

Team Owner

I get worried when every Tom, Dick, and Harry want to buy something and right now that's silver.

I gotta give LaCostaRacer credit though, he's been pushing it for years and probably made a ton of $.

I gotta give LaCostaRacer credit though, he's been pushing it for years and probably made a ton of $.

#238

The sizzle in the Steak

I believe there is more upside as well for commodities in general.

There are many things that can effect it, however.

I'm not a doom and gloom end of the world "Glen Beck" guy....the sky is not falling IMHO....but there are some serious troubles with Fed policy and the world economy at large that lead credence as to why many are putting their $$$ into commodities, and why the prices are rising.

#240

Drifting

Good luck to all involved with Gold and Silver- there is still some more money to be made for all the reasons I have mentioned in this thread. Nothing has changed except the price.