How much ~ do you save a month?

#81

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

Actually thinking about it more, since my post in 2015, I'm saving 6% pretax on my payroll for my works 401K. 6% maximizes the 3% match my company offers.

#82

Team Owner

#83

Safety Car

But essentially my two investor heroes are: Jack Bogle (Vanguard) and Warren Buffett.

To boil it down, my investment philosophy is something like this: https://www.bogleheads.org/wiki/Lazy_portfolios

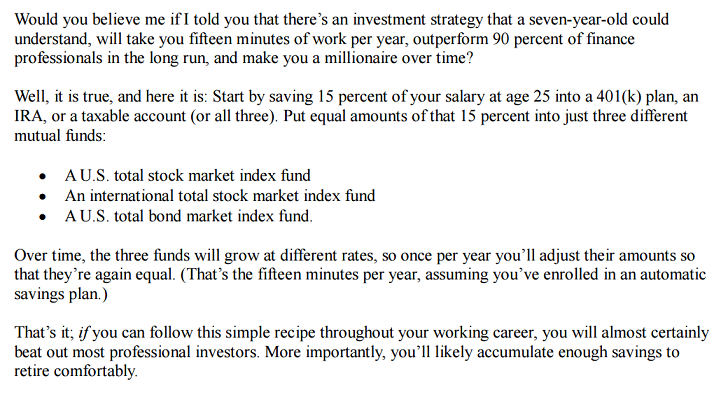

And to copy and paste from William Bernstein, which I think he speaks a LOT of truth:

15%+ will be even better if you can muster it. Done. Enjoy retirement.

source: https://www.etf.com/docs/IfYouCan.pdf

The following users liked this post:

Jakes_tl (03-06-2017)

#84

Senior Moderator

My novice advice is to put in as much as your employer is willing to match into a Roth IRA. When I started, that was 6% with my employer matching 3% (or half of whatever I contribute up to 3%). I believe they have upped that to 4.5%, so I'm putting in 9% now. My employer contributions are tradition IRA though.

If you have kids or are about to start a family, health savings accounts and flexible spending/dependent care accounts are huge. I personally pay in as much income tax as possible (my W-2 says single with no dependents) and get 10-15% back in my refund essentially creating a pseudo-savings account. I realize I do not have emergency access nor any interest (not that I would get any otherwise), but my life is currently too hectic to manage a complex portfolio, and I have zero temptation to spend it since I can't.

If you have kids or are about to start a family, health savings accounts and flexible spending/dependent care accounts are huge. I personally pay in as much income tax as possible (my W-2 says single with no dependents) and get 10-15% back in my refund essentially creating a pseudo-savings account. I realize I do not have emergency access nor any interest (not that I would get any otherwise), but my life is currently too hectic to manage a complex portfolio, and I have zero temptation to spend it since I can't.

#86

Azine Jabroni

I've had a Roth IRA since I was 22. That money is just ridiculous and has grown a bunch in 7 short years. After I got married, I crossed the threshold where I can no longer contribute to it without some trickery, but I like what nist7 posted. The key is to fill a (preferably ROTH) 401k to achieve whatever your company match is, then move the rest to a Roth IRA. That worked for me as a single guy. Once I married someone who makes a lot more money than I do, things got pretty complicated.

#88

Team Owner

saving is for suckers. spend every dime you got and live like there's no tomorrow!

#89

Team Owner

#90

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

The following users liked this post:

TacoBello (03-06-2017)

#91

Team Owner

A wife and kids could have been replaced by a Lambo and whores.

#92

Team Owner

Why do you think I don't have kids? I've got a wife, so no need for whores, but the Lambo on the other hand...

#93

Team Owner

I was just thinking about my own situation.

#95

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

#97

Senior Moderator

Rule #1 in 'investing': always always max out employer matching. You're literally leaving money on the table if not doing so.

The following users liked this post:

oo7spy (03-08-2017)

#100

Senior Moderator

Originally Posted by KaMLuNg

screw all you guys that get free money... my employer doesn't match... consider you guys lucky!!!

The following users liked this post:

oo7spy (03-08-2017)

#102

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,171

Received 2,773 Likes

on

1,976 Posts

#104

Safety Car

I've had a Roth IRA since I was 22. That money is just ridiculous and has grown a bunch in 7 short years. After I got married, I crossed the threshold where I can no longer contribute to it without some trickery, but I like what nist7 posted. The key is to fill a (preferably ROTH) 401k to achieve whatever your company match is, then move the rest to a Roth IRA. That worked for me as a single guy. Once I married someone who makes a lot more money than I do, things got pretty complicated.

Also if you make more than the income limit...you can always do Backdoor Roth IRA.

Looking them up, their expense ratios seems VERY high. Close to 1% range.

- 37 (52%) have delivered a NEGATIVE alpha, which means that they have underperformed their respective benchmarks since inception

- 34 (48%) have delivered a POSTIVE alpha, which means that they have outperformed their respective benchmarks since inception

- 1 (1.4%) has delivered a POSITIVE alpha at the 95% CONFIDENCE LEVEL, which means that it has outperformed their respective benchmark consistently enough since inception that we have 95% confidence that it will persist in the future and is not merely based on random outcomes

Not very attractive funds imo...

The following users liked this post:

nist7 (03-08-2017)

#107

Safety Car

That's bad ass. It's always great to pay yourself first (savings, 401k, IRA, etc.), then pay required expenses (food, house, utilities, etc.), then get the luxury/fun stuff with what's left over!

I'm not very good so far (just about 10%) but I'll definitely be upping that number very soon.

A healthy 30-40% savings rate would go long way towards a nice and early retirement

I'm not very good so far (just about 10%) but I'll definitely be upping that number very soon.

A healthy 30-40% savings rate would go long way towards a nice and early retirement

#108

Team Owner

#110

Moderator

Regional Coordinator (Southeast)

Regional Coordinator (Southeast)

Join Date: Dec 2003

Location: Mooresville, NC

Age: 37

Posts: 43,461

Received 3,656 Likes

on

2,490 Posts

I currently have 12% going into a 401k and then used to have another 4-8% as expenses allowed just going into savings. This has taken a large hit this year on the variable savings part so far but the amount for my 401k has stayed the same. I also have a 4% lump sum pension building at work that next year jumps to 7%.

I do need to start streamlining my expenses and track things more accurately through this year so I can find other places I can save from.

I do need to start streamlining my expenses and track things more accurately through this year so I can find other places I can save from.

#112

Senior Moderator

Originally Posted by KaMLuNg

FYI - the Vagon isn't a form of savings...

#113

Moderator

Regional Coordinator (Southeast)

Regional Coordinator (Southeast)

Join Date: Dec 2003

Location: Mooresville, NC

Age: 37

Posts: 43,461

Received 3,656 Likes

on

2,490 Posts

That is why I said this years savings has taken a big hit including pulling from past savings because of the Vagon issues. One of the reasons I choose to put so much into my 401k straight away before I even get my paycheck so I know I am saving things that I can't even touch.

#114

Senior Moderator

The emotional returns boost morale and productivity. Smiles per mile.

#115

Moderator

Regional Coordinator (Southeast)

Regional Coordinator (Southeast)

Join Date: Dec 2003

Location: Mooresville, NC

Age: 37

Posts: 43,461

Received 3,656 Likes

on

2,490 Posts

#116

Moderator

Regional Coordinator (Southeast)

Regional Coordinator (Southeast)

Join Date: Dec 2003

Location: Mooresville, NC

Age: 37

Posts: 43,461

Received 3,656 Likes

on

2,490 Posts

#117

Senior Moderator

iTrader: (5)

for those of you struggling to save... read the below...

http://www.collaborativefund.com/blo...to-save-money/

CLIFFS:

" one of the most powerful ways to increase your savings isn’t to raise your income, but your humility. "

http://www.collaborativefund.com/blo...to-save-money/

CLIFFS:

" one of the most powerful ways to increase your savings isn’t to raise your income, but your humility. "

#118

Burning Brakes

iTrader: (5)

I get 6% matched plus a 2.5% lump sum of my annual salary so you could say 8.5% is matched. I put in 7% myself, which puts me at 14.5%, but I want to up it after my next promotion to hit the IRS annual limit.

My mortgage is only 25% of my post-tax take home pay (after the girlfriend's contribution), I don't have any debt outside of the mortgage, and the girlfriend covers all food expenses so I'm able to save a pretty decent amount each month.

My mortgage is only 25% of my post-tax take home pay (after the girlfriend's contribution), I don't have any debt outside of the mortgage, and the girlfriend covers all food expenses so I'm able to save a pretty decent amount each month.

#119

Moderator Alumnus

do I care what I do/have.

I mean if someone does/buys something and likes it, then that's all well and good, but It's not going to change

my spending habits in any form.

#120

Senior Moderator

iTrader: (5)

I can tell you that I save a bunch of money by simply not giving a **** what other people do/have, nor

do I care what I do/have.

I mean if someone does/buys something and likes it, then that's all well and good, but It's not going to change

my spending habits in any form.

do I care what I do/have.

I mean if someone does/buys something and likes it, then that's all well and good, but It's not going to change

my spending habits in any form.

Well, time sure does fly, and good news for all is that if you are focused you can get sh*t done! I've managed to pay off my mortgage about 9 months ago!!!

Well, time sure does fly, and good news for all is that if you are focused you can get sh*t done! I've managed to pay off my mortgage about 9 months ago!!!