Apple: What you gon' do with all that junk inside your trunk?

#321

$556.07 - Up $10.11 (1.85%)

Apple's finally in the positive for 2013. Up 0.19%

#322

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

China Mobile to Officially Begin iPhone 5s and iPhone 5c Sales on January 17

#323

Watch stock rally tomorrow.

#324

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

my bet is that it tanks

#325

#326

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

Stocks always do the opposite of what I want...

#327

#328

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

#329

#330

$515.81 - Down $34.69 (6.30%

#331

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

#332

So they beat on both top and bottom numbers.

But Q2 guidance of sales of between $42 billion and $44 billion is lower than the $46.12 billion that analysts forecast.

For Q1, Apple sold:

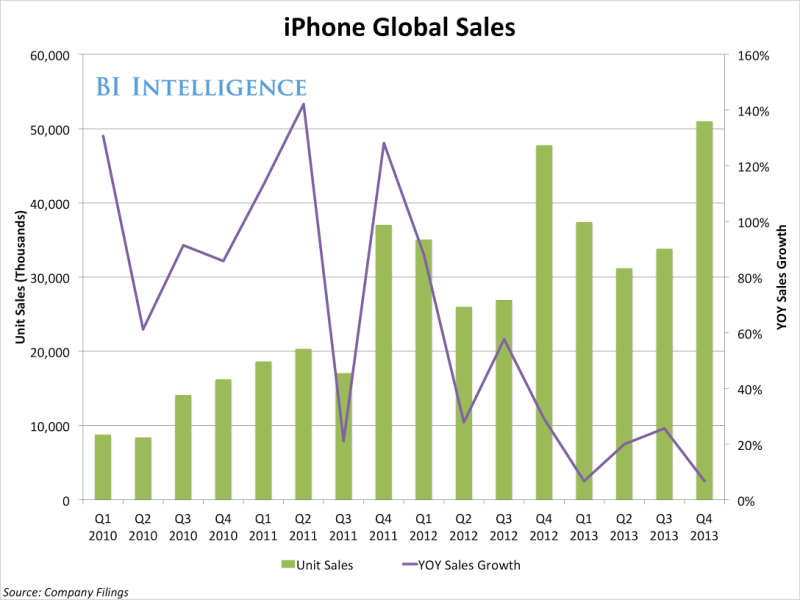

iPhone: 51 million (56-57 million expected) vs 47.8 million units in the year-ago period

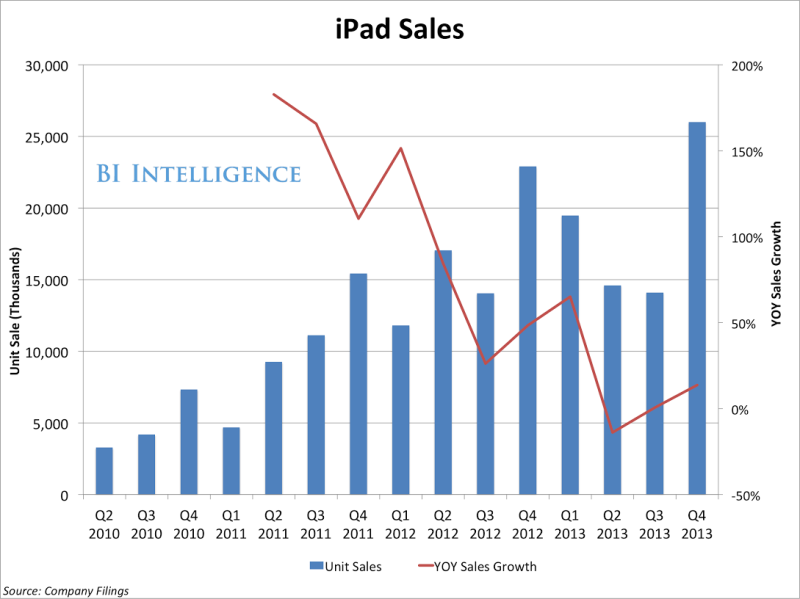

iPad: 26 million (24-25 million expected) vs 22.9 million units in the year-ago period

Earned $13.1 billion, or $14.50 a share, on sales of $57.6 billion. Analysts, on average, were expecting earnings of $14.07 a share on sales of $57.46 billion, according to Thomson Reuters.

For Q1, Apple sold:

iPhone: 51 million (56-57 million expected) vs 47.8 million units in the year-ago period

iPad: 26 million (24-25 million expected) vs 22.9 million units in the year-ago period

#333

After Hours : $503.99 - Down $46.51 (8.45%)

Last edited by AZuser; 01-27-2014 at 04:15 PM.

#334

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

Fuck those analysts and their unreasonable expectations...

#335

I think what hurt the stock the most was their Q2 2014 guidance. Estimated revenue between $42-$44 billion means flat sales year over year (Q2 2013 revenue was $43.6 billion). Despite the awesome Q1 2014 sales and numbers, people want to see growth, not zero growth (even though quite a bit of it's being deferred).

At least their margins are expected to remain stable. Estimated Q2 2014 margins of 37%-38% vs Q2 2013 margins of 37.5%

Q1 2014 margins fell to 37.9% from 38.6% in Q1 2013

Just bought 15 more shares. The new product(s) and product category they have planned later in 2014 per Tim Cook hopefully will help with Q3 and Q4 2014 numbers.

At least their margins are expected to remain stable. Estimated Q2 2014 margins of 37%-38% vs Q2 2013 margins of 37.5%

Q1 2014 margins fell to 37.9% from 38.6% in Q1 2013

Just bought 15 more shares. The new product(s) and product category they have planned later in 2014 per Tim Cook hopefully will help with Q3 and Q4 2014 numbers.

#336

#337

Pro

Right now the only thing stopping me from buying AAPL is fear of the whole market making a correction. I feel like there will be a better entry point, maybe another 10-15% lower than today's price sometime in the next few weeks.

#338

I just don't see AAPL pulling back to $430-$458 range. My guess is around $485 at most.

#339

I just don't see AAPL pulling back to $430-$458 range. My guess is around $485 at most.

$521.68 - Up $9.17 (1.79%)

Apple takes $14B bite of its stock via buyback

Apple has repurchased $14 billion of its stock in the two weeks after its first-quarter financial results and second-quarter revenue outlook disappointed investors.

Its shares rose in morning trading Friday.

Apple bought $12 billion of the shares through an accelerated repurchase program and $2 billion on the open market, the company confirmed.

Late Thursday Apple Inc. CEO Tim Cook said in an interview with The Wall Street Journal that the company was "surprised" when its stock dropped 8 percent the day after its earnings report and revenue outlook. He told the newspaper he wanted to be "aggressive" and "opportunistic."

Its $14 billion stock buyback signals the company remains confident in its business. This is good news for investors, including Carl Icahn. The billionaire activist investor has been pressuring Apple to boost its share repurchases. Just last month Icahn raised his stake in Apple, revealing on Twitter that he'd put another $500 million into Apple stock. He already owned about 4.7 million Apple Inc. shares worth more than $2.5 billion.

Icahn has said he wants the Cupertino, Calif., company to spend $50 billion buying back its own stock during the current fiscal year ending in September.

Apple has repurchased more than $40 billion of its shares in the last 12 months.

http://finance.yahoo.com/news/apple-...153506088.html

Apple has repurchased $14 billion of its stock in the two weeks after its first-quarter financial results and second-quarter revenue outlook disappointed investors.

Its shares rose in morning trading Friday.

Apple bought $12 billion of the shares through an accelerated repurchase program and $2 billion on the open market, the company confirmed.

Late Thursday Apple Inc. CEO Tim Cook said in an interview with The Wall Street Journal that the company was "surprised" when its stock dropped 8 percent the day after its earnings report and revenue outlook. He told the newspaper he wanted to be "aggressive" and "opportunistic."

Its $14 billion stock buyback signals the company remains confident in its business. This is good news for investors, including Carl Icahn. The billionaire activist investor has been pressuring Apple to boost its share repurchases. Just last month Icahn raised his stake in Apple, revealing on Twitter that he'd put another $500 million into Apple stock. He already owned about 4.7 million Apple Inc. shares worth more than $2.5 billion.

Icahn has said he wants the Cupertino, Calif., company to spend $50 billion buying back its own stock during the current fiscal year ending in September.

Apple has repurchased more than $40 billion of its shares in the last 12 months.

http://finance.yahoo.com/news/apple-...153506088.html

Apple Just Added About $0.80 To Its EPS Over The Next Year

In an interview with the Wall Street Journal Apple’s CEO, Tim Cook, said that the company had bought back $14 billion of its shares in the ten days since it reported its December quarter results. Cook said he wanted to be “aggressive” and “opportunistic”.

Good move on Apple’s part

One of the biggest complaints about company management’s and stock buybacks is that they tend to buy when the stock is high and not when it has fallen. It is hard to make a case that the stock is expensive with it selling at a 11.3x PE multiple and having almost 30% of its market cap in cash (about 18% when you adjust for additional taxes that would have to be paid on overseas cash and set aside $20 billion to run the business).

If Apple paid an average price of $500 it would have bought 28 million shares or just over 3% of the total outstanding (892 million as of January 10 per the 10-Q). At an average of 4 million per day it was about 19% of the total volume that has traded since January 27.

Increases EPS by about $0.80 over a full year

Depending on how many shares the Street was modeling Apple would buy back in the March quarter (I was at 10 million based on spending $5 billion at $500 per share) if the $14 billion is the total amount for the quarter (which I don’t believe it will be) EPS estimates for the quarter should increase by about $0.20 and $0.80 when viewed over a full year. While the full year amount should have occurred eventually it does boost EPS sooner and decreases the amount it will have to pay out in dividends by $55 million since this has occurred before the February 10 recording date.

The shares have probably formed a bottom around $500

Now that investors know that Apple has been aggressive with its share buybacks and will “support” the stock the shares have probably formed a bottom. Even though Apple only has $20 billion left in U.S. cash after spending the $14 billion and $18 billion remaining in its $60 billion share buyback program it does provide some level of comfort that management is willing to be more aggressive than passive when it sees the stock decline.

http://www.forbes.com/sites/chuckjon...-the-next-year

In an interview with the Wall Street Journal Apple’s CEO, Tim Cook, said that the company had bought back $14 billion of its shares in the ten days since it reported its December quarter results. Cook said he wanted to be “aggressive” and “opportunistic”.

Good move on Apple’s part

One of the biggest complaints about company management’s and stock buybacks is that they tend to buy when the stock is high and not when it has fallen. It is hard to make a case that the stock is expensive with it selling at a 11.3x PE multiple and having almost 30% of its market cap in cash (about 18% when you adjust for additional taxes that would have to be paid on overseas cash and set aside $20 billion to run the business).

If Apple paid an average price of $500 it would have bought 28 million shares or just over 3% of the total outstanding (892 million as of January 10 per the 10-Q). At an average of 4 million per day it was about 19% of the total volume that has traded since January 27.

Increases EPS by about $0.80 over a full year

Depending on how many shares the Street was modeling Apple would buy back in the March quarter (I was at 10 million based on spending $5 billion at $500 per share) if the $14 billion is the total amount for the quarter (which I don’t believe it will be) EPS estimates for the quarter should increase by about $0.20 and $0.80 when viewed over a full year. While the full year amount should have occurred eventually it does boost EPS sooner and decreases the amount it will have to pay out in dividends by $55 million since this has occurred before the February 10 recording date.

The shares have probably formed a bottom around $500

Now that investors know that Apple has been aggressive with its share buybacks and will “support” the stock the shares have probably formed a bottom. Even though Apple only has $20 billion left in U.S. cash after spending the $14 billion and $18 billion remaining in its $60 billion share buyback program it does provide some level of comfort that management is willing to be more aggressive than passive when it sees the stock decline.

http://www.forbes.com/sites/chuckjon...-the-next-year

#340

Almost back to where it was before earnings.

$542.71 - Up $6.79 (1.27%)

$542.71 - Up $6.79 (1.27%)

The following users liked this post:

Mizouse (02-13-2014)

#341

3 hours to go.....

#342

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

#343

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

#344

#345

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

#346

- 7:1 stock split on Monday, June 9, 2014

- Raising dividend 8%

- Raising buy back to $90 billion (from $60 billion)

Q2 2014 profit of $10.2 billion ($11.62 a share) on revenue of $45.6 billion vs estimates of $10.18 a share and revenue of $43.67 billion. Q2 2013 profit was $9.5 billion ($10.09 a share) and revenue of $43.6 billion

Trading halted.

Come on... open at $600.

- Raising dividend 8%

- Raising buy back to $90 billion (from $60 billion)

Q2 2014 profit of $10.2 billion ($11.62 a share) on revenue of $45.6 billion vs estimates of $10.18 a share and revenue of $43.67 billion. Q2 2013 profit was $9.5 billion ($10.09 a share) and revenue of $43.6 billion

Trading halted.

Come on... open at $600.

Last edited by AZuser; 04-23-2014 at 03:45 PM.

#347

After Hours : $566.40 - Up $41.65 (7.94%)

#348

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

#349

iPhones sales up 17% year over year to 43.7 million units vs. 37.7 million units expected by analysts

iPads sales down to 16.35 million units vs. 19.7 million units expected by analysts.

Mac sales were at 4.1 million vs 4 million units expected.

Big iPad miss.

iPads sales down to 16.35 million units vs. 19.7 million units expected by analysts.

Mac sales were at 4.1 million vs 4 million units expected.

Big iPad miss.

Last edited by AZuser; 04-23-2014 at 04:01 PM.

#350

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

Wow that dividend yield thou. 2.3% to 8%????

#351

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

Nvm reading comprehension > me.

Raising it by 8%

Wait a minute a 7-1 split. Meaning ill have 7x more shares... Meaning more dividends?

Raising it by 8%

Wait a minute a 7-1 split. Meaning ill have 7x more shares... Meaning more dividends?

Last edited by Mizouse; 04-23-2014 at 04:11 PM.

#352

Bumping the dividend up to 8% really would have caused the stock to open at $600+ for after hour trading.

@

@

Uz7gB2x.jpg

Guy owns like $3 billion in AAPL

AAPL still has $156 billion in cash. The share buy backs they've done didn't even make a dent in their war chest.

The share buy backs they've done didn't even make a dent in their war chest.

The more Tim Cook speaks, the higher the share price goes. Complete opposite of what it's done during previous conference calls.

After Hours : $569.00 - Up $44.25 (8.43%)

@

@ Uz7gB2x.jpg

Guy owns like $3 billion in AAPL

AAPL still has $156 billion in cash.

The share buy backs they've done didn't even make a dent in their war chest.

The share buy backs they've done didn't even make a dent in their war chest.The more Tim Cook speaks, the higher the share price goes. Complete opposite of what it's done during previous conference calls.

After Hours : $569.00 - Up $44.25 (8.43%)

Last edited by AZuser; 04-23-2014 at 04:23 PM.

The following users liked this post:

Mizouse (04-23-2014)

#353

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

Shits gonna hit $600 again soon.

Day high of $599

Day high of $599

#354

Team Owner

Thread Starter

Apple planning to buy Beats Audio. Dr. Dre richest rapper in the world?

#355

Sanest Florida Man

Dre becomes a billionaire just in time to buy the Clippers

#356

qSaiLXJ.jpg

#357

$625.63 - Up $11.50 (1.87%)

And new 52 week high of $625.86.

Hoping it doesn't give back everything tomorrow or later in the week.

Looking for $700 right before 7-to-1 split.

#358

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

If it hits $700 I'm selling.

#359

http://tech.fortune.cnn.com/2014/05/...-share-target/

Bernstein: 5 reasons Apple will hit a post-split $100 per share

"An active bet against Apple," writes Toni Sacconaghi, "may be difficult to sustain."

When Apple (AAPL) broke through $625 Tuesday to hit a 600-day high, Bernstein's Toni Sacconaghi was one of 19 Apple analysts whose price targets were underwater.

He took care of that Wednesday morning with a note to clients that raised his 12-month target to $700 from $615. After June 9, when Apple splits 7 for 1, Sacconaghi's new target will be a nice round $100 a share.

Why the change? He offers five reasons:

Sacconaghi is bullish about Apple's prospects for the next three to six months. Beyond that? Not so much.

"An active bet against Apple," writes Toni Sacconaghi, "may be difficult to sustain."

When Apple (AAPL) broke through $625 Tuesday to hit a 600-day high, Bernstein's Toni Sacconaghi was one of 19 Apple analysts whose price targets were underwater.

He took care of that Wednesday morning with a note to clients that raised his 12-month target to $700 from $615. After June 9, when Apple splits 7 for 1, Sacconaghi's new target will be a nice round $100 a share.

Why the change? He offers five reasons:

- Apple's shares generally outperform the market ahead of a new product launch -- by 11% on average -- and he's expecting two significant new product offerings this year: A big iPhone and the so-called iWatch.

- Growth investors are light the stock and can't get much lighter. "For benchmark sensitive managers," he writes, "we believe an active bet against Apple may be difficult to sustain."

- The forthcoming stock split (on June 9 to holders of record as of June 2) could broaden retail interest and make it easier for stock price to climb (e.g., $90 to $100, vs. $625 to $700).

- Apple is unlikely to let itself miss estimates in a new CFOs first quarter, and it has considerable power to make sure it doesn't (through stock buybacks, for example).

- The stock is still cheap compared with other "more stable" securities. Even at $700 a share Apple would be trading at a 20% discount to Microsoft (MSFT), Oracle (ORCL) and IBM (IBM).

Sacconaghi is bullish about Apple's prospects for the next three to six months. Beyond that? Not so much.

"Longer-term," he writes, "it is unclear to us that Apple can sustainably increase its earnings over the next 3 to 5 years. We believe Apple's primary end markets (smartphones and tablets) are increasingly mature and that overall gross margins are more likely to decline than improve over time. Additionally, while Apple is an innovative company, we note that the law of large numbers dictates that new product categories will have an increasingly difficult time moving the needle financially for the company."

http://finance.yahoo.com/news/two-an...134652425.html

Two Analysts Move Apple With Price Target Changes

Apple shares popped higher Wednesday morning after two analysts boosted price targets.

Barclays: Target Raised From $590 to $655, Maintains Equal-weight

Analyst Ben Reitzes writes, “While we still have long-term margin concerns, the momentum trade is hard not to acknowledge at this point. Apple has avoided the widely expected first half slump in earnings and finally seems poised to announce a few new categories.”

Reitzes thinks overseas iPhone sales, the possibility of an iWatch and new services are encouraging, but “The key long-term question remains whether Apple can monetize its iTunes and App Store base further through offering payments services and other compelling web services.

We believe the company will enhance its services offerings this year, but it will be hard to create meaningful recurring revenue that expands its multiple beyond the mid to low teens.”

Barclays’ $655 price target is based on elevated 2015 and 2016 growth; 11 percent and five percent year-over-year sales growth.

Bernstein: Target From $615 to $700, Maintains Outperform

Toni Sacconaghi of Bernstein noted several catalysts to justify an elevated price target on Apple. These include a larger iPhone screen to attract Android users at a higher price, stabilized gross margins and US consumers in a better position to upgrade phones due to changes by mobile carriers.

Another point Sacconaghi made concerned the benefit from a split. Reasons the split may be accretive include greater interest from retail traders and heightened liquidity, encouraging funds to take bigger stakes and traders to be more active in the stock.

Apple shares popped higher Wednesday morning after two analysts boosted price targets.

Barclays: Target Raised From $590 to $655, Maintains Equal-weight

Analyst Ben Reitzes writes, “While we still have long-term margin concerns, the momentum trade is hard not to acknowledge at this point. Apple has avoided the widely expected first half slump in earnings and finally seems poised to announce a few new categories.”

Reitzes thinks overseas iPhone sales, the possibility of an iWatch and new services are encouraging, but “The key long-term question remains whether Apple can monetize its iTunes and App Store base further through offering payments services and other compelling web services.

We believe the company will enhance its services offerings this year, but it will be hard to create meaningful recurring revenue that expands its multiple beyond the mid to low teens.”

Barclays’ $655 price target is based on elevated 2015 and 2016 growth; 11 percent and five percent year-over-year sales growth.

Bernstein: Target From $615 to $700, Maintains Outperform

Toni Sacconaghi of Bernstein noted several catalysts to justify an elevated price target on Apple. These include a larger iPhone screen to attract Android users at a higher price, stabilized gross margins and US consumers in a better position to upgrade phones due to changes by mobile carriers.

Another point Sacconaghi made concerned the benefit from a split. Reasons the split may be accretive include greater interest from retail traders and heightened liquidity, encouraging funds to take bigger stakes and traders to be more active in the stock.

http://blogs.wsj.com/moneybeat/2014/...er-run-to-700/

Apple Shares Poised for Another Run to $700

One bullish analyst predicts Apple Inc.'s recent rally is far from over.

Shares have risen about 20% since the company’s better-than-expected quarterly report last month, and Bernstein analyst Toni Sacconaghi sees “several reasons to continue to be bullish” on Apple in the near-term. He boosted his price target to $700 from $615 (or $100 after the company completes its 7-for-1 stock split next month).

Mr. Sacconaghi sees the stock getting an additional lift as it historically performs well a few a months ahead of an iPhone announcement. Many industry watchers predict Apple could be readying an iPhone 6 for release later this year, one that could contain a larger screen and higher price tag than current offerings. That “could stabilize gross margins and materially boost revenue growth,” he said, while estimating a new iPhone could come in early to mid-September, similar to previous introductions of the iPhone 5 and 5S.

In addition, the upcoming stock split “could broaden retail interest and psychologically make it easier for the stock price to climb,” he said. While splits don’t fundamentally change anything about a company’s business, they do have a history of leading to strong stock performances, he noted. From 1950 through May 2002, a stock split has on average led to positive relative returns through the following month, quarter and year, according to Bernstein’s calculations.

“We view Apple as a trading stock with a positive risk/reward balance over the next 3-6 months,” Mr. Sacconaghi wrote in a note to clients.

Apple’s stock jumped above $600 earlier this month for the first time since November 2012. The stock is up 12% this year, far outpacing both the S&P 500 and the tech-heavy Nasdaq Composite, although Apple shares remain down about 11% from the record high above $700 in September 2012.

Mr. Sacconaghi is part of a growing contingent of market watchers getting more optimistic about Apple’s shares. Last week Oppenheimer’s head technician Ari Wald made the case for why Apple could be poised for another run to record highs.

Still, Mr. Sacconaghi acknowledged he’s not overly bullish about the stock over the long term.

“We do not see a clear path to sustained earnings growth without new product categories, given Apple’s increasingly mature end markets and risk of margin pressure going forward,” he said.

Until then, he’s confident that Apple shares still have some more room to run.

One bullish analyst predicts Apple Inc.'s recent rally is far from over.

Shares have risen about 20% since the company’s better-than-expected quarterly report last month, and Bernstein analyst Toni Sacconaghi sees “several reasons to continue to be bullish” on Apple in the near-term. He boosted his price target to $700 from $615 (or $100 after the company completes its 7-for-1 stock split next month).

Mr. Sacconaghi sees the stock getting an additional lift as it historically performs well a few a months ahead of an iPhone announcement. Many industry watchers predict Apple could be readying an iPhone 6 for release later this year, one that could contain a larger screen and higher price tag than current offerings. That “could stabilize gross margins and materially boost revenue growth,” he said, while estimating a new iPhone could come in early to mid-September, similar to previous introductions of the iPhone 5 and 5S.

In addition, the upcoming stock split “could broaden retail interest and psychologically make it easier for the stock price to climb,” he said. While splits don’t fundamentally change anything about a company’s business, they do have a history of leading to strong stock performances, he noted. From 1950 through May 2002, a stock split has on average led to positive relative returns through the following month, quarter and year, according to Bernstein’s calculations.

“We view Apple as a trading stock with a positive risk/reward balance over the next 3-6 months,” Mr. Sacconaghi wrote in a note to clients.

Apple’s stock jumped above $600 earlier this month for the first time since November 2012. The stock is up 12% this year, far outpacing both the S&P 500 and the tech-heavy Nasdaq Composite, although Apple shares remain down about 11% from the record high above $700 in September 2012.

Mr. Sacconaghi is part of a growing contingent of market watchers getting more optimistic about Apple’s shares. Last week Oppenheimer’s head technician Ari Wald made the case for why Apple could be poised for another run to record highs.

Still, Mr. Sacconaghi acknowledged he’s not overly bullish about the stock over the long term.

“We do not see a clear path to sustained earnings growth without new product categories, given Apple’s increasingly mature end markets and risk of margin pressure going forward,” he said.

Until then, he’s confident that Apple shares still have some more room to run.

#360

Moderator

Join Date: Oct 2004

Location: Not Las Vegas (SF Bay Area)

Age: 39

Posts: 63,178

Received 2,773 Likes

on

1,976 Posts

So it looks like I should sell then?

You know, everytime you post in here I keep thinking the apple stock is tanking

You know, everytime you post in here I keep thinking the apple stock is tanking