Netflix

#41

The sizzle in the Steak

#42

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Yea I saw that too but it's because of the poor 4Q forecast...

#43

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Ppppaaaaaaaaaiiiiiiinnnnnnn!!!!!!!!!!

#45

Suzuka Master

So now that most of the that arent going to pay the price increase left, and Netflix took a huge drop in the market.

Can it only go up now? They shouldnt be losing many more customers so long as the competition doesn't become stronger

Can it only go up now? They shouldnt be losing many more customers so long as the competition doesn't become stronger

#46

Team Owner

Thread Starter

Netflix expects to lose money the next two quarters due to expansion, so it's still a crap shoot IMO.

If they don't get the Starz contract renewed there will be a fresh batch of subscribers jumping ship early next year.

If they don't get the Starz contract renewed there will be a fresh batch of subscribers jumping ship early next year.

#47

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

They've also been signing up more content recently so

#48

Suzuka Master

Yea, they have some big contracts that are gonna be adding some content in january/february right?

#49

The sizzle in the Steak

Netflix to sell convertible debt to raise capital

Video rental company Netflix Inc said late on Monday that it agreed to sell $200 million of convertible debt to long-time backer Technology Crossover Ventures to raise new capital.

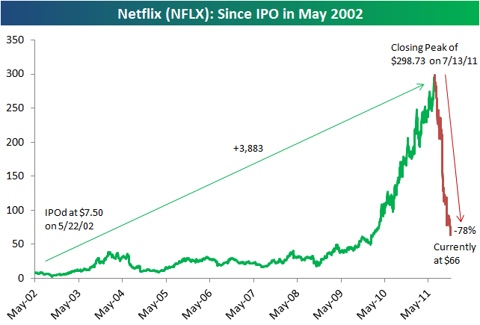

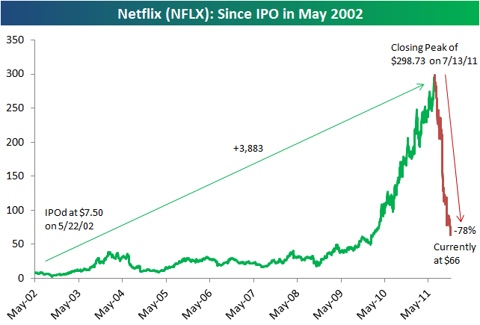

Netflix has lost about two-thirds of its market value since the company's shares touched a high of almost $300 in July.

The company, which had $159.2 million in cash and cash equivalents at the end of September, has struggled to renegotiate video content deals. It has also lost subscribers and warned of a first-quarter loss.

When Netflix Chief Executive Reed Hastings "said hey I'm going to double content spend in 2012, we couldn't see how it could happen. It was blowing up our model ... But if they really had to go out and double content spend, he had to do something to get the cash," UBS analyst Brian Fitzgerald told Reuters.

"It's necessary for the company because they have to get some content ahead of the launches in UK and Ireland."

As part of the agreement, TCV will receive zero-coupon notes, due in 2018, that convert to Netflix common stock at a price of about $85.80 per share.

Fitzgerald said the valuation of the private placement was indicative of the risk attached to the company's business model.

"The problem with the stock is you have other deep pocketed technology companies like Amazon, Google, Apple and even the incumbent MSOs and companies like HBO Go, and they are all starting to get their content out just as ubiquitously as Netflix," he said.

"I think that the riskiness to the model is baked into that $85 share price."

The deal requires Netflix to raise at least $200 million by selling common stock to other, unaffiliated investors, according to a filing with the Securities and Exchange Commission.

Shares of Netflix fell 0.6 percent to $74 in extended trade on Monday.

TCV, a leading venture capital firm, has been an investor in Netflix for many years. TCV co-founder Jay Hoag is on Netflix's board.

TCV also has investments in Groupon, Facebook and Electronic Arts.

http://www.reuters.com/article/2011/...7AK2I920111122

oh boy!

Video rental company Netflix Inc said late on Monday that it agreed to sell $200 million of convertible debt to long-time backer Technology Crossover Ventures to raise new capital.

Netflix has lost about two-thirds of its market value since the company's shares touched a high of almost $300 in July.

The company, which had $159.2 million in cash and cash equivalents at the end of September, has struggled to renegotiate video content deals. It has also lost subscribers and warned of a first-quarter loss.

When Netflix Chief Executive Reed Hastings "said hey I'm going to double content spend in 2012, we couldn't see how it could happen. It was blowing up our model ... But if they really had to go out and double content spend, he had to do something to get the cash," UBS analyst Brian Fitzgerald told Reuters.

"It's necessary for the company because they have to get some content ahead of the launches in UK and Ireland."

As part of the agreement, TCV will receive zero-coupon notes, due in 2018, that convert to Netflix common stock at a price of about $85.80 per share.

Fitzgerald said the valuation of the private placement was indicative of the risk attached to the company's business model.

"The problem with the stock is you have other deep pocketed technology companies like Amazon, Google, Apple and even the incumbent MSOs and companies like HBO Go, and they are all starting to get their content out just as ubiquitously as Netflix," he said.

"I think that the riskiness to the model is baked into that $85 share price."

The deal requires Netflix to raise at least $200 million by selling common stock to other, unaffiliated investors, according to a filing with the Securities and Exchange Commission.

Shares of Netflix fell 0.6 percent to $74 in extended trade on Monday.

TCV, a leading venture capital firm, has been an investor in Netflix for many years. TCV co-founder Jay Hoag is on Netflix's board.

TCV also has investments in Groupon, Facebook and Electronic Arts.

http://www.reuters.com/article/2011/...7AK2I920111122

oh boy!

#50

New 52 week low today.

#51

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

finally back above a hundred....

shouldve gotten more at 66 a share...

shouldve gotten more at 66 a share...

#52

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Up 10% after hours. 105.15/share

220k subscribers added last quarter, profit of $52 million.

Still got a sour taste in my mouth...

220k subscribers added last quarter, profit of $52 million.

Still got a sour taste in my mouth...

#54

The sizzle in the Steak

buy low, sell high

#55

Team Owner

Thread Starter

You need brass balls to trade this stock.

#56

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#57

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Wait so they beat wall streets estimates but the stock tumbles?

#58

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

I dont think this thing will in a long time go back to $198/share.

What do you guys think I should do?

What do you guys think I should do?

#59

Sure, they beat Wall Street estimates, but a loss is still a loss. That's not good since they've been so highly profitable before.

What was your buy in price? If you believe that they'll be profitable in Q2 like they say, then I'd hang on.

While US subscriber growth seems to be slowing, international growth seems to be doing good. That may help with next quarters #'s, although they are still losing a lot of $ internationally, so that will be a negative for them even if Canada becomes profitable.

Plus, NFLX is going to have another competitor (Verizon and Redbox) to deal with in the 2nd half of 2012. Pay attention to AMZN when they report on Thursday. See how their streaming service is doing.

Look over their Investor Letter <-- link

All I know is that NFLX streaming needs to add more new content and quick. I'm already bored with it and am considering canceling since there aren't much newer movies available like I can get from Redbox.

Netflix Inc projected slower subscriber growth for its key U.S. video-streaming service, disappointing investors and sending its shares down 17 percent.

While Netflix reported a first-quarter loss that was not as steep as Wall Street projected, it warned that domestic streaming additions in the second quarter would be below that seen during the same period in 2010.

Adding customers to the instant-streaming business is key to the company's future as it moves away from mailing DVDs in its signature red envelopes.

"They are giving a signal to the Street their growth story is over," said Pachter, who rates Netflix a "sell."

For the first quarter, Netflix posted revenue of $870 million, up 21 percent from a year earlier. The company had a net loss of $4.6 million or 8 cents per share in the quarter, versus a net profit of $60.2 million a year earlier.

Analysts had expected a loss of 27 cents per share, according to Thomson Reuters I/B/E/S.

The company added 1.7 million U.S. streaming customers in the quarter, while losing about 1.1 million U.S. DVD subscribers.

On Monday, Netflix said it expected to return to profitability in the second quarter and launch in another European market in the fourth quarter of this year.

The move into another market may have added to concerns among investors, said Gabelli & Co analyst Brett Harriss.

While Netflix reported a first-quarter loss that was not as steep as Wall Street projected, it warned that domestic streaming additions in the second quarter would be below that seen during the same period in 2010.

Adding customers to the instant-streaming business is key to the company's future as it moves away from mailing DVDs in its signature red envelopes.

"They are giving a signal to the Street their growth story is over," said Pachter, who rates Netflix a "sell."

For the first quarter, Netflix posted revenue of $870 million, up 21 percent from a year earlier. The company had a net loss of $4.6 million or 8 cents per share in the quarter, versus a net profit of $60.2 million a year earlier.

Analysts had expected a loss of 27 cents per share, according to Thomson Reuters I/B/E/S.

The company added 1.7 million U.S. streaming customers in the quarter, while losing about 1.1 million U.S. DVD subscribers.

On Monday, Netflix said it expected to return to profitability in the second quarter and launch in another European market in the fourth quarter of this year.

The move into another market may have added to concerns among investors, said Gabelli & Co analyst Brett Harriss.

While US subscriber growth seems to be slowing, international growth seems to be doing good. That may help with next quarters #'s, although they are still losing a lot of $ internationally, so that will be a negative for them even if Canada becomes profitable.

Internationally, Netflix added more customers in its first three months of UK / Ireland availability than it did in the same period for Latin America or Canada, and expects its Canadian service to be profitable a quarter earlier than expected.

Look over their Investor Letter <-- link

All I know is that NFLX streaming needs to add more new content and quick. I'm already bored with it and am considering canceling since there aren't much newer movies available like I can get from Redbox.

#60

Moderator

Now that I think about it, I don't use Netflix to watch movies any more. I mainly watch shows that I've been neglecting (eg Southpark, The Walking Dead, Breaking bad, etc).

Netflix streaming definitely lacks a lot of current releases.

Netflix streaming definitely lacks a lot of current releases.

#61

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

What was your buy in price? If you believe that they'll be profitable in Q2 like they say, then I'd hang on.

Plus, NFLX is going to have another competitor (Verizon and Redbox) to deal with in the 2nd half of 2012. Pay attention to AMZN when they report on Thursday. See how their streaming service is doing.

Look over their Investor Letter <-- link

All I know is that NFLX streaming needs to add more new content and quick. I'm already bored with it and am considering canceling since there aren't much newer movies available like I can get from Redbox.

Plus, NFLX is going to have another competitor (Verizon and Redbox) to deal with in the 2nd half of 2012. Pay attention to AMZN when they report on Thursday. See how their streaming service is doing.

Look over their Investor Letter <-- link

All I know is that NFLX streaming needs to add more new content and quick. I'm already bored with it and am considering canceling since there aren't much newer movies available like I can get from Redbox.

And I never liked the streaming, I want to watch new releases, so that's why I dropped streaming and kept the blurays.

Speaking of which I gotta find where I put them before I went on vacation...

#62

several options off the top of my head:

1) if you don't believe in company any more, sell (not necessarily tomorrow), take loss and use to offset any gains. use this as a lesson to take profits next time.

2) if you still believe in company, buy more at lower prices to offset higher original purchase price (dollar cost averaging)

3) if you still believe in company, wait until it becomes profitable again and maybe stock price will get back to or above $198 (looks doubtful right now) whenever that will be

option 2 seems best as I believe stock will rise again to $100 toward the end of the year

#63

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

i was thinking that too.

i think the company has probably gotten thru the worst part of the price hike.

i think the company has probably gotten thru the worst part of the price hike.

#64

Team Owner

Thread Starter

Competition is coming on fast from multiple directions. Apple, Amazon, Cable Cos. I'm trying to understand why they wanted to ditch the DVD by mail business when they more or less had a monopoly there. Then they chose to push hard into streaming and they are getting attacked on all fronts. Losing contracts from content providers, a lot of competition, and pissing off your customers is not a formula for success. IMO eventually they are going to need someone to buy them out or they will end up like Blockbuster.

Last edited by doopstr; 04-24-2012 at 09:06 AM.

#65

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Ugh... I can't take this anymore. I think I'm gonna sell it all. Finally went into the red. Losing principle now.

Definitely should've taken profits...

Me = moron.

Definitely should've taken profits...

Me = moron.

#66

Team Owner

Thread Starter

Hopefully you have learned something about stops. If you don't set them you end up trading on emotion.

#67

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

I think at my best I was up over 30% for my entire portfolio...

Me = greedy...

Me = greedy...

#68

at $80.42 - up $8.38 (11.63%)

Up over 30% from its lows in early-mid June.

Up over 30% from its lows in early-mid June.

Last edited by AZuser; 07-05-2012 at 11:02 AM.

#69

$84.97 - Up $3.33 (4.08%)

Last edited by AZuser; 07-12-2012 at 03:05 PM.

#70

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Wake me up when it goes back to $191/share

0

0

#71

You still holding NFLX?

Not sure about $191, but like I said before $100 (maybe even $120) is very likely.

I'm thinking next earnings report in 2 weeks will be good.

Not sure about $191, but like I said before $100 (maybe even $120) is very likely.

I'm thinking next earnings report in 2 weeks will be good.

Netflix (NFLX) video subscribers are relying on the video service for TV viewing, reports Tech Crunch, citing a recent survey from Nielsen. The number of subscribers who prefer to use Netflix for its primary method for TV has grown to 19% from 11% a year ago.

Netflix Watch Instantly Cannibalizes Pay-TV VOD & Premium Channels Thanks to Lower Costs and Better Availability

Low cost and viewing flexibility give Netflix an advantage over pay-TV VOD and premium broadcast TV, according to a new study from Parks Associates on consumer video viewing. Choosing Content: Viewing Video found Netflix Watch Instantly rates higher in customer satisfaction than premium broadcast TV because of these factors. Netflix also topped pay-TV VOD in terms of cost.

“Consumers can pay for a month of Netflix for about the same amount as for two pay-TV VOD movies,” said Brett Sappington, Director, Research, Parks Associates. “Parks Associates research shows consumers know the quality of the OTT service is not comparable to pay-TV quality, but the cost-benefit comparison is enough to affect their purchase decisions.”

The Netflix over-the-top (OTT) service also influences the decision processes of pay-TV consumers, raising the possibility of Watch Instantly cannibalizing pay-TV offerings. Parks Associates research found 16% of U.S. broadband consumers, when watching movies on VOD, consider instead using an online subscription service as an alternative. Similarly, 17% of those watching TV programs on a premium channel like HBO consider using Netflix instead.

"Netflix is competitive against VOD and premium channels because it has a decisive edge in cost,” said John Barrett, Director, Consumer Analytics, Parks Associates. “Its greatest weakness is picture quality, but there are times when the consumer will sacrifice quality for other considerations. Pay-TV providers should emphasize their inherent advantages in content and picture quality but also need to develop alternative services that counter Netflix's advantages in cost and flexibility.”

Pay-TV providers worldwide have adopted their own OTT services to combat independent services such as Netflix, but consumer awareness is low and few providers offer subscription OTT services. Comcast offers an OTT subscription service exclusively to its pay-TV subscribers, and DISH Network offers an online service to its subscribers via Blockbuster. Verizon and Redbox are partnering to offer an over-the-top service later this year.

http://www.parksassociates.com/blog/...pr-jun2012-ott

Low cost and viewing flexibility give Netflix an advantage over pay-TV VOD and premium broadcast TV, according to a new study from Parks Associates on consumer video viewing. Choosing Content: Viewing Video found Netflix Watch Instantly rates higher in customer satisfaction than premium broadcast TV because of these factors. Netflix also topped pay-TV VOD in terms of cost.

“Consumers can pay for a month of Netflix for about the same amount as for two pay-TV VOD movies,” said Brett Sappington, Director, Research, Parks Associates. “Parks Associates research shows consumers know the quality of the OTT service is not comparable to pay-TV quality, but the cost-benefit comparison is enough to affect their purchase decisions.”

The Netflix over-the-top (OTT) service also influences the decision processes of pay-TV consumers, raising the possibility of Watch Instantly cannibalizing pay-TV offerings. Parks Associates research found 16% of U.S. broadband consumers, when watching movies on VOD, consider instead using an online subscription service as an alternative. Similarly, 17% of those watching TV programs on a premium channel like HBO consider using Netflix instead.

"Netflix is competitive against VOD and premium channels because it has a decisive edge in cost,” said John Barrett, Director, Consumer Analytics, Parks Associates. “Its greatest weakness is picture quality, but there are times when the consumer will sacrifice quality for other considerations. Pay-TV providers should emphasize their inherent advantages in content and picture quality but also need to develop alternative services that counter Netflix's advantages in cost and flexibility.”

Pay-TV providers worldwide have adopted their own OTT services to combat independent services such as Netflix, but consumer awareness is low and few providers offer subscription OTT services. Comcast offers an OTT subscription service exclusively to its pay-TV subscribers, and DISH Network offers an online service to its subscribers via Blockbuster. Verizon and Redbox are partnering to offer an over-the-top service later this year.

http://www.parksassociates.com/blog/...pr-jun2012-ott

Netflix streaming tops 1 billion hours in month for first time

Netflix has reached a new milestone as the Watch Instantly digital streaming service saw more than 1 billion hours streamed last month.

CEO Reed Hastings announced the good news via the following message posted to his Facebook page this week:

There are a number of factors that have contributed to Netflix's latest achievement. Certainly the international expansion across Latin America as well as a foot in the door in Europe with a launch in the United Kingdom have helped.

Furthermore, the $7.99 monthly plan is continually more appealing to younger consumers who don't want to shell out anywhere between $50 to $100 each month for cable when they can access plenty of on-demand TV shows and movies on nearly every electronic device they own from gaming consoles to smartphones.

Netflix has reached a new milestone as the Watch Instantly digital streaming service saw more than 1 billion hours streamed last month.

CEO Reed Hastings announced the good news via the following message posted to his Facebook page this week:

There are a number of factors that have contributed to Netflix's latest achievement. Certainly the international expansion across Latin America as well as a foot in the door in Europe with a launch in the United Kingdom have helped.

Furthermore, the $7.99 monthly plan is continually more appealing to younger consumers who don't want to shell out anywhere between $50 to $100 each month for cable when they can access plenty of on-demand TV shows and movies on nearly every electronic device they own from gaming consoles to smartphones.

#72

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

no i sold that shit a long time ago.

took a fat loss and used the money to buy more AAPL..

took a fat loss and used the money to buy more AAPL..

#73

Well, F me.

After Hours: $69.37 - Down $11.02 (13.71%)

Earnings were good like I expected, but stock is down AH.

After Hours: $69.37 - Down $11.02 (13.71%)

Earnings were good like I expected, but stock is down AH.

A first look at the Netflix Q2 numbers: Earnings of 11 cents a share on revenue of $889 million. The street was expecting five cents per share and $889 million. At least as important, though, are the video service’s subscriber numbers. Here investors were looking for 24.3 million domestic streaming subscribers, 9.1 million DVD subs, and 3.7 million subscribers from Canada, Latin America and the UK, and Netflix didn’t quite get there: 23.9 million domestic, 9.2 million DVD, and 3.6 million international.

The street is unhappy with something here: NFLX has plummeted 14 percent since the release hit the wires.

Here’s a possible warning flag for investors on Q3: Netflix is saying that the summer Olympics could impact growth. That’s the first time I believe I’ve heard them warn about that.

“For Q3 quarter-to-date, our domestic net additions are very nearly the same as Q3 2010 over the comparable partial period. In that quarter two years ago, we finished with 1.8 million domestic net additions. However, in the middle of that quarter, we launched Netflix on the iPhone to great reception, and we don’t have an equivalent launch this quarter. Moreover, this quarter the Olympics are likely to have a negative impact on Netflix viewing and sign-ups. So, our Q3 guidance is 1 million to 1.8 million domestic net adds. If we finish Q3 in the high end of that range, we would remain on track for 7 million domestic net additions for the year; otherwise it would be challenging to achieve that goal by year end.”

That said, the guidance that Netflix is offering for Q3 would seem to be what investors were looking for: Up to 25.7 million streaming subs, 4.4 million international and 8.7 million DVD subscribers.

http://allthingsd.com/20120724/netfl...D_yahoo_ticker

The street is unhappy with something here: NFLX has plummeted 14 percent since the release hit the wires.

Here’s a possible warning flag for investors on Q3: Netflix is saying that the summer Olympics could impact growth. That’s the first time I believe I’ve heard them warn about that.

“For Q3 quarter-to-date, our domestic net additions are very nearly the same as Q3 2010 over the comparable partial period. In that quarter two years ago, we finished with 1.8 million domestic net additions. However, in the middle of that quarter, we launched Netflix on the iPhone to great reception, and we don’t have an equivalent launch this quarter. Moreover, this quarter the Olympics are likely to have a negative impact on Netflix viewing and sign-ups. So, our Q3 guidance is 1 million to 1.8 million domestic net adds. If we finish Q3 in the high end of that range, we would remain on track for 7 million domestic net additions for the year; otherwise it would be challenging to achieve that goal by year end.”

That said, the guidance that Netflix is offering for Q3 would seem to be what investors were looking for: Up to 25.7 million streaming subs, 4.4 million international and 8.7 million DVD subscribers.

http://allthingsd.com/20120724/netfl...D_yahoo_ticker

#74

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

How is a profit loss of 91% good?

#75

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Anyway I'm glad I dumped that.

Maybe I shouldve tried those puts/calls?

Maybe I shouldve tried those puts/calls?

#76

Well, if you look at the year ago quarter, then yes... not good at all. But since the company had guided down for the rest of the year, we already knew that NFLX wouldn't meet last years numbers. That growth rate is gone... thought people would have priced that into the #s, but I guess peoples expectations were still too high. Q2 is turning into a repeat of Q1.

Anyways, what I meant about good earnings is that they beat the street. They earned 11 cents a share on revenue of $889 million vs street expectations of 5 cents per share on revenue of $889 million.

It's also a big improvement over Q1 #s: 8 cents a share loss on $4.6 million revenue. Oh well... on to Q3.

Let's see how WFM does tomorrow and SBUX on Thurs.

Anyways, what I meant about good earnings is that they beat the street. They earned 11 cents a share on revenue of $889 million vs street expectations of 5 cents per share on revenue of $889 million.

It's also a big improvement over Q1 #s: 8 cents a share loss on $4.6 million revenue. Oh well... on to Q3.

Let's see how WFM does tomorrow and SBUX on Thurs.

#77

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

i need to save more so i can buy more stocks.... ive spent waaaaaaay to much this year...

#78

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Holy shit, down 25%????

#79

Senior Moderator

wow, "Dark of the Moon" is on Netflix....

#80

price is back to where it was about 5 month ago.

$86.32 - Up $2.95 (3.54%)

$86.32 - Up $2.95 (3.54%)

NFLX down 14% to $87 after hours

NFLX down 14% to $87 after hours