Dividend Stocks

#81

AZ Community Team

Join Date: May 2007

Location: N35°03'16.75", W 080°51'0.9"

Posts: 32,488

Received 7,770 Likes

on

4,341 Posts

I looked in to several and I cannot find the 'value' in CEFs (in general). In almost every case I've looked at CEFs underperform ... in many cases, dramatically underperform ... run-of-the-mill Dividend ETFs/Mutual Funds on total return. Here is what I see when I look at most CEFs:

- High Fees. Far in excess of 1%. Usually around 2% or more. That comes 'off the top' from the funds assets. Comparatively, it is easy to find Dividend ETFs with fees in the 0.10% range. My friend says, "Ignore the fees. I don't pay any fees", but I'm pretty sure he's dead wrong about that.

- Unusually high dividend yields. CEFs DO pay extremely high yields, often with low entry price per share. Say, 10% - 15% vs around 3% or 4% for a typical dividend fund.

- Declining Equity. I often see consistent CEF share price erosion along side the high yields. That effectively means you are trading equity for cash. Most dividend focused ETFs conserve and grow equity.

- Underlying quality. Most CEFs I've seen that rely on debt instruments (i.e. bonds/notes) are getting high returns from low quality debt. Others are using various leverage strategies, but there is an associated cost with that leverage which further erodes total return.

Over all, I don't see the value. Can someone explain to me why Cash is better than total return?

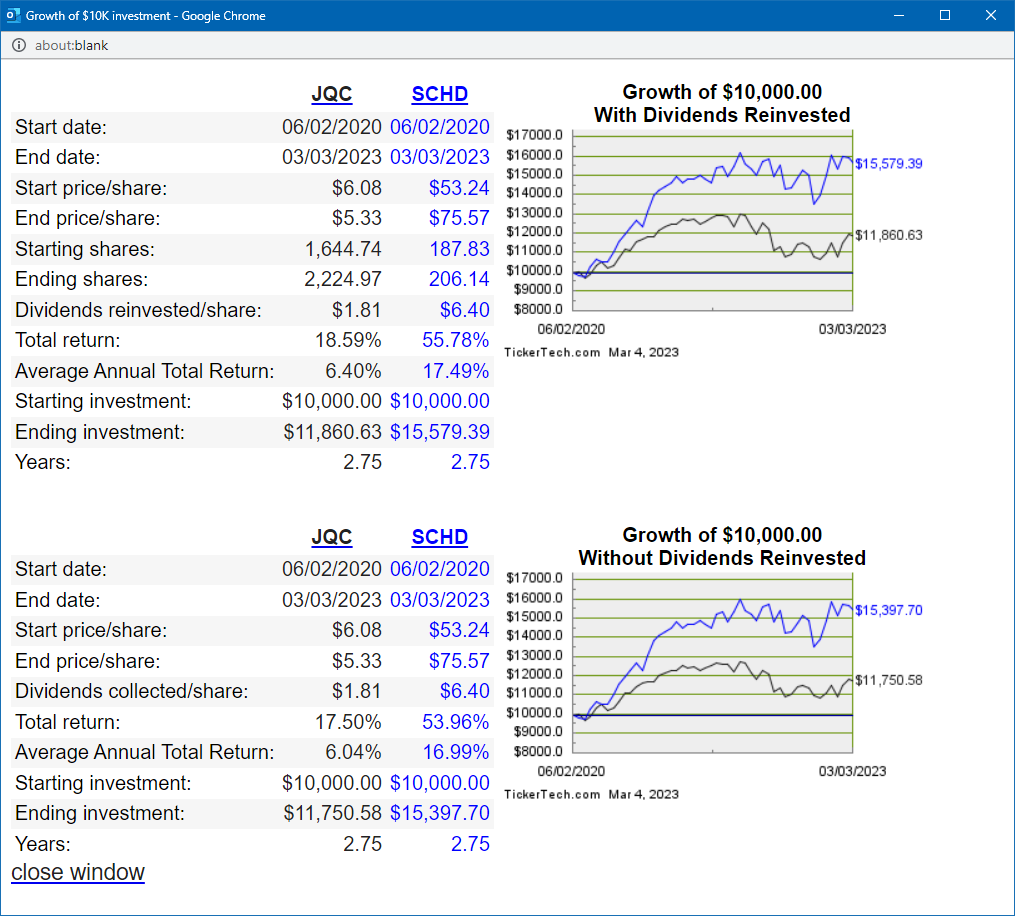

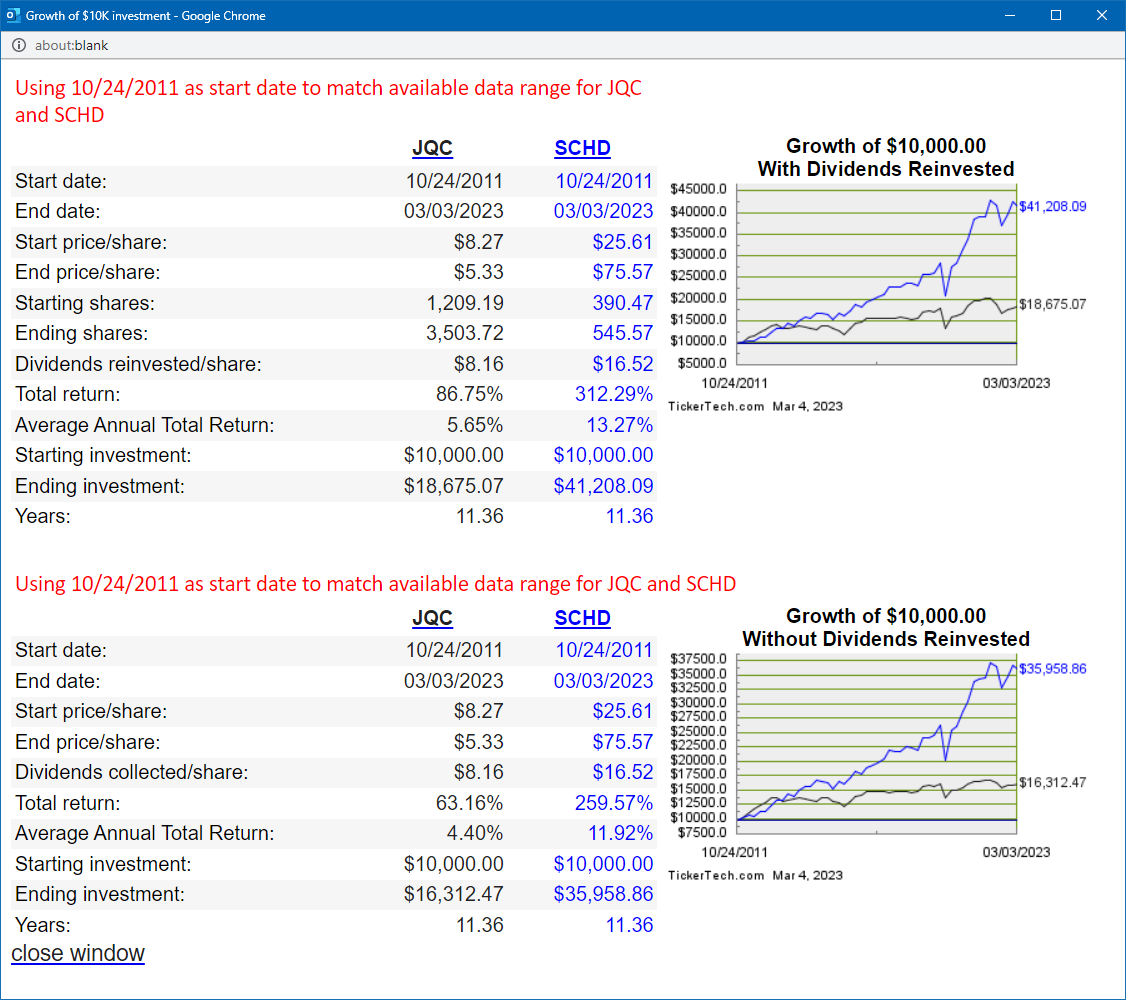

For the CEF that kicked of this thread (JQC), below are total return comparisons to SCHD from the date this thread started and from oldest common date from inception. In the bottom graph, I just cannot conceive how cash is more valuable than 2.2X total return ... seriously, if there's a case for that, I'd really like to understand it ( @Ken1997TL @AZuser ?)

https://www.dividendchannel.com/drip...ns-calculator/

Last edited by Bearcat94; 03-04-2023 at 02:14 PM.

Thread

Thread Starter

Forum

Replies

Last Post