Is the DOW going to burst at some point?

#161

#162

#163

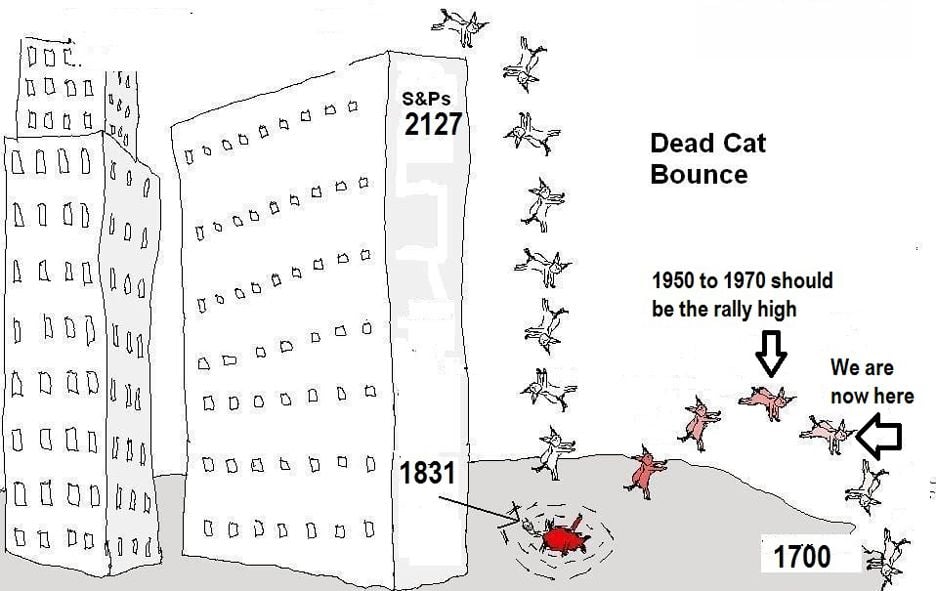

Dead cat bounce.

Lowest closing point last week for all 3 indices was on Tues. Aug 25

Dow about 396 pts away from last week's lowest close of 15,666.44

S&P 500 about 48 pts away from last week's lowest close of 1867.61

Nasdaq about 125 pts away from last week's lowest close of 4506.49

Buy the dip!

Lowest closing point last week for all 3 indices was on Tues. Aug 25

Dow about 396 pts away from last week's lowest close of 15,666.44

S&P 500 about 48 pts away from last week's lowest close of 1867.61

Nasdaq about 125 pts away from last week's lowest close of 4506.49

Buy the dip!

#164

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

#165

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

Does a dead cat actually bounce? I would think it would more go "splat" especially from a 7 floor drop

The following users liked this post:

Mizouse (09-01-2015)

#167

Drifting

Dow: 16,058.3

Gold: 1139.3

Dow/gold: 14.09

Definitely more funk in the market. Until the Fed flinches on the interest rate hike, we're going to see markets trend down. QE helped inflate the markets and a perceived tightening will bring markets down to levels before QE was active.

The economic news coming out has generally been crappy. For example, the Dallas Fed Manufacturing survey came out with another crappy number: -15.8 .vs an expected -2.5. That goes back to 'great recession' times to have a number worse; however, we still get what seems to be good employment reports. We'll see how the August jobs report looks like on Friday. Even with a good jobs report, you need to look at the quality of jobs created. Two part-time jobs does not equal one good paying full-time job so you can have a great report numbers but crappy jobs data if all you listen to is the headline number.

At least futures are up about +164 as I write this- perhaps Wednesday will be another dead cat bounce. Watch out if if things start strong and end weak on Wednesday- there is a lot of air between 16,058 and 12,471 which I would consider a pretty firm support level established back in October 2013.

Gold: 1139.3

Dow/gold: 14.09

Definitely more funk in the market. Until the Fed flinches on the interest rate hike, we're going to see markets trend down. QE helped inflate the markets and a perceived tightening will bring markets down to levels before QE was active.

The economic news coming out has generally been crappy. For example, the Dallas Fed Manufacturing survey came out with another crappy number: -15.8 .vs an expected -2.5. That goes back to 'great recession' times to have a number worse; however, we still get what seems to be good employment reports. We'll see how the August jobs report looks like on Friday. Even with a good jobs report, you need to look at the quality of jobs created. Two part-time jobs does not equal one good paying full-time job so you can have a great report numbers but crappy jobs data if all you listen to is the headline number.

At least futures are up about +164 as I write this- perhaps Wednesday will be another dead cat bounce. Watch out if if things start strong and end weak on Wednesday- there is a lot of air between 16,058 and 12,471 which I would consider a pretty firm support level established back in October 2013.

Last edited by LaCostaRacer; 09-02-2015 at 12:14 AM.

The following users liked this post:

03SSMTL-S (09-02-2015)

#168

Chinese market closed until Monday because of holiday (70th Anniversary of WWII Victory Day) and U.S. markets closed on Monday because of Labor Day.

Should be pretty calm for the rest of the week and into Tuesday.

Should be pretty calm for the rest of the week and into Tuesday.

#169

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

calm is of no use to me, id like it to go up thursday and friday please kthnx

#170

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

The following users liked this post:

Mizouse (09-04-2015)

#172

Az User

Join Date: Feb 2005

Location: parts unknown

Age: 45

Posts: 12,488

Received 2,486 Likes

on

1,645 Posts

"... we estimate that only about half (or slightly more than half) of total technical selling was completed to-date (mostly completed by VT funds, half by CTAs, and a smaller fraction by RPs). We estimate that a further ~$100bn of selling remains to be completed over the next 1-3 weeks. As a result, we expect elevated volatility and downside price risk to persist."

#174

market long over due for correction. there is no way that the market should have been at 18K+

just wait to the realization sets in that the world is basically bankrupt.... China has massive over capacity and debt. Spain is Tango Uniform, Greece is on life support, France is about to die.... etc and then there is the USA who's debt is insurmountable

just wait to the realization sets in that the world is basically bankrupt.... China has massive over capacity and debt. Spain is Tango Uniform, Greece is on life support, France is about to die.... etc and then there is the USA who's debt is insurmountable

Last edited by YeuEmMaiMai; 09-05-2015 at 08:08 AM.

#175

Drifting

Dow: 16,102.4

Gold: 1122.30

Dow/Gold: 14.35

The FED continues to hint at a rate hike in September and the markets are beginning to price this possibility in mind. The jobs report indicates the unemployment rate decreased. There is nothing to stop the Fed from thinking they should hike rates except the point that it is already a cycle too late- they should have hiked rates years ago.

If the Fed does hike rates, the economy will go back into a recession and stocks will go down to the levels of 2009. The other change that would happen is that companies will have a harder time getting cheap money to borrow to buy back their stock and seemingly bolster their earnings. These companies have been playing that game for years now and that has bolstered values a little. They will have to make money the old fashion way by improving the goods and services that they provide instead of buying back their stock.

Gold: 1122.30

Dow/Gold: 14.35

The FED continues to hint at a rate hike in September and the markets are beginning to price this possibility in mind. The jobs report indicates the unemployment rate decreased. There is nothing to stop the Fed from thinking they should hike rates except the point that it is already a cycle too late- they should have hiked rates years ago.

If the Fed does hike rates, the economy will go back into a recession and stocks will go down to the levels of 2009. The other change that would happen is that companies will have a harder time getting cheap money to borrow to buy back their stock and seemingly bolster their earnings. These companies have been playing that game for years now and that has bolstered values a little. They will have to make money the old fashion way by improving the goods and services that they provide instead of buying back their stock.

The following users liked this post:

YeuEmMaiMai (09-05-2015)

#176

Race Director

Roller Coaster, wooo, wooo, wooo....

#177

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

No rate hike for now.

#178

Drifting

Dow: 16,384.58

Gold 1139.10

Dow/Gold: 14.38

USD: 95.0

It's interesting that no rate hike results in a -65..2 Dow Thursday and then a bigger -290.1 Dow Friday- how's that for a market reaction to what should have been good news?

If you listened to the Fed statement, Yellen essentially said she has no idea for when they will raise rates. In the Q/A session she actually said that she could not rule out not keeping interest rates at zero 'forever'. What's up with that? The scary thing is that she seems to think that the Fed has the ability to keep interest rates at zero- like the Fed is in control of all this stuff. Eventually buyers of U.S. bonds will go on strike and not buy any and that will create some problems for the treasury.

I think the Fed is going to need to take the rate hikes off the table to make the market happy. I'm betting on a nice round of QE in early 2016 to continue this farce.

Thursday's news is a screaming buy signal for gold and silver because the dollar is going to weaken. The USD dropped .2 this week but that's the beginning of a new downward trend- I expect the USD to drop down to 80 like it was in early 2014.

Gold 1139.10

Dow/Gold: 14.38

USD: 95.0

It's interesting that no rate hike results in a -65..2 Dow Thursday and then a bigger -290.1 Dow Friday- how's that for a market reaction to what should have been good news?

If you listened to the Fed statement, Yellen essentially said she has no idea for when they will raise rates. In the Q/A session she actually said that she could not rule out not keeping interest rates at zero 'forever'. What's up with that? The scary thing is that she seems to think that the Fed has the ability to keep interest rates at zero- like the Fed is in control of all this stuff. Eventually buyers of U.S. bonds will go on strike and not buy any and that will create some problems for the treasury.

I think the Fed is going to need to take the rate hikes off the table to make the market happy. I'm betting on a nice round of QE in early 2016 to continue this farce.

Thursday's news is a screaming buy signal for gold and silver because the dollar is going to weaken. The USD dropped .2 this week but that's the beginning of a new downward trend- I expect the USD to drop down to 80 like it was in early 2014.

#179

More market volatility ahead, I'm sure, as people worry about possible October rate hike.

Yellen Says She Still Expects Rate Increase This Year - Bloomberg Business

Yellen Says She Still Expects Rate Increase This Year - Bloomberg Business

Yellen Says She Still Expects Rate Increase This Year

September 24, 2015 — 2:13 PM PDT

Federal Reserve Chair Janet Yellen said the U.S. central bank is on track to raise interest rates this year, even as she acknowledged that economic “surprises” could lead them to change that plan.

“Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter,” Yellen said during a speech Thursday in Amherst, Massachusetts. “But if the economy surprises us, our judgments about appropriate monetary policy will change.”

Yellen, 69, spoke a week after the Federal Open Market Committee left its benchmark federal funds target near zero, saying "recent global economic and financial developments" might damp growth and inflation in the U.S. Concerns over a slowdown in China following a surprise Aug. 11 devaluation of the yuan triggered turmoil in financial markets and raised questions about the outlook for the global economy.

Slower demand from China, where growth is projected to drop below 7 percent this year, has helped push down commodity prices, sapping already low inflation in the U.S. The Fed’s preferred gauge of price pressures rose 0.3 percent in the year through July and has been under its 2 percent target since April 2008.

Fading Headwinds

“We cannot be certain about the pace at which the headwinds still restraining the domestic economy will continue to fade,” Yellen said in her remarks Thursday. “Recent global economic and financial developments highlight the risk that a slowdown in foreign growth might restrain U.S. economic activity somewhat further.”

The Fed has been forced to weigh headwinds against signs of continued growth in the domestic economy. U.S. employers have added 1.7 million jobs to payrolls this year, pushing unemployment down to 5.1 percent in August, its lowest in more than seven years.

“On balance the economy is no longer far away from full employment,” Yellen said in her speech. “In contrast, inflation has continued to run below the Committee’s objective over the past several years, and over the past 12 months it has been essentially zero.”

Yellen highlighted that inflation expectations have remained well-anchored, but said that the central bank shouldn’t take it for granted that they will stay that way. She said she thinks “temporary effects” of falling energy and non-energy import prices are the driver behind the tepid inflation, and expects price pressures to rebound barring further decline in crude oil prices and further appreciation in the dollar.

September 24, 2015 — 2:13 PM PDT

Federal Reserve Chair Janet Yellen said the U.S. central bank is on track to raise interest rates this year, even as she acknowledged that economic “surprises” could lead them to change that plan.

“Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter,” Yellen said during a speech Thursday in Amherst, Massachusetts. “But if the economy surprises us, our judgments about appropriate monetary policy will change.”

Yellen, 69, spoke a week after the Federal Open Market Committee left its benchmark federal funds target near zero, saying "recent global economic and financial developments" might damp growth and inflation in the U.S. Concerns over a slowdown in China following a surprise Aug. 11 devaluation of the yuan triggered turmoil in financial markets and raised questions about the outlook for the global economy.

Slower demand from China, where growth is projected to drop below 7 percent this year, has helped push down commodity prices, sapping already low inflation in the U.S. The Fed’s preferred gauge of price pressures rose 0.3 percent in the year through July and has been under its 2 percent target since April 2008.

Fading Headwinds

“We cannot be certain about the pace at which the headwinds still restraining the domestic economy will continue to fade,” Yellen said in her remarks Thursday. “Recent global economic and financial developments highlight the risk that a slowdown in foreign growth might restrain U.S. economic activity somewhat further.”

The Fed has been forced to weigh headwinds against signs of continued growth in the domestic economy. U.S. employers have added 1.7 million jobs to payrolls this year, pushing unemployment down to 5.1 percent in August, its lowest in more than seven years.

“On balance the economy is no longer far away from full employment,” Yellen said in her speech. “In contrast, inflation has continued to run below the Committee’s objective over the past several years, and over the past 12 months it has been essentially zero.”

Yellen highlighted that inflation expectations have remained well-anchored, but said that the central bank shouldn’t take it for granted that they will stay that way. She said she thinks “temporary effects” of falling energy and non-energy import prices are the driver behind the tepid inflation, and expects price pressures to rebound barring further decline in crude oil prices and further appreciation in the dollar.

#181

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

#182

Race Director

Don?t Panic Over Dow?s 1,089 Plunge and Definitely Don't Sell | Fox Business

For the year so far:

Dow down 11%

S&P down 8%

Nasdaq down 4.5%

Not great, but certainly not a terrifying year, so far...

For the year so far:

Dow down 11%

S&P down 8%

Nasdaq down 4.5%

Not great, but certainly not a terrifying year, so far...

Dow down 3.8%

S&P down 1.7%

Nasdaq up 1%

#184

#185

No rate hike. But possibility still on the table at next FOMC meeting in December.

DOW, S&P, and Nasdaq all fall 1% immediately after the news.

rMkifT6.pngoJyA1iY.pngECuYkag.png

Stocks trim gains after Fed signals possible December rate hike - MarketWatch

DOW, S&P, and Nasdaq all fall 1% immediately after the news.

rMkifT6.pngoJyA1iY.pngECuYkag.png

Stocks trim gains after Fed signals possible December rate hike - MarketWatch

Stocks trim gains after Fed signals possible December rate hike

U.S. stocks briefly erased modest gains on Wednesday after the Federal Reserve announced it would keep interest rates unchanged at near zero, but signaled that a rate increase is still on the table “at its next meeting” in December.

Investors perceived the statement as slightly hawkish, as the central bank showed less worry about global financial and economic developments hurting the U.S. economy than it did at its September meeting.

The vote was 9 to 1, with Richmond Fed President Jeffrey Lacker dissenting for the second meeting in a row. Lacker wants to raise the so-called fed-funds rate to 0.25 points.

“There is not too much surprise in the statement, but investors should realize that the Fed will raise rates, either in December or early next year, because they have to” said Marig Ogg, president at Tower Bridge Advisors.

According to the CME Group’s Fed Watch Tool, the market is pricing in 46.5% probability in December. Those odds were 34% before the announcement. The first fully priced-in rate increase has been pushed out to March 2016.

U.S. stocks briefly erased modest gains on Wednesday after the Federal Reserve announced it would keep interest rates unchanged at near zero, but signaled that a rate increase is still on the table “at its next meeting” in December.

Investors perceived the statement as slightly hawkish, as the central bank showed less worry about global financial and economic developments hurting the U.S. economy than it did at its September meeting.

The vote was 9 to 1, with Richmond Fed President Jeffrey Lacker dissenting for the second meeting in a row. Lacker wants to raise the so-called fed-funds rate to 0.25 points.

“There is not too much surprise in the statement, but investors should realize that the Fed will raise rates, either in December or early next year, because they have to” said Marig Ogg, president at Tower Bridge Advisors.

According to the CME Group’s Fed Watch Tool, the market is pricing in 46.5% probability in December. Those odds were 34% before the announcement. The first fully priced-in rate increase has been pushed out to March 2016.

#186

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

They're kind of rebounding

#187

Team Owner

#188

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

#189

Drifting

Dow: 17,663.5

Gold 1141.70

Dow/Gold: 15.47

USD: 97.02

The markets and Dollar have risen since my last posting. The markets finally digested that maybe there won't be an interest rate increase this year. It seems like once the Dow goes up to these levels, then the FED starts hinting that maybe there will be a rate increase. I bet not.

I don't think we'll see a Dow 18k this year because the fear of an increase in interest rates might take affect now and that should temper any more big gains. 1300 points in 6 weeks is a decent gain for the Dow already- probably time for it to go down a little.

Gold 1141.70

Dow/Gold: 15.47

USD: 97.02

The markets and Dollar have risen since my last posting. The markets finally digested that maybe there won't be an interest rate increase this year. It seems like once the Dow goes up to these levels, then the FED starts hinting that maybe there will be a rate increase. I bet not.

I don't think we'll see a Dow 18k this year because the fear of an increase in interest rates might take affect now and that should temper any more big gains. 1300 points in 6 weeks is a decent gain for the Dow already- probably time for it to go down a little.

The following users liked this post:

Mizouse (11-01-2015)

#190

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

I sure hope it pulls back a bit soon. Give me some good buy opportunities again

#191

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

#192

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

#193

I think it's time to take profit in whatever is still up for the year. I'm sensing another market sell off. End of year profit taking.

Back to Sept lows for Dow, S&P 500, and Nasdaq?

Back to Sept lows for Dow, S&P 500, and Nasdaq?

#194

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

I'm hoping for a pull back and then a Santa rally

#195

Drifting

Dow: 17,245.2

Gold 1083.40

Dow/Gold: 15.92

USD: 99.1

The markets are weighing the prospects of a mid December rate hike and have come down from the highs of last week. Gold has weakened and the Dollar has strengthened-all normal if there is to be a rate hike.

It's strange how everybody thinks a rate hike is so possible in December when you

read the wording of the Fed statement. It's also predictable that the Fed is not

tryig to correct the market's interpretation either- the Fed is mostly quiet on that

front with just a few quirps from some of the governors in the media.

We could see more market weakness if things repeat like they did when the Fed was supposedly going to raise rates in September. We're 1150 points from some of the end of the week lows in September now (9/4 had a Dow closing of 16,102.4). You would think if the market thinks a rate increase is more probable than September that the Dow may need to go lower than September. So ... yes there is a lot more downside risk to the Dow while things are getting pondered by the Fed and the market.

I believe the Fed already knows what they are going to do and doesn't need to wait

for more data. They have been waiting for more data for 7 years and haven't raised rates so it's hard to fathom what new economic report will come out that will show them it's time to tighten. My guess is that the Fed will find a great excuse not to raise interest rates. Who knows it could be that the stock market being weak might be its excuse.

Gold 1083.40

Dow/Gold: 15.92

USD: 99.1

The markets are weighing the prospects of a mid December rate hike and have come down from the highs of last week. Gold has weakened and the Dollar has strengthened-all normal if there is to be a rate hike.

It's strange how everybody thinks a rate hike is so possible in December when you

read the wording of the Fed statement. It's also predictable that the Fed is not

tryig to correct the market's interpretation either- the Fed is mostly quiet on that

front with just a few quirps from some of the governors in the media.

We could see more market weakness if things repeat like they did when the Fed was supposedly going to raise rates in September. We're 1150 points from some of the end of the week lows in September now (9/4 had a Dow closing of 16,102.4). You would think if the market thinks a rate increase is more probable than September that the Dow may need to go lower than September. So ... yes there is a lot more downside risk to the Dow while things are getting pondered by the Fed and the market.

I believe the Fed already knows what they are going to do and doesn't need to wait

for more data. They have been waiting for more data for 7 years and haven't raised rates so it's hard to fathom what new economic report will come out that will show them it's time to tighten. My guess is that the Fed will find a great excuse not to raise interest rates. Who knows it could be that the stock market being weak might be its excuse.

#196

Race Director

Dow: 17,663.5

Gold 1141.70

Dow/Gold: 15.47

USD: 97.02

The markets and Dollar have risen since my last posting. The markets finally digested that maybe there won't be an interest rate increase this year. It seems like once the Dow goes up to these levels, then the FED starts hinting that maybe there will be a rate increase. I bet not.

I don't think we'll see a Dow 18k this year because the fear of an increase in interest rates might take affect now and that should temper any more big gains. 1300 points in 6 weeks is a decent gain for the Dow already- probably time for it to go down a little.

Gold 1141.70

Dow/Gold: 15.47

USD: 97.02

The markets and Dollar have risen since my last posting. The markets finally digested that maybe there won't be an interest rate increase this year. It seems like once the Dow goes up to these levels, then the FED starts hinting that maybe there will be a rate increase. I bet not.

I don't think we'll see a Dow 18k this year because the fear of an increase in interest rates might take affect now and that should temper any more big gains. 1300 points in 6 weeks is a decent gain for the Dow already- probably time for it to go down a little.

#197

Safety Car

The Fed Has Set the Stage For a Stock Market Crash | Zero Hedge

In a short summary: Fed's QE prop up of the markets has distorted psychology in a way that any Fed moves to raise rates would cause a mass hysteria and basically "artificially" cause another crash (rather than any change in market fundamentals).

It's pretty obivous to many people, I hope, that this so called recovery is some truly weak ass shit and that the growth of wall street numbers is far out-stripping growth on Main St, USA.

In a short summary: Fed's QE prop up of the markets has distorted psychology in a way that any Fed moves to raise rates would cause a mass hysteria and basically "artificially" cause another crash (rather than any change in market fundamentals).

It's pretty obivous to many people, I hope, that this so called recovery is some truly weak ass shit and that the growth of wall street numbers is far out-stripping growth on Main St, USA.

#199

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,172

Received 2,773 Likes

on

1,976 Posts

I thought they reopened their stores?

#200

Drifting

Dow: 17,492.3

Gold 1072.00

Dow/Gold: 16.32

USD: 97.33

Since my last posting, the markets have rallied; however, both gold and the dollar have not. We have had 3 consecutive down days for a sum of -355.3 Dow points. Today was interesting in that we had a positive triple digit market for a while in the morning and then it closed negative.

This is by no means any crash but it appears to show a turning point in the market. Yesterday, the New York Stock Exchange Bullish Percent turned negative which is a bearish signal for the overall market.

I think the market is anticipating an interest rate increase next week- much like it did in early September when the Dow was down 540 points for the weekly close. It would not surprise me if we continue to see down days until next week. The energy industry has been raped the last week with the decrease in oil prices- a bottom must be getting close there.

Sectors showing relative strength: Nasdaq (until today anyway), consumer staples, health, info technology, and utilities.

Sectors showing weakness: NYSE, sp100, sp500, Dow 30, finance, consumer discretionary, energy, gold miners, industrials, materials, telecomm

By the looks of these traits, it seems like a recession is coming.

Gold 1072.00

Dow/Gold: 16.32

USD: 97.33

Since my last posting, the markets have rallied; however, both gold and the dollar have not. We have had 3 consecutive down days for a sum of -355.3 Dow points. Today was interesting in that we had a positive triple digit market for a while in the morning and then it closed negative.

This is by no means any crash but it appears to show a turning point in the market. Yesterday, the New York Stock Exchange Bullish Percent turned negative which is a bearish signal for the overall market.

I think the market is anticipating an interest rate increase next week- much like it did in early September when the Dow was down 540 points for the weekly close. It would not surprise me if we continue to see down days until next week. The energy industry has been raped the last week with the decrease in oil prices- a bottom must be getting close there.

Sectors showing relative strength: Nasdaq (until today anyway), consumer staples, health, info technology, and utilities.

Sectors showing weakness: NYSE, sp100, sp500, Dow 30, finance, consumer discretionary, energy, gold miners, industrials, materials, telecomm

By the looks of these traits, it seems like a recession is coming.