Anyone use Robinhood to trade?

#41

https://blog.robinhood.com/news/2018...for-everyone-1

To stay true to our goal of offering everyone the best financial products...

#42

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

#43

Sanest Florida Man

Yes. That's what it means when it says "stockholders of record as of September 4, 2018"

But that doesn't mean if you buy on Sept. 4 or even Sept. 3 that you'll get dividend. You need to account for the ex-dividend date.

https://www.investopedia.com/ask/ans...idend-date.asp

But that doesn't mean if you buy on Sept. 4 or even Sept. 3 that you'll get dividend. You need to account for the ex-dividend date.

https://www.investopedia.com/ask/ans...idend-date.asp

#44

Sanest Florida Man

Maybe it's not worth doing for 32 cents/share dividend but on higher payouts, why not do that?

#45

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

Because there is a possibility of losing money between the time you buy the stock and when the dividend is paid out.

#46

Sanest Florida Man

But there's always that risk with any stock.

#47

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

The following users liked this post:

#1 STUNNA (08-02-2018)

#48

Sanest Florida Man

I knew that had to be a thing. It requires a lot more maintenance then just buying stock and holding it for years

#49

Sanest Florida Man

Introducing Global Stocks on Robinhood

Many of you have expressed interest in investing in global companies that aren’t currently available on Robinhood. Today, we’re thrilled to announce that we’ll be rolling out American Depositary Receipts (ADRs) on Robinhood, adding over 250 new stocks of global companies.

Invest in companies you love from around the world, from countries including China, Japan, Germany, Canada, and the United Kingdom. Some of the most frequently searched companies, such as Tencent, Nintendo, and Adidas, will be available on Robinhood, along with many others. Search “New on Robinhood” on mobile or web to view the full list.

In the coming months, we’ll also expand the global list with stocks from France, including most frequently searched companies Ubisoft Entertainment, LVMH, andMichelin.

ADRs allow you to invest in companies that are based outside the U.S., and aren’t listed on U.S. stock exchanges such as Nasdaq and NYSE. You may also choose to invest in global stocks to diversify your portfolio. As with U.S. stocks, you can invest in ADRs on Robinhood commission-free. Learn more about ADRs on our Help Center.

Stay tuned for more updates soon!

Invest in companies you love from around the world, from countries including China, Japan, Germany, Canada, and the United Kingdom. Some of the most frequently searched companies, such as Tencent, Nintendo, and Adidas, will be available on Robinhood, along with many others. Search “New on Robinhood” on mobile or web to view the full list.

In the coming months, we’ll also expand the global list with stocks from France, including most frequently searched companies Ubisoft Entertainment, LVMH, andMichelin.

ADRs allow you to invest in companies that are based outside the U.S., and aren’t listed on U.S. stock exchanges such as Nasdaq and NYSE. You may also choose to invest in global stocks to diversify your portfolio. As with U.S. stocks, you can invest in ADRs on Robinhood commission-free. Learn more about ADRs on our Help Center.

Stay tuned for more updates soon!

#50

Sanest Florida Man

question about after hours purchases: I wanted to buy NIO on Friday so I put in an order for $10/share. This morning NIO was down to $9 pre-market so I cancelled my order before it was executed. However had I not cancelled would the shares have been purchased at $10/share or $9/share?

In the end I cancelled, and manually repurchased at $9 but I was curious what would've happened if I didn't cancel.

In the end I cancelled, and manually repurchased at $9 but I was curious what would've happened if I didn't cancel.

#51

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

Did you put in a limit order or market order?

#52

Sanest Florida Man

Market order

#53

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

Oh wait. I see you said after hours.

In that case you likely placed a limit order at $10/share.

With a limit order it would fulfill the order at a price of $10/share or better.

in this case as soon as the market opened the order would've went thru at $9/share or whatever price it opened at.

In that case you likely placed a limit order at $10/share.

With a limit order it would fulfill the order at a price of $10/share or better.

in this case as soon as the market opened the order would've went thru at $9/share or whatever price it opened at.

#54

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

I sometimes do that for IPOs.

when they estimate the opening price. I just put in a limit order at like $10-30 more than the range.

that way when it starts trading I get in at the opening trade price.

when they estimate the opening price. I just put in a limit order at like $10-30 more than the range.

that way when it starts trading I get in at the opening trade price.

#55

Team Owner

My recommendation is to always use limit orders. Setting a market order to execute at the open is just asking to get bent over. Does Robinhood not offer after hours trading?

#56

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

They do.

they just recently gave after hours trading to everyone.

they just recently gave after hours trading to everyone.

#57

https://www.barrons.com/articles/rob...ks-51544723146

Robinhood Seeks to Take On the Banks With a 3% Rate, but There’s a Catch

Dec. 13, 2018

Even as interest rates have risen in the past two years, most checking and savings accounts pay next to nothing. Banks don’t like to give away money if they don’t have to, and they haven’t been pressured to raise rates by consumers or competitors.

Now, Robinhood, best known as an investing app that allows people to trade stocks for free, says it wants to put the heat on those banks. As of Thursday, the app is offering savings and checking accounts that yield 3% annual interest rates paid out daily. What’s more, there are no account minimums or other requirements that banks often add in the fine print. And Robinhood has hooked up with ATM networks to allow it to offer free withdrawals from 75,000 banks using a debit card.

“Right now the banks are paying on average less than a 10th of a point,” Robinhood CEO Baiju Bhatt tells Barron’s. “We’ve seen some of the banking businesses try to compete with Robinhood but their products are just not very good and they’re full of gotchas.”

There is, however, an important catch to the Robinhood product that makes it different from traditional checking and savings accounts. Technically, it’s not a checking or savings account as most consumers understand those products--it is a cash management account, a product generally offered by brokers instead of banks. To get the rate, people need to sign up for a brokerage account at Robinhood, which is not a bank.

The cash in these accounts is not insured by the Federal Deposit Insurance Corporation. The FDIC is a federal agency that protects bank account holders up to $250,000.

Instead of FDIC insurance, the Robinhood products are insured by the Securities Investor Protection Corporation, or SIPC, a nonprofit membership corporation that oversees broker-dealers.

“I don’t think I can legally say that they are the same, but they serve an analogous purpose for brokerages,” Bhatt says.

SIPC makes a distinction between itself and the FDIC on its website.

“It is important to understand that SIPC is not the securities world equivalent of the FDIC, which insures depositors of insured banks,” the website says.

In an email to Barron’s the head of the SIPC cast doubt on the idea that it would insure checking or savings accounts.

“SIPC protects cash that is deposited with a brokerage firm for one limited purpose...the purpose of purchasing securities,” wrote Stephen P. Harbeck, the president and CEO of SIPC. “Cash deposited for other reasons would not be protected.”

Robinhood says that because the checking and savings products are technically part of a brokerage account, they would be protected by SIPC like other brokerage assets. People can trade stocks and other assets through the brokerage using the money in these checking and savings accounts.

If a broker goes bankrupt, SIPC works with a court-appointed trustee to return customer cash. In total, the SIPC protects up to $500,000 of cash and securities, with a $250,000 limit for cash only.

Other broker-dealers also offer cash management accounts with checking-like features, though the branding and insurance is different. Fidelity, for instance, offers a cash management account that acts like a checking account and allows people to use fee-free ATMs. But it’s not branded as a checking account, and cash funds are swept to a bank where that money is eligible for FDIC protection.

Robinhood says it will explain the difference to customers in its marketing.

“We don’t think that’s something that a lot of customers are going to be scrutinizing the details of, or will really see value in there being the difference between the two,” Bhatt says. “The product we’re offering has the same insurance amount, which is a quarter of a million dollars.”

It’s also not clear that Robinhood will be able to sustainably make money off this product.

The company says it will make money on the product by investing the proceeds in U.S. Treasury securities. The 10-year Treasury note was trading at 2.91% on Thursday, while the 30-year was at 3.15%. It will also share in the interchange fees that Mastercard (ticker: MA) receives when people use their debit cards.

Of course, if Robinhood can’t make money, this 3% deal could eventually evaporate. Like other checking and savings accounts, Robinhood rates can change based on changes in interest rates. Should rates fall, Robinhood could cut the amount of interest it offers to customers, though Bhatt says, “This is not a teaser rate.”

There are FDIC-insured bank accounts that pay decent rates, though not quite at this 3% level. The digital banking operation of Goldman Sachs (GS), Marcus, now offers a savings account that yields 2.05%. Those accounts are FDIC insured.

Dec. 13, 2018

Even as interest rates have risen in the past two years, most checking and savings accounts pay next to nothing. Banks don’t like to give away money if they don’t have to, and they haven’t been pressured to raise rates by consumers or competitors.

Now, Robinhood, best known as an investing app that allows people to trade stocks for free, says it wants to put the heat on those banks. As of Thursday, the app is offering savings and checking accounts that yield 3% annual interest rates paid out daily. What’s more, there are no account minimums or other requirements that banks often add in the fine print. And Robinhood has hooked up with ATM networks to allow it to offer free withdrawals from 75,000 banks using a debit card.

“Right now the banks are paying on average less than a 10th of a point,” Robinhood CEO Baiju Bhatt tells Barron’s. “We’ve seen some of the banking businesses try to compete with Robinhood but their products are just not very good and they’re full of gotchas.”

There is, however, an important catch to the Robinhood product that makes it different from traditional checking and savings accounts. Technically, it’s not a checking or savings account as most consumers understand those products--it is a cash management account, a product generally offered by brokers instead of banks. To get the rate, people need to sign up for a brokerage account at Robinhood, which is not a bank.

The cash in these accounts is not insured by the Federal Deposit Insurance Corporation. The FDIC is a federal agency that protects bank account holders up to $250,000.

Instead of FDIC insurance, the Robinhood products are insured by the Securities Investor Protection Corporation, or SIPC, a nonprofit membership corporation that oversees broker-dealers.

“I don’t think I can legally say that they are the same, but they serve an analogous purpose for brokerages,” Bhatt says.

SIPC makes a distinction between itself and the FDIC on its website.

“It is important to understand that SIPC is not the securities world equivalent of the FDIC, which insures depositors of insured banks,” the website says.

In an email to Barron’s the head of the SIPC cast doubt on the idea that it would insure checking or savings accounts.

“SIPC protects cash that is deposited with a brokerage firm for one limited purpose...the purpose of purchasing securities,” wrote Stephen P. Harbeck, the president and CEO of SIPC. “Cash deposited for other reasons would not be protected.”

Robinhood says that because the checking and savings products are technically part of a brokerage account, they would be protected by SIPC like other brokerage assets. People can trade stocks and other assets through the brokerage using the money in these checking and savings accounts.

If a broker goes bankrupt, SIPC works with a court-appointed trustee to return customer cash. In total, the SIPC protects up to $500,000 of cash and securities, with a $250,000 limit for cash only.

Other broker-dealers also offer cash management accounts with checking-like features, though the branding and insurance is different. Fidelity, for instance, offers a cash management account that acts like a checking account and allows people to use fee-free ATMs. But it’s not branded as a checking account, and cash funds are swept to a bank where that money is eligible for FDIC protection.

Robinhood says it will explain the difference to customers in its marketing.

“We don’t think that’s something that a lot of customers are going to be scrutinizing the details of, or will really see value in there being the difference between the two,” Bhatt says. “The product we’re offering has the same insurance amount, which is a quarter of a million dollars.”

It’s also not clear that Robinhood will be able to sustainably make money off this product.

The company says it will make money on the product by investing the proceeds in U.S. Treasury securities. The 10-year Treasury note was trading at 2.91% on Thursday, while the 30-year was at 3.15%. It will also share in the interchange fees that Mastercard (ticker: MA) receives when people use their debit cards.

Of course, if Robinhood can’t make money, this 3% deal could eventually evaporate. Like other checking and savings accounts, Robinhood rates can change based on changes in interest rates. Should rates fall, Robinhood could cut the amount of interest it offers to customers, though Bhatt says, “This is not a teaser rate.”

There are FDIC-insured bank accounts that pay decent rates, though not quite at this 3% level. The digital banking operation of Goldman Sachs (GS), Marcus, now offers a savings account that yields 2.05%. Those accounts are FDIC insured.

The following users liked this post:

#1 STUNNA (12-14-2018)

#58

Sanest Florida Man

I signed up for the beta today...

#59

Team Owner

This guy from r/wallstreetbets is now a legend.

https://www.marketwatch.com/story/tr...000-2019-01-22

Trader says he has ‘no money at risk,’ then promptly loses almost 2,000%

This about sums it up

https://www.reddit.com/r/wallstreetb...d_of_1r0nyman/

https://www.marketwatch.com/story/tr...000-2019-01-22

Trader says he has ‘no money at risk,’ then promptly loses almost 2,000%

This about sums it up

https://www.reddit.com/r/wallstreetb...d_of_1r0nyman/

Last edited by doopstr; 01-22-2019 at 04:49 PM.

#60

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

#61

Sanest Florida Man

They made him a mod after that

#62

Don't need Robinhood now

AMTD: $36.06 : -$10.64 (-22.78%)

ETFC: $35.59 : -$8.10 (-18.55%)

IBKR: $49.81 : -$3.97 (-7.38%)

SCHW: $38.10 : -$3.73 (-8.92%)

It's only a matter of time before TD Ameritrade and E*Trade follow.

https://www.wsj.com/articles/charles...ts-11569935983

Schwab following Interactive Brokers

https://www.wsj.com/articles/PR-CO-20190926-911400

AMTD: $36.06 : -$10.64 (-22.78%)

ETFC: $35.59 : -$8.10 (-18.55%)

IBKR: $49.81 : -$3.97 (-7.38%)

SCHW: $38.10 : -$3.73 (-8.92%)

It's only a matter of time before TD Ameritrade and E*Trade follow.

https://www.wsj.com/articles/charles...ts-11569935983

Charles Schwab Ending Online Trading Commissions on U.S.-Listed Products

Oct. 1, 2019 9:19 am ET

Charles Schwab Corp. on Tuesday said it would eliminate commissions for stocks, ETFs and options listed on U.S. or Canadian exchanges across all mobile and web trading channels, a move it said will cut quarterly revenue by 3% to 4%.

The San Francisco financial-services company currently charges a commission of $4.95 for online U.S. stock, ETF and options trades.

Charles Schwab said the move, which is effective Oct. 7, is aimed at making online investing more affordable, and it noted that with new firms entering the market using zero or low commissions as a lever, it “seemed inevitable that commissions would head towards zero.”

Charles Schwab said the pricing reduction is equivalent to about $90 million to $100 million in quarterly revenue, which roughly translates to 3% to 4% of total net revenue. However, the firm said its commissions per revenue trade have been falling for several years, “so the potential revenue impact in coming quarters could very well be smaller.”

Charles Schwab said clients’ trading options will continue to pay 65 cents per contract.

Oct. 1, 2019 9:19 am ET

Charles Schwab Corp. on Tuesday said it would eliminate commissions for stocks, ETFs and options listed on U.S. or Canadian exchanges across all mobile and web trading channels, a move it said will cut quarterly revenue by 3% to 4%.

The San Francisco financial-services company currently charges a commission of $4.95 for online U.S. stock, ETF and options trades.

Charles Schwab said the move, which is effective Oct. 7, is aimed at making online investing more affordable, and it noted that with new firms entering the market using zero or low commissions as a lever, it “seemed inevitable that commissions would head towards zero.”

Charles Schwab said the pricing reduction is equivalent to about $90 million to $100 million in quarterly revenue, which roughly translates to 3% to 4% of total net revenue. However, the firm said its commissions per revenue trade have been falling for several years, “so the potential revenue impact in coming quarters could very well be smaller.”

Charles Schwab said clients’ trading options will continue to pay 65 cents per contract.

Schwab following Interactive Brokers

https://www.wsj.com/articles/PR-CO-20190926-911400

Interactive Brokers to Launch IBKR Lite

Sept. 26, 2019 1:24 pm ET

Interactive Brokers Group, Inc. today announced IBKR Lite, a new offering that will provide commission-free, unlimited trades on US exchange-listed stocks and Exchange Traded Funds.

IBKR Lite was designed to meet the needs of investors who are seeking a simple, cost-free way to trade US exchange-listed stocks and ETFs and do not wish to consider our efforts to obtain greater price improvement through our IB SmartRoutingSM system. The new offering will complement Interactive Brokers' existing services, which will be rebranded as IBKR Pro. IBKR Lite will be available in October.

. . . .

Sept. 26, 2019 1:24 pm ET

Interactive Brokers Group, Inc. today announced IBKR Lite, a new offering that will provide commission-free, unlimited trades on US exchange-listed stocks and Exchange Traded Funds.

IBKR Lite was designed to meet the needs of investors who are seeking a simple, cost-free way to trade US exchange-listed stocks and ETFs and do not wish to consider our efforts to obtain greater price improvement through our IB SmartRoutingSM system. The new offering will complement Interactive Brokers' existing services, which will be rebranded as IBKR Pro. IBKR Lite will be available in October.

. . . .

#63

Team Owner

TD Ameritrade fires back at Schwab by cutting commissions to zero

https://www.investmentnews.com/artic...ssions-to-zero

#64

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

RH started a movement

#65

https://www.cnbc.com/2019/10/02/e-tr...e-fee-war.html

Who's left? Fidelity, Merrill Edge, Vanguard,...

E-Trade drops commissions on trades, joining Schwab, TD Ameritrade in brokerage fee war

Key Points

.

Key Points

.

- E-Trade is getting rid of commission fees on U.S. stock, ETF and options trades.

- The move comes within a week of Interactive Brokers, Charles Schwab and TD Ameritrade all dropping their commission fees.

- E-Trade estimates a quarterly revenue impact of $75 million from dropping fees.

#66

Team Owner

Picked up some AMTD today for $33. 3.58% yield,  (hope they don't cut it) My first commission free trade,

(hope they don't cut it) My first commission free trade,

(hope they don't cut it) My first commission free trade,

(hope they don't cut it) My first commission free trade,

#67

Another one

https://www.prnewswire.com/news-rele...300931311.html

https://www.prnewswire.com/news-rele...300931311.html

Ally Invest Joins the Zero Commissions Movement

Oct 04, 2019

CHARLOTTE, N.C., Oct. 4, 2019 /PRNewswire/ -- Ally Invest, the online brokerage and wealth management arm of Ally Financial Inc. (NYSE: ALLY), today announced it is joining the online trading movement that is eliminating commissions on U.S. exchange-listed stock, ETF, and option trades. The firm's long-standing per trade price of $4.95 is now moving to $0, effective October 9, 2019. In addition, clients trading options pay a competitive contract fee of just $0.50.

"With continued advancements in technology making online trading increasingly more cost-efficient, it was inevitable our industry would reach a point where self-directed investors could participate in the market for little to no cost," said Lule Demmissie, president of Ally Invest. "At Ally Invest, we've been planning for this evolution to democratize investing and are happy to be in the company of firms prepared to offer customers zero commission trading, while continuing to deliver an outstanding customer experience with a host of innovative investing and banking offerings."

. . . .

Oct 04, 2019

CHARLOTTE, N.C., Oct. 4, 2019 /PRNewswire/ -- Ally Invest, the online brokerage and wealth management arm of Ally Financial Inc. (NYSE: ALLY), today announced it is joining the online trading movement that is eliminating commissions on U.S. exchange-listed stock, ETF, and option trades. The firm's long-standing per trade price of $4.95 is now moving to $0, effective October 9, 2019. In addition, clients trading options pay a competitive contract fee of just $0.50.

"With continued advancements in technology making online trading increasingly more cost-efficient, it was inevitable our industry would reach a point where self-directed investors could participate in the market for little to no cost," said Lule Demmissie, president of Ally Invest. "At Ally Invest, we've been planning for this evolution to democratize investing and are happy to be in the company of firms prepared to offer customers zero commission trading, while continuing to deliver an outstanding customer experience with a host of innovative investing and banking offerings."

. . . .

#68

Sanest Florida Man

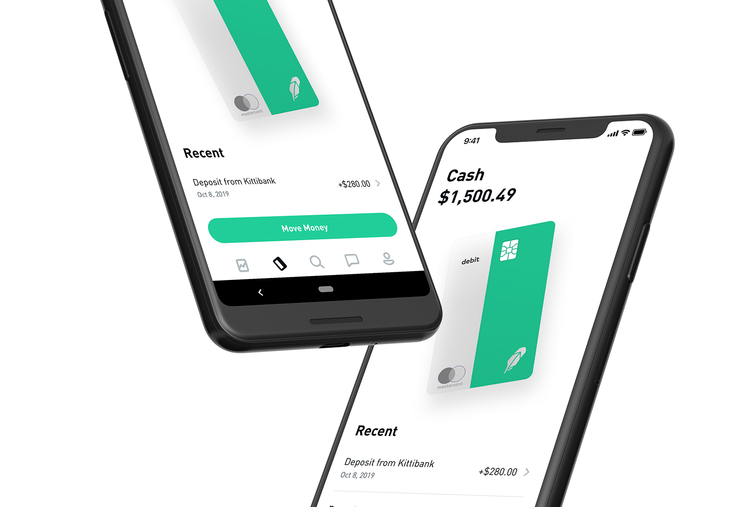

We believe our financial system should work for you and do more for your money. To help get us there, we announced plans in December to launch a new product. We made mistakes with that announcement, which led us to hit the reset button and start over from scratch.

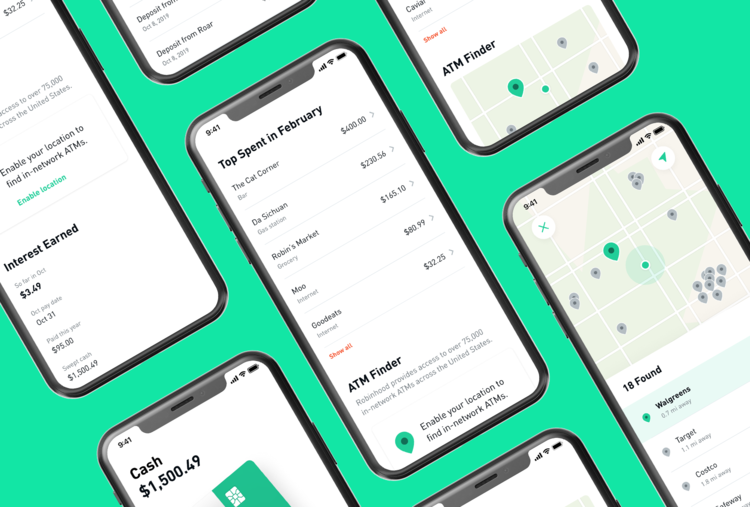

Today, we’re excited to announce Cash Management, a new feature to give you more flexibility with your money. Invest, spend, and earn interest with a competitive Annual Percentage Yield (APY)*—all through your brokerage account. Join the waitlist today, and get early access to sign up when we launch.

Join the Waitlist for Cash Management

Keep Earning

With Cash Management, your uninvested cash is moved to program banks that pay you 2.05% APY as of October 8, 2019. Uninvested cash is money you have in your brokerage account that you plan to invest, but haven’t yet invested or spent. Interest is paid every month, on every penny. Keep in mind that like any variable rate, it may go up or down over time at the banks’ discretion, due to factors including market conditions.

With Cash Management, we don’t charge foreign transaction fees or maintenance fees, and there are no account minimums. Other fees, Gold fees, and third party fees may apply to your brokerage account. Learn more.

FDIC Insurance

Your uninvested cash at these program banks is eligible for FDIC insurance up to a total of $1.25 million–or up to $250,000 per bank, subject to FDIC rules. You can read more about FDIC insurance here.

Customized Debit Card, 75,000+ ATMs, and More

Use your debit card anywhere Mastercard® is accepted and spend directly from your brokerage account. Choose from four card designs: Green, Black, White, and the American Flag. Don’t pay fees at more than 75,000 in-network ATMs. You can also pay bills, and use Apple Pay, Samsung Pay, or Google Pay.

Thanks for being patient as we built Cash Management. We can’t wait for you to check it out soon.

Today, we’re excited to announce Cash Management, a new feature to give you more flexibility with your money. Invest, spend, and earn interest with a competitive Annual Percentage Yield (APY)*—all through your brokerage account. Join the waitlist today, and get early access to sign up when we launch.

Join the Waitlist for Cash Management

Keep Earning

With Cash Management, your uninvested cash is moved to program banks that pay you 2.05% APY as of October 8, 2019. Uninvested cash is money you have in your brokerage account that you plan to invest, but haven’t yet invested or spent. Interest is paid every month, on every penny. Keep in mind that like any variable rate, it may go up or down over time at the banks’ discretion, due to factors including market conditions.

With Cash Management, we don’t charge foreign transaction fees or maintenance fees, and there are no account minimums. Other fees, Gold fees, and third party fees may apply to your brokerage account. Learn more.

FDIC Insurance

Your uninvested cash at these program banks is eligible for FDIC insurance up to a total of $1.25 million–or up to $250,000 per bank, subject to FDIC rules. You can read more about FDIC insurance here.

Customized Debit Card, 75,000+ ATMs, and More

Use your debit card anywhere Mastercard® is accepted and spend directly from your brokerage account. Choose from four card designs: Green, Black, White, and the American Flag. Don’t pay fees at more than 75,000 in-network ATMs. You can also pay bills, and use Apple Pay, Samsung Pay, or Google Pay.

Thanks for being patient as we built Cash Management. We can’t wait for you to check it out soon.

#69

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

FDIC insurance? I’m intrigued.

#70

Team Owner

Who's got 2.05%APY now? Ally just dropped me from 1.9% to 1.8%.

#71

https://www.bankrate.com/banking/sav...ings-accounts/

Best high-yield savings accounts in October 2019

BrioDirect – 2.46% APY

Vio Bank – 2.42% APY

TAB Bank – 2.40% APY

Popular Direct – 2.40% APY

Customers Bank – 2.40% APY

SFGI Direct – 2.27% APY

MySavingsDirect – 2.25% APY

Comenity Direct – 2.25% APY

Prime Alliance Bank – 2.22% APY

HSBC Direct – 2.20% APY

Best high-yield savings accounts in October 2019

BrioDirect – 2.46% APY

Vio Bank – 2.42% APY

TAB Bank – 2.40% APY

Popular Direct – 2.40% APY

Customers Bank – 2.40% APY

SFGI Direct – 2.27% APY

MySavingsDirect – 2.25% APY

Comenity Direct – 2.25% APY

Prime Alliance Bank – 2.22% APY

HSBC Direct – 2.20% APY

The following users liked this post:

doopstr (10-09-2019)

#72

There's also the Cash Management Accounts (what Robinhood is) from Wealthfront (2.07% APY) and Betterment (2.04% APY)

SoFi Money, another CMA, used to have a 2.xx% APY similar to Weathfront and Betterment, but now it's down to 1.80%

Oh, and Credit Karma is going to offer a 2.03% APY account: https://fortune.com/2019/10/03/inter...-credit-karma/

Better list of high yield accounts at https://www.doctorofcredit.com/high-...avings-to-get/

.

SoFi Money, another CMA, used to have a 2.xx% APY similar to Weathfront and Betterment, but now it's down to 1.80%

Oh, and Credit Karma is going to offer a 2.03% APY account: https://fortune.com/2019/10/03/inter...-credit-karma/

Better list of high yield accounts at https://www.doctorofcredit.com/high-...avings-to-get/

.

Last edited by AZuser; 10-09-2019 at 07:33 PM.

The following users liked this post:

doopstr (10-10-2019)

#73

https://www.wsj.com/articles/fidelit...ro-11570680060

Fidelity Is Latest to Cut Online Trading Commissions to Zero

Oct. 10, 2019 12:01 am ET

Fidelity Investments eliminated trading commissions on its online brokerage, matching a step some of its biggest rivals unveiled last week.

Beginning early Thursday, Fidelity stopped charging individual investors commissions on online trades of U.S. stocks, exchange-traded funds and options trades. For investment advisers, commissions will be cut to zero on Nov. 4. Fidelity’s online brokerage has 21.8 million accounts.

Before Thursday’s move, Fidelity charged $4.95 for online stock trades.

. . . .

Two months ago, Fidelity unveiled plans to divert clients’ cash into higher-yielding money-market funds, arguing the step provided a sharp contrast to their competitors’ practice of paying out ultralow rates on cash.

More than 500 ETFs already have traded commission-free on Fidelity’s platform, including several hundred managed by BlackRock Inc. “We continue to have a great relationship with BlackRock as well as the other ETF sponsors currently participating in our commission-free ETF platform,” a Fidelity spokeswoman said.

Oct. 10, 2019 12:01 am ET

Fidelity Investments eliminated trading commissions on its online brokerage, matching a step some of its biggest rivals unveiled last week.

Beginning early Thursday, Fidelity stopped charging individual investors commissions on online trades of U.S. stocks, exchange-traded funds and options trades. For investment advisers, commissions will be cut to zero on Nov. 4. Fidelity’s online brokerage has 21.8 million accounts.

Before Thursday’s move, Fidelity charged $4.95 for online stock trades.

. . . .

Two months ago, Fidelity unveiled plans to divert clients’ cash into higher-yielding money-market funds, arguing the step provided a sharp contrast to their competitors’ practice of paying out ultralow rates on cash.

More than 500 ETFs already have traded commission-free on Fidelity’s platform, including several hundred managed by BlackRock Inc. “We continue to have a great relationship with BlackRock as well as the other ETF sponsors currently participating in our commission-free ETF platform,” a Fidelity spokeswoman said.

#74

Team Owner

https://www.bankrate.com/banking/sav...ings-accounts/

Best high-yield savings accounts in October 2019

BrioDirect – 2.46% APY

Best high-yield savings accounts in October 2019

BrioDirect – 2.46% APY

The following users liked this post:

Mizouse (10-10-2019)

#75

Maybe they were updating site right then because home page shows 2.30% for me. It's like when you posted that Ally just dropped you from 1.9% to 1.8%. When I checked, Ally still had 1.9%, but now it reads 1.8%

6xsx6v3.png

6xsx6v3.png

#76

https://www.wsj.com/articles/schwab-...ks-11571334424

Schwab, in Bid for Younger Clients, to Allow Investors to Buy and Sell Fractions of Stocks

Oct. 17, 2019 1:47 pm ET

Charles Schwab Corp. will let investors buy and sell fractions of shares in coming months as part of an effort to attract younger clients.

Founder and Chairman Charles R. Schwab told The Wall Street Journal Thursday that fractional share trading would soon be introduced, along with several other new programs, as the online brokerage looks ahead after it eliminated trading commissions earlier this month.

The move would be the first by a major online brokerage to allow investors to buy and sell fractions of stocks. Some of the most well-known and popular companies have very high price tags, making owning a share impossible for some would-be investors. A share of Amazon.com Inc., for example, costs $1,792.

When Schwab said this month that it would nix trading commissions, it acknowledged competitive pressure from new entrants. Digital upstarts such as Robinhood Markets Inc. helped popularize the zero-commission model in the online-brokerage business, and some others have already allowed for fractional share trading. One such company is M1 Finance LLC, a Chicago-based online brokerage that splits every share into one-one hundred thousandth of a share.

Oct. 17, 2019 1:47 pm ET

Charles Schwab Corp. will let investors buy and sell fractions of shares in coming months as part of an effort to attract younger clients.

Founder and Chairman Charles R. Schwab told The Wall Street Journal Thursday that fractional share trading would soon be introduced, along with several other new programs, as the online brokerage looks ahead after it eliminated trading commissions earlier this month.

The move would be the first by a major online brokerage to allow investors to buy and sell fractions of stocks. Some of the most well-known and popular companies have very high price tags, making owning a share impossible for some would-be investors. A share of Amazon.com Inc., for example, costs $1,792.

When Schwab said this month that it would nix trading commissions, it acknowledged competitive pressure from new entrants. Digital upstarts such as Robinhood Markets Inc. helped popularize the zero-commission model in the online-brokerage business, and some others have already allowed for fractional share trading. One such company is M1 Finance LLC, a Chicago-based online brokerage that splits every share into one-one hundred thousandth of a share.

#77

Moderator

Thread Starter

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

sweet time to buy 1/10th of a share of Amazon

#78

Team Owner

#79

Team Owner

#80

Team Owner

https://markets.businessinsider.com/...rce=reddit.com

Robinhood's 'infinite money' glitch has inspired copycat traders - and one user has now grown a $1.7 million position

Robinhood's 'infinite money' glitch has inspired copycat traders - and one user has now grown a $1.7 million position

Call_Warrior, a member of the r/WallStreetBets subreddit, posted screenshots on Tuesday night showing how the glitch was used to buy 47,600 shares of Advanced Micro Devices. The post has since been deleted.