Disney

#161

https://www.marketwatch.com/story/oh...ice-2018-08-05

Oh bother! ‘Christoper Robin’ can’t overcome ‘Mission: Impossible’ at box office

Aug. 5, 2018

Disney’s “Christopher Robin,” a live-action film starring Ewan McGregor as the grown-up title character who is reunited with Winnie the Pooh and friends, earned an estimate $25 million domestically in its debut weekend, only good enough for second place.

The opening was the lowest for a Disney film since 2016’s “The BFG” and “Pete’s Dragon,” according to the Hollywood Reporter, and marked only the second time this year — along with “A Wrinkle in Time” — that a Disney movie didn’t open at No. 1.

While Winnie the Pooh is popular worldwide, the movie is banned from opening in China, reportedly because opponents of President Xi Jinping have compared the leader to the rotund cartoon bear.

The weekend’s top spot went to “Mission: Impossible — Fallout,” from Viacom Inc.’s Paramount Pictures, for the second week in a row. The latest installment of the blockbuster action franchise, starring Tom Cruise as superspy Hunt, took in an estimated $35 million, for a two-week domestic total of $124.5 million. It’s been an even bigger hit overseas, bringing in an additional $205 million.

The Lionsgate action-comedy “The Spy Who Dumped Me,” starring Mila Kunis and Kate McKinnon, placed third in its opening weekend, with $12.4 million.

Aug. 5, 2018

Disney’s “Christopher Robin,” a live-action film starring Ewan McGregor as the grown-up title character who is reunited with Winnie the Pooh and friends, earned an estimate $25 million domestically in its debut weekend, only good enough for second place.

The opening was the lowest for a Disney film since 2016’s “The BFG” and “Pete’s Dragon,” according to the Hollywood Reporter, and marked only the second time this year — along with “A Wrinkle in Time” — that a Disney movie didn’t open at No. 1.

While Winnie the Pooh is popular worldwide, the movie is banned from opening in China, reportedly because opponents of President Xi Jinping have compared the leader to the rotund cartoon bear.

The weekend’s top spot went to “Mission: Impossible — Fallout,” from Viacom Inc.’s Paramount Pictures, for the second week in a row. The latest installment of the blockbuster action franchise, starring Tom Cruise as superspy Hunt, took in an estimated $35 million, for a two-week domestic total of $124.5 million. It’s been an even bigger hit overseas, bringing in an additional $205 million.

The Lionsgate action-comedy “The Spy Who Dumped Me,” starring Mila Kunis and Kate McKinnon, placed third in its opening weekend, with $12.4 million.

#162

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

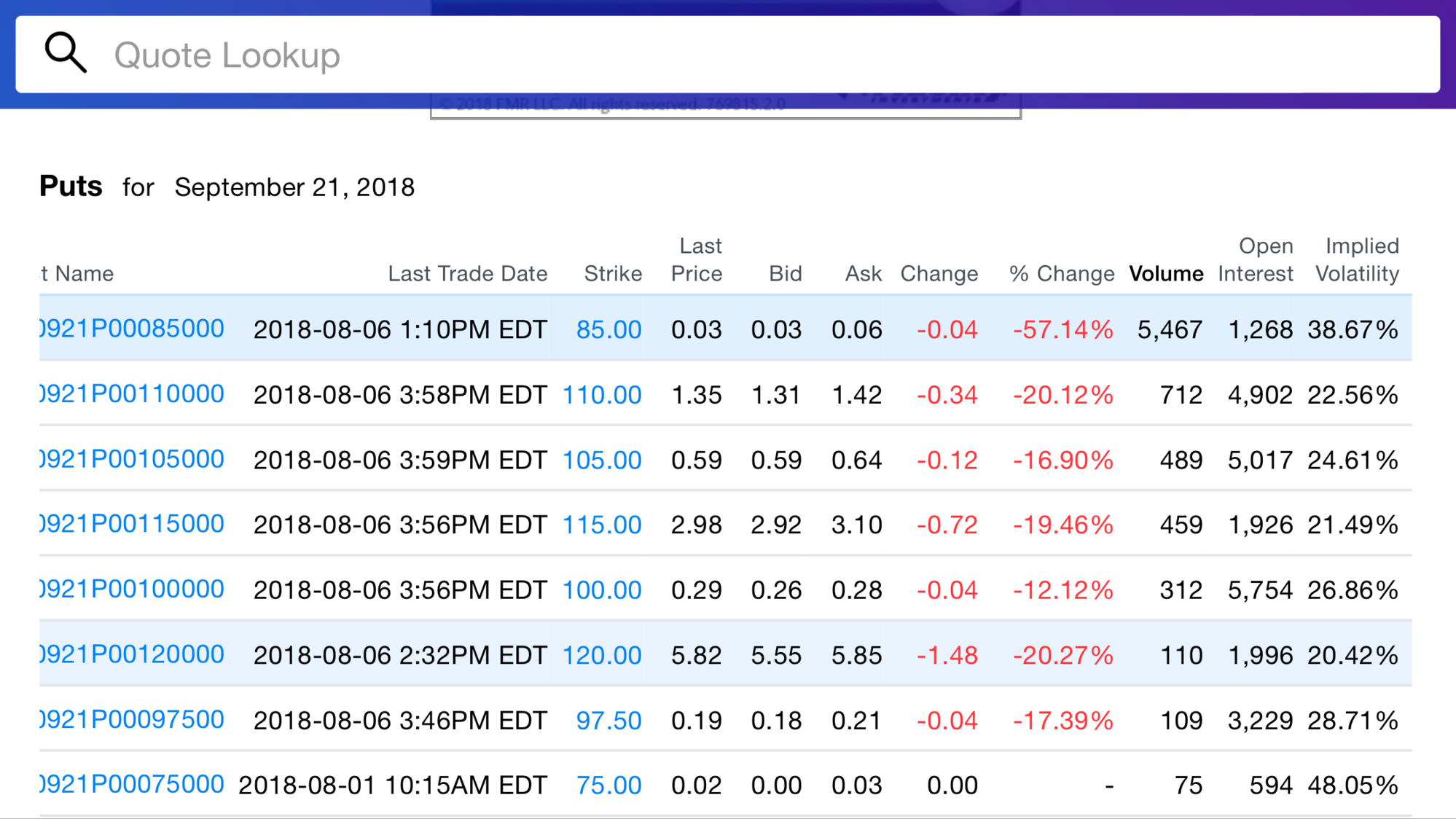

theres some volume today in the 8/10 $120 call option

116.22 USD +2.14 (1.88%)

Last edited by Mizouse; 08-06-2018 at 11:22 AM.

#163

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#164

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Oooooo

116.56 USD +0.62 (0.53%)

Closed: Aug 7, 4:06 PM EDT

After hours 113.01 −3.55 (3.05%)

116.56 USD +0.62 (0.53%)

Closed: Aug 7, 4:06 PM EDT

After hours 113.01 −3.55 (3.05%)

#165

$113.99 : -$2.61 (-2.24%)

After hours: 4:08PM EDT

Miss.

EPS of $1.87 vs estimates of $1.95

Revenue of $15.23 billion vs estimates of $15.34 billion

After hours: 4:08PM EDT

Miss.

EPS of $1.87 vs estimates of $1.95

Revenue of $15.23 billion vs estimates of $15.34 billion

The following users liked this post:

Mizouse (08-07-2018)

#166

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

why you no go down more

why you no go down more

#167

Media and networks: $6.156 billion vs estimates for $6.10 billion -- slight beat

Parks and resorts: $5.193 billion vs estimates for $5.28 billion -- miss

Studio: $2.878 billion vs estimates for $2.89 billion -- slight miss

Consumer and interactive: $1.001 billion vs estimates for $1.11 billion -- miss

https://www.thewaltdisneycompany.com...8-earnings.pdf

Parks and resorts: $5.193 billion vs estimates for $5.28 billion -- miss

Studio: $2.878 billion vs estimates for $2.89 billion -- slight miss

Consumer and interactive: $1.001 billion vs estimates for $1.11 billion -- miss

https://www.thewaltdisneycompany.com...8-earnings.pdf

#168

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

116.75 +0.19 (0.16%)

#169

Might take a chance and jump in if it gets down to $105-$106 area.

Be a bagholder with @Mizouse?

00Soyvd.png

Reports Q4 2018 results on Nov. 8

current Q4 2018 analyst estimates

EPS of $1.33 per share

Revenue of $13.7 billion

And more competition on the way for Disney.

https://www.wsj.com/articles/at-t-st...019-1539195487

Be a bagholder with @Mizouse?

00Soyvd.png

Reports Q4 2018 results on Nov. 8

current Q4 2018 analyst estimates

EPS of $1.33 per share

Revenue of $13.7 billion

And more competition on the way for Disney.

https://www.wsj.com/articles/at-t-st...019-1539195487

AT&T Streaming Video Service Is Set to Launch in 2019

New online service—still unnamed—is expected to debut in the fourth quarter of 2019 and center around HBO

Oct. 10, 2018

AT&T Inc. is set to launch a streaming video service next year featuring films and TV shows it acquired from its blockbuster purchase of Time Warner, bringing another service to a crowded marketplace and ratcheting up its rivalry with Netflix Inc.

The new online service, which has yet to be named or priced, is expected to debut in the fourth quarter of 2019, AT&T said on Wednesday. It will center around HBO and offer a selection of AT&T-owned movies and TV series but won’t replace the existing streaming service HBO Now, said John Stankey, chief of WarnerMedia, as Time Warner is now called.

AT&T’s push into the direct-to-consumer battlefield is the latest sign that entertainment companies want to establish their direct lane to the customer instead of relying on a third-party distributor to act as a go-between. As more consumers abandon traditional cable and satellite-TV contracts, entertainment companies are trying to keep up with Netflix, Amazon.com Inc. and new low-cost upstarts.

Walt Disney Co. in August sketched out plans for a direct video service that could carry everything from “The Simpsons” to “The Avengers” movies. It is also slated to launch next year.

When Disney first announced its streaming service last year, it also said it would pull future movies from Netflix. Disney has since agreed to buy a variety of assets that are a part of 21st Century Fox Inc.

Mr. Stankey said AT&T won’t be pulling all of its programming off third-party services like Netflix, which have helped boost Time Warner’s profits for years. But there are scenarios he could envision where new and older content could be exclusive to AT&T’s new streaming service, he said.

AT&T said the planned service’s new subscribers would offset licensing revenue, suggesting the company could make fewer movies and reruns available to rival services in favor of its own brand.

Mr. Stankey said his job “isn’t to build another Netflix,” though WarnerMedia can’t afford to be left behind, as more TV watchers demand to view video outside their traditional cable packages.

“We better be at that table when the customer makes that decision: That is a collection of things I must have,” he said.

One relationship that could change as AT&T pursues its direct-to-consumer strategy is between the CW Network and Netflix, which is the second home for popular CW shows such as “Riverdale,” “Arrow” and “The Flash.”

The streaming deal Netflix has with the CW has made the network, which is a joint-venture between Warner Bros. and CBS Corp. , a profitable entity. The shows, which are popular on Netflix, also helped drive up CW’s viewership.

Mr. Stankey declined to say whether AT&T would renew that deal when it expires but noted that the CW shows appeal to a key young adult demographic that most networks and platforms struggle to reach.

The move to create a one-size-fits-all streaming service is a sign of the changing culture that AT&T is seeking to bring to WarnerMedia, which generated $31 billion of revenue last year. For much of its history, Warner Bros., HBO and Turner operated as individual fiefs that rarely worked together. That arrangement started to change in recent years, as new leaders were tapped for the three units. Now, with AT&T in control, it is pushing harder for a more collaborative environment.

AT&T first jumped into the streaming TV field in 2016 with DirecTV Now, an online-only TV package. A slimmer bundle of channels called WatchTV went live in June.

Unlike AT&T’s previous offerings, which bundle channels from all over the media landscape, the company’s new service will offer films, TV series, older content, documentaries and animated shows in a new package. Aside from HBO, its existing on-demand brands include Boomerang, FilmStruck and Machinima, though Time Warner’s chief executive said during the trial that those digital offerings have signed on less than half a million subscribers among them.

The new service won’t include news from CNN, though Mr. Stankey said some CNN documentaries could be on the menu. He also said HBO was a “really important property” but might not be reaching all the customers it wants as a stand-alone brand.

“What’s different about this product is it’s HBO and more,” he said.

New online service—still unnamed—is expected to debut in the fourth quarter of 2019 and center around HBO

Oct. 10, 2018

AT&T Inc. is set to launch a streaming video service next year featuring films and TV shows it acquired from its blockbuster purchase of Time Warner, bringing another service to a crowded marketplace and ratcheting up its rivalry with Netflix Inc.

The new online service, which has yet to be named or priced, is expected to debut in the fourth quarter of 2019, AT&T said on Wednesday. It will center around HBO and offer a selection of AT&T-owned movies and TV series but won’t replace the existing streaming service HBO Now, said John Stankey, chief of WarnerMedia, as Time Warner is now called.

AT&T’s push into the direct-to-consumer battlefield is the latest sign that entertainment companies want to establish their direct lane to the customer instead of relying on a third-party distributor to act as a go-between. As more consumers abandon traditional cable and satellite-TV contracts, entertainment companies are trying to keep up with Netflix, Amazon.com Inc. and new low-cost upstarts.

Walt Disney Co. in August sketched out plans for a direct video service that could carry everything from “The Simpsons” to “The Avengers” movies. It is also slated to launch next year.

When Disney first announced its streaming service last year, it also said it would pull future movies from Netflix. Disney has since agreed to buy a variety of assets that are a part of 21st Century Fox Inc.

Mr. Stankey said AT&T won’t be pulling all of its programming off third-party services like Netflix, which have helped boost Time Warner’s profits for years. But there are scenarios he could envision where new and older content could be exclusive to AT&T’s new streaming service, he said.

AT&T said the planned service’s new subscribers would offset licensing revenue, suggesting the company could make fewer movies and reruns available to rival services in favor of its own brand.

Mr. Stankey said his job “isn’t to build another Netflix,” though WarnerMedia can’t afford to be left behind, as more TV watchers demand to view video outside their traditional cable packages.

“We better be at that table when the customer makes that decision: That is a collection of things I must have,” he said.

One relationship that could change as AT&T pursues its direct-to-consumer strategy is between the CW Network and Netflix, which is the second home for popular CW shows such as “Riverdale,” “Arrow” and “The Flash.”

The streaming deal Netflix has with the CW has made the network, which is a joint-venture between Warner Bros. and CBS Corp. , a profitable entity. The shows, which are popular on Netflix, also helped drive up CW’s viewership.

Mr. Stankey declined to say whether AT&T would renew that deal when it expires but noted that the CW shows appeal to a key young adult demographic that most networks and platforms struggle to reach.

The move to create a one-size-fits-all streaming service is a sign of the changing culture that AT&T is seeking to bring to WarnerMedia, which generated $31 billion of revenue last year. For much of its history, Warner Bros., HBO and Turner operated as individual fiefs that rarely worked together. That arrangement started to change in recent years, as new leaders were tapped for the three units. Now, with AT&T in control, it is pushing harder for a more collaborative environment.

AT&T first jumped into the streaming TV field in 2016 with DirecTV Now, an online-only TV package. A slimmer bundle of channels called WatchTV went live in June.

Unlike AT&T’s previous offerings, which bundle channels from all over the media landscape, the company’s new service will offer films, TV series, older content, documentaries and animated shows in a new package. Aside from HBO, its existing on-demand brands include Boomerang, FilmStruck and Machinima, though Time Warner’s chief executive said during the trial that those digital offerings have signed on less than half a million subscribers among them.

The new service won’t include news from CNN, though Mr. Stankey said some CNN documentaries could be on the menu. He also said HBO was a “really important property” but might not be reaching all the customers it wants as a stand-alone brand.

“What’s different about this product is it’s HBO and more,” he said.

#170

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#171

https://www.nytimes.com/2018/06/08/b...es-disney.html

Pixar Co-Founder to Leave Disney After ‘Missteps’

June 8, 2018

John Lasseter, the animation titan who has been on leave from the Walt Disney Company since November because of what he called “missteps” that made some staff members feel “disrespected and uncomfortable,” will not return to the conglomerate.

Disney said on Friday that Mr. Lasseter — the co-founder of Pixar Animation Studios who has long been one of Disney’s most important creative executives, serving as a force behind the “Toy Story,” “Cars” and “Frozen” franchises — would take on a consulting role at the company until the end of the year and then leave permanently. He will not have an office in the interim.

June 8, 2018

John Lasseter, the animation titan who has been on leave from the Walt Disney Company since November because of what he called “missteps” that made some staff members feel “disrespected and uncomfortable,” will not return to the conglomerate.

Disney said on Friday that Mr. Lasseter — the co-founder of Pixar Animation Studios who has long been one of Disney’s most important creative executives, serving as a force behind the “Toy Story,” “Cars” and “Frozen” franchises — would take on a consulting role at the company until the end of the year and then leave permanently. He will not have an office in the interim.

$113.82 : -$4.04 (-3.42%)

https://www.hollywoodreporter.com/ne...retire-1154569

Pixar Co-Founder Ed Catmull to Retire

10/23/2018

The president of Walt Disney and Pixar Animation Studios will step down from his current roles at the end of this year and stay on as an adviser through July 2019.

Ed Catmull, who co-founded Pixar along with Steve Jobs and John Lasseter and in doing so revolutionized the animation industry, is retiring after a ground-breaking five-decade career, during which he has been involved with dozens of hit films from Toy Story to Frozen to this year's Incredibles 2.

Catmull, who acts as president of both Walt Disney and Pixar Animation Studios, will step down from his current roles at the end of this year, according to a Disney announcement on Tuesday, and then stay on as an adviser through July 2019 before formally retiring.

Catmull, who earned a doctorate in computer technology from the University of Utah, was hired by George Lucas in 1979 to lead Lucasfilm's computer division before then going on to co-found Pixar with Jobs and Lasseter in 1986. In 1995, Pixar released Toy Story, the first computer-animated hit, the first of 20 Pixar features, which have collectively won 15 Academy Awards and earned more than $13 billion at the worldwide box office.

When Disney, which had been releasing Pixar films, acquired the studio for $7.4 billion in 2006, Catmull was named president of both Walt Disney Animation Studios and Pixar Animation Studios, overseeing the business side of the operations, while Lasseter oversaw the films as chief creative officer until he stepped down this summer following complaints about his workplace behavior.

In announcing his own retirement, Catmull continued, “From the request of George Lucas to bring technology to the film industry, to the vision of Steve Jobs, and the extraordinary freedom provided by [Disney executives] Bob Iger, Alan Horn, and Alan Bergman, we continue to dream of stories and ways of making those stories that always surprise. I have the mixed emotions that come with stepping away from a group of people I love, but also with the utmost pride and pleasure that we now have at both Pixar and Disney Animation the most dedicated and imaginative leaders I have worked with.”

Disney didn't name a successor for Catmull, Instead, Pixar president Jim Morris and Walt Disney Animation Studios president Andrew Millstein will continue to oversee operations at their respective studios, reporting to Bergman, Walt Disney Studios president. And Pixar and Walt Disney Animation will continue to be creatively led by chief creative officers Pete Docter and Jennifer Lee, respectively, reporting to Horn, Walt Disney Studios chairman.

"Ed Catmull’s impact on the entertainment industry is immeasurable,” commented Disney chairman and CEO Iger. “A pioneer of the intersection of creativity and technology, Ed expanded the possibilities for storytellers along with the expectations of audiences. We’re profoundly grateful for his innumerable contributions, ranging from his pivotal, groundbreaking work at Lucasfilm and Pixar to the exceptional leadership he brought to Pixar and Walt Disney Animation over the last 12 years, and we wish him the best in his well-deserved retirement.”

Added Horn: "Ed is a one-of-a-kind talent, a genius who sees beyond the ordinary to the extraordinary. His unique perspective and invaluable leadership have fostered the creation of films and technologies that will stand the test of time."

10/23/2018

The president of Walt Disney and Pixar Animation Studios will step down from his current roles at the end of this year and stay on as an adviser through July 2019.

Ed Catmull, who co-founded Pixar along with Steve Jobs and John Lasseter and in doing so revolutionized the animation industry, is retiring after a ground-breaking five-decade career, during which he has been involved with dozens of hit films from Toy Story to Frozen to this year's Incredibles 2.

Catmull, who acts as president of both Walt Disney and Pixar Animation Studios, will step down from his current roles at the end of this year, according to a Disney announcement on Tuesday, and then stay on as an adviser through July 2019 before formally retiring.

Catmull, who earned a doctorate in computer technology from the University of Utah, was hired by George Lucas in 1979 to lead Lucasfilm's computer division before then going on to co-found Pixar with Jobs and Lasseter in 1986. In 1995, Pixar released Toy Story, the first computer-animated hit, the first of 20 Pixar features, which have collectively won 15 Academy Awards and earned more than $13 billion at the worldwide box office.

When Disney, which had been releasing Pixar films, acquired the studio for $7.4 billion in 2006, Catmull was named president of both Walt Disney Animation Studios and Pixar Animation Studios, overseeing the business side of the operations, while Lasseter oversaw the films as chief creative officer until he stepped down this summer following complaints about his workplace behavior.

In announcing his own retirement, Catmull continued, “From the request of George Lucas to bring technology to the film industry, to the vision of Steve Jobs, and the extraordinary freedom provided by [Disney executives] Bob Iger, Alan Horn, and Alan Bergman, we continue to dream of stories and ways of making those stories that always surprise. I have the mixed emotions that come with stepping away from a group of people I love, but also with the utmost pride and pleasure that we now have at both Pixar and Disney Animation the most dedicated and imaginative leaders I have worked with.”

Disney didn't name a successor for Catmull, Instead, Pixar president Jim Morris and Walt Disney Animation Studios president Andrew Millstein will continue to oversee operations at their respective studios, reporting to Bergman, Walt Disney Studios president. And Pixar and Walt Disney Animation will continue to be creatively led by chief creative officers Pete Docter and Jennifer Lee, respectively, reporting to Horn, Walt Disney Studios chairman.

"Ed Catmull’s impact on the entertainment industry is immeasurable,” commented Disney chairman and CEO Iger. “A pioneer of the intersection of creativity and technology, Ed expanded the possibilities for storytellers along with the expectations of audiences. We’re profoundly grateful for his innumerable contributions, ranging from his pivotal, groundbreaking work at Lucasfilm and Pixar to the exceptional leadership he brought to Pixar and Walt Disney Animation over the last 12 years, and we wish him the best in his well-deserved retirement.”

Added Horn: "Ed is a one-of-a-kind talent, a genius who sees beyond the ordinary to the extraordinary. His unique perspective and invaluable leadership have fostered the creation of films and technologies that will stand the test of time."

#172

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Just when it was getting good and hit a new 52-week

#173

Tomorrow.

Q4 2018 analyst estimates

EPS: $1.34 (FactSet), $1.35 (Estimize) . . . Was $1.07 a year ago

Revenue: $13.73 billion (FactSet), $13.9 billion (Estimize) . . . Was $12.779 billion a year ago

estimated revenue by segment:

https://www.marketwatch.com/story/di...ulu-2018-11-07

https://www.marketwatch.com/story/bo...ops-2018-11-04

Q4 2018 analyst estimates

EPS: $1.34 (FactSet), $1.35 (Estimize) . . . Was $1.07 a year ago

Revenue: $13.73 billion (FactSet), $13.9 billion (Estimize) . . . Was $12.779 billion a year ago

estimated revenue by segment:

- Media and networks: $5.7 billion . . . Was $5.465 billion a year ago

- Parks and resorts: $5.08 billion . . . Was $4.667 billion a year ago

- Studio: $1.78 billion . . . Was $1.432 billion a year ago

- Consumer products and interactive media: $1.16 billion . . . Was $1.215 billion a year ago

https://www.marketwatch.com/story/di...ulu-2018-11-07

Disney earnings: Investors expect an update on streaming strategy, Fox and Hulu

Nov 7, 2018

Disney’s cable segment has suffered lackluster results for the past three years, thanks to increasing cord-cutting among viewers. Now the House of Mouse is building up ammunition to join the streaming wars; it debuted direct-to-consumer streaming service ESPN+ in April and is preparing for the launch of a dedicated Disney streaming service in late 2019.

Disney also finalized a deal to acquire 21st Century Fox’s entertainment assets, including the storied Twentieth Century Fox TV and film studios, cable networks including FX and National Geographic Channel, Star India and Fox’s stake in Hulu. The deal was initially valued at $71 billion and included Fox’s 39% stake in Sky PLC. But Fox agreed in September to sell that stake to Comcast Corp. after losing a fierce bidding war for majority control of Sky. Now the deal will cost Disney substantially less.

On Thursday, investors will be looking for further details on Disney’s plans for the new Fox assets. Chief Executive Bob Iger tossed out a few hints during Disney’s third-quarter earnings call, including that Fox’s Searchlight label will likely produce original film and TV for Disney’s streaming service. And in October, Iger announced several top Fox TV executives would be moving to Disney’s TV division.

The company’s streaming strategy will be at the top of investors’ minds. Investors will be looking for an update on subscription growth at ESPN+, along with any further details about Disney’s coming direct-to-consumer service.

Then there’s the question of Hulu. The streaming service was once a joint venture with Fox, Disney, Comcast and AT&T, with the companies owning 30%, 30%, 30% and 10% respectively. But with the Fox deal, Disney will end up with a 60% stake. What role will Hulu play in Disney’s new universe, especially considering Disney’s own plans to launch a streaming service? And will the company attempt to buy the remaining stake from Comcast and AT&T?

Earnings: Analysts polled by FactSet expect Disney to post earnings of $1.34 a share, a 25% increase from the fourth quarter of 2017. Estimize is expecting EPS of $1.35.

Revenue: Analysts polled by FactSet expect revenue of $13.73 billion, with $5.7 billion coming from media networks and $5.08 billion from the parks and resorts segment. Disney’s consumer products and interactive media division is expected to bring in revenue of $1.16 billion, while the studio division is expected to bring in revenue of $1.78 billion. Estimize pegs total revenue at $13.9 billion. Disney reported revenue of $15.2 billion in the fourth quarter of 2017.

Nov 7, 2018

Disney’s cable segment has suffered lackluster results for the past three years, thanks to increasing cord-cutting among viewers. Now the House of Mouse is building up ammunition to join the streaming wars; it debuted direct-to-consumer streaming service ESPN+ in April and is preparing for the launch of a dedicated Disney streaming service in late 2019.

Disney also finalized a deal to acquire 21st Century Fox’s entertainment assets, including the storied Twentieth Century Fox TV and film studios, cable networks including FX and National Geographic Channel, Star India and Fox’s stake in Hulu. The deal was initially valued at $71 billion and included Fox’s 39% stake in Sky PLC. But Fox agreed in September to sell that stake to Comcast Corp. after losing a fierce bidding war for majority control of Sky. Now the deal will cost Disney substantially less.

On Thursday, investors will be looking for further details on Disney’s plans for the new Fox assets. Chief Executive Bob Iger tossed out a few hints during Disney’s third-quarter earnings call, including that Fox’s Searchlight label will likely produce original film and TV for Disney’s streaming service. And in October, Iger announced several top Fox TV executives would be moving to Disney’s TV division.

The company’s streaming strategy will be at the top of investors’ minds. Investors will be looking for an update on subscription growth at ESPN+, along with any further details about Disney’s coming direct-to-consumer service.

Then there’s the question of Hulu. The streaming service was once a joint venture with Fox, Disney, Comcast and AT&T, with the companies owning 30%, 30%, 30% and 10% respectively. But with the Fox deal, Disney will end up with a 60% stake. What role will Hulu play in Disney’s new universe, especially considering Disney’s own plans to launch a streaming service? And will the company attempt to buy the remaining stake from Comcast and AT&T?

Earnings: Analysts polled by FactSet expect Disney to post earnings of $1.34 a share, a 25% increase from the fourth quarter of 2017. Estimize is expecting EPS of $1.35.

Revenue: Analysts polled by FactSet expect revenue of $13.73 billion, with $5.7 billion coming from media networks and $5.08 billion from the parks and resorts segment. Disney’s consumer products and interactive media division is expected to bring in revenue of $1.16 billion, while the studio division is expected to bring in revenue of $1.78 billion. Estimize pegs total revenue at $13.9 billion. Disney reported revenue of $15.2 billion in the fourth quarter of 2017.

https://www.marketwatch.com/story/bo...ops-2018-11-04

Walt Disney Co.’s holiday-themed fantasy “The Nutcracker and the Four Realms” finished far back in second place, with a disappointing $20 million in its opening weekend. The family-friendly movie may be Disney’s biggest bust in more than two years, costing an estimated $125 million to make.

#174

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

:ibFML:

#175

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

After hours 118.60 +2.60 (2.24%)

- Earnings: $1.48 per share vs. $1.34 per share forecast by Refinitiv

Revenue: $14.31 billion vs. $13.73 billion forecast by Refinitiv

Last edited by Mizouse; 11-08-2018 at 03:10 PM.

#176

https://www.thewaltdisneycompany.com...8-earnings.pdf

EPS: $1.48 vs estimates for $1.34 (FactSet), $1.35 (Estimize) . . . up 38.32% from $1.07 a year ago -- beat

Revenue: $14.307 billion vs estimates for $13.73 billion (FactSet), $13.9 billion (Estimize) . . . up 11.96% from $12.779 billion a year ago -- beat

revenue by segment:

EPS: $1.48 vs estimates for $1.34 (FactSet), $1.35 (Estimize) . . . up 38.32% from $1.07 a year ago -- beat

Revenue: $14.307 billion vs estimates for $13.73 billion (FactSet), $13.9 billion (Estimize) . . . up 11.96% from $12.779 billion a year ago -- beat

revenue by segment:

- Media and networks: $5.963 billion vs estimates for $5.7 billion . . . up 9.11% from $5.465 billion a year ago -- beat

- Parks and resorts: $5.070 billion vs estimates for $5.08 billion . . . up 8.64% from $4.667 billion a year ago -- beat

- Studio: $2.151 billion vs estimates for $1.78 billion . . . up 50.2% from $1.432 billion a year ago -- beat

- Consumer products and interactive media: $1.123 billion vs estimates for $1.16 billion . . . down 7.57% from $1.215 billion a year ago -- miss. Probably due to Toys R Us bankruptcy.

#177

Disney+

https://preview.disneyplus.com/

https://www.cnbc.com/2018/11/08/disn...late-2019.html

https://preview.disneyplus.com/

https://www.cnbc.com/2018/11/08/disn...late-2019.html

Disney's new Netflix rival will be called Disney+ and launch late 2019

Disney's new streaming service will be called Disney+ and launch in late 2019, CEO Bob Iger announced on the company's earnings call Thursday.

The service will also feature new, original shows and movies, including original Marvel and Star Wars series. Marvel fan favorite character Loki, played by Tom Hiddleston, will get an original series on the Disney+ service. A prequel series to Star Wars movie "Rogue One" about the character Cassian Andor, portrayed by Diego Luna, will also call the service home.

Other original shows and movies include a rebooted version of The High School Musical franchise. It will also be a hub for animated content, including the next season of "Star Wars: The Clone Wars" and an new original animated series based on Pixar's "Monsters Inc." Exclusive movies include "Noel," a Christmas movie about Santa's daughter played by Anna Kendrick, and "Togo," a movie about the 1925 Nome Serum Run starring William DaFoe.

Disney launched a placeholder website for Disney+ that shows off logos of brands like Pixar, National Geographic and Marvel.

Disney's new streaming service will be called Disney+ and launch in late 2019, CEO Bob Iger announced on the company's earnings call Thursday.

The service will also feature new, original shows and movies, including original Marvel and Star Wars series. Marvel fan favorite character Loki, played by Tom Hiddleston, will get an original series on the Disney+ service. A prequel series to Star Wars movie "Rogue One" about the character Cassian Andor, portrayed by Diego Luna, will also call the service home.

Other original shows and movies include a rebooted version of The High School Musical franchise. It will also be a hub for animated content, including the next season of "Star Wars: The Clone Wars" and an new original animated series based on Pixar's "Monsters Inc." Exclusive movies include "Noel," a Christmas movie about Santa's daughter played by Anna Kendrick, and "Togo," a movie about the 1925 Nome Serum Run starring William DaFoe.

Disney launched a placeholder website for Disney+ that shows off logos of brands like Pixar, National Geographic and Marvel.

#178

https://www.cnbc.com/2019/01/18/disn...n-started.html

https://www.bloomberg.com/news/artic...stors-april-11

Reports Q1 2019 results on Feb. 5

current analyst estimates

EPS: $1.56 (FactSet), $1.64 (Estimize) . . . EPS was $1.89 a year ago

Revenue: $15.2 billion (FactSet), $15.34 billion (Estimize) . . . Revenue was $15.35 billion a year ago

Disney is already losing over $1 billion in streaming, and its Netflix competitor has yet to launch

Fri, Jan 18 2019

Disney isn’t launching its new streaming service until later this year, but investors are already learning the economic challenges of the business.

The media company said in a filing on Friday that its investment in Hulu was the primary contributor to a $580 million loss in equity investments in the fiscal year that ended Sept. 30. Additionally, Disney lost $469 million in its direct-to consumer-segment, largely from BAMtech, the streaming technology that powers ESPN+ and other over-the-top services.

That’s more than $1 billion associated with streaming, the area where CEO Bob Iger is focusing his attention. Disney will debut its Disney+ offering later in 2019 to better compete with Netflix and Amazon.

Losses in streaming will likely surge in the early days of the venture, as content and technology costs spike, said Rich Greenfield, an analyst at BTIG. Disney has also yet to assume control of another 30 percent of Hulu, part of its $71.3 billion deal for the majority of 21st Century Fox. If Disney were to acquire Comcast’s 30 percent stake in Hulu, that would further increase operating losses.

Disney is hoping that, over time, millions of paying customers will subscribe to Disney+ for its new original content and library of Disney movies and TV shows. Pricing hasn’t been disclosed. Netflix, which announced its quarterly earnings on Thursday, has 139 million global subscribers and just informed them that it’s raising prices by 13 percent to 18 percent.

Disney announced its acquisition of a majority stake in BAMtech (formerly owned by Major League Baseball) in 2017, so its report for 2018 is the first to show consolidated earnings results for the company.

Streaming is a hard place to make money, even for Netflix. While the company consistently posts positive operating income, it has burned cash for years, raising new debt and spending the revenue it generates on new content. Netflix could spend well over $10 billion for movies and shows in 2019, according to some analyst estimates.

Disney’s media networks, which include ESPN, ABC, Disney Channel and others, brought in $7.3 billion in operating income for 2018. Investors will be paying close attention to that number as streaming becomes a bigger focus and consumers are given another lower-cost entertainment option in the move away from traditional cable.

Fri, Jan 18 2019

Disney isn’t launching its new streaming service until later this year, but investors are already learning the economic challenges of the business.

The media company said in a filing on Friday that its investment in Hulu was the primary contributor to a $580 million loss in equity investments in the fiscal year that ended Sept. 30. Additionally, Disney lost $469 million in its direct-to consumer-segment, largely from BAMtech, the streaming technology that powers ESPN+ and other over-the-top services.

That’s more than $1 billion associated with streaming, the area where CEO Bob Iger is focusing his attention. Disney will debut its Disney+ offering later in 2019 to better compete with Netflix and Amazon.

Losses in streaming will likely surge in the early days of the venture, as content and technology costs spike, said Rich Greenfield, an analyst at BTIG. Disney has also yet to assume control of another 30 percent of Hulu, part of its $71.3 billion deal for the majority of 21st Century Fox. If Disney were to acquire Comcast’s 30 percent stake in Hulu, that would further increase operating losses.

Disney is hoping that, over time, millions of paying customers will subscribe to Disney+ for its new original content and library of Disney movies and TV shows. Pricing hasn’t been disclosed. Netflix, which announced its quarterly earnings on Thursday, has 139 million global subscribers and just informed them that it’s raising prices by 13 percent to 18 percent.

Disney announced its acquisition of a majority stake in BAMtech (formerly owned by Major League Baseball) in 2017, so its report for 2018 is the first to show consolidated earnings results for the company.

Streaming is a hard place to make money, even for Netflix. While the company consistently posts positive operating income, it has burned cash for years, raising new debt and spending the revenue it generates on new content. Netflix could spend well over $10 billion for movies and shows in 2019, according to some analyst estimates.

Disney’s media networks, which include ESPN, ABC, Disney Channel and others, brought in $7.3 billion in operating income for 2018. Investors will be paying close attention to that number as streaming becomes a bigger focus and consumers are given another lower-cost entertainment option in the move away from traditional cable.

Disney to Show New Streaming Service at April Investor Day

January 18, 2019

Company has said investments will crimp earnings this year

Walt Disney Co. will show off its highly anticipated Disney+ streaming service at an April 11 investor meeting, providing a peek at a platform that will challenge Netflix Inc. head on.

The service, which will include original movies and TV shows from Disney’s Marvel, Pixar and other brands, is scheduled to debut later this year. It will be a third, more family-focused streaming service, on top of Disney’s existing ESPN+ and Hulu, which will soon be majority owned by the Burbank, California-based entertainment giant.

Among traditional media companies, Disney is making the biggest bet on streaming and monthly subscriptions. The company will soon complete the $71 billion purchase of 21st Century Fox Inc.’s entertainment assets, which will bring in more film and TV franchises it can exploit in theaters, on TV and online.

After that deal was announced in late 2017, Disney reorganized its business to create a stand-alone direct-to-consumer division for streaming. In a filing Friday, the company provided details on how that business and all of Disney’s divisions would have looked under the new structure for the past three years.

Disney’s direct-to-consumer division, for example, lost $738 million on revenue of $3.4 billion for the fiscal year that ended Sept. 29. Those numbers reflect the company’s investment in new content and technology, without the full benefit of subscription revenue from the new streaming service still in development and ESPN+, which was introduced in April.

Disney executives have been preparing investors for what might be a transitional year, due to investments in the new services. Chief Financial Officer Christine McCarthy said in November that costs associated with ESPN+ would reduce profit by $100 million in the just-ended fiscal first quarter.

January 18, 2019

Company has said investments will crimp earnings this year

Walt Disney Co. will show off its highly anticipated Disney+ streaming service at an April 11 investor meeting, providing a peek at a platform that will challenge Netflix Inc. head on.

The service, which will include original movies and TV shows from Disney’s Marvel, Pixar and other brands, is scheduled to debut later this year. It will be a third, more family-focused streaming service, on top of Disney’s existing ESPN+ and Hulu, which will soon be majority owned by the Burbank, California-based entertainment giant.

Among traditional media companies, Disney is making the biggest bet on streaming and monthly subscriptions. The company will soon complete the $71 billion purchase of 21st Century Fox Inc.’s entertainment assets, which will bring in more film and TV franchises it can exploit in theaters, on TV and online.

After that deal was announced in late 2017, Disney reorganized its business to create a stand-alone direct-to-consumer division for streaming. In a filing Friday, the company provided details on how that business and all of Disney’s divisions would have looked under the new structure for the past three years.

Disney’s direct-to-consumer division, for example, lost $738 million on revenue of $3.4 billion for the fiscal year that ended Sept. 29. Those numbers reflect the company’s investment in new content and technology, without the full benefit of subscription revenue from the new streaming service still in development and ESPN+, which was introduced in April.

Disney executives have been preparing investors for what might be a transitional year, due to investments in the new services. Chief Financial Officer Christine McCarthy said in November that costs associated with ESPN+ would reduce profit by $100 million in the just-ended fiscal first quarter.

Reports Q1 2019 results on Feb. 5

current analyst estimates

EPS: $1.56 (FactSet), $1.64 (Estimize) . . . EPS was $1.89 a year ago

Revenue: $15.2 billion (FactSet), $15.34 billion (Estimize) . . . Revenue was $15.35 billion a year ago

Last edited by AZuser; 01-20-2019 at 01:09 PM.

#179

Tuesday.

Q1 2019 analyst estimates

EPS: $1.55 . . . Was $1.89 a year ago. $1.55 would represent a 17.99% Y/Y decline

Rev: $15.18 billion . . . Was $15.35 billion a year ago. $15.18 billion would represent a 1.11% Y/Y decline

Q1 2019 analyst estimates

EPS: $1.55 . . . Was $1.89 a year ago. $1.55 would represent a 17.99% Y/Y decline

Rev: $15.18 billion . . . Was $15.35 billion a year ago. $15.18 billion would represent a 1.11% Y/Y decline

#180

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Fml

#181

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

112.40USD +0.58 (0.52%)

#182

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Beat??

After-hours: 115.00 +2.34 (2.08%)

After-hours: 115.00 +2.34 (2.08%)

#183

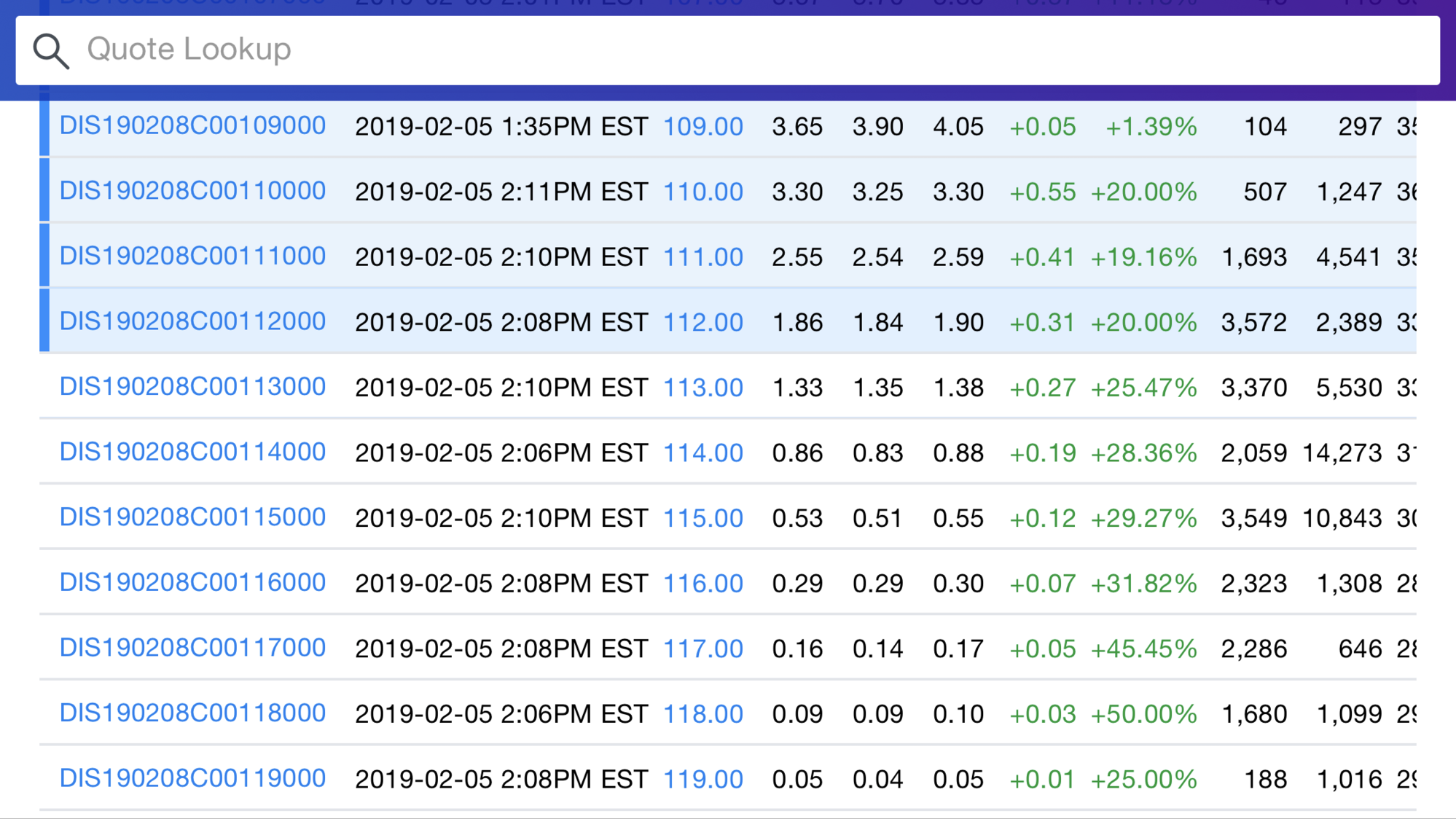

$1.84 vs $1.55 (FactSet, Refinitiv) estimate . . . declined 2.65% Y/Y

$15.30 billion vs $15.18 billion (FactSet), $15.14 billion (Refinitiv) estimate . . . declined 0.33% Y/Y

https://www.thewaltdisneycompany.com...9-earnings.pdf

$15.30 billion vs $15.18 billion (FactSet), $15.14 billion (Refinitiv) estimate . . . declined 0.33% Y/Y

https://www.thewaltdisneycompany.com...9-earnings.pdf

Last edited by AZuser; 02-05-2019 at 03:12 PM.

The following users liked this post:

Mizouse (02-05-2019)

#184

Studio Entertainment's 27% revenue decline and 63% income decline illustrates what happens when they don't continually put out hit movies.

Luckily, Parks, Experiences & Consumer Products still bringing in the $$$

Segments

Parks, Experiences & Consumer Products

Parks, Experiences, & Consumer Products revenues for the quarter increased 5% to $6.8 billion and segment operating income increased 10% to $2.2 billion. Operating income growth for the quarter was due to an increase at our domestic theme parks and resorts, partially offset by a decrease from licensing activities.

Studio Entertainment

Studio Entertainment revenues for the quarter decreased 27% to $1.8 billion and segment operating income decreased 63% to $309 million. Lower operating income was due to a decrease in theatrical distribution results, partially offset by growth in TV/SVOD distribution.

The decrease in theatrical distribution results was due to the strong performance of Star Wars: The Last Jedi and Thor: Ragnarok in the prior-year quarter compared to Mary Poppins Returns and The Nutcracker and the Four Realms in the current year. Other significant releases included Ralph Breaks the Internet in the current quarter, while the prior-year quarter included Coco.

Growth in TV/SVOD distribution results was due to the performance of Incredibles 2 and Avengers: Infinity War in the current quarter compared to Cars 3 and Guardians of the Galaxy Vol. 2 in the prior- year quarter, more title availabilities, and to a lesser extent, an impact from the adoption of ASC 606 (see below).

Luckily, Parks, Experiences & Consumer Products still bringing in the $$$

Segments

- Revenues

- Media Networks: $5.921 billion . . . +7% Y/Y

- Parks, Experiences & Consumer Products: $6.824 billion . . . +5% Y/Y

- Studio Entertainment: $1.824 billion . . . -27% Y/Y

from $2.509 billion

from $2.509 billion - Direct-to-Consumer & International: $918 million . . . -1% Y/Y

- Segment operating income/loss:

- Media Networks: $$1.330 billion . . . +7% Y/Y

- Parks, Experiences & Consumer Products: $2.152 billion . . . +10% Y/Y

- Studio Entertainment: $306 million . . . -63% Y/Y from $825 million

- Direct-to-Consumer & International: loss of $136 million . . . from loss of $42 million a year ago

Parks, Experiences & Consumer Products

Parks, Experiences, & Consumer Products revenues for the quarter increased 5% to $6.8 billion and segment operating income increased 10% to $2.2 billion. Operating income growth for the quarter was due to an increase at our domestic theme parks and resorts, partially offset by a decrease from licensing activities.

Studio Entertainment

Studio Entertainment revenues for the quarter decreased 27% to $1.8 billion and segment operating income decreased 63% to $309 million. Lower operating income was due to a decrease in theatrical distribution results, partially offset by growth in TV/SVOD distribution.

The decrease in theatrical distribution results was due to the strong performance of Star Wars: The Last Jedi and Thor: Ragnarok in the prior-year quarter compared to Mary Poppins Returns and The Nutcracker and the Four Realms in the current year. Other significant releases included Ralph Breaks the Internet in the current quarter, while the prior-year quarter included Coco.

Growth in TV/SVOD distribution results was due to the performance of Incredibles 2 and Avengers: Infinity War in the current quarter compared to Cars 3 and Guardians of the Galaxy Vol. 2 in the prior- year quarter, more title availabilities, and to a lesser extent, an impact from the adoption of ASC 606 (see below).

#185

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#186

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#187

https://www.cnbc.com/2019/02/05/disn...-december.html

Current quarter (Q2 2019) movies:

Can Captain Marvel match the success of Black Panther?"

Black Panther is the 3rd highest grossing film in the U.S. and Canada and 9th highest grossing film of all time. It's also the highest grossing solo super hero film. Tough act to follow.

I'd say Dumbo is a tie with A Wrinkle in Time but since Dumbo has such a late in the quarter release date, I don't think it will add much to revenue and profits.

"The theatrical success of 'Star Wars: The Last Jedi' in Q1 last year was a key driver to licensing results so the absence of a comparable franchise title in Q1 this year created a meaningful headwind to our licensing results," Christine McCarthy, Disney's chief financial officer, said during an earnings call Tuesday.

Without a big blockbuster like "Star Wars" in December, Disney missed out on money at the box office and through retail.

"Home Entertainment results also faced a difficult comparison given Q2 titles last year included 'Star Wars: The Last Jedi,' 'Thor: Ragnarok' and 'Coco,'" McCarthy said. "As a result we expect operating income from our theatrical and home entertainment businesses to be $450 million to $500 million lower than in Q2 last year, which was the best second quarter in the studio's history."

Without a big blockbuster like "Star Wars" in December, Disney missed out on money at the box office and through retail.

"Home Entertainment results also faced a difficult comparison given Q2 titles last year included 'Star Wars: The Last Jedi,' 'Thor: Ragnarok' and 'Coco,'" McCarthy said. "As a result we expect operating income from our theatrical and home entertainment businesses to be $450 million to $500 million lower than in Q2 last year, which was the best second quarter in the studio's history."

Captain Marvel

Release date: Friday, March 8

Dumbo

Release date: Friday, March 29

vs Q2 2018 movies:Release date: Friday, March 8

Dumbo

Release date: Friday, March 29

Black Panther

Release date: February 16

A Wrinkle in Time

Release date: March 9

Release date: February 16

A Wrinkle in Time

Release date: March 9

Can Captain Marvel match the success of Black Panther?"

Black Panther is the 3rd highest grossing film in the U.S. and Canada and 9th highest grossing film of all time. It's also the highest grossing solo super hero film. Tough act to follow.

I'd say Dumbo is a tie with A Wrinkle in Time but since Dumbo has such a late in the quarter release date, I don't think it will add much to revenue and profits.

#188

Star Wars: Galaxy’s Edge opening months earlier than planned. Should give a nice boost to their Q3 and Q4 2019 revenue and income for Parks, Experiences & Consumer Products segment.

https://disneyparks.disney.go.com/bl...ywood-studios/

https://disneyparks.disney.go.com/bl...ywood-studios/

Star Wars: Galaxy’s Edge to Open May 31 at Disneyland Resort, August 29 at Disney’s Hollywood Studios

Thu, March 7, 2019

Minutes ago, we shared an exciting announcement many of you have been waiting to hear – Star Wars: Galaxy’s Edge is opening ahead of schedule on May 31 at Disneyland Resort in Southern California and August 29 at Disney’s Hollywood Studios in Florida.

That’s right – it’s debuting early because of high guest interest in experiencing this new, immersive land. On opening day for phase one, you’ll be able to live your own Star Wars story and take the controls of the most famous ship in the galaxy aboard Millennium Falcon: Smugglers Run, sample amazing galactic food and beverages, explore an intriguing collection of merchant shops and more.

And for phase two, opening later this year, will be Star Wars: Rise of the Resistance, the most ambitious, immersive and advanced attraction ever imagined that will put guests in the middle of a climactic battle between the First Order and the Resistance and will blur the lines between fantasy and reality. In light of tremendous demand, Disney made the decision to open the land in phases to allow guests to sooner enjoy the one-of-a-kind experiences that make Star Wars: Galaxy’s Edge so spectacular.

Guests planning to visit Star Wars: Galaxy’s Edge at Disneyland park in California between May 31 and June 23, 2019 will need valid theme park admission and will be required to make a no-cost reservation, subject to availability, to access the land. Information on how to make a reservation will be available at a later date on Disneyland.com and the Disney Parks Blog. Guests staying at one of the three Disneyland Resort hotels during these dates will receive a designated reservation to access Star Wars: Galaxy’s Edge during their stay (one reservation per registered guest); valid theme park admission is required.

A reservation will not be offered or required to experience Star Wars: Galaxy’s Edge at the Walt Disney World Resort at this time. And you should know that valid theme park admission to Disney’s Hollywood Studios is required to visit Star Wars: Galaxy’s Edge after its opening on August 29, 2019. Capacity is limited. Additionally, Star Wars: Galaxy’s Edge will be available during Extra Magic Hours. During Extra Magic Hours guests staying at select Walt Disney World Resort hotels can spend extra time at Disney’s Hollywood Studios enjoying select attractions. Details will also be available at a later date on Disneyworld.com and the Disney Parks Blog.

. . . .

[ SNIP ]

Thu, March 7, 2019

Minutes ago, we shared an exciting announcement many of you have been waiting to hear – Star Wars: Galaxy’s Edge is opening ahead of schedule on May 31 at Disneyland Resort in Southern California and August 29 at Disney’s Hollywood Studios in Florida.

That’s right – it’s debuting early because of high guest interest in experiencing this new, immersive land. On opening day for phase one, you’ll be able to live your own Star Wars story and take the controls of the most famous ship in the galaxy aboard Millennium Falcon: Smugglers Run, sample amazing galactic food and beverages, explore an intriguing collection of merchant shops and more.

And for phase two, opening later this year, will be Star Wars: Rise of the Resistance, the most ambitious, immersive and advanced attraction ever imagined that will put guests in the middle of a climactic battle between the First Order and the Resistance and will blur the lines between fantasy and reality. In light of tremendous demand, Disney made the decision to open the land in phases to allow guests to sooner enjoy the one-of-a-kind experiences that make Star Wars: Galaxy’s Edge so spectacular.

Guests planning to visit Star Wars: Galaxy’s Edge at Disneyland park in California between May 31 and June 23, 2019 will need valid theme park admission and will be required to make a no-cost reservation, subject to availability, to access the land. Information on how to make a reservation will be available at a later date on Disneyland.com and the Disney Parks Blog. Guests staying at one of the three Disneyland Resort hotels during these dates will receive a designated reservation to access Star Wars: Galaxy’s Edge during their stay (one reservation per registered guest); valid theme park admission is required.

A reservation will not be offered or required to experience Star Wars: Galaxy’s Edge at the Walt Disney World Resort at this time. And you should know that valid theme park admission to Disney’s Hollywood Studios is required to visit Star Wars: Galaxy’s Edge after its opening on August 29, 2019. Capacity is limited. Additionally, Star Wars: Galaxy’s Edge will be available during Extra Magic Hours. During Extra Magic Hours guests staying at select Walt Disney World Resort hotels can spend extra time at Disney’s Hollywood Studios enjoying select attractions. Details will also be available at a later date on Disneyworld.com and the Disney Parks Blog.

. . . .

[ SNIP ]

#189

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

114.01USD -0.88 (-0.77%)

#190

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Fml

108.69 USD −1.31 (-1.19%)

108.69 USD −1.31 (-1.19%)

#191

Stay Out Of the Left Lane

Join Date: Oct 2003

Location: SE Mass --- > Central VA --- > SE Mass

Age: 57

Posts: 8,953

Received 1,236 Likes

on

1,023 Posts

Maybe the market doesn't like or is simply reacting to the Fox deal

#192

At $71 billion, they over paid. Comcast kept forcing them to up their bid.

3 year performance of DIS. Under performed the Dow, S&P 500, and Nasdaq. It's been stuck moving sideways.

Z0gyucb.png

3 year performance of DIS. Under performed the Dow, S&P 500, and Nasdaq. It's been stuck moving sideways.

Z0gyucb.png

#193

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

#194

https://www.businesswire.com/news/ho...0411005925/en/

The Walt Disney Company Spotlights Comprehensive Direct-to-Consumer Strategy at 2019 Investor Day

April 11, 2019

The Walt Disney Company today presented an extensive overview of its comprehensive direct-to-consumer strategy, including presentations on Hulu, Hotstar, ESPN+, and the upcoming Disney+ service at its highly-anticipated Investor Day, which took place on the Company’s studio lot.

. . . .

“Disney+ marks a bold step forward in an exciting new era for our company – one in which consumers will have a direct connection to the incredible array of creative content that is The Walt Disney Company’s hallmark. We are confident that the combination of our unrivaled storytelling, beloved brands, iconic franchises, and cutting-edge technology will make Disney+ a standout in the marketplace, and deliver significant value for consumers and shareholders alike,” Mr. Iger said.

During today’s presentation, the Company unveiled a first look at the Disney+ offering, which will launch in the U.S. on November 12, 2019 at $6.99 per month. The service will offer fans of all ages a new way to experience the unparalleled content from the Company’s iconic entertainment brands, including Disney, Pixar, Marvel, Star Wars, and National Geographic, and will be available on connected TV and mobile devices.

Home of Great Storytelling

. . . .

In addition to its robust library of theatrical and television content, in its first year Disney+ will release more than 25 original series and 10 original films, documentaries, and specials by some of the industry’s most prolific and creative storytellers. New original titles for Disney+ announced today include:

Marvel Studios:

.

Walt Disney Animation Studios:

.

Pixar Animation Studios:

.

National Geographic:

.

Disney Television Animation:

.

These titles will join previously announced scripted originals including “The Mandalorian,” the world’s first scripted live-action Star Wars series, the exclusive new season of “Star Wars: The Clone Wars,” “High School Musical: The Musical: The Series,” the untitled Cassian Andor series starring Diego Luna and Alan Tudyk, the Marvel Studios series “Loki” starring Tom Hiddleston, “Monsters at Work,” “Diary of a Female President,” and live-action films “Lady and the Tramp,” “Noelle,” “Togo,” Timmy Failure” and “Stargirl.” Nonfiction series also announced earlier this week include “Be Our Chef,” “Cinema Relics: Iconic Art of the Movies (wt),” “Earthkeepers (wt),” “Encore!,” the untitled Walt Disney Imagineering documentary series, “Marvel’s 616,” “Marvel’s Hero Project,” “(Re)Connect,” “Rogue Trip,” and “Shop Class (wt).”

Additionally, Disney+ announced that all 30 seasons of “The Simpsons” will be available on the service on day one. In year one, audiences will also have access to family-friendly Fox titles like “The Sound of Music,” “The Princess Bride,” and “Malcolm in the Middle.” This content will join an impressive collection of more than 7,500 television episodes and 500 films including blockbuster hits from 2019 and beyond.

“We’re extremely excited about our growing portfolio of direct-to-consumer offerings. As we demonstrated today, with Disney+ we will deliver extraordinary entertainment in innovative ways to audiences around the world,” said Mr. Mayer. “We’ll continue to enhance the user experience with a constant pipeline of high-quality programming, making the service even more appealing to consumers.”

High-Quality Consumer Experience

Designed to super-serve the most ardent fans, Disney+ will provide subscribers with a feature-rich product experience that makes it easy to navigate, discover, and watch their favorite programming with immersive brand tiles and dedicated pages for Disney, Pixar, Marvel, Star Wars, and National Geographic. Subscribers will have the ability to create custom profiles with each receiving personalized experiences curated to their unique tastes based on past behaviors and preferred content.

The Disney+ service will be available on a wide range of mobile and connected TV devices, including gaming consoles, streaming media players, and smart TVs, and will adjust to the best possible high definition viewing experience based on a subscriber’s available bandwidth, with support for up to 4K HDR video playback. Fans will also have access to an unprecedented amount of content for offline viewing.

Following its U.S. debut, Disney+ will rapidly expand globally, with plans to be in nearly all major regions of the world within the next two years.

Visit DisneyPlus.com to register your email and be kept up to date on the service.

April 11, 2019

The Walt Disney Company today presented an extensive overview of its comprehensive direct-to-consumer strategy, including presentations on Hulu, Hotstar, ESPN+, and the upcoming Disney+ service at its highly-anticipated Investor Day, which took place on the Company’s studio lot.

. . . .

“Disney+ marks a bold step forward in an exciting new era for our company – one in which consumers will have a direct connection to the incredible array of creative content that is The Walt Disney Company’s hallmark. We are confident that the combination of our unrivaled storytelling, beloved brands, iconic franchises, and cutting-edge technology will make Disney+ a standout in the marketplace, and deliver significant value for consumers and shareholders alike,” Mr. Iger said.

During today’s presentation, the Company unveiled a first look at the Disney+ offering, which will launch in the U.S. on November 12, 2019 at $6.99 per month. The service will offer fans of all ages a new way to experience the unparalleled content from the Company’s iconic entertainment brands, including Disney, Pixar, Marvel, Star Wars, and National Geographic, and will be available on connected TV and mobile devices.

Home of Great Storytelling

. . . .

In addition to its robust library of theatrical and television content, in its first year Disney+ will release more than 25 original series and 10 original films, documentaries, and specials by some of the industry’s most prolific and creative storytellers. New original titles for Disney+ announced today include:

Marvel Studios:

.

- “The Falcon and The Winter Soldier” live-action series with Anthony Mackie returning as Falcon and Sebastian Stan reprising his role as Winter Soldier

- “WandaVision” live-action series with Elizabeth Olsen returning as Wanda Maximoff and Paul Bettany reprising his role as The Vision

- “Marvel’s What If…?,” the first animated series from Marvel Studios, taking inspiration from the comic books of the same name. Each episode will explore a pivotal moment from the Marvel Cinematic Universe and turn it on its head, leading the audience into uncharted territory

Walt Disney Animation Studios:

.

- “Into the Unknown: Making Frozen 2” documentary series showing the hard work and imagination that go into making one of the most highly-anticipated Walt Disney Animation Studios features

Pixar Animation Studios:

.

- Toy Story-based projects, “Forky Asks a Question” animated short series and “Lamp Life” short film

National Geographic:

.

- “The World According to Jeff Goldblum” documentary series where Jeff pulls back the curtain on a seemingly familiar object to reveal a world of astonishing connections, fascinating science, and a whole lot of big ideas

- “Magic of the Animal Kingdom” documentary series which takes viewers behind the scenes with the highly respected animal-care experts, veterinarians, and biologists at Disney’s Animal Kingdom and Epcot’s SeaBase aquarium

Disney Television Animation:

.

- “The Phineas and Ferb Movie” (working title) animated film featuring many of the original voice cast

These titles will join previously announced scripted originals including “The Mandalorian,” the world’s first scripted live-action Star Wars series, the exclusive new season of “Star Wars: The Clone Wars,” “High School Musical: The Musical: The Series,” the untitled Cassian Andor series starring Diego Luna and Alan Tudyk, the Marvel Studios series “Loki” starring Tom Hiddleston, “Monsters at Work,” “Diary of a Female President,” and live-action films “Lady and the Tramp,” “Noelle,” “Togo,” Timmy Failure” and “Stargirl.” Nonfiction series also announced earlier this week include “Be Our Chef,” “Cinema Relics: Iconic Art of the Movies (wt),” “Earthkeepers (wt),” “Encore!,” the untitled Walt Disney Imagineering documentary series, “Marvel’s 616,” “Marvel’s Hero Project,” “(Re)Connect,” “Rogue Trip,” and “Shop Class (wt).”

Additionally, Disney+ announced that all 30 seasons of “The Simpsons” will be available on the service on day one. In year one, audiences will also have access to family-friendly Fox titles like “The Sound of Music,” “The Princess Bride,” and “Malcolm in the Middle.” This content will join an impressive collection of more than 7,500 television episodes and 500 films including blockbuster hits from 2019 and beyond.

“We’re extremely excited about our growing portfolio of direct-to-consumer offerings. As we demonstrated today, with Disney+ we will deliver extraordinary entertainment in innovative ways to audiences around the world,” said Mr. Mayer. “We’ll continue to enhance the user experience with a constant pipeline of high-quality programming, making the service even more appealing to consumers.”

High-Quality Consumer Experience

Designed to super-serve the most ardent fans, Disney+ will provide subscribers with a feature-rich product experience that makes it easy to navigate, discover, and watch their favorite programming with immersive brand tiles and dedicated pages for Disney, Pixar, Marvel, Star Wars, and National Geographic. Subscribers will have the ability to create custom profiles with each receiving personalized experiences curated to their unique tastes based on past behaviors and preferred content.

The Disney+ service will be available on a wide range of mobile and connected TV devices, including gaming consoles, streaming media players, and smart TVs, and will adjust to the best possible high definition viewing experience based on a subscriber’s available bandwidth, with support for up to 4K HDR video playback. Fans will also have access to an unprecedented amount of content for offline viewing.

Following its U.S. debut, Disney+ will rapidly expand globally, with plans to be in nearly all major regions of the world within the next two years.

Visit DisneyPlus.com to register your email and be kept up to date on the service.

#195

https://www.thewaltdisneycompany.com...sults-webcast/

Iger said he'll be stepping down as CEO when his contract expires in 2021, so in 2 years. Is that enough time to find and groom a successor?

.

Disney’s Q2 FY19 Earnings Results Webcast

The Walt Disney Company will discuss fiscal second quarter 2019 financial results via a live audio webcast beginning at 4:30 p.m. EDT / 1:30 p.m. PDT on Wednesday, May 8, 2019.

Results will be released after the close of regular trading on May 8, 2019.

The Walt Disney Company will discuss fiscal second quarter 2019 financial results via a live audio webcast beginning at 4:30 p.m. EDT / 1:30 p.m. PDT on Wednesday, May 8, 2019.

Results will be released after the close of regular trading on May 8, 2019.

Iger said he'll be stepping down as CEO when his contract expires in 2021, so in 2 years. Is that enough time to find and groom a successor?

.

Last edited by AZuser; 04-11-2019 at 08:59 PM.

The following users liked this post:

Mizouse (04-12-2019)

#197

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

127.13USD +10.53 (9.03%)

Last edited by Mizouse; 04-12-2019 at 09:37 AM.

#198

Team Owner

#199

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

Still applies.

3.5 years and I’ve finally turned green? Ya fvck Mickey Mouse

3.5 years and I’ve finally turned green? Ya fvck Mickey Mouse

The following users liked this post:

doopstr (04-12-2019)

#200

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,169

Received 2,773 Likes

on

1,976 Posts

131.73 USD +1.67 (+1.28%)

New all time high as well $132.39